- Bitcoin’s worth elevated by 4% within the final seven days.

- Market indicators hinted at a worth correction.

The whole crypto market has been experiencing a bull rally during the last week, as high cash registered double-digit good points.

Nonetheless, the crypto concern and greed index was sitting at a “greed” place at press time, suggesting that there may be a pattern reversal quickly.

What the crypto concern and greed index suggests

The worth of the king coin, Bitcoin [BTC], remained bullish during the last week because it traded above the psychological resistance of $65k. As per CoinMarketCap, BTC’s worth elevated by greater than 4% in seven days.

On the time of writing, BTC was buying and selling at $66,744 with a market capitalization of over $1.29 trillion. Other than Bitcoin, Ethereum [ETH] bulls additionally dominated the market as its worth elevated by over 2% previously seven days.

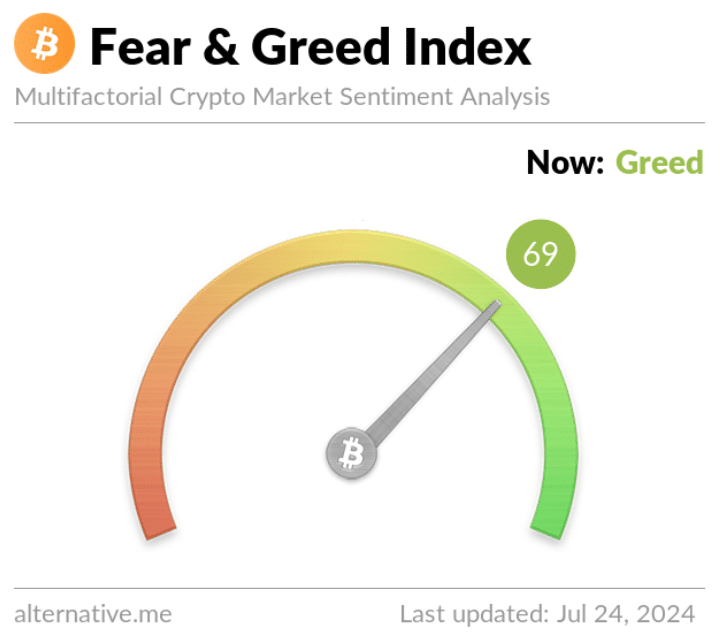

AMBCrypto then took a have a look at the concern and greed index to see whether or not the market was preparing for a correction.

As per our evaluation, on the time of writing, the crypto concern and greed index had a studying of 69, that means that the market was in a “greed” part.

Every time the indicator hits that degree, it signifies that the possibilities of a worth correction are excessive.

Supply: Different.me

Will BTC set off the downtrend?

