- Bitcoin’s annualized funding charge reached a two-month excessive, impacting buying and selling exercise and volatility.

- Whale curiosity surged and MVRV ratio declined.

In the previous couple of days, Bitcoin[BTC] confronted a quick stoop, breaching the $27,000 mark. Regardless of this, the prevailing sentiment relating to cryptocurrency was predominantly constructive.

Learn Bitcoin’s Value Prediction 2023-2024

Funding charges develop

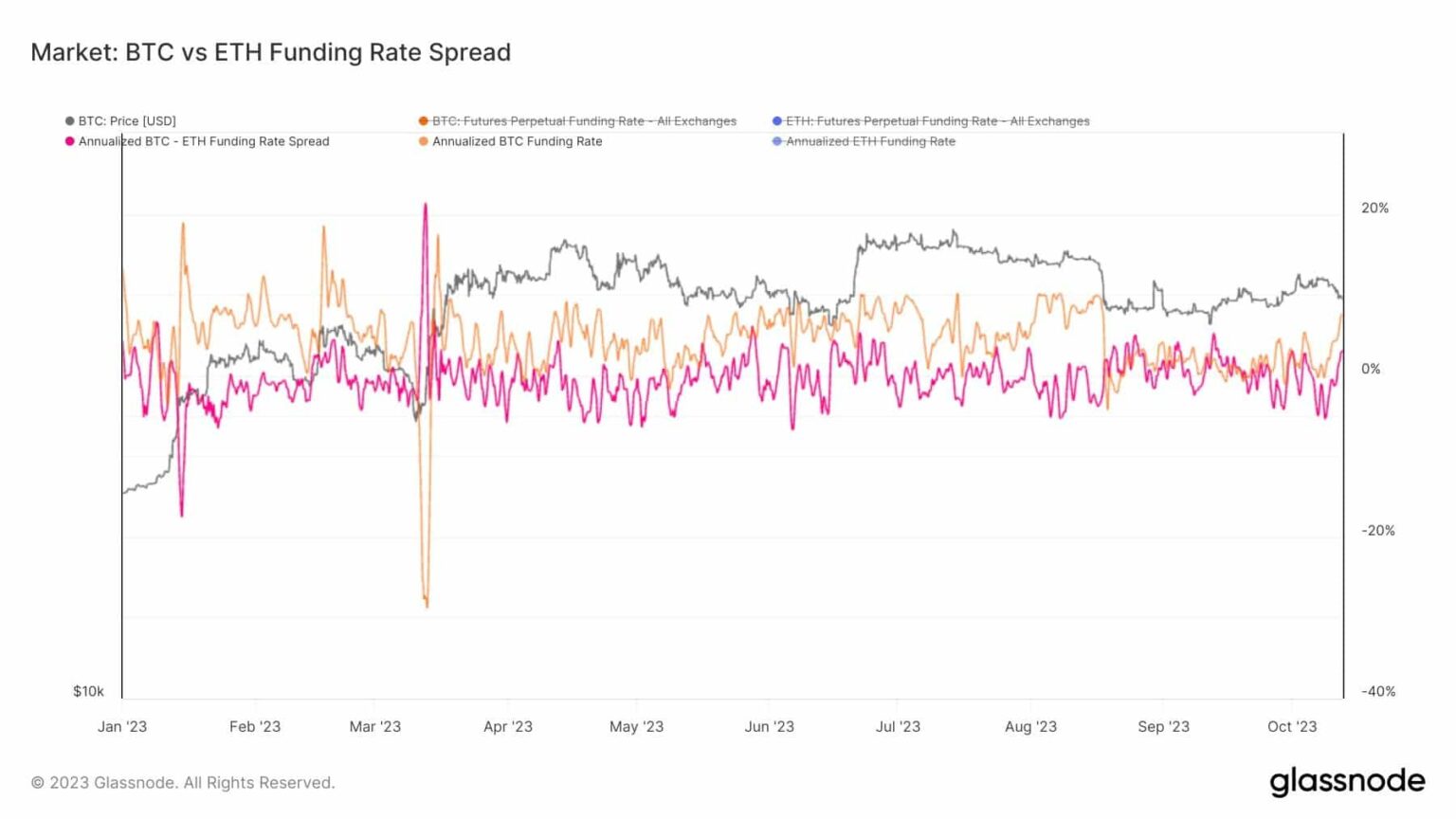

One notable growth was the surge in Bitcoin’s annualized funding charge, which reached a two-month excessive of over 7.5%. This charge signifies the price of holding a place in Bitcoin, influencing how merchants method the market.

A notable spike on this charge has the potential to entice extra merchants into the market, thereby rising buying and selling exercise. Nonetheless, it additionally introduces the opportunity of elevated volatility, with merchants searching for to capitalize on these funding charges.

Concurrently, Bitcoin’s open curiosity additionally soared to a two-month excessive as effectively. Elevated open curiosity usually suggests a rising degree of participation available in the market.

This might doubtlessly lead to extra liquid markets, a broader variety of merchants, and more healthy general circumstances. Nonetheless, it might additionally heighten market volatility.

Supply: glassnode

Merchants react

Furthermore, the put-to-call ratio for Bitcoin skilled a shift from 0.5 to 0.46. This lower signifies an elevated inclination in direction of bullish positions available in the market. This sentiment might affect their buying and selling methods, and it may be indicative of a market ripe for worth will increase.

Moreover, there was an enlargement of Bitcoin’s 25 Delta Skew in latest days. This Skew is used to gauge choices merchants’ notion of potential massive worth actions.

When this metric rises, it normally indicators an rising demand for protecting choices, indicating a level of warning amongst merchants.

Supply: Velo

How are holders holding up

Furthermore, the variety of Bitcoin addresses holding 1 or extra BTC grew. These massive traders can considerably impression Bitcoin’s market dynamics because of their substantial holdings. This demonstrated ongoing curiosity from main gamers.

📈 #Bitcoin $BTC Variety of Addresses Holding 1+ Cash simply reached an ATH of 1,023,292

View metric:https://t.co/s7tx1xxyz3 pic.twitter.com/iKTEDQp2Iz

— glassnode alerts (@glassnodealerts) October 5, 2023

Is your portfolio inexperienced? Take a look at the BTC Revenue Calculator

Conversely, Bitcoin’s Market Worth to Realized Worth (MVRV) ratio noticed a notable decline. This ratio represents the common revenue or lack of Bitcoin holders.

A reducing MVRV would possibly counsel that fewer BTC holders have been sitting on substantial income. Whereas this might doubtlessly alleviate promoting stress within the quick time period, it might additionally point out a much less speculative market.

Supply: Santiment