High quality and worthwhile firms with sturdy stability sheets may have shares with better earnings because the economic system suffers weakening progress, stated UBS analysts.

UBS analysts, of their Yr Forward 2024 report, stated that the fairness market will rally reasonably in 2024 as earnings develop and rates of interest are anticipated to fall.

They see the S&P 500 (NYSEARCA:SPY) rising to 4,700 by December 2024 and a 9% improve in EPS.

“We expect that leaner inventories, one-off base results in healthcare, and earnings contributions from the expertise sector and different high quality firms ought to offset cyclical headwinds from slower U.S. financial progress,” UBS analysts wrote.

UBS doesn’t low cost macroeconomic and geopolitical points that create uncertainty round earnings.

“The MSCI All Nation World Index (ACWI) is buying and selling at 15.9 occasions 12-month ahead price-to-earnings, roughly 10% above its 15-year common,” they added. However the MSCI ACWI High quality Index has traditionally outperformed the MSCI (ACWI) by 1 proportion level over six-month durations the place progress slowed however stayed constructive.

UBS expects this to repeat in 2024.

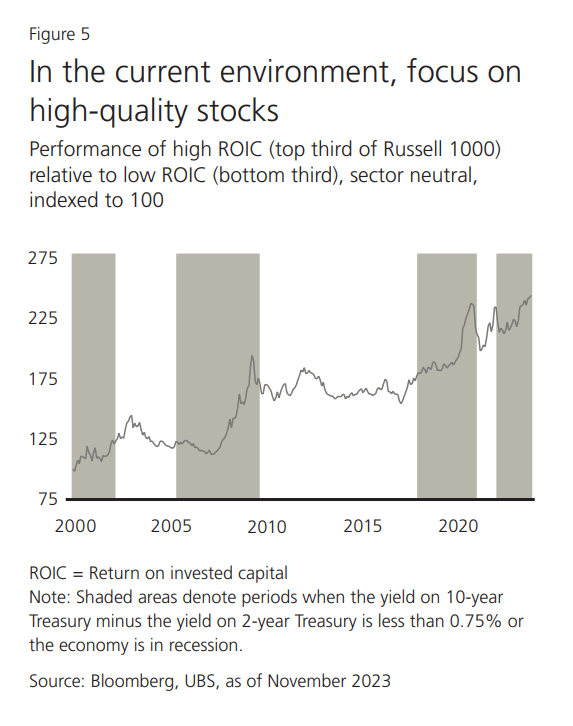

High quality shares have outperformed even in durations of financial contraction, in comparison with the general index.

Tech shares, particularly these incorporating AI, must be those that might be recession-proof, UBS analysts stated.