- MATIC traded 23% decrease than the identical time final week.

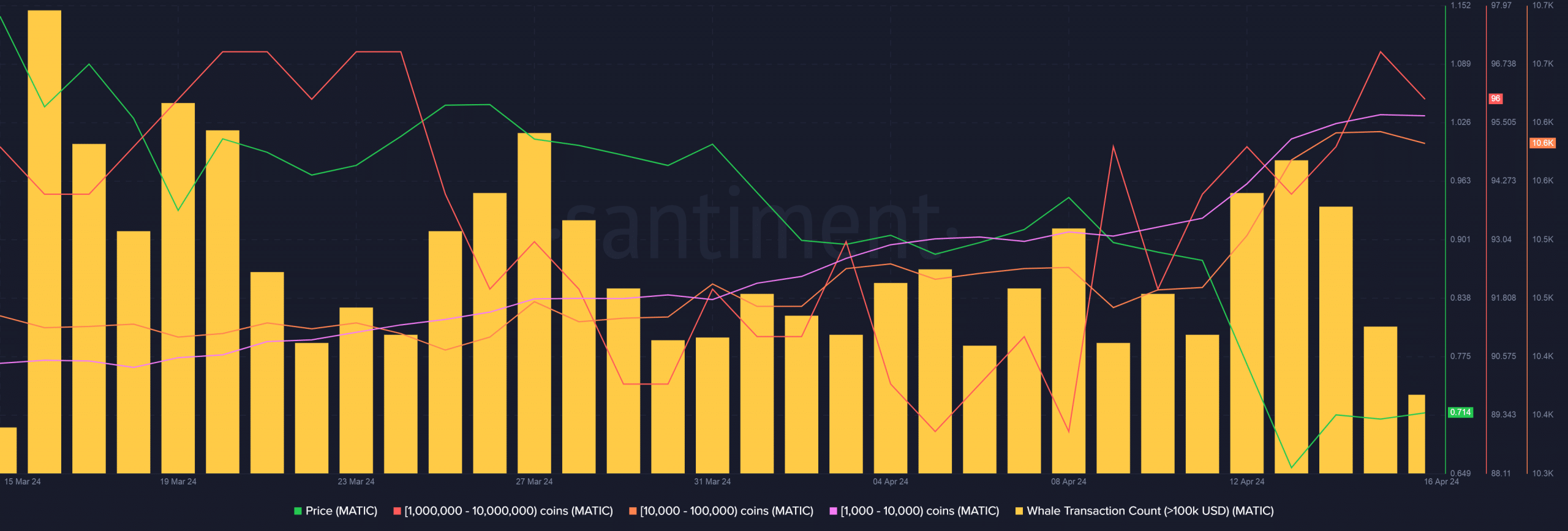

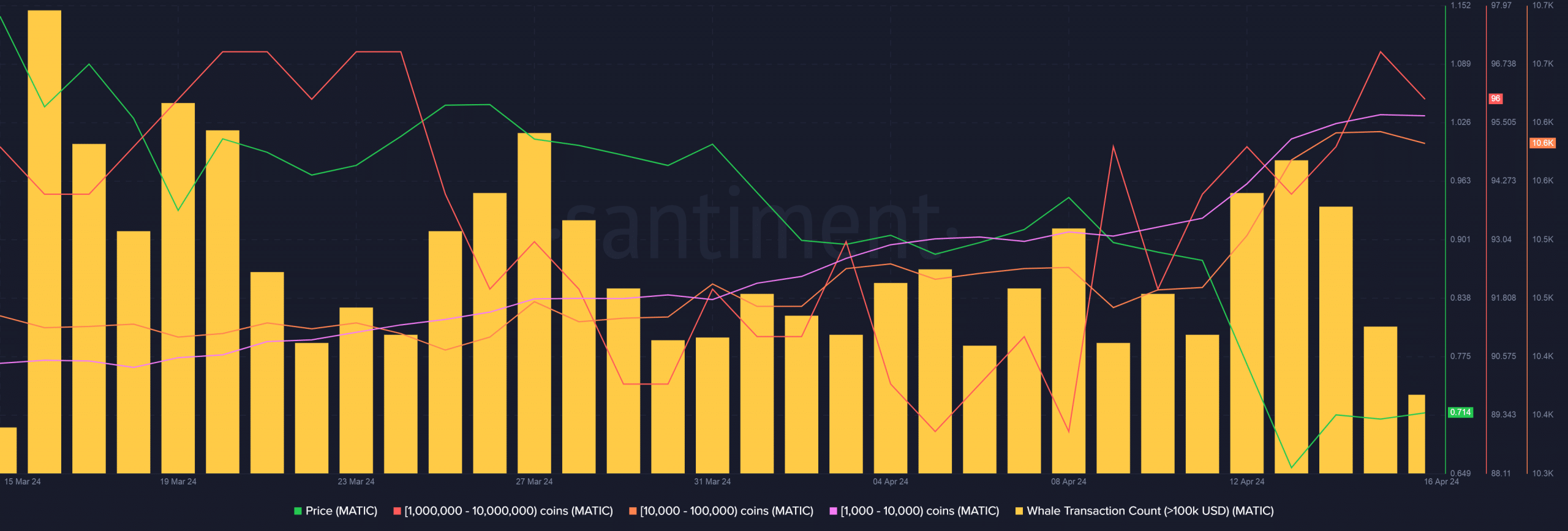

- Wallets holding between 1,000 to 10 million cash elevated sharply over the week.

The crypto market remained soaked in crimson, as Bitcoin [BTC] and most main altcoins didn’t counter draw back volatility.

Not an exception, MATIC, suffered as effectively, dropping almost 4% within the final 24 hours, based on CoinMarketCap.

The native token of fashionable layer-2 (L2) community Polygon was buying and selling at $0.71 as of this writing, 23% decrease than the identical time final week.

Alternative to stockpile some extra?

Usually, such sharp corrections in a bull market aren’t considered with an overtly unfavorable sentiment, for they permit seasoned market gamers to build up cash at decrease costs.

On-chain tracker Lookonchain drew consideration to at least one such whale who utilized the draw back to replenish their luggage.

Amongst varied altcoins, MATIC featured prominently, with almost 2 million of them getting scooped up by the rich investor.

However this was not only a one-off incident. Utilizing Santiment’s information, AMBCrypto observed a noticeable uptick in holdings of whale cohorts.

The variety of wallets holding between 1,000 to 10 million cash elevated sharply over the week. On the similar time, giant transactions, price greater than $100,000, elevated considerably.

This indicated that whales have been certainly shopping for MATIC’s dip.

Supply: Santiment

Whales assured of MATIC’s rebound?

