Within the unstable ocean of cryptos, whales – people or entities with substantial capital – navigate with a method that usually leaves a path for smaller fish to observe.

One such crypto whale has not too long ago been making waves in Ethereum. Certainly, it has demonstrated a bullish stance on the second-largest cryptocurrency by market capitalization.

Crypto Whale Piles Up on Ethereum

On November 4, a crypto whale made a notable transfer by depositing 31.80 million USDT to Binance, solely to withdraw 8,698 ETH valued at roughly $15.94 million a couple of hours later. Nonetheless, this was not a one-off occasion.

Simply two days earlier, on November 2, the identical crypto whale had deposited 24,495 ETH, equal to $45 million, to Binance after the worth of Ethereum noticed an uptick, aiming to internet a cool revenue of round $5.47 million.

In keeping with LookOnChain, the whale’s trading history with Ethereum is impressive. It boasted eight trades since February 12, seven of which have been worthwhile. This interprets to an enviable win charge of 87.5%, with a cumulative revenue exceeding $13 million.

Learn extra: Learn how to Purchase Ethereum (ETH) and Every part You Have to Know

These actions underscore a broader narrative that Ethereum, regardless of its current worth fluctuations, holds a profitable potential for individuals who know when to purchase and promote.

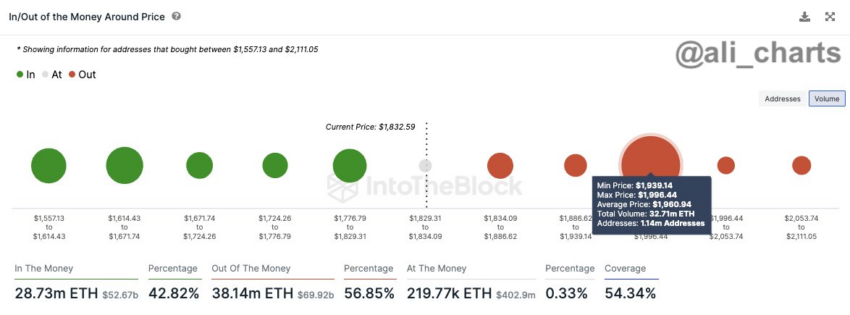

BeInCrypto’s World Head of Information, Ali Martinez, lent weight to this narrative. Referring to on-chain information from IntoTheBlock, Martinez pointed out a significant resistance level.

“You could want to attend for ETH to beat the massive provide wall at $1,960 for a bullish breakout,” Martinez stated.

In keeping with the info, a whopping 1.14 million addresses bought almost 33 million ETH at this worth level. Due to this fact making it a stiff provide wall.

The sensible whale’s current shopping for spree aligns with the anticipation of Ethereum’s worth breaking by this resistance. The meticulous strikes by this savvy investor highlight the boldness in Ethereum’s worth trajectory. It might even be the nuanced dance of technique and timing within the cryptocurrency market, the place each dip and rise can herald alternatives for the discerning eye.

Disclaimer

In adherence to the Belief Challenge pointers, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to supply correct, well timed data. Nonetheless, readers are suggested to confirm info independently and seek the advice of with an expert earlier than making any selections based mostly on this content material.