Uniswap V4 is right here. The ecosystem has been a great distance since 2018 and has grow to be of works as a easy automated market maker. With V4, Uniswap has simplified processes, cheaper and extra versatile for the decentralized monetary DEAS and customers. So what precisely does V4 convey to the desk and the way does it relate to earlier variations? This information treats every part it is advisable to know concerning the newest model of the decentralized change in 2025.

On this information:

- What’s Uniswap V4: how else is it?

- Uniswap V4 vs. different variations

- Uniswap V4 Options: A Deep Dive

- Who ought to change to Uniswap V4?

- How do Polish work in Uniswap?

- The present standing of Uniswap V4

- Uniswap v4 versus older variations

- Regularly requested questions

What’s Uniswap V4: how else is it?

Uniswap V4 is the newest improve to the world’s largest decentralized change, designed to decrease buying and selling prices, enhance effectivity and to provide customers extra management over liquidity and reimbursements.

Uniswap V4 is the Defi -Metropolis dialog in 2025. Here’s a fast overview of all the brand new features that packaged:

- A lot decrease fuel prices – as much as 99.99% cheaper to create liquidity swimming pools.

- HOOKS – Builders can alter the buying and selling logic (akin to dynamic prices and orders restrict).

- FLASH Accounting – Leaves pointless token transfers, which saves fuel prices.

- Dynamic prices – Polish can mechanically alter prices based mostly on market situations.

- Indigenous ETH help – No extra squeezing ETH in Weth for appearing.

- Singleton Contract – Uniswap V4 manages all swimming pools beneath one contract, which lowers the complexity with totally different notches.

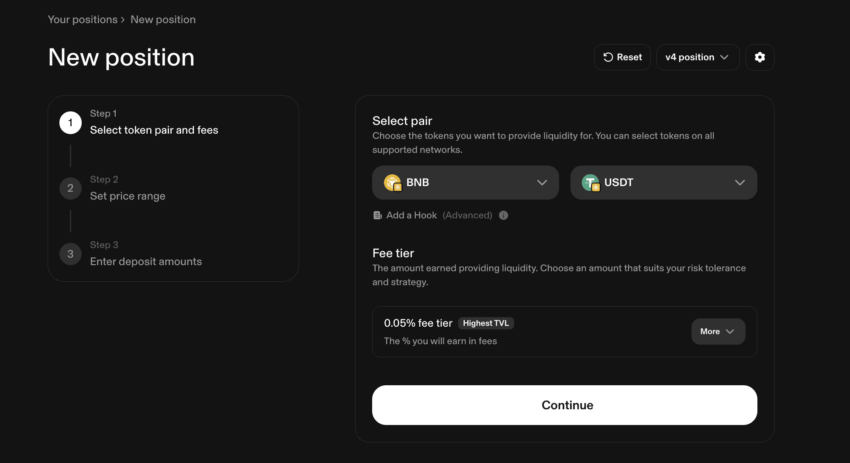

Creating Uniswap V4 positions: Uniswap

Uniswap V4 vs. different variations

Here’s a fast overview of the features that each earlier model has launched.

Uniswap V1 (2018)

- Initially decentralized automated market maker (AMM).

- ETH was required if the bridge for each commerce (no direct token-to-token swaps).

- No value oracles, no superior commerce methods – solely a primary change system.

Uniswap v2 (2020)

- Direct ERC-20 to ERC-20-trade (ETH now not wanted as a bridge).

- Flash Swaps – Customers can borrow belongings with out prior collateral.

- Launched value oracles, making swaps safer.

Uniswap V3 (2021)

- Concentrated liquidity – Liquidity suppliers (LPS) can go for value reaches for his or her funds.

- A number of reimbursement ranges (0.05%, 0.3%, 1%) for higher market effectivity.

- Extra capital environment friendly however costly because of particular person pool contracts.

