- Demand for ETH grew as put-to-call ratios declined

- ETH’s value motion remained stagnant as costs fluctuated

Ethereum [ETH] has remained stagnant across the $3500-mark for fairly a while now. Regardless of its sideways motion, nevertheless, bullish sentiment round ETH has been rising.

Ethereum demand surges

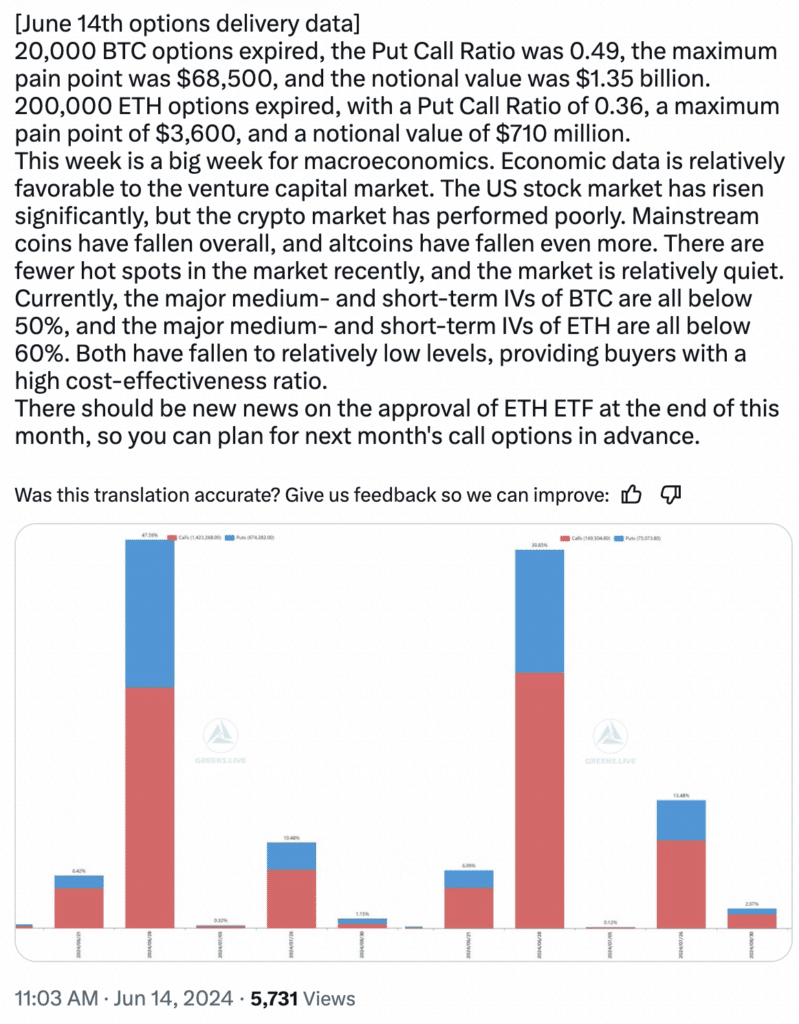

In response to current information, 200,000 Ethereum choices contracts not too long ago expired, and the info surrounding this occasion hinted at a surge of bullish sentiment within the Ethereum market. The Put-Name Ratio, a key indicator of market bias, sat at a low 0.36 at press time.

This implies there was considerably much less shopping for of put choices in comparison with name choices – An indication that almost all choices merchants anticipate Ethereum’s value to rise. Additional including to the optimism is the utmost ache level of $3,600. This value stage signifies the purpose the place most choices contracts expire nugatory.

If Ethereum surpasses $3,600 at expiry, most name choices will probably be worthwhile, once more reflecting a bullish bias.

Lastly, low implied volatility (IV) under 60% throughout all short-term ETH choices contracts additional fueled the bullish outlook. Right here, implied volatility displays anticipated value motion, and decrease IV suggests buyers anticipate Ethereum’s value to stay steady or hike within the close to time period.

