- Greater than 55% of the whole stablecoins in circulation had been in whale custody.

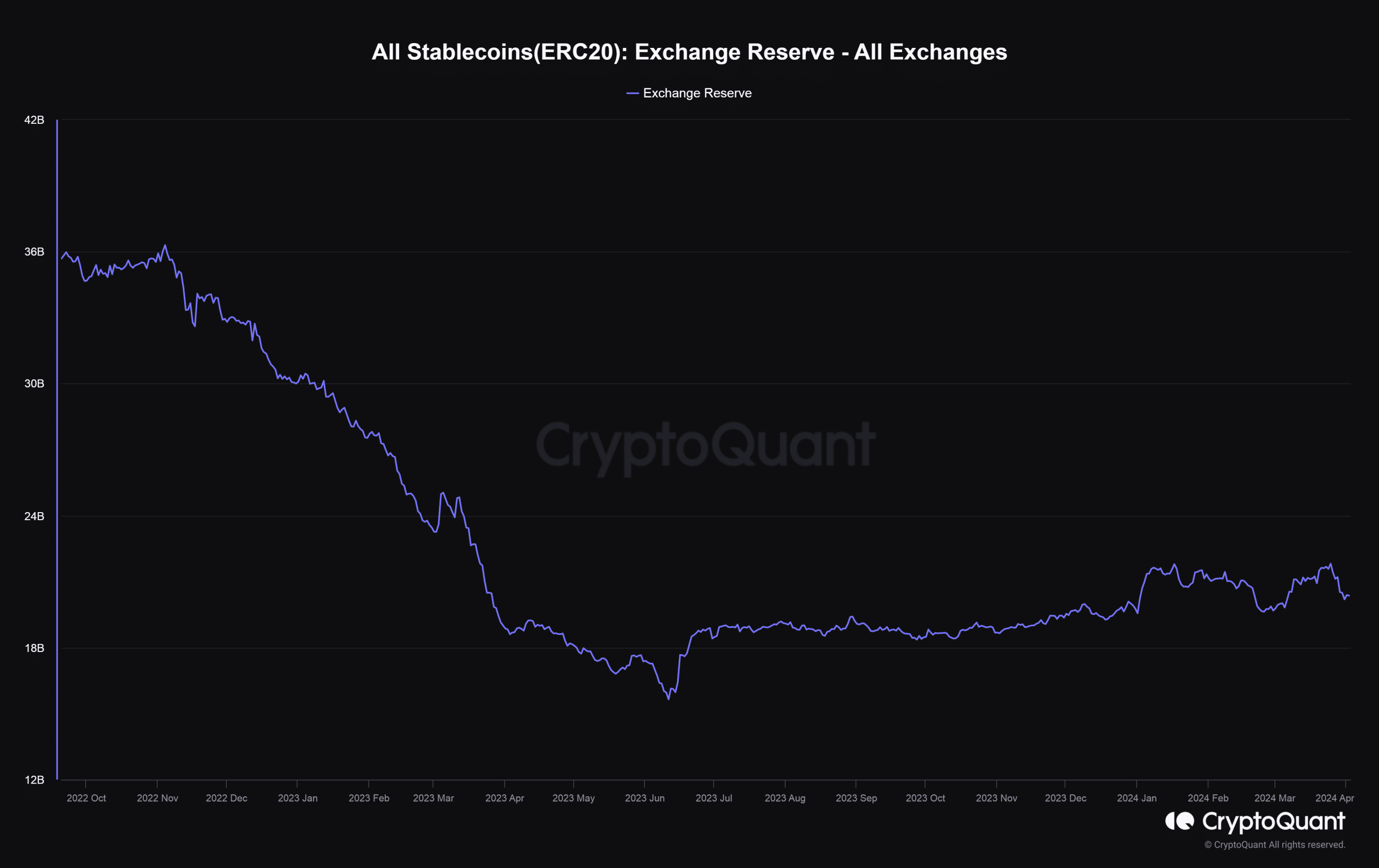

