Wirestock/iStock Editorial by way of Getty Photos

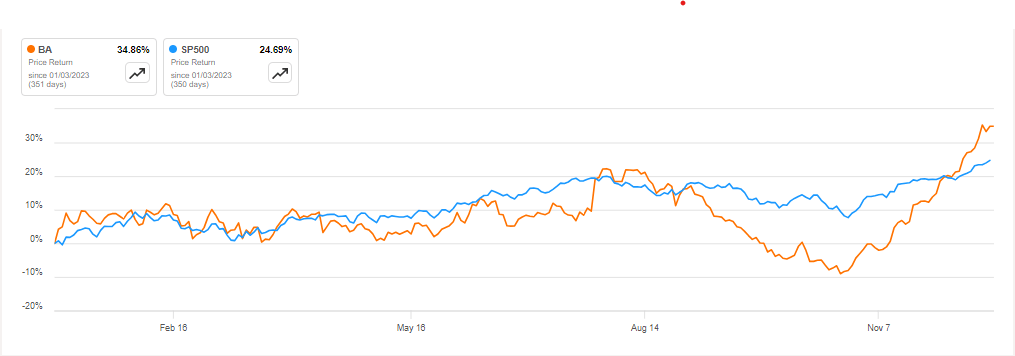

Shares of Boeing (NYSE:BA) have gained by a couple of third in 2023, following a 5% drop within the earlier yr. 2023 noticed the jet maker undergo from manufacturing points affecting fuselages which might be denting deliveries of its best-selling 737 narrow-body jets.

As a outcome, the corporate in September stated its 737 jet deliveries could be on the decrease finish of its aim of 400–450. This forecast was additional diminished to 375-400 737 airplanes by October-end.

For almost all of the yr, Boeing shares had been buying and selling decrease, noting a 4% decline up till its third-quarter earnings. Since then, the inventory has skyrocketed over 40% and is at the moment hovering close to its 2021 highs.

“We’re bullish on business aerospace into 2024,” stated Goldman Sachs analysts in a observe.

“Boeing & Airbus new plane provide remains to be properly under very robust ranges of demand, and we anticipate 2024 to see additional provide chain and output enchancment. The aerospace aftermarket stays among the finest companies throughout Industrials,” the analysts added.

Monetary providers agency Baird marked Boeing and key provider Spirit AeroSystems (SPR) as its high picks for 2024 within the aerospace business.

“Boeing (BA) is predicted to extend the output of its best-selling 737-Max to 42 a month by the tip of the primary quarter of 2024, and to 47 a month later within the yr. Output of the 787 Dreamliner is about to increase from 5 a month to seven a month by the center of subsequent yr,” Baird stated. The agency has a $300 worth goal on Boeing.

On its half, Boeing in October reaffirmed steering for $4.5B – $6.5B of working money stream and $3.0B – $5.0B of free money stream (non-GAAP) for the full-year.

Indications from Quantitative measures, Wall Road, and SA group

Looking for Alpha’s Quant Ranking system gave Boeing a Maintain score. The corporate acquired an A+ for profitability and an A- for momentum, whereas its valuation was graded an F, the identical as three months in the past.

Promote-side analysts had been extra favorable to Boeing. About 24 of the 30 analysts surveyed within the final 90 days had a Purchase or greater score on the corporate. Whereas the remaining six really useful the inventory as a Maintain.

“If you wish to spend money on Boeing for its present monetary power, there may be not a lot motive to take action, as the corporate has a steadiness sheet that’s loaded with debt and inventories,” stated SA Analyst Dhierin Bechai.

“Nonetheless, simply from assessing orders and deliveries, we will already see that there’s robust demand for airplanes that help money stream era going ahead,” Bechai added.