Uniswap -versions in contrast

Uniswap -versions in contrast

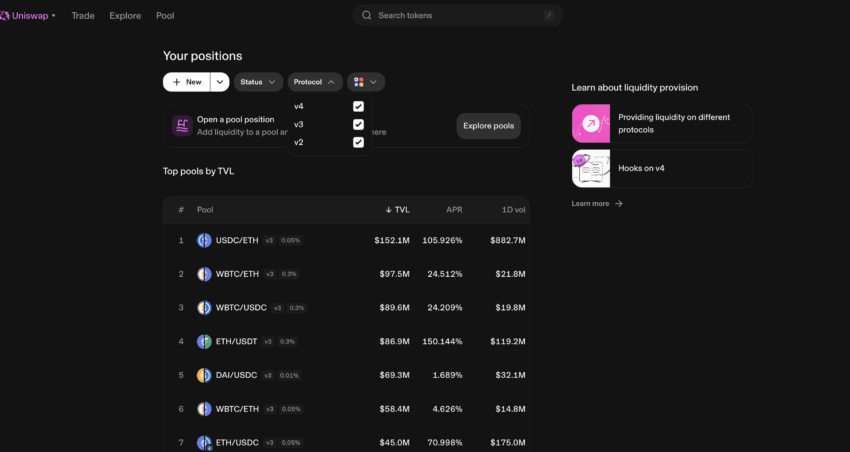

All obtainable variations: Uniswap

Uniswap V4 Options: A Deep Dive

Within the following sections we are going to look higher in each new characteristic.

The largest change: the Singleton contract

For (V3): Every new liquidity pool required a separate sensible contract, making transactions dearer.

Now (V4): One giant contract (Singleton Design) offers with all swimming pools beneath one roof, in order that the fuel prices are significantly decreased.

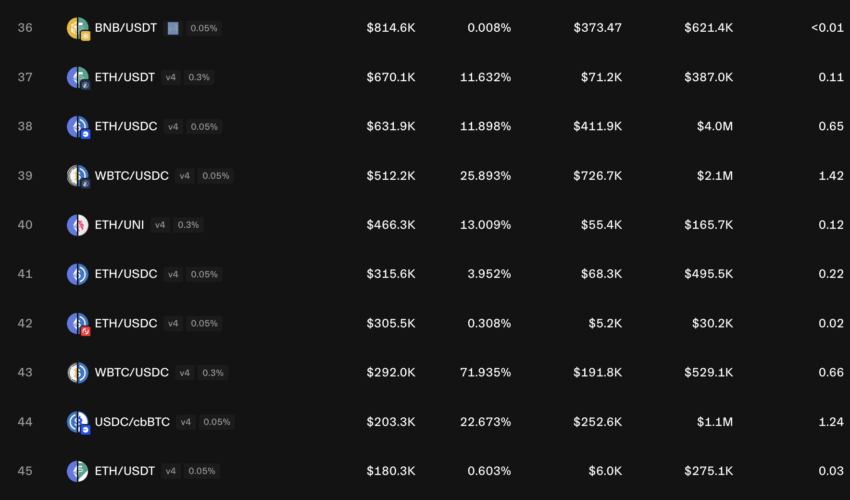

Uniswap V4Pools with comparatively low liquidity: uniswap

Crucial ideas are in fact already memed:

Crochet

For (V3): The logic of uniswap was decided – transactions adopted a hard and fast sample and liquidity suppliers had restricted management.

Now (V4): Builders can add tailored commerce guidelines with hooks.

