zhengzaishuru

By Bob Iaccino

At a look

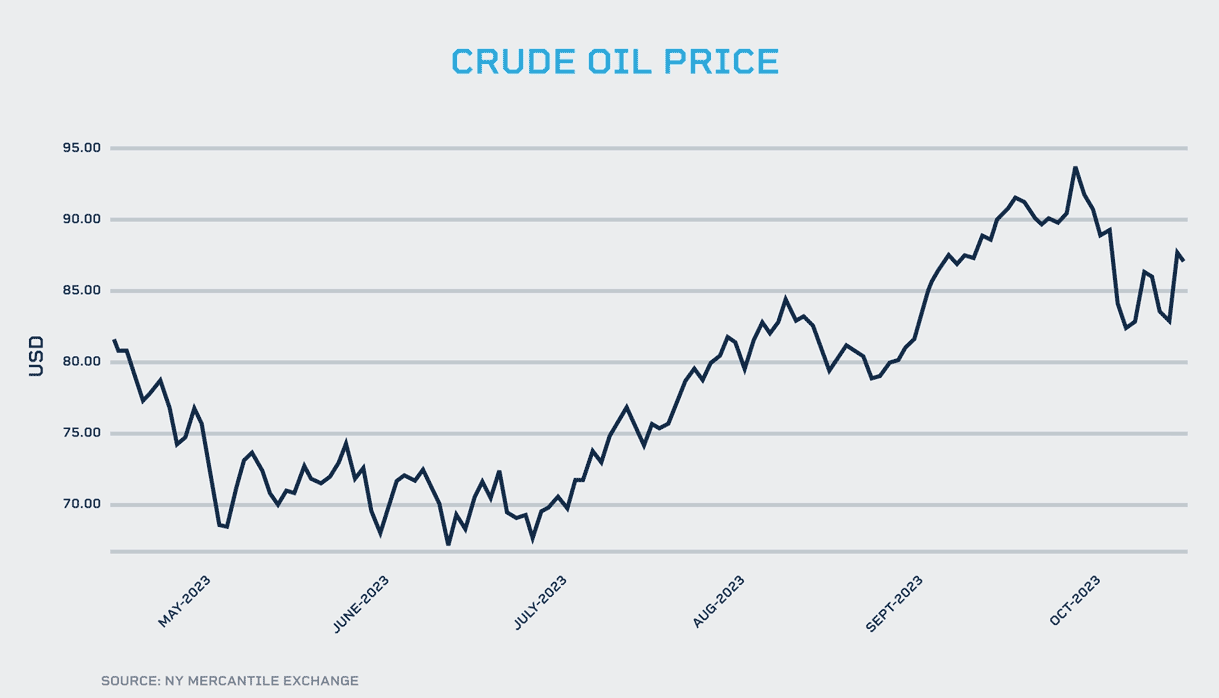

- The extension of oil manufacturing cuts by Saudi Arabia and Russia by December helped push Brent and WTI crude markets increased.

- U.S. crude oil manufacturing hit a document 13.2 million barrels per day in early October, passing ranges not seen since pre-pandemic.

No matter your view on an power transition, escaping this financial actuality is unattainable: We’re going to be fueled by crude oil for the foreseeable future. Which will change sometime, however not as we speak.