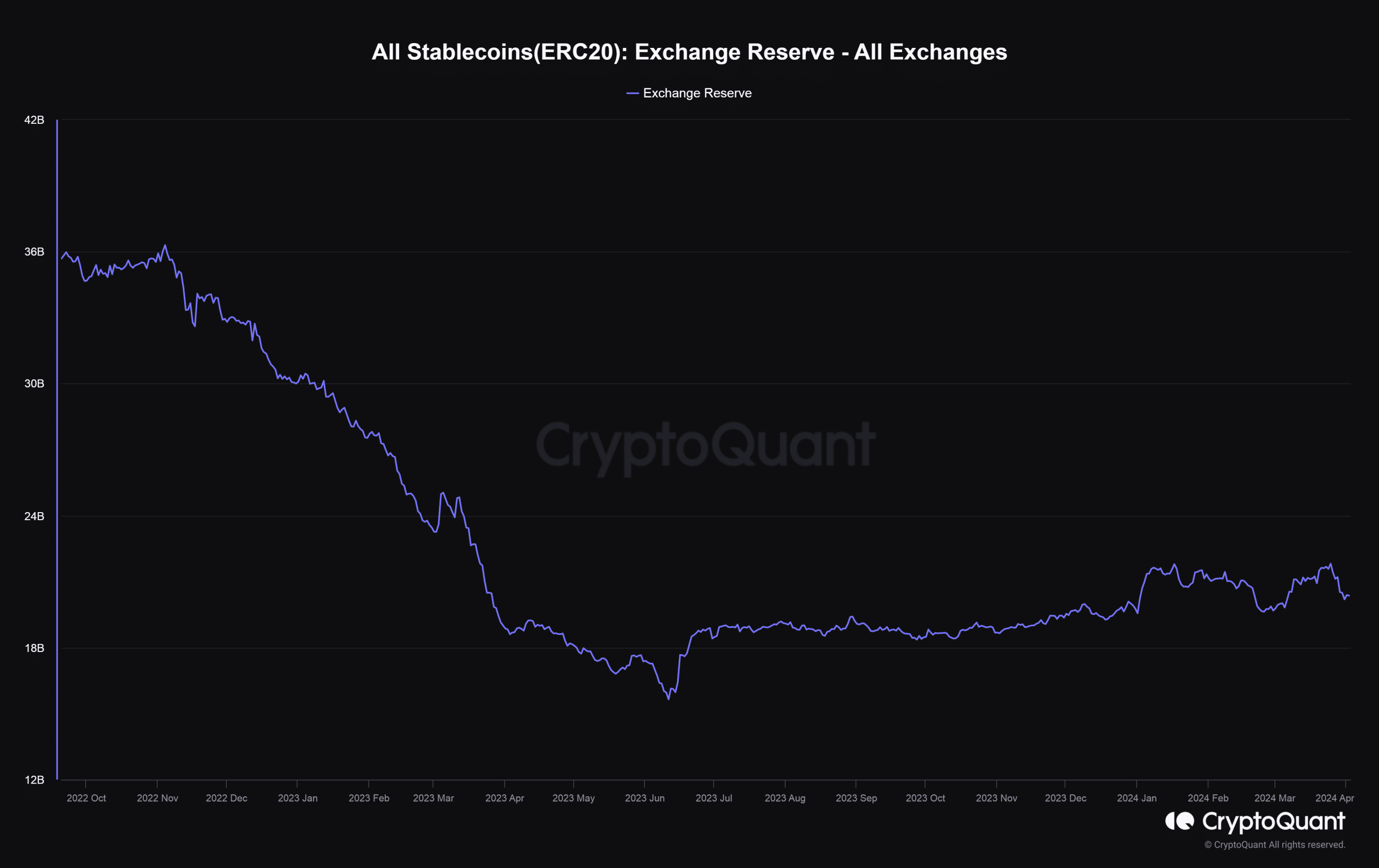

- Stablecoin reserves on exchanges have risen considerably because the begin of the yr.