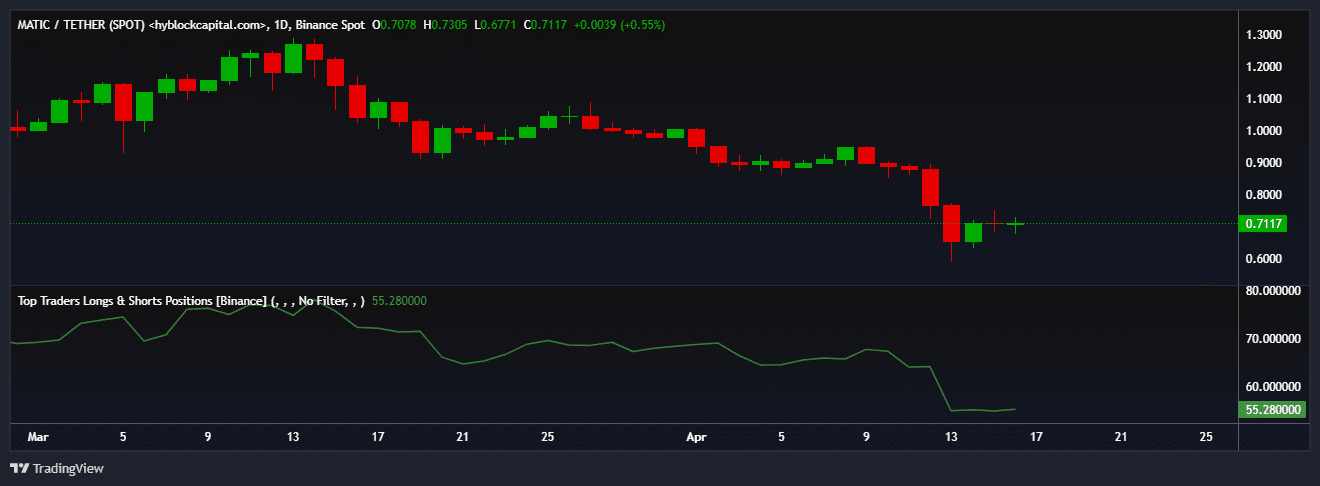

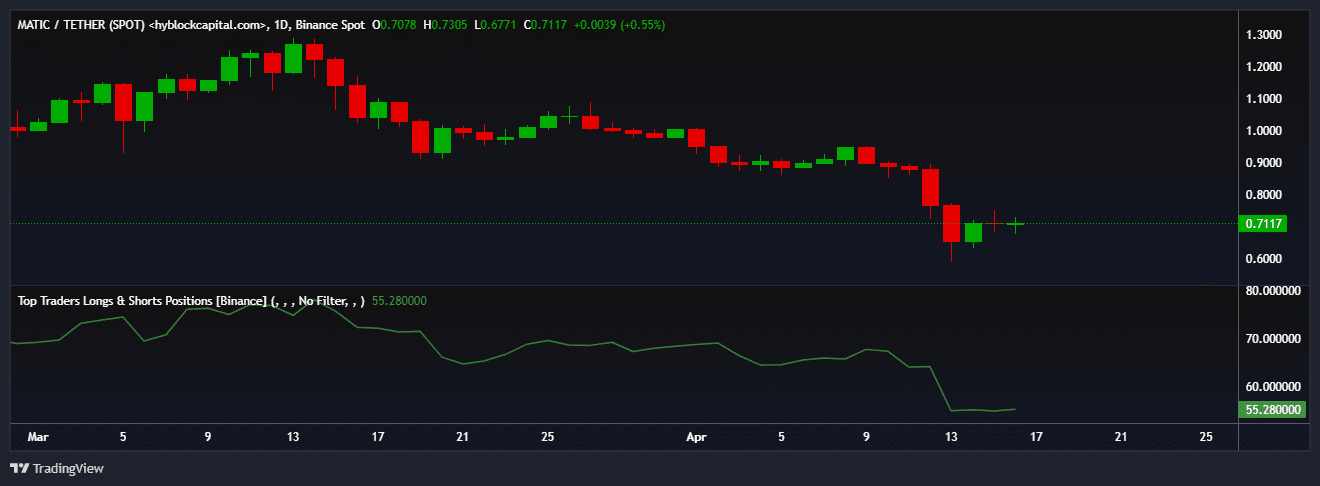

The motivation to build up was rooted of their bullish expectations from MATIC.

Regardless of a notable drop, almost 55% of all whale positions for MATIC on Binance have been lengthy as of this writing, based on AMBCrypto’s evaluation of Hyblock Capital’s information.

This recommended that they have been assured of a rebound within the brief time period.

