- Merchants lowered their quantity of leverage as BTC costs stabilized.

- Holders remained unprofitable regardless of the worth appreciation.

Bitcoin [BTC] has impressed hope amidst holders and merchants alike as its value reclaimed the $64,000 ranges. During the last 24 hours, BTC has remained near this stage and has not fluctuated a lot.

Declining leverage

This stability is accompanied by excellent news from the derivatives market, which is exhibiting indicators of well being.

One such indicator is the numerous reset in Funding Charges that occurred after the latest value drop. This reset means that leverage available in the market could also be reducing.

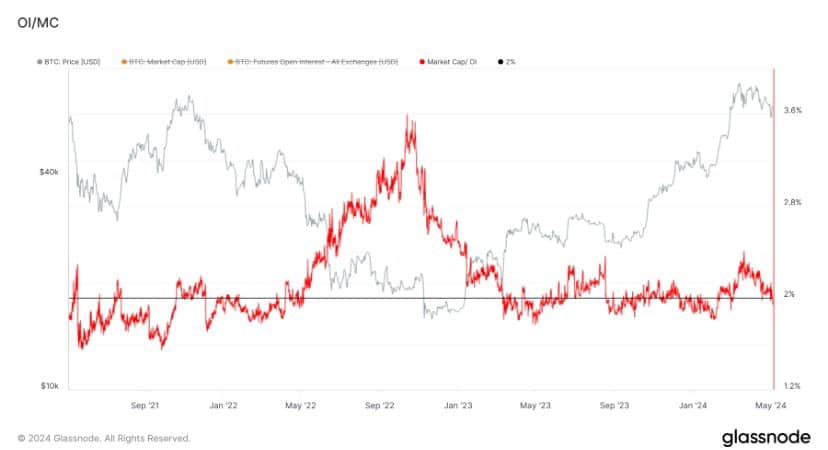

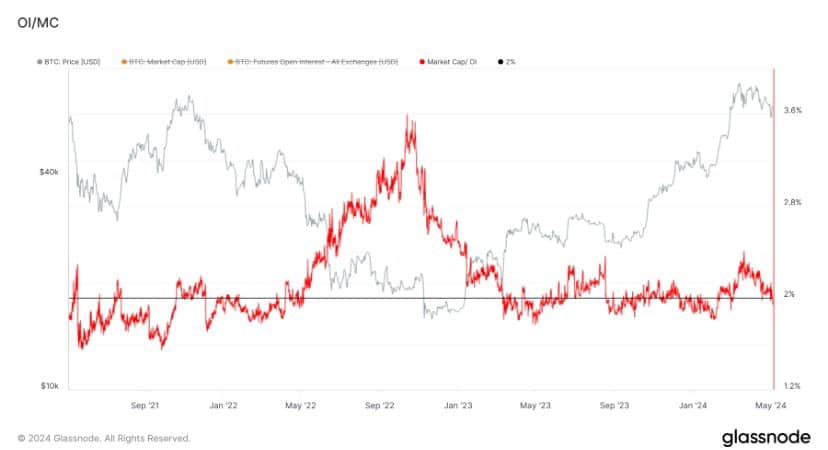

Including to the constructive sentiment is the truth that Open Curiosity as a share of market cap has fallen under 2%.

That is the primary time this has occurred since February, and it’s one other indicator of decreased leverage available in the market.

Decrease leverage could be seen as an indication of lowered danger, which is mostly constructive for the long-term well being of BTC.