Supply: X

Trying on the value motion

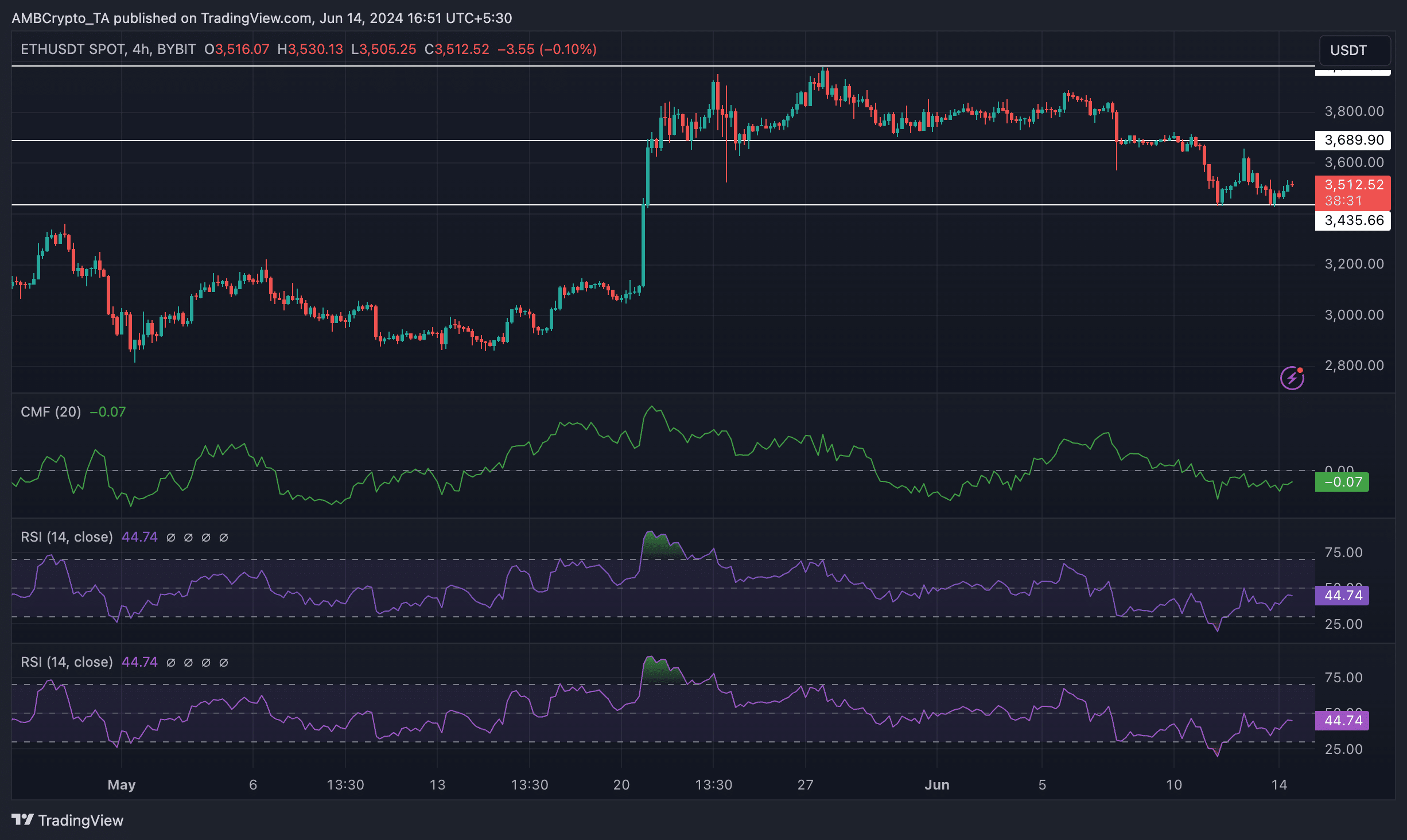

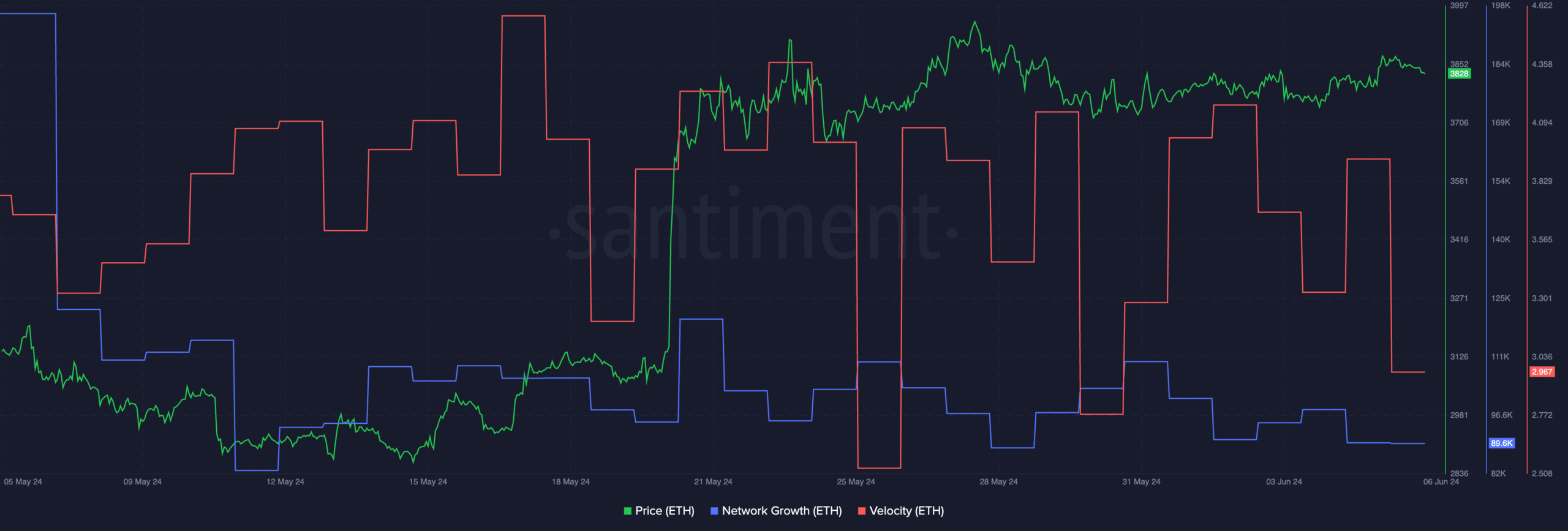

At press time, ETH was buying and selling at $3,512.52. Whereas the value of ETH has appreciated considerably after 20 Could, as time went on, the bullish sentiment round ETH depleted itself. In reality, because the altcoin’s value fell once more after 27 Could, its market development reversed itself too.

If bearish sentiment persists, the value of ETH may go right down to the $3,000-level. The CMF (Chaikin Cash Move) for ETH fell considerably throughout this era as nicely.

This indicated that the cash circulation for ETH fell materially. The RSI (Relative Power Index) for ETH was additionally comparatively low. The declining RSI could possibly be an indication of ETH’s bullish momentum waning on the charts.

Supply: Buying and selling View

How will new addresses adapt?

