Bitcoin’s (BTC) value reclaimed $30,000 on October 20, erasing losses from huge liquidations that adopted Cointelegraph’s misguided information report on Monday. On-chain evaluation outlines elements that would propel BTC towards the $40,000 milestone.

Bitcoin value hit $30,000 on Friday as markets responded to a number of bullish macro occasions, together with Grayscale’s fresh application for Spot Bitcoin ETF with the US Securities and Alternate Fee. Will the bullish traders maintain out to reclaim $40,000?

Rising Bitcoin Dominance May Push Costs Towards $40,000

Bitcoin value crossed $30,000 on Friday, bringing its weekly beneficial properties into double-digits. Nevertheless, very important indicators present that BTC costs will seemingly rise increased within the coming days.

First, Bitcoin Dominance (BTC.D) has risen for 10 consecutive days since October 10. That is fairly uncommon as a result of, traditionally, as soon as BTC scores sizable beneficial properties and crosses a milestone value degree, traders start to diversify and channel funds into altcoins to amplify their beneficial properties strategically.

Nevertheless, the skittish macroeconomic panorama and occasions surrounding the Center East disaster might make traders unwilling to diversify into altcoins this time round.

This latest pattern in BTC.D affirms the thesis that Bitcoin’s “secure haven” standing might additional speed up the continuing value rally.

The chart beneath exhibits that Bitcoin’s crypto market share stood at 51% when the disaster broke out on October 7. Following two weeks of escalating tensions, Bitcoin has gained extra floor, with BTC.D rising towards 52.71% on October 20.

Bitcoin Dominance (BTC.D) captures the proportion of the whole cryptocurrency market valuation that Bitcoin presently holds. When Bitcoin’s market rises throughout bearish macro circumstances, it alerts that traders are exhibiting decrease danger urge for food and piling into BTC as a secure haven wager.

This phenomenon was additionally noticed after the Russian vs. Ukraine conflict broke out round February 24, 2022. Bitcoin’s Dominance within the crypto market jumped from 44% to 48% inside two weeks.

After the preliminary value dip from the conflict FUD, BTC value skyrocketed 51% from $20,200 to $30,400 between March 10 and April 10, 2022, as crypto traders keyed into Bitcoin’s secure haven standing.

The chart above exhibits that the circumstances surrounding the present Bitcoin value rally and BTC.D developments are just like occasions that adopted the Russia vs. Ukraine conflict.

If historical past repeats, one other 50% bounce might ship Bitcoin value nicely above the $40,000 mark within the weeks forward.

Lengthy-term Holders Have Made Massive Acquisitions Since Earlier All-Time Excessive.

Massive BTC transfers from weak palms to long-term holders are one other very important on-chain indicator that would additional speed up the continuing Bitcoin value rally.

In keeping with key information factors obtained from Glassnode, Lengthy-term holders had 11 million BTC, whereas Brief-term holders’ provide stood at 5 million BTC when Bitcoin value peaked at $69,000 in November 2021.

Since then, Lengthy-term traders (blue line) acquired over 3 million extra BTC as their balances reached 14.89 million BTC as of October 19. In the meantime, Brief-term merchants’ provide (crimson line) has dropped by greater than half, sitting at 2.4 million BTC.

This vividly illustrates an enormous switch of wealth from the weak palms to extra resilient traders over the past 2-years.

Wallets which have held their crypto property unmoved for over a yr are considered long-term hodlers. This persistent enhance within the quantity of BTC held long-term additional affirms international confidence in Bitcoin as a secure haven asset.

With lesser BTC now in charge of short-term merchants, it creates a synthetic market shortage. Therefore, an additional enhance in Bitcoin dominance and total market demand might speed up the worth rally towards $40,000.

BTC Worth Prediction: The $40,000 Goal is Viable

From an on-chain perspective, the rising market dominance and long-term holder acquisitions might push BTC’s value additional towards $40,000.

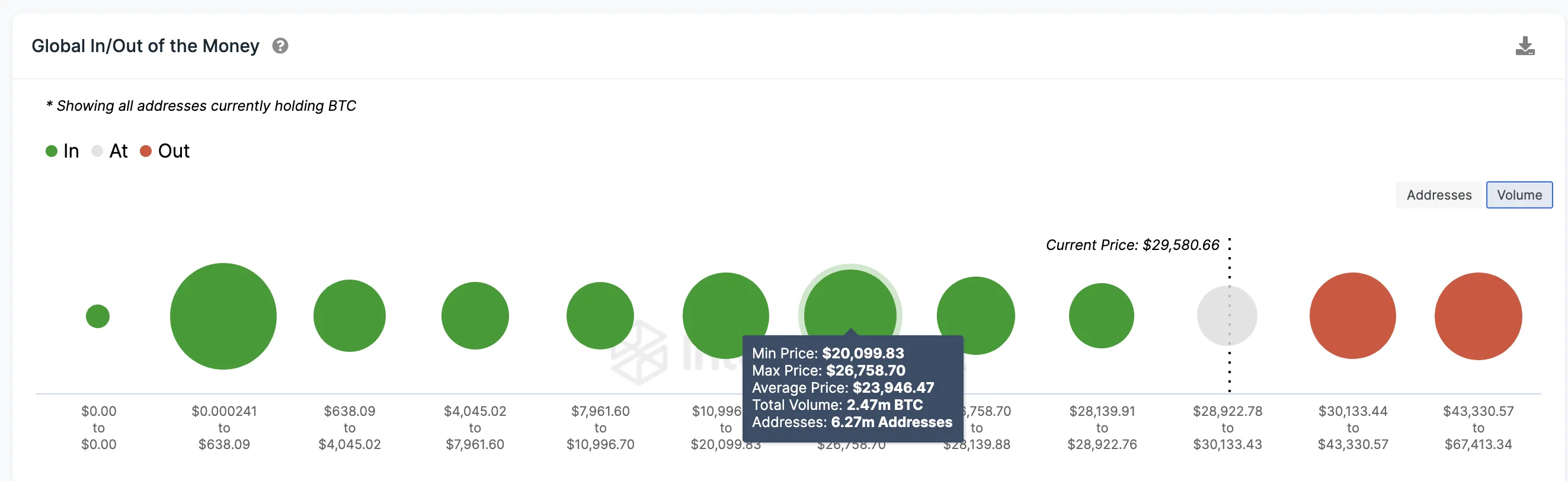

Nevertheless, the International In/Out of Cash information depicting present Bitcoin holders’ entry value distribution highlights key resistance ranges.

It exhibits that BTC’s preliminary resistance across the $30,130 territory is sort of vital. As illustrated beneath, the two.08 million addresses purchased 842,330 BTC at a median value of $30,133.

However a decisive breakout from that $30,200 resistance might open the door to a bigger upswing nicely above $35,000

Nonetheless, the bears might invalidate this bullish prediction if Bitcoin value reverses beneath $25,000. Nevertheless, the chart depicts that 6.27 million addresses bought 2.47 million cash on the most value of $26,750.

If these wallets proceed to HODL, BTC value will seemingly enter an immediate value rebound.

But when the bears get round that help buy-wall, it might catalyze a protracted Bitcoin value downswing towards $25,000.

Disclaimer

Consistent with the Belief Venture tips, this value evaluation article is for informational functions solely and shouldn’t be thought-about monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market circumstances are topic to vary with out discover. At all times conduct your individual analysis and seek the advice of with an expert earlier than making any monetary selections.