Supply: Glassnode

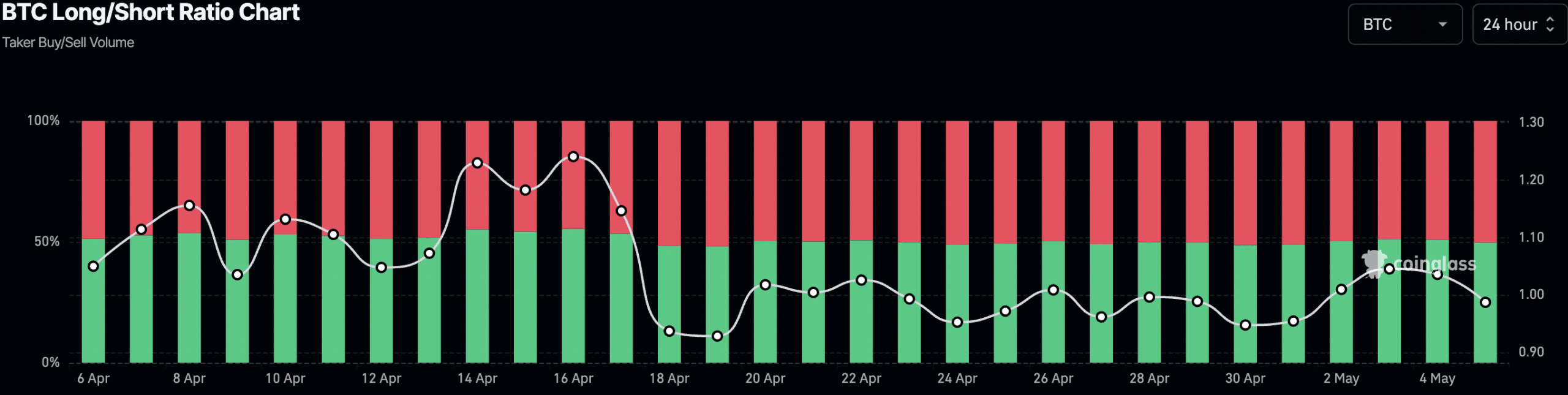

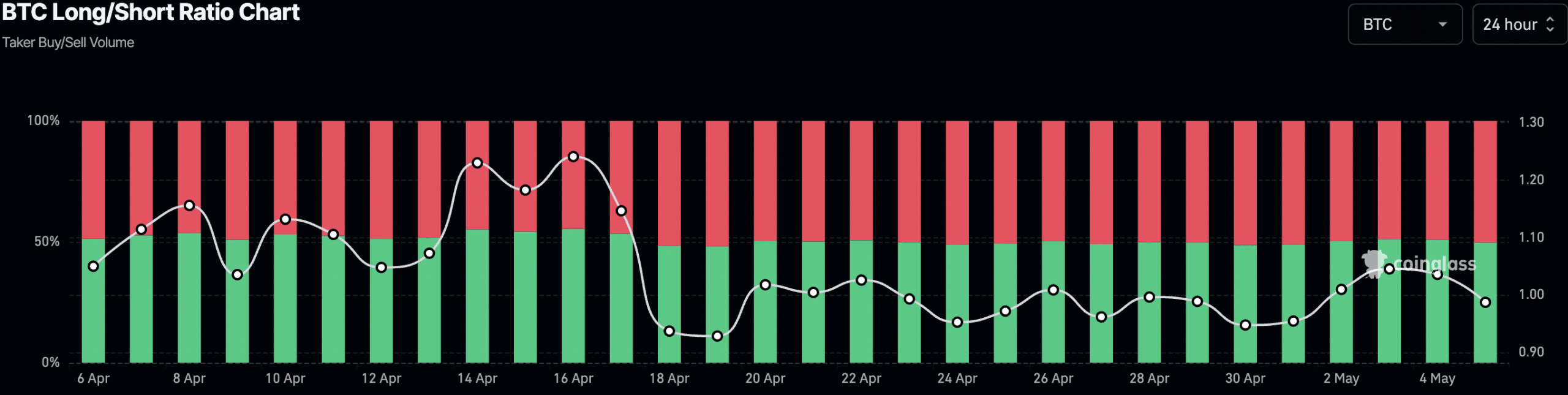

Nonetheless, merchants skewed extra in the direction of the skeptical aspect when it got here to BTC. Coinglass’ information indicated that the share of brief positions taken in opposition to BTC have been a lot larger than the lengthy positions being taken.

Supply: coinglass

How are holders doing?

At press time, BTC was buying and selling at 64,232.57, with its value having risen by 1.37% within the final 24 hours. Nonetheless, the quantity at which BTC was buying and selling at had decreased by 11.18% throughout this era.

Regardless of BTC’s latest surge in value, holders remained unprofitable.