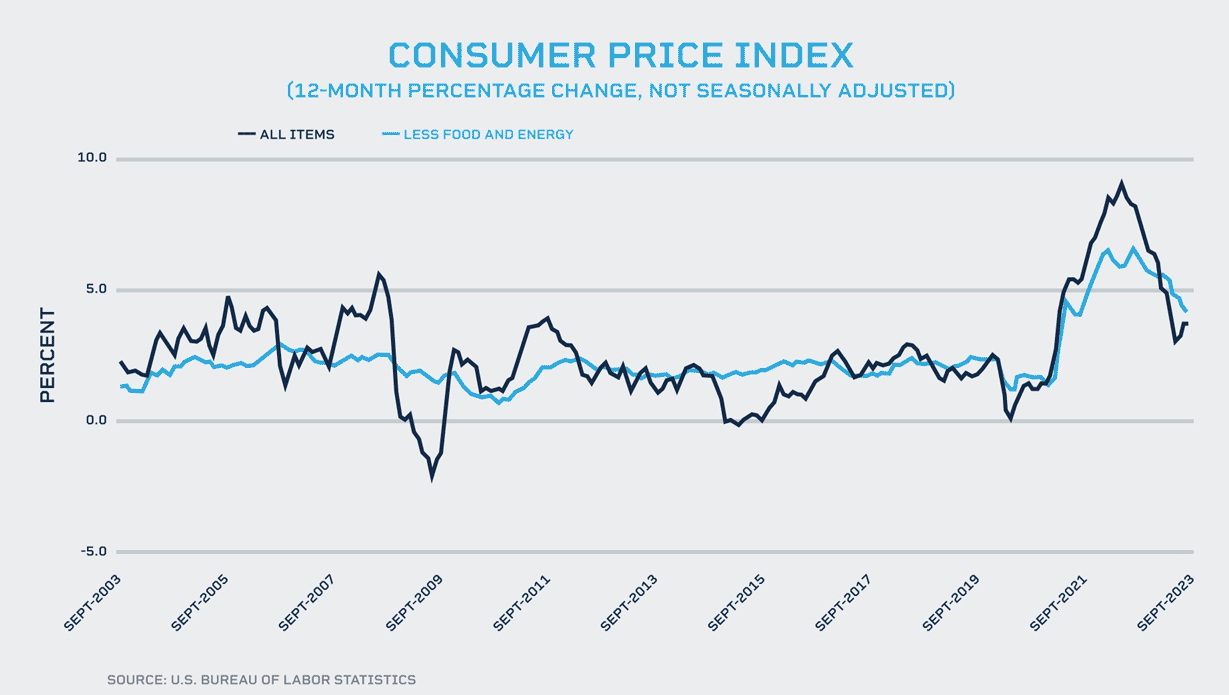

The ebbs and flows in crude oil pricing considerably impression international economies. Rising crude oil costs have not too long ago been gently nudging headline inflation charges increased and compelling central banks worldwide to reexamine their insurance policies.

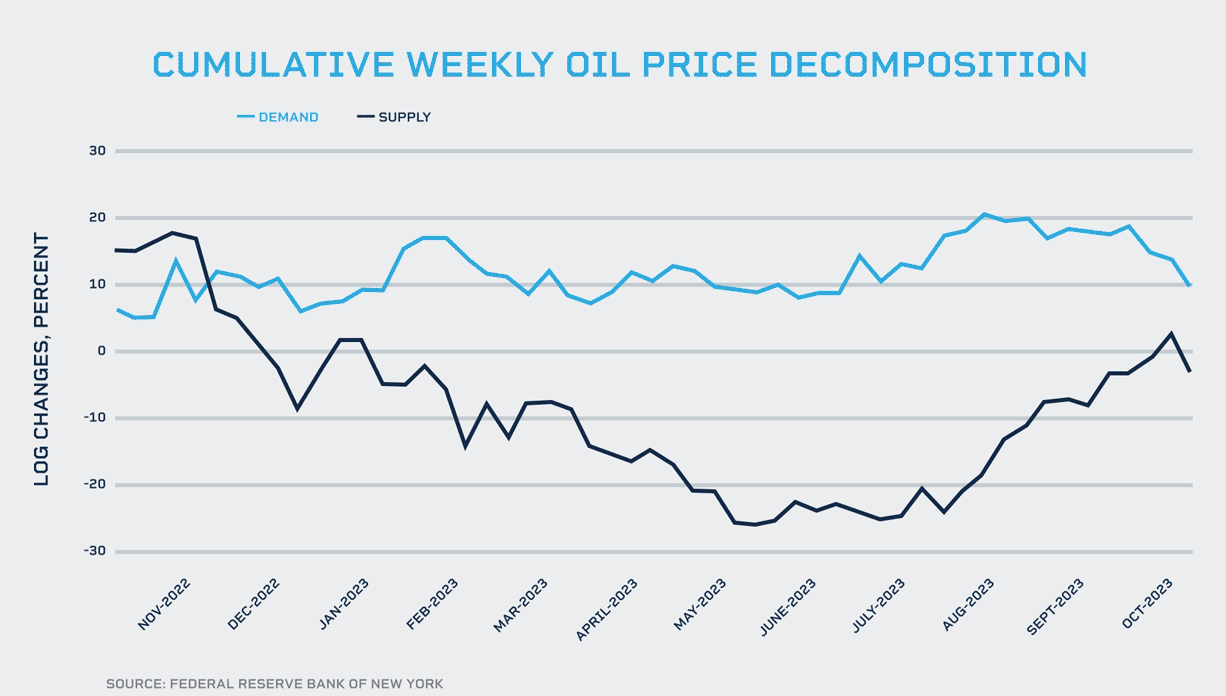

In September, Saudi Arabia and Russia agreed to increase their 1.3 million barrels per day manufacturing cuts by December. Some analysts consider this may lead to a market deficit of greater than 1.5 million barrels per day within the fourth quarter of 2023.