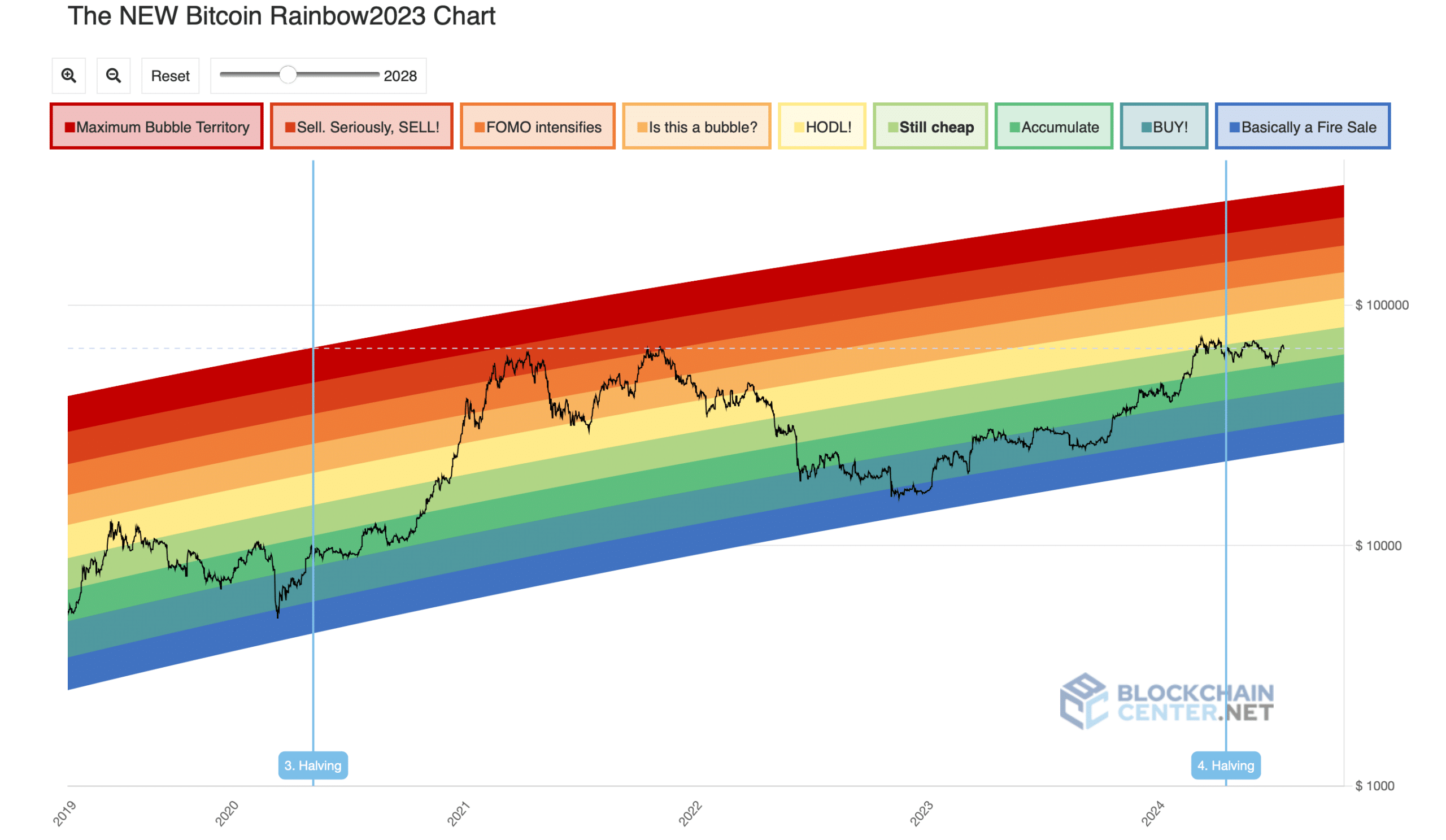

AMBCrypto then checked BTC’s rainbow chart to see whether or not it indicated a worth correction, which could end in a whole market correction.

Based on our evaluation, BTC’s rainbow chart prompt that the coin was nonetheless low cost to purchase. This clearly meant that traders nonetheless have the chance to build up extra BTC earlier than its worth skyrockets.

As per the chart, BTC may contact $1.23 million earlier than the market will get right into a FOMO stage.

Supply: Blockchaincenter

AMBCrypto then took a have a look at CryptoQuant’s data to search out out what metrics prompt. We discovered that BTC’s change reserve was dropping, that means that promoting stress on the coin was low.

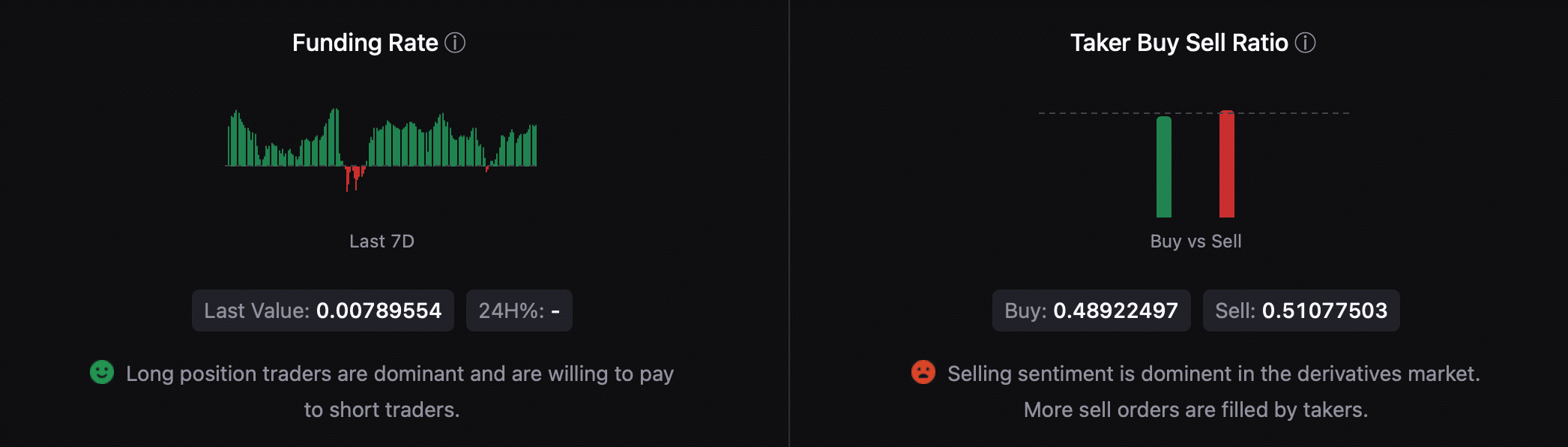

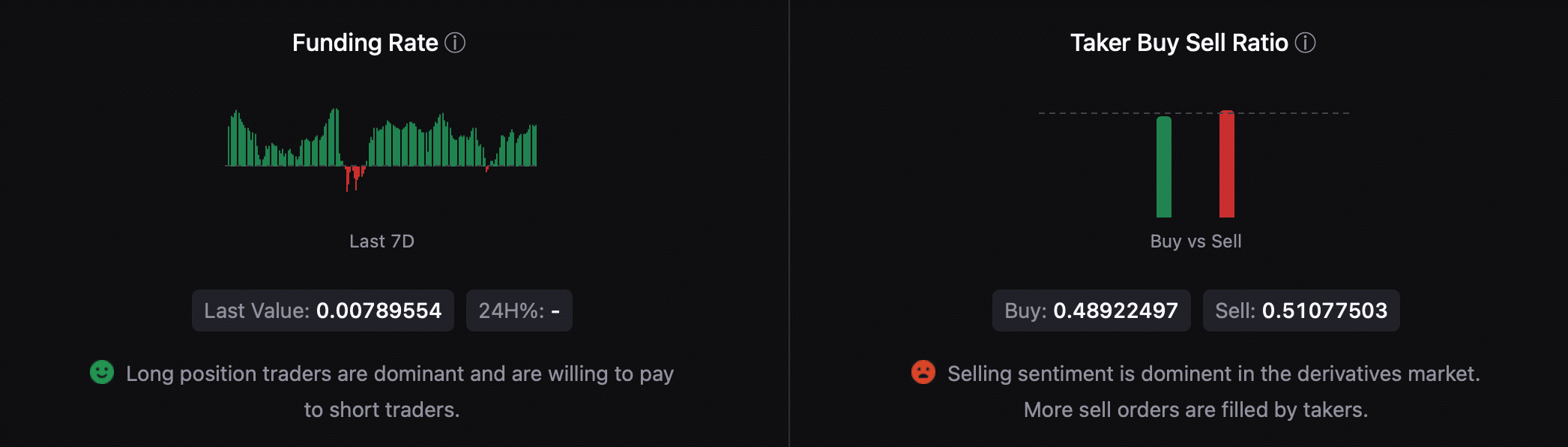

Issues within the derivatives market additionally seemed fairly optimistic as BTC’s Funding Fee elevated. Nonetheless, the Taker Purchase Promote Ratio turned purple. This meant that derivatives traders have been promoting BTC at press time.