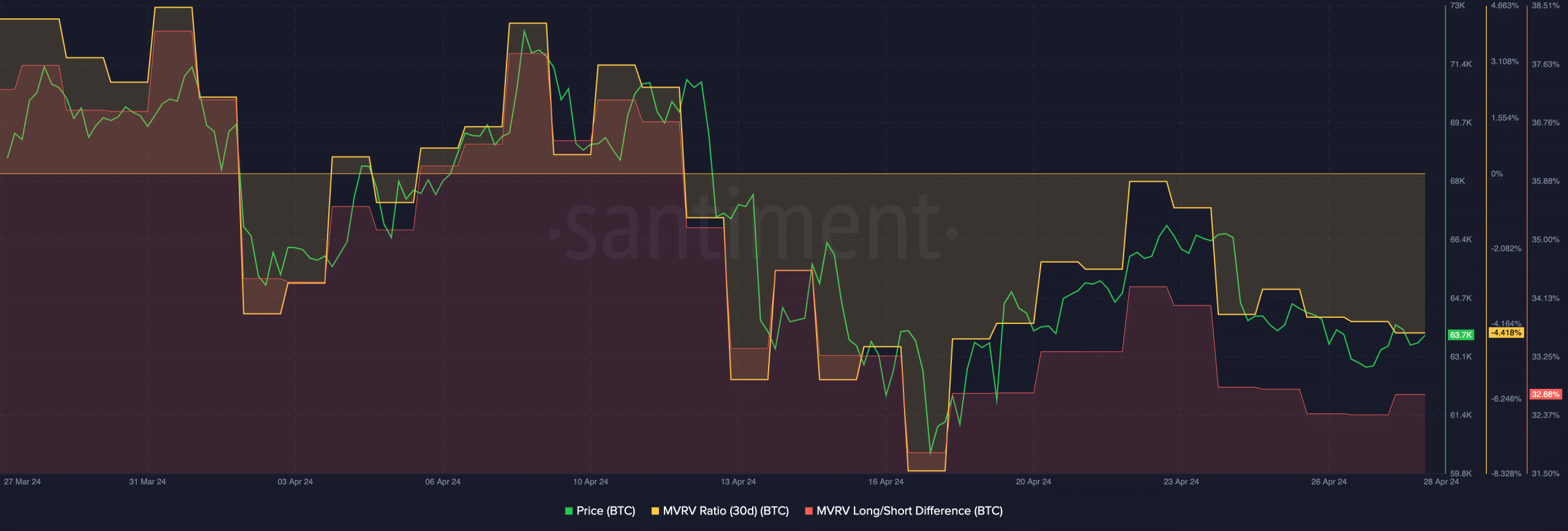

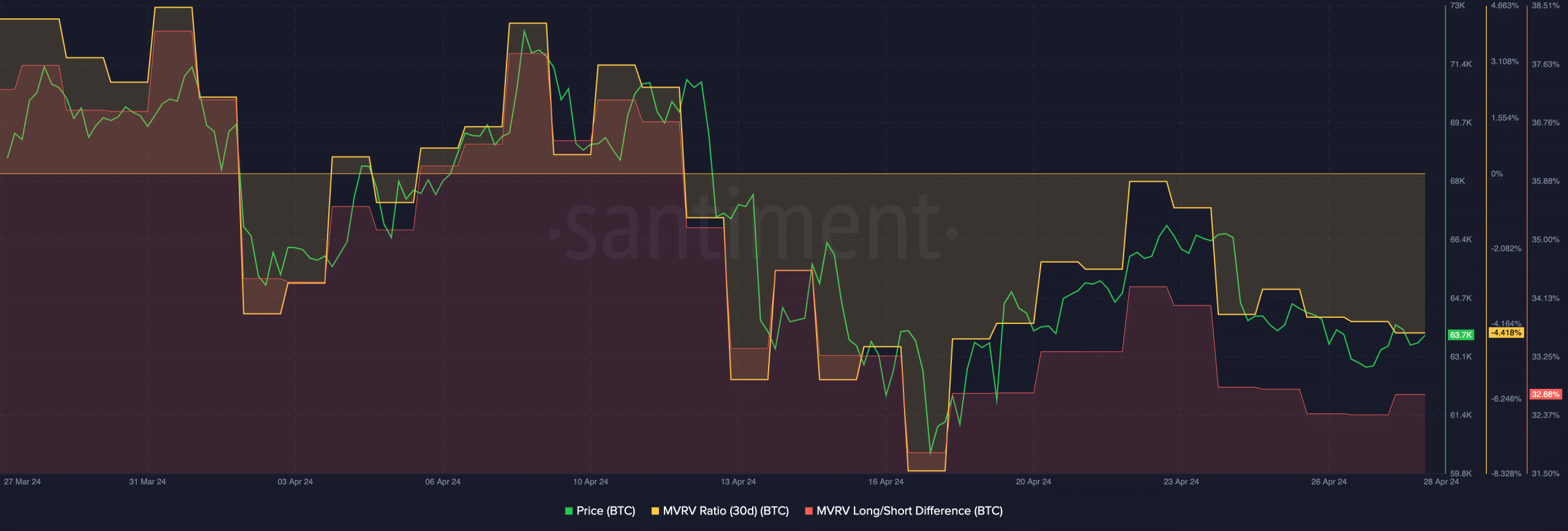

AMBCrypto’s examination of Santiment’s information revealed that the MVRV ratio of BTC had fallen, implying that the majority holders have been ready for his or her holdings to show inexperienced.

This can be constructive for BTC within the brief time period as these addresses are prone to maintain on to their BTC until the costs transfer previous a sure value level.

Nonetheless, what would problem BTC’s rally could be the declining Lengthy/Brief distinction.

A waning Lengthy/Brief distinction exhibits that the variety of long run holders have been declining and have been getting outnumbered by brief time period holders.

Is your portfolio inexperienced? Try the BTC Revenue Calculator

It’s anticipated of those brief time period holders to show what’s often called “paper palms” which suggests the tendency to promote holdings amidst market volatility and never displaying perception of their holdings.

The angle and conviction of those short-term holders will play an enormous function in figuring out the worth motion of BTC going ahead.

Supply: Santiment