Supply: Hyblock Capital

Is your portfolio inexperienced? Take a look at the MATIC Revenue Calculator

Unfavorable commentary dominates

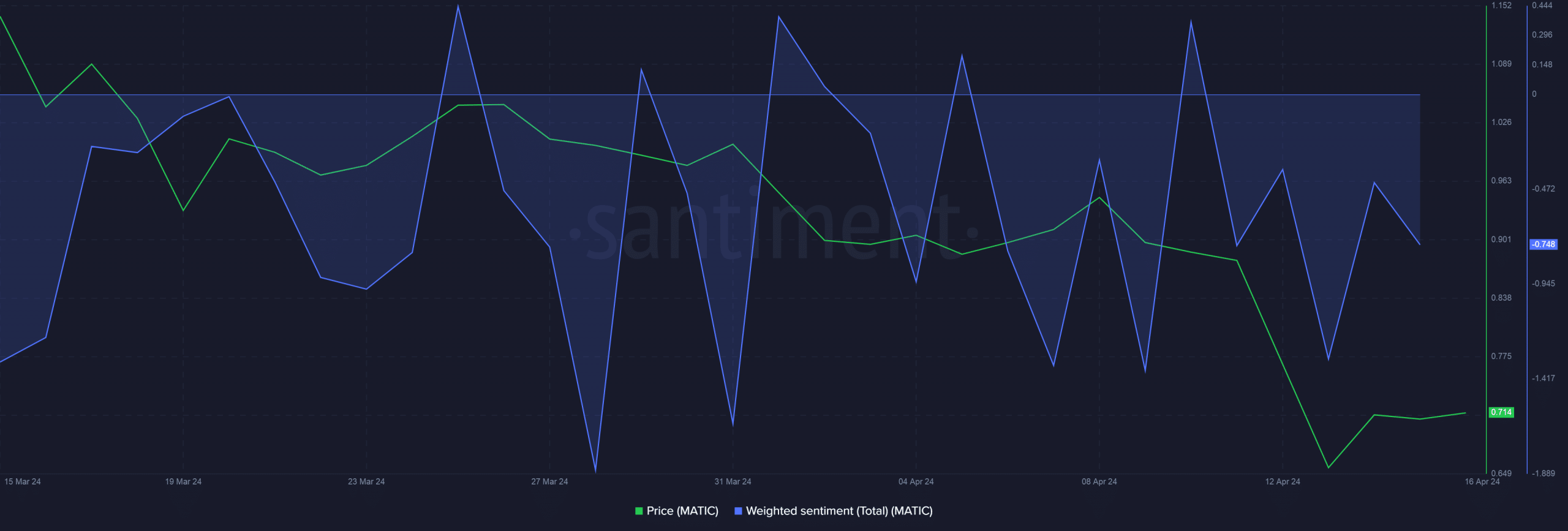

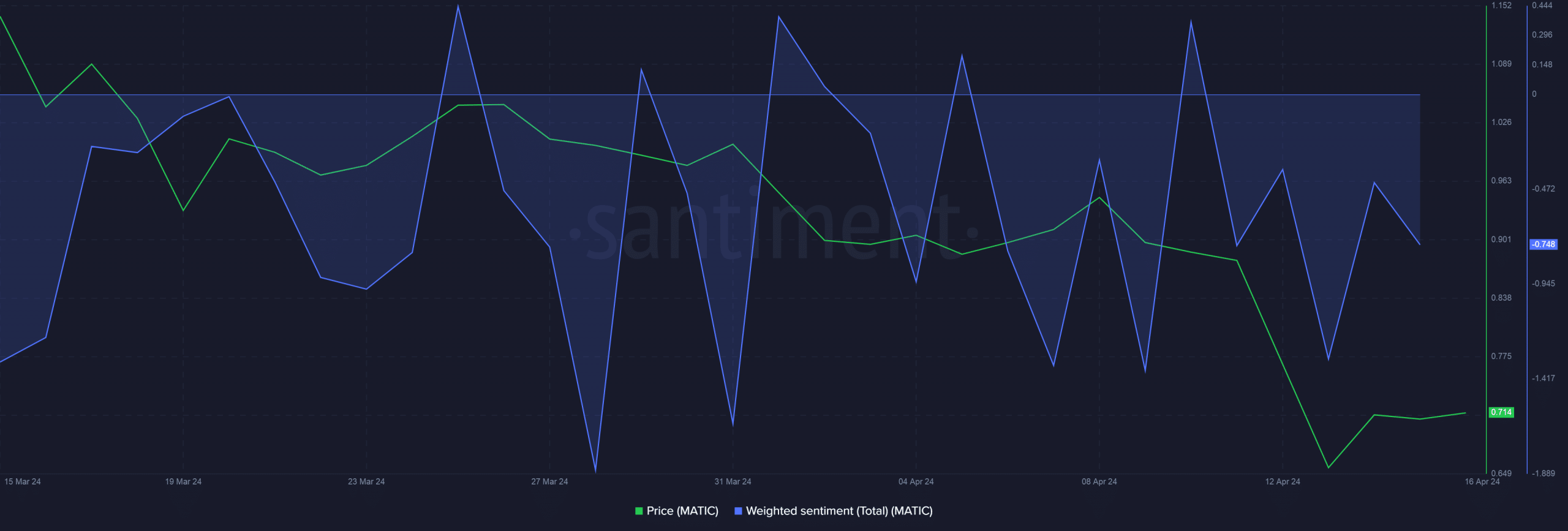

Nonetheless, the value hunch contributed to elevated unfavorable commentary across the coin, as evidenced by the unfavorable Weighted Sentiment indicator.

Usually, such bearish takes may affect retail traders’ participation, because the latter are persuaded by discussions, significantly on social media.

Supply: Santiment