BTC’s worth has significantly struggled because the US Securities and Alternate Fee (SEC) accepted spot Bitcoin ETFs (exchange-traded funds).

Nonetheless, the ETFs have attracted many traders, leading to a document buying and selling quantity inside the first two days of buying and selling.

Bitcoin ETFs See File Buying and selling Quantity

Out there information exhibits that spot Bitcoin ETFs collectively achieved a considerable buying and selling quantity of roughly $8 billion. The quantity peaked at roughly $4.6 billion on the inaugural day, adopted by a quantity exceeding $3 billion on the second buying and selling day.

Grayscale’s GBTC ETF emerged as essentially the most actively traded spot Bitcoin ETF throughout this era. Impressively, it recorded a complete buying and selling quantity surpassing $4 billion, solidifying its place on the forefront of the market.

New issuers like BlackRock, Constancy, Bitwise, and others additionally noticed appreciable buying and selling actions in the course of the days. Notably, BlackRock CEO Larry Fink praised the early success, including that he noticed the highest cryptocurrency as an asset class relatively than a forex.

Nonetheless, some analysts argued that this early buying and selling exercise was a flop as a result of most got here from Grayscale outflows. However Bloomberg analyst Jeremy Seyffart countered that such arguments have been “clickbait” based mostly on “god candle expectations that have been out of contact with actuality.”

“We saved speaking about how a major amount of cash into this stuff have been going to come back from different Bitcoin and crypto associated exposures. And we saved speaking about the long term impression of what these might open up as a bridge. Something speaking about this being flop or horrible is both click on bait or simply had “god candle” expectations that have been out of contact with actuality,” Seyffart added.

BTC Worth Falls Following Promote Stress

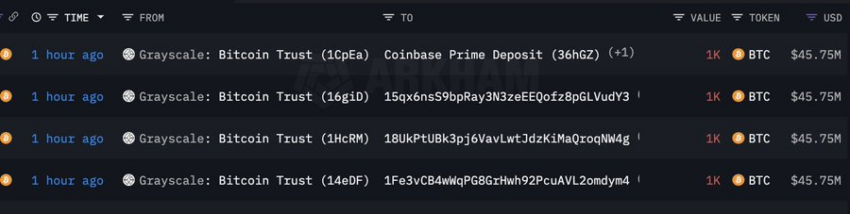

Amidst the heightened buying and selling exercise, Grayscale transferred 4,000 BTC valued at $183 million to Coinbase. This transaction, performed in 4 batches of 1,000 BTC every, transpired on Coinbase Prime, a major participant within the just lately initiated Bitcoin ETFs.

It’s price highlighting that Coinbase serves as a dealer and custodian for Grayscale. So, these BTC transfers might represent a deposit originating from the sale of Grayscale’s ETF.

Learn extra: Did Bitcoin Hit a Market Prime? Sensible Whale Offered 2,742 BTC

Moreover, on-chain analyst JA Maartunn noted the potential for elevated promote orders within the Bitcoin market. He identified that two promote orders, encompassing 1,900 BTC, have been positioned to set off at particular worth factors. The primary is 894 BTC at $44,000 and an extra 1,071 BTC when the asset reaches $45,100.

“There may be presently a chronic interval of robust promoting stress, which can have peaked. It’s doable that the value might start to revert to the imply presently,” crypto analyst Maartunn stated.

These transactions considerably impacted BTC’s worth. Bitcoin dropped by greater than 7% to underneath $42,000 earlier than rebounding to $42,781 as of press time.

Disclaimer

In adherence to the Belief Venture tips, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to offer correct, well timed info. Nonetheless, readers are suggested to confirm information independently and seek the advice of with knowledgeable earlier than making any choices based mostly on this content material. Please notice that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.