One of many greatest bullish indicators for the crypto market is rising reserves of stablecoins. It’s because they’re extensively used to purchase different cryptocurrencies, all whereas preserving the fiat worth.

Whales hoard stablecoins

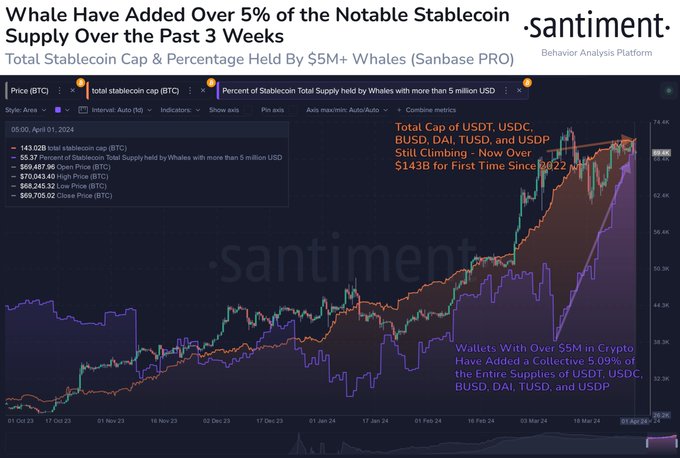

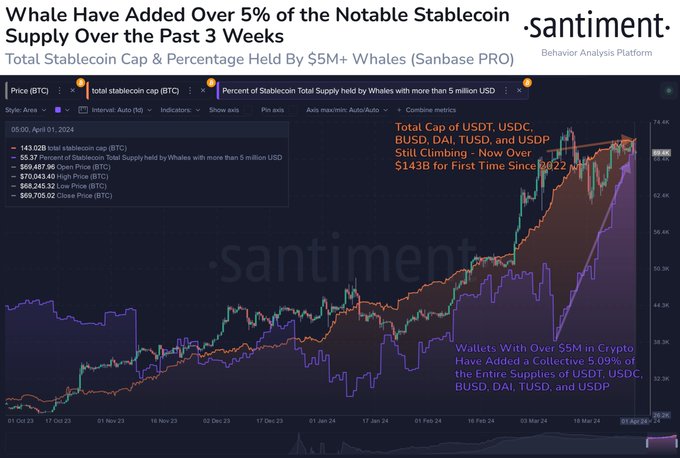

In accordance with on-chain analytics agency Santiment, whale wallets with greater than $5 million in holdings have been on an stablecoin accumulation spree over the previous three weeks.

Certainly, this cohort acquired greater than 5% of the whole provides of those main cash, together with USDT, USDC, DAI, and TUSD over the previous three weeks. As of the first of April, greater than 55% of the whole stablecoins in circulation had been in whale custody.

Supply: Santiment

Shopping for stress to extend?

Santiment agreed to the speculation that whales is perhaps ready for the market to right considerably, permitting them to purchase massive and add on to their Bitcoin [BTC] positions.

