- Whales amassed over $9 million price of ERC-20 tokens.

- Pepe and LINK noticed a extra optimistic value pattern than UNI.

Not too long ago, Pepe [PEPE], Uniswap [UNI], and Chainlink [LINK] witnessed important whale accumulations. Whereas UNI stood out with its distinct value pattern, PEPE and LINK displayed related value actions.

One other commonality amongst these belongings is that they’re all ERC-20 tokens. The continued accumulation and value traits are thought of a bullish sign, which might affect the Ethereum [ETH] community.

Whales accumulate Pepe, Chainlink, and Uniswap

In line with knowledge from Lookonchain, whales engaged in important accumulation actions on the 4th of Might, buying thousands and thousands of {dollars} price of varied ERC-20 tokens.

One notable transaction concerned a whale withdrawing 322.48 billion Pepe tokens from the Binance change, valued at roughly $2.78 million.

One other whale withdrew 500,000 UNI tokens price about $3.75 million and 183,799 LINK tokens price roughly $2.62 million from the Binance [BNB] change.

Pepe and Chainlink see uptrends

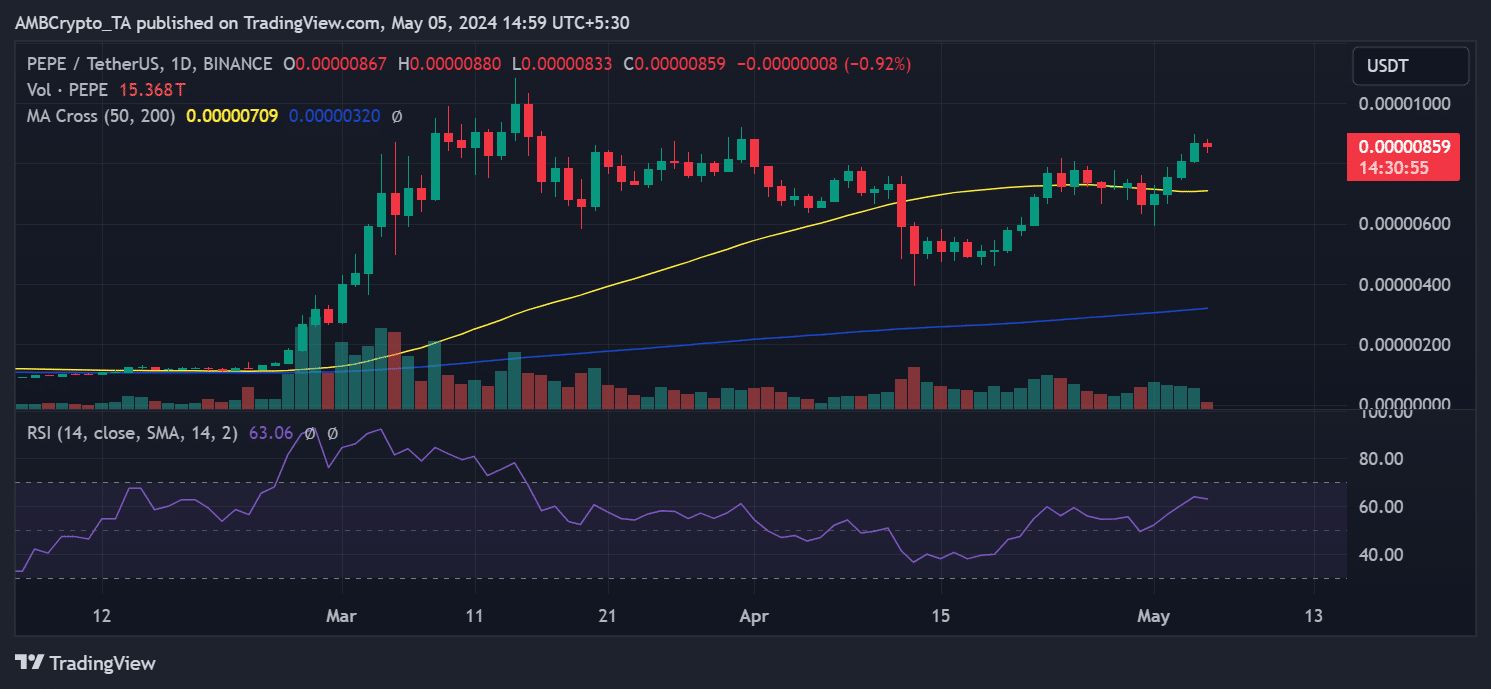

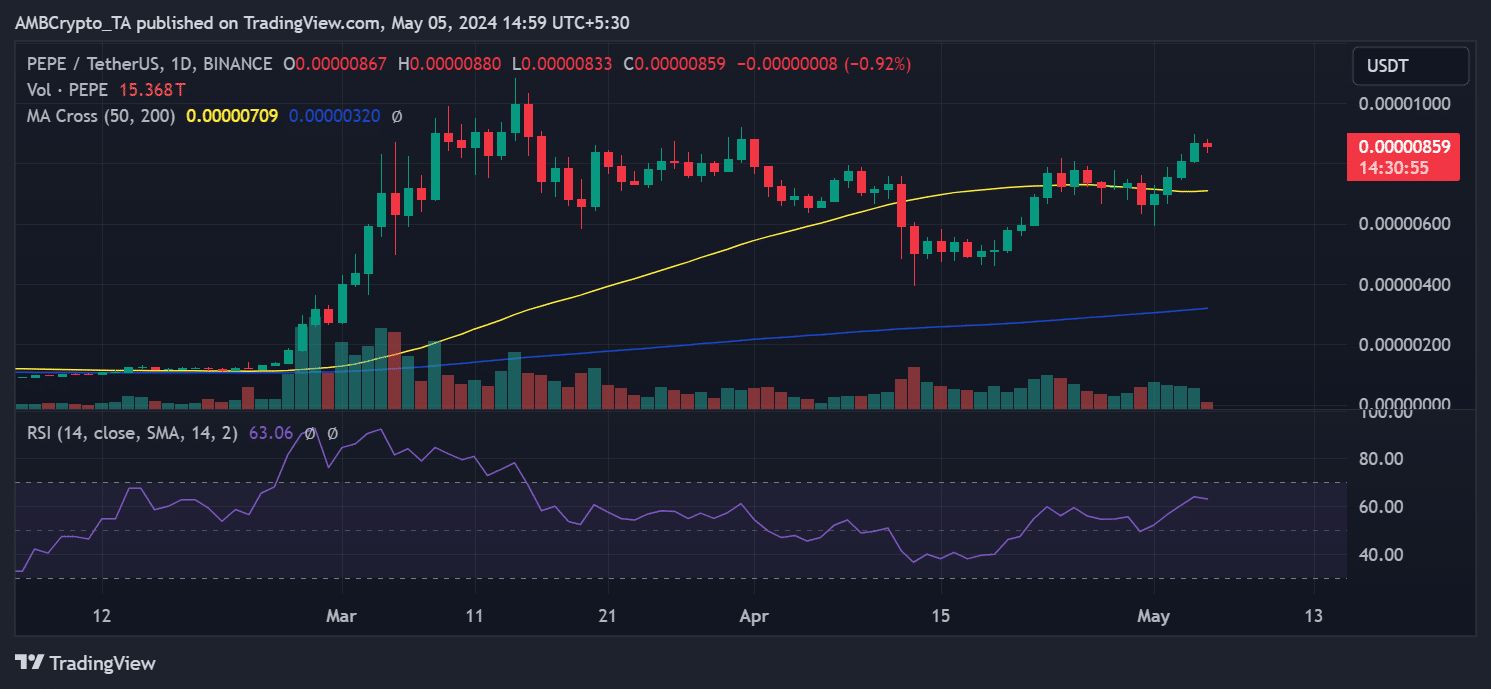

AMBCrypto’s evaluation of Pepe’s value motion on a each day timeframe chart revealed consecutive uptrends from the first to the 4th of Might. On the 4th of Might, its worth surged by 7.30%.

Notably, its value pattern was now positioned above its quick shifting common (yellow line), which had transitioned to offer help, indicating a optimistic value pattern.

Nevertheless, Pepe was experiencing a decline of over 1% in its buying and selling worth on the time of writing.