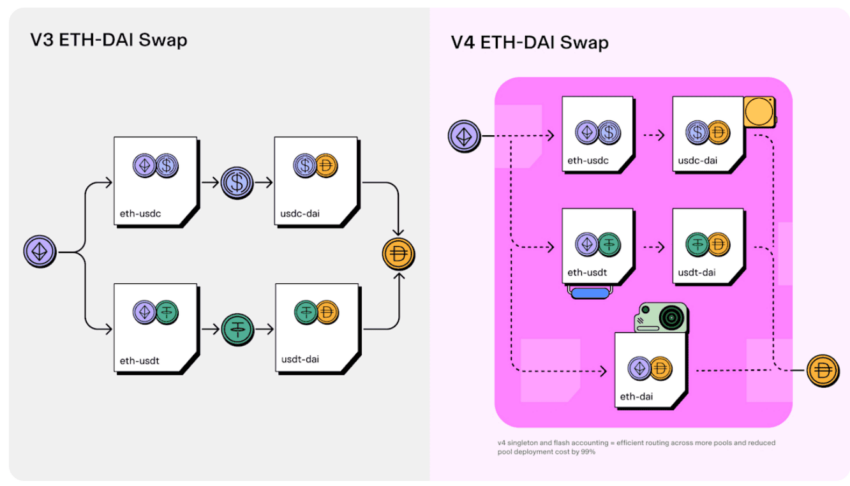

Uniswap v4 swap mechanism: uniswap weblog

With hooks you’ll be able to:

- Arrange dynamic prices that mechanically alter throughout excessive volatility.

- Create restrict orders, in order that solely a swap occurs if the value is sweet.

- Auto-Kroest LP rewards with out handbook intervention.

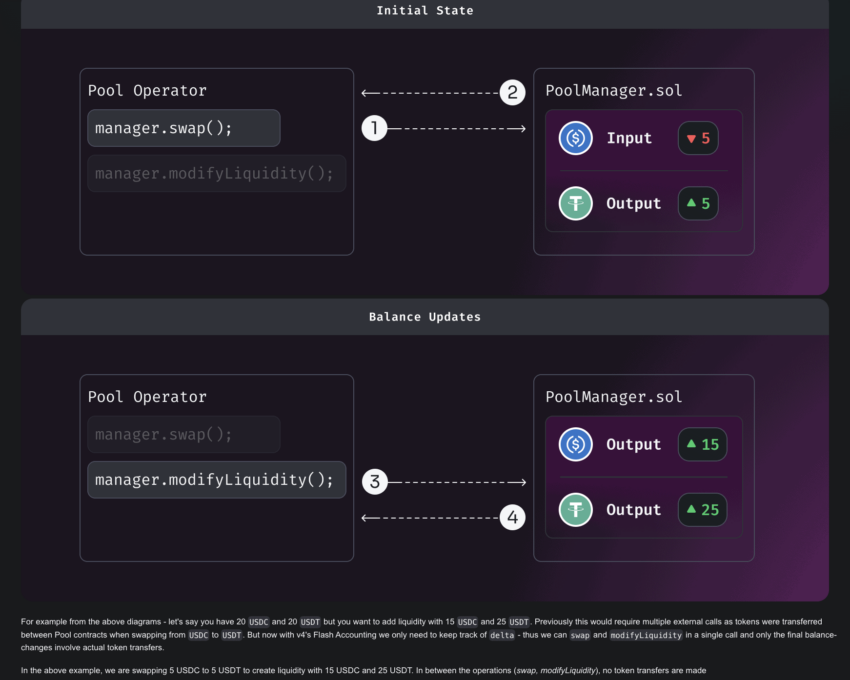

What is going on on with Flash Accounting?

For (V3): Each time you change tokens, Uniswap tokens transfers forwards and backwards a number of instances by commerce.

Now (V4): Uniswap retains observe of all stability adjustments internally and solely has the ultimate quantity, which reduces fuel prices.

Dynamic

This operate brings smarter costs for Swaps. Listed below are the variations:

For (V3): Polish had mounted prices (0.05%, 0.3%, 1%), which implies that LPS couldn’t alter based mostly on market tendencies.

Now (V4): Prices can rise in the course of the excessive volatility and reduce throughout quiet durations, in order that the LP earnings is optimized.

Indigenous ETH help

For (V3): You needed to wrap Eth in Weth earlier than you acted.

Now (V4): You possibly can act with native ETH, save further fuel prices and simplify transactions.