Whereas OPEC+ determined to evaluate their choice month-to-month, the extension helped to energy each Brent and WTI crude markets increased, which complicates issues for the U.S. Federal Reserve and different international central banks.

These establishments are involved {that a} sustained rise within the worth of crude oil might derail among the progress they’ve made on inflation. Vitality costs are a nuanced a part of inflation that central banks can not immediately management.

So, what are a few of these nuances, and the way do they ship ripples throughout economies, affecting inflation and central financial institution insurance policies?

Understanding the correlation between crude oil costs and inflation begins with understanding that crude oil is kind of actually a gasoline of the worldwide financial engine.

The worth of oil can affect the price of power, transportation and manufacturing, subsequently affecting the costs of products and companies. This interconnectedness implies that a surge in oil costs inevitably contributes to inflation, though to what stage is a supply of debate amongst strategists, economists, and their varied fashions.

What shouldn’t be a supply of debate, nevertheless, is a significant soar within the worth of crude oil might necessitate changes in financial insurance policies by central banks.

Crude oil’s impression on inflation comes from two major sources.

Price-Push Inflation:

Rising crude oil costs are a textbook precursor to cost-push inflation. Many analysts are fast to level out that the share of a client’s complete price range spent on power (together with on the gasoline pump) is simply within the vary of three% to six%.

However this is not the one place the place oil would possibly have an effect on the patron price range. Increased oil costs escalate manufacturing prices, rising costs for items and companies, thus stoking client inflation.

Industries closely reliant on oil, similar to transportation and manufacturing, significantly really feel the pinch, transferring the extra prices to customers.

Demand-Pull Inflation:

Shoppers are additionally vulnerable to demand-pull inflation. A easy instance could be that as the associated fee to fabricate and transport a brand new fridge begins driving the worth of fridges increased, customers resolve to hurry out and purchase one now earlier than the worth will increase much more.

However it’s not simply customers. When oil-producing nations expertise a windfall because of elevated oil costs, their elevated buying energy can gasoline further demand-pull inflation on a world foundation.

This rise in sum-total demand, outpacing provide, exerts upward strain on costs, contributing additional to inflation, and the circle continues.

This inflationary impression can generate a world central financial institution response, particularly when mixed with present and persistently excessive inflation.

Central banks might attempt to modify by increased charges, which may harm small companies and customers who might rely to a sure extent on short-term loans for essential spending.

They may be way more aggressive on lowering their stability sheet, which reduces cash provide and slows development.

Increased crude oil costs may work to gradual an economic system when mixed with increased charges. Increased gasoline costs for customers might lead to decreased disposable revenue for households, doubtlessly dampening client spending on different items and companies.

It might additionally enhance reliance on short-term loans, similar to bank cards and residential fairness strains of credit score, loans which now could also be set at increased charges than they have been within the latest previous.

Since client spending accounts for a good portion of financial exercise, a decline on this can have an effect on company revenues and inventory costs.

There’s some hope on this cycle, nevertheless, as OPEC’s crude oil manufacturing climbed in August by a median of 113,000 barrels per day, in response to the group’s newest month-to-month oil market report. The manufacturing increase was primarily led by Iran and Nigeria, each exempt from manufacturing quotas.

Additionally, crude oil manufacturing in the US surpassed 13 million barrels a day through the first week of October, which is increased than it has been since March 2020. This document manufacturing is coming simply as we enter the slowest seasonal demand for crude oil.

If different oil-producing nations choose up the slack, and demand does not spike past expectations, central banks might dodge a bullet immediately on the progress they’ve made to date on inflation.

Editor’s Observe: The abstract bullets for this text have been chosen by Looking for Alpha editors.