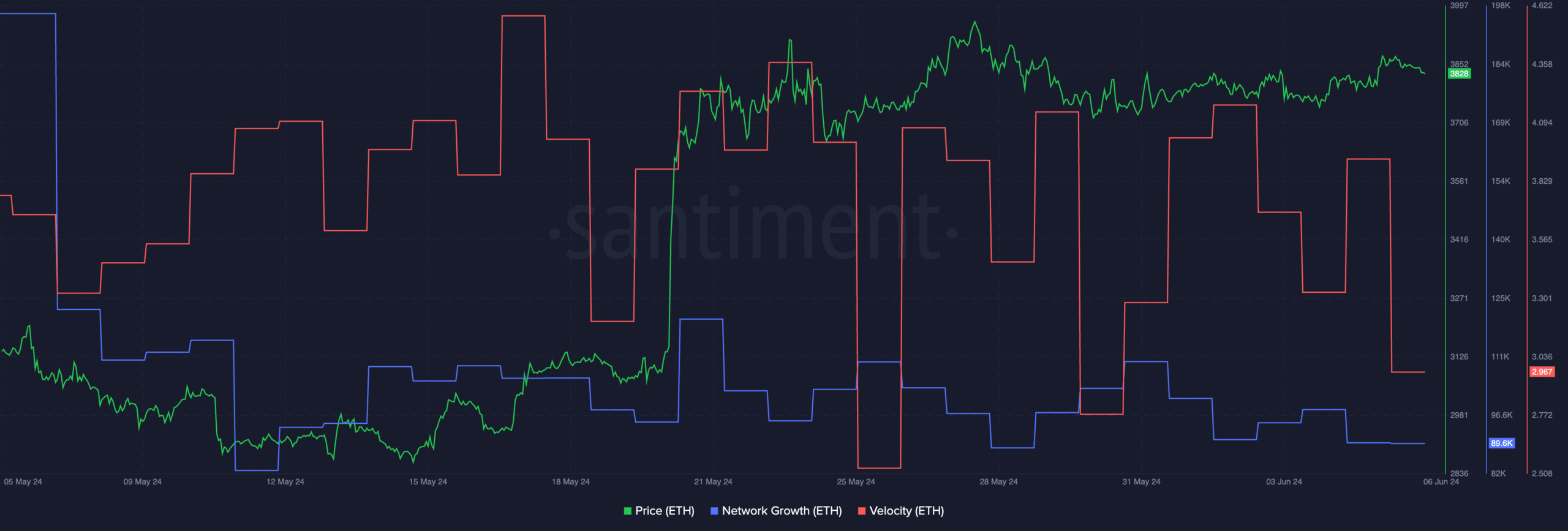

AMBCrypto’s evaluation of Santiment’s information revealed that the community progress for ETH additionally fell materially as the value of declined. The falling community progress implied that new addresses have been dropping curiosity in ETH and weren’t prepared to purchase the altcoin on the current low cost.

Learn Ethereum (ETH) Worth Prediction 2024-25

If this development continues and addresses the refusal to purchase extra ETH, it might additional influence the value of ETH negatively.

Furthermore, the speed of ETH additionally plummeted throughout this era, implying that the frequency at which the trades have been occurring had additionally fallen considerably over the previous couple of days.

Supply: Santiment

Nonetheless, if the recognition of ETFs continues to rise, the general curiosity in ETH can even develop considerably as Wall Road cash flows in.