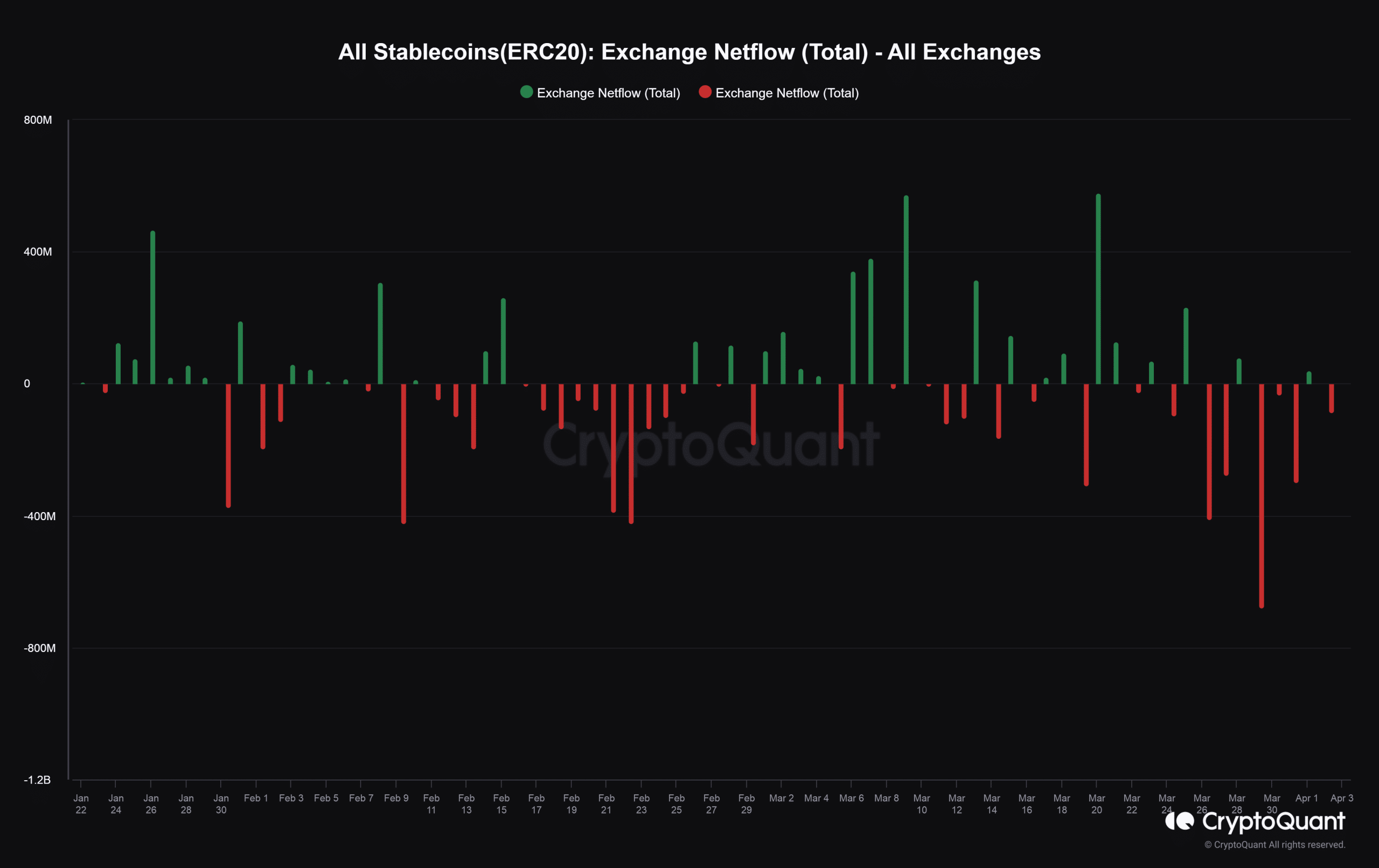

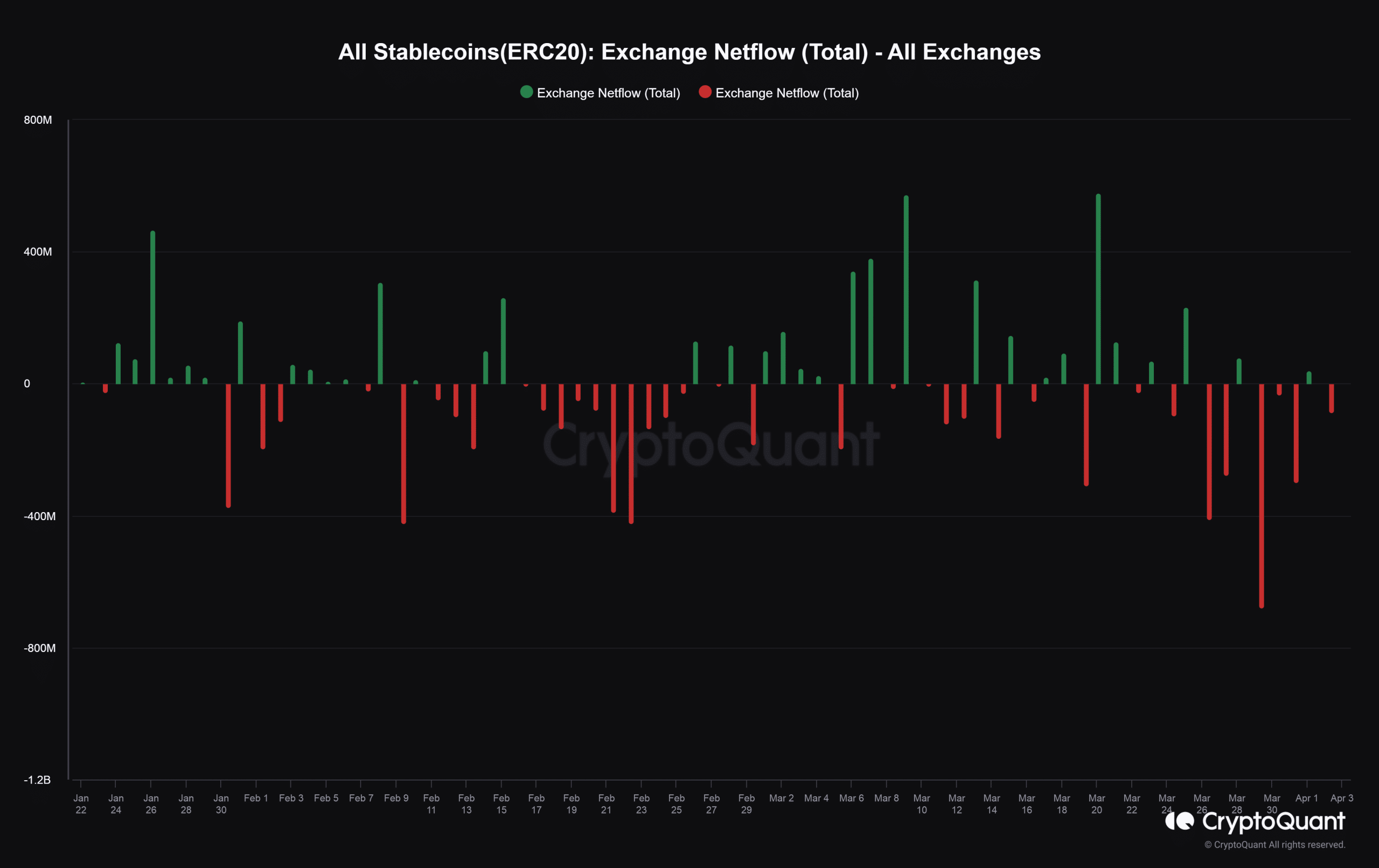

Apparently, the market did retrace on the first of April. AMBCrypto investigated CryptoQuant knowledge and noticed web stablecoin inflows to cryptocurrency exchanges, lending credence to the aforementioned narrative.

Supply: CryptoQuant

Stablecoin reserves on exchanges have risen considerably because the begin of the yr. As of this writing, practically 20.36 billion cash had been held in trade wallets, highest in additional than a yr.

Traditionally, rise in stablecoin deposits have preceded sharp improve in Bitcoin’s market worth. Therefore, there was a better chance of elevated volatility and Bitcoin’s rebound within the subsequent two weeks or so.