Supply: TradingView

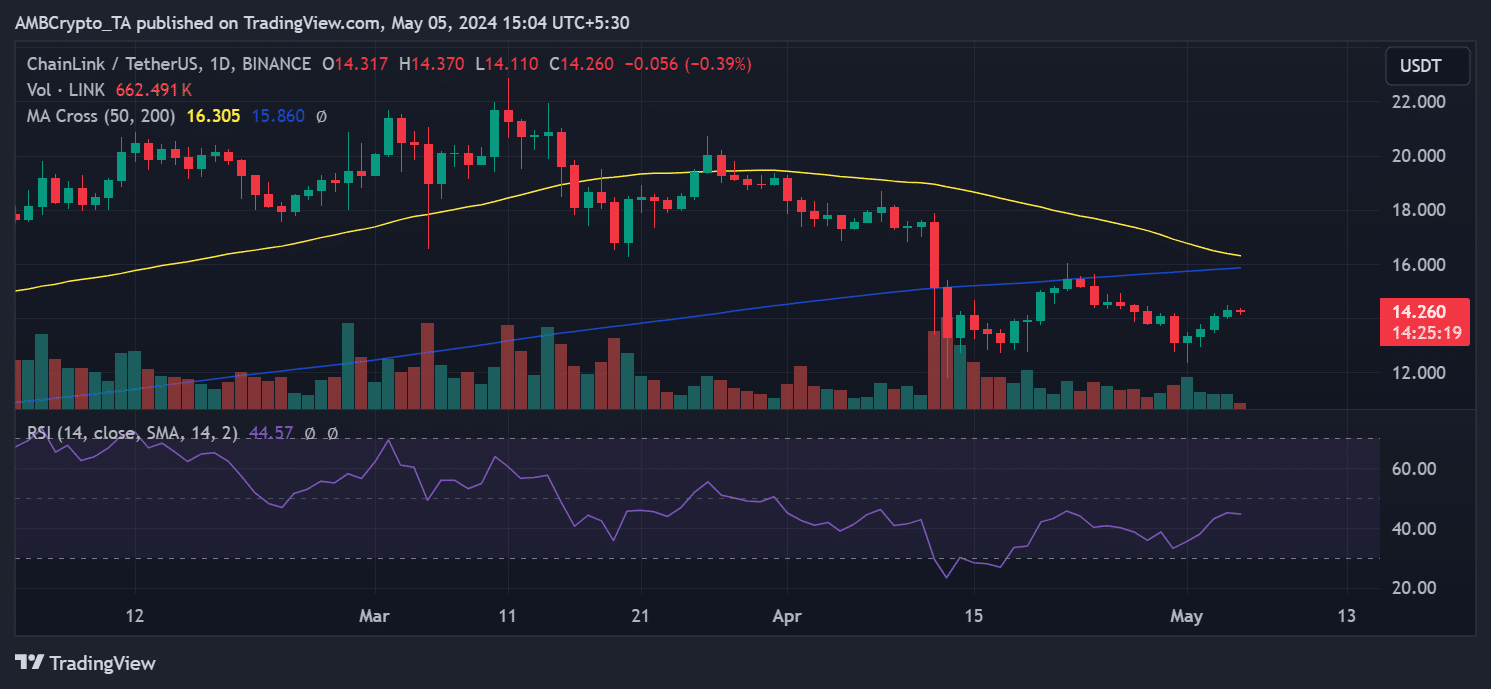

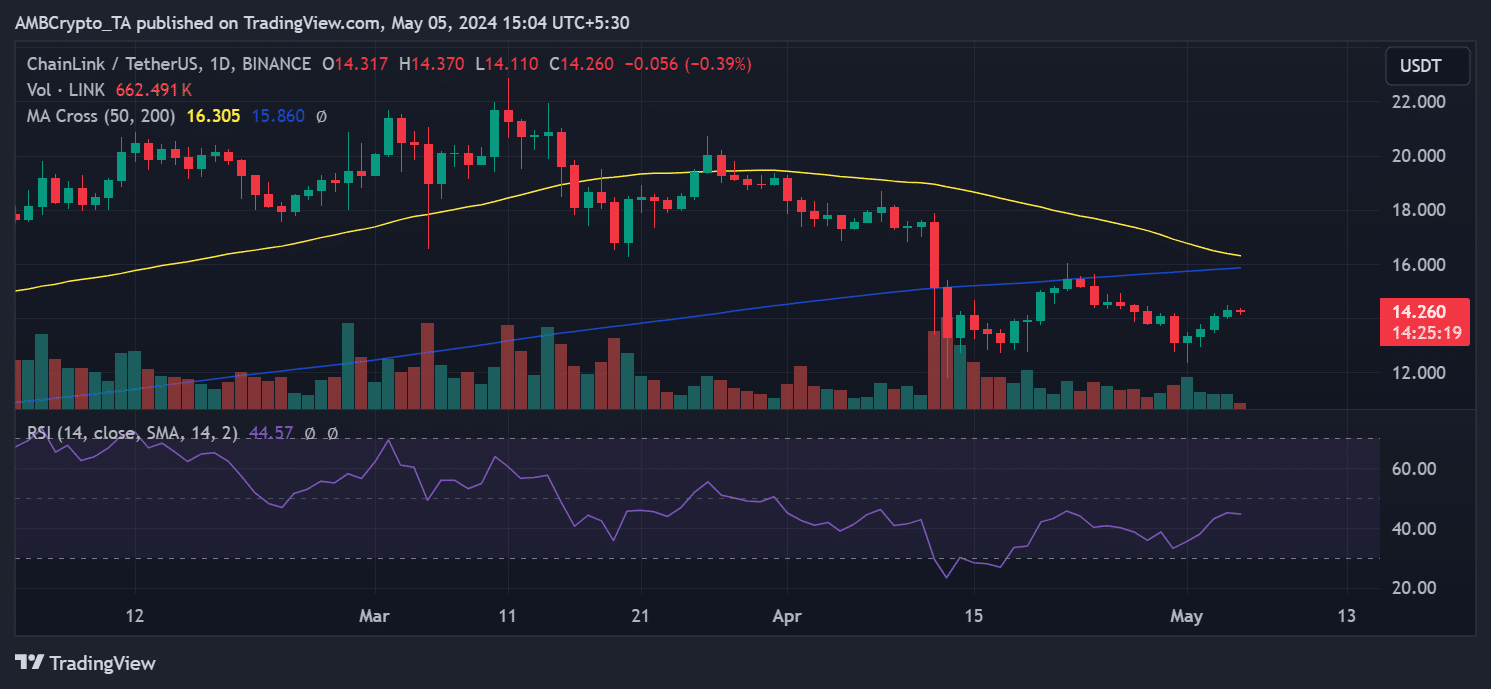

AMBCrypto discovered that Chainlink