Higher liquidity administration with subscribers

For (V3): In case you wished further rewards to supply liquidity, you had to make use of your place, which suggests that you’ve got registered the test briefly.

Now (V4): Subscribers permit you to earn rewards with out giving management of your funds.

Who ought to change to Uniswap V4?

You possibly can think about using V4:

- If you’re a dealer: you get decrease fuel prices, native ETH help and extra environment friendly swaps.

- If you’re a liquidity supplier: you’ll be able to optimize your liquidity with hooks and earn higher rewards with dynamic prices.

- If you’re a developer: you get full management over commerce methods with tailored hooks.

Or, if you’re utterly searching for an alternative choice to uniswap, the X messages under comprise a couple of choices.

How do Polish work in Uniswap?

When you’ve got beforehand used Uniswap, you could have had an interplay with liquidity swimming pools – however you might not understand how they work behind the scenes.

How Polish labored in Uniswap V3 versus V4

For (V3): Every buying and selling couple had its personal separate sensible contract, which implies that in case you wished to behave in a number of Polish, Uniswap needed to talk with a number of contracts, enhance fuel prices and delay issues.

Now (V4): Polish now not dwell in separate contracts. As an alternative, all of them exist in a single huge contract referred to as the Pool Supervisor.

This implies:

- Making a brand new swimming pool is planning 99.99% cheaper In comparison with earlier variations – as a result of you don’t implement utterly new contract.

- Multi-Hop Swaps (Trade by a number of swimming pools) are a lot cheaper-out of that tokens do not have to maneuver that a lot.

- All swimming swimming pools are managed in a single place, making every part sooner and extra environment friendly.

V3 additionally left one other drawback to unravel – how tokens transfer inside Polish. Each commerce or liquidity adjustment in earlier variations required a number of ERC-20 transfers, which unnecessarily elevated fuel prices.

Enterprise swimming pools: Uniswap

ERC-6909: A extra fuel environment friendly tok system for Polish

In Uniswap V4, the protocol has been upgraded from ERC-1155 to ERC-6909 To optimize token claims, repayments and liquidity positions.

Now ENISWAP V4-6909 is introducing a lighter and extra gas-efficient token commonplace that helps the liquidity suppliers and merchants to save lots of on reimbursements by lowering pointless exterior calls.

What this implies for liquidity suppliers and merchants:

- Decrease fuel prices when offering or eradicating liquidity.

- Extra environment friendly liquidity administration -LPS doesn’t have to maneuver ERC-20 tokens each time they convey with the swimming pool.

- Excessive-frequency merchants and liquidity managers profit probably the most as a result of they keep away from costly ERC-20 property inspections and transfers.

The present standing of Uniswap V4

Sure, uniswap v4 is dwell. However extra is going on within the background:

- V4 is applied on 10+ block chains, together with Ethereum, Polygon, Arbitrum, on MAINNET, BASE, BNB chain, Blast, World Chain, Avalanche and Zora Community.

- Liquidity nonetheless migrates – many merchants nonetheless use V3 -Swimming pools, however new liquidity is added to V4 each day. Polish might be obtainable on time.

- Swaps are routed by the V2, V3 and V4 through Uniswapx, which is able to mechanically discover one of the best value for you.

Supported Blockchains: Uniswap V4

Comment: In case you change, you do not have to do something – Uniswap mechanically routes your commerce to one of the best pool (whether or not it’s V2, V3 or V4). Even in case you provide liquidity, you now have a alternative. You possibly can follow V3 if you need, or migrate to V4 for decrease fuel prices and elevated adjustment choices.

Uniswap v4 versus older variations

UNISWAP V4 brings cheaper transactions, extra flexibility and superior features, making it the only option for many customers. V3, nonetheless, nonetheless has a lead in deep liquidity, and a few merchants and LPS might desire the mounted reimbursement buildings and the established ecosystem. For now, V4 is the longer term, however V3 and V2 nonetheless meet particular wants, so your determination should be based mostly in your buying and selling type and liquidity technique.