Supply: CryptoQuant

High stablecoins in full demand in 2024

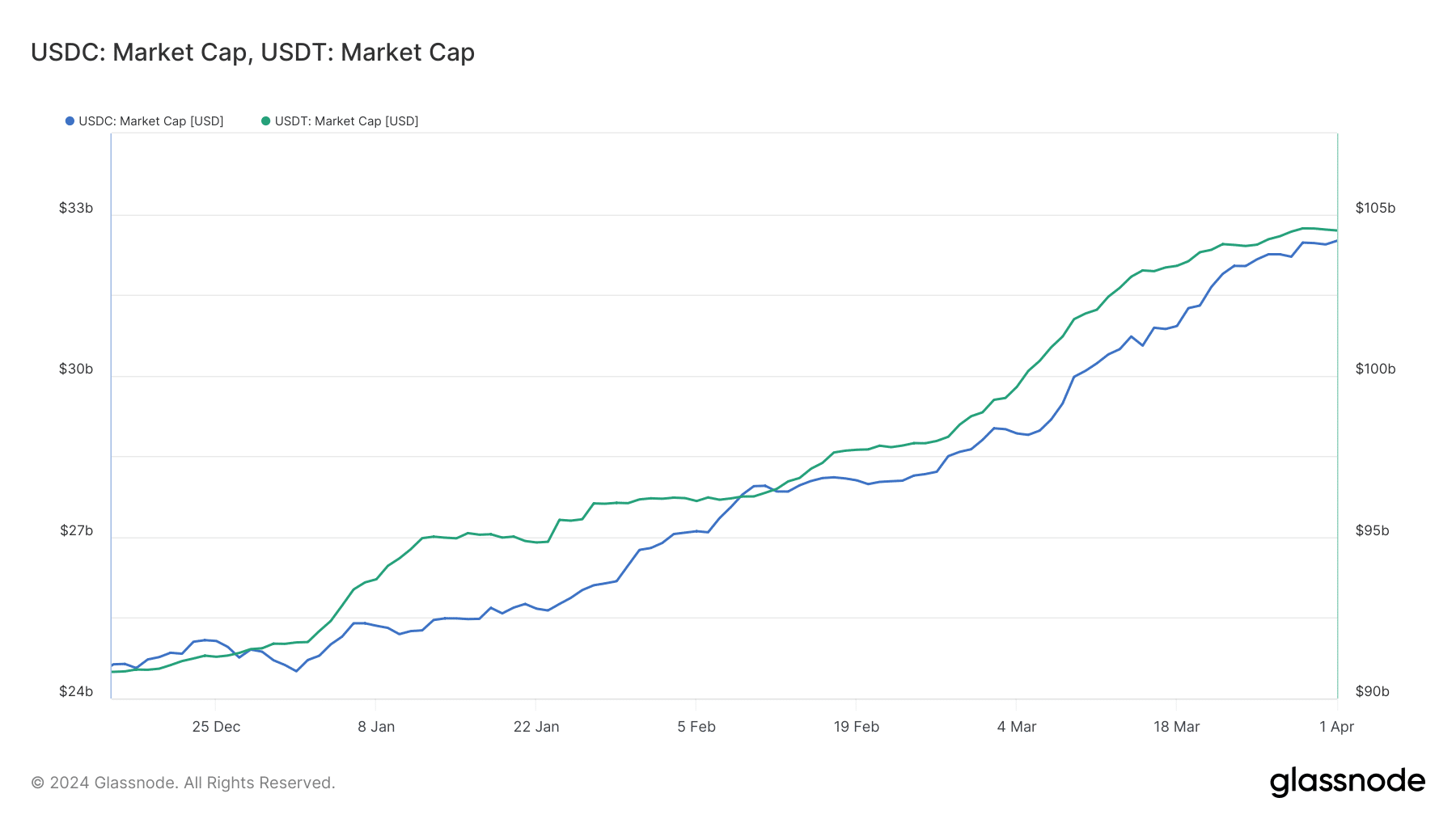

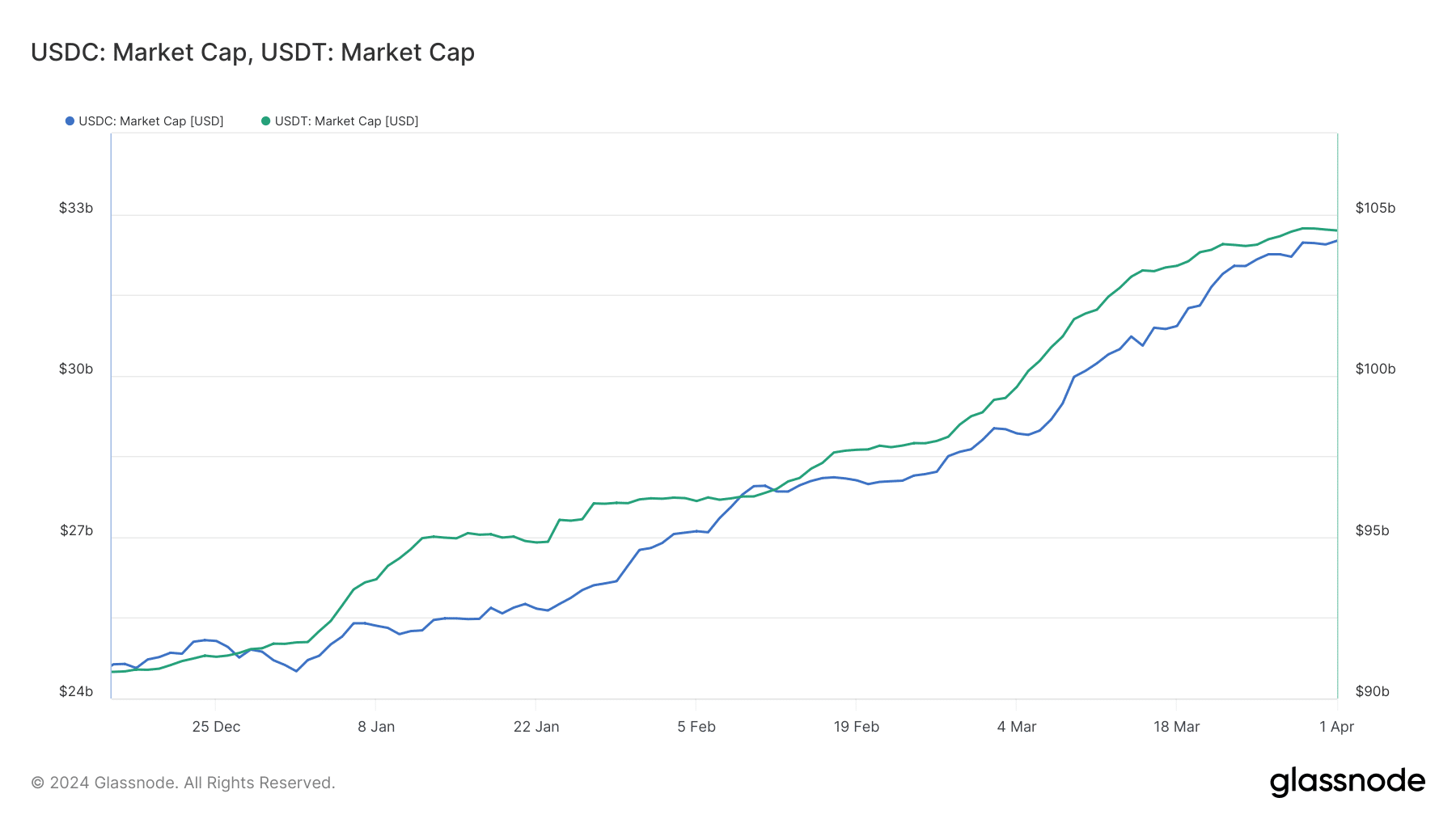

In the meantime, the worldwide stablecoin cap continued to mount, going previous $143 billion for the primary time since 2022. The restoration was led by the 2 main property – USDT and USDC.

World’s largest stablecoin, USDT, has carried on the constructive momentum from final yr, rising 13% year-to-date (YTD) to a whopping $104 billion in market valuation.

Nonetheless, the actual success story has been USDC, leaping 33% YTD to $32 billion, after encountering main downsides final yr.

Supply: Glassnode