Supply: CryptoQuant

Learn Bitcoin’s [BTC] Worth Prediction 2024-25

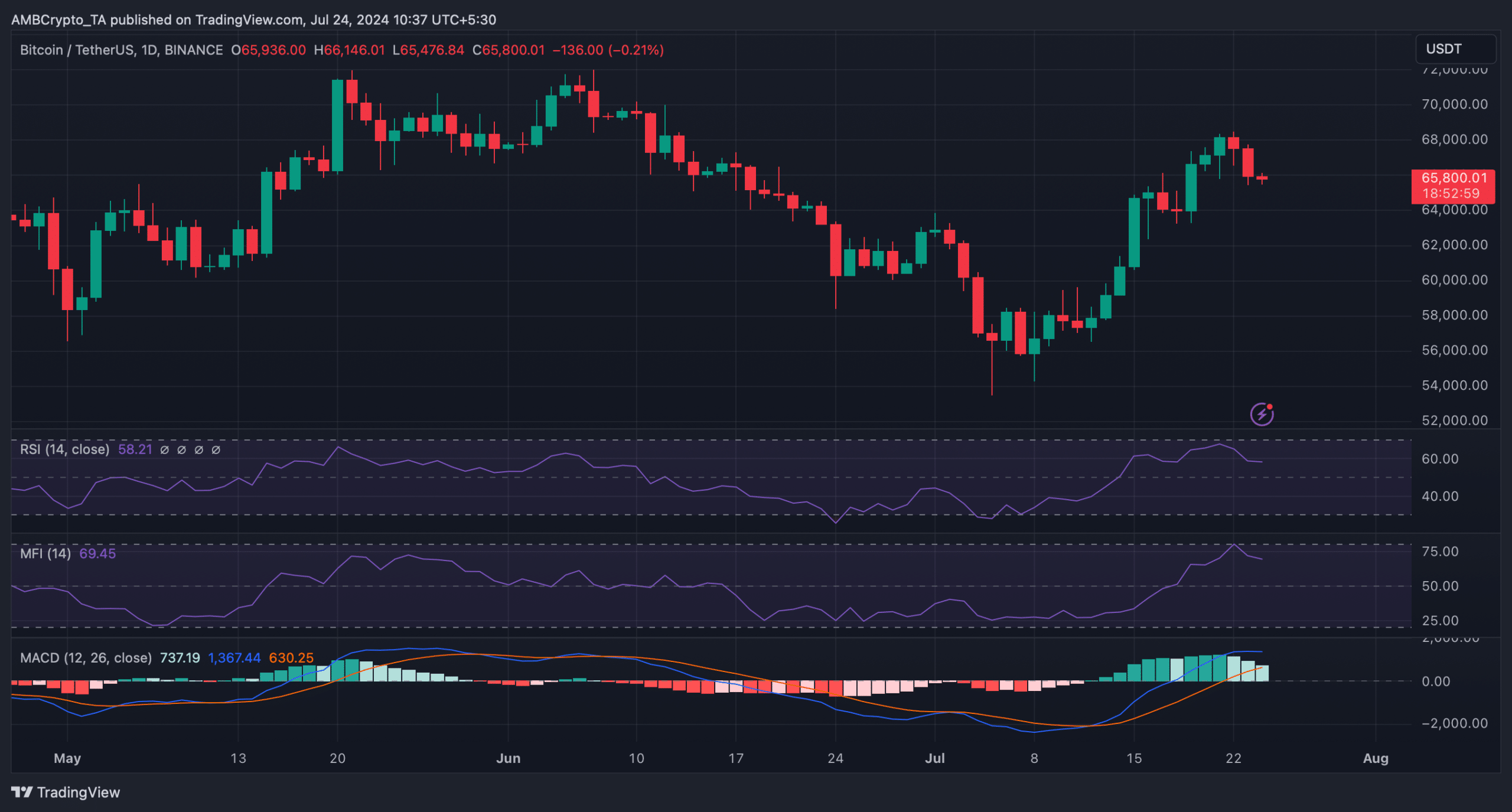

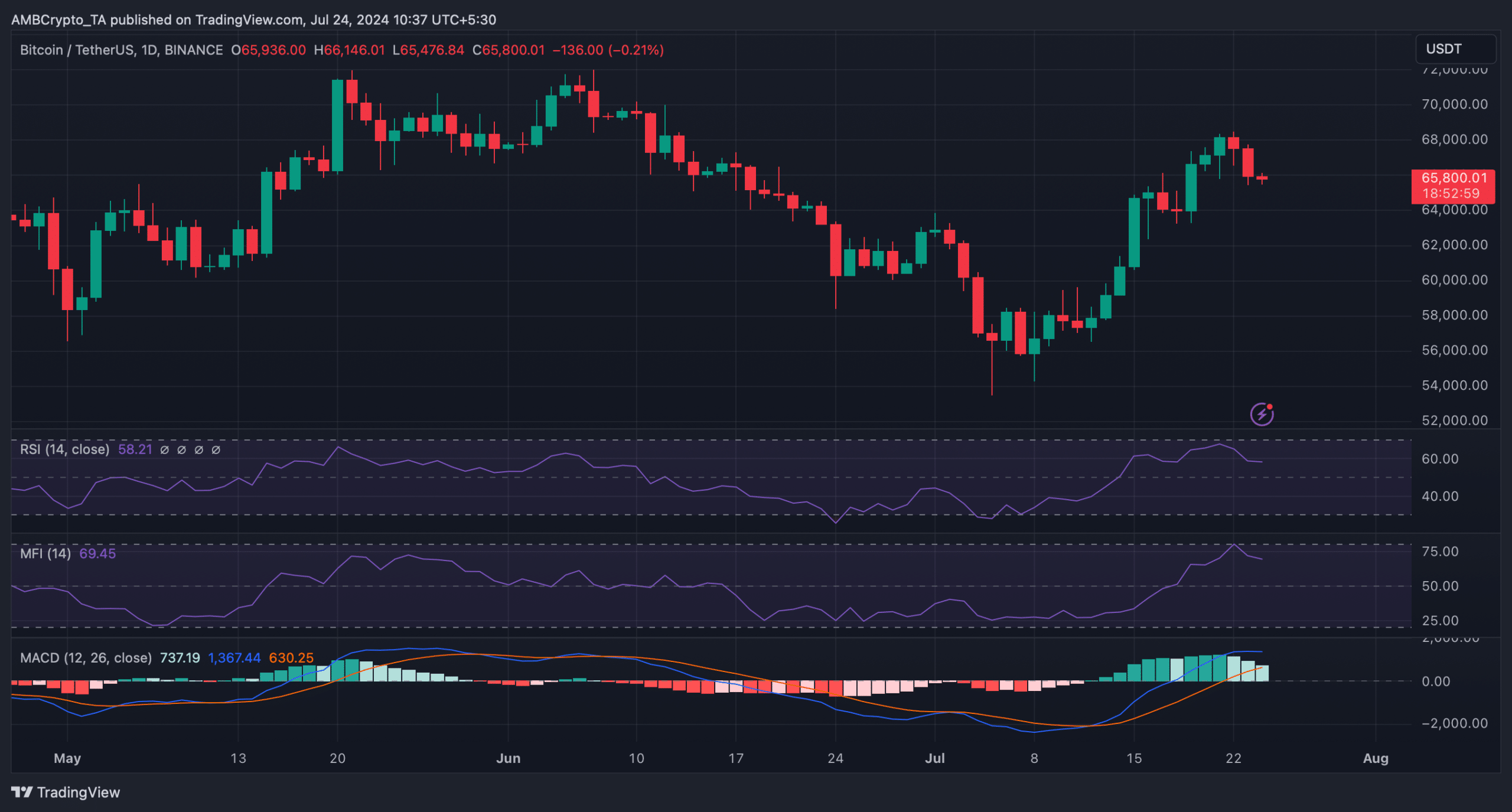

The market indicators seemed fairly bearish on the coin. As an example, the Relative Energy Index (RSI) registered a downtick. Its Cash Stream Index (MFI) additionally adopted an identical pattern because it went southward.

This clearly indicated that the possibilities of a worth correction have been excessive. Nonetheless, the MACD remained within the bulls’ favor, hinting at a continued worth rise.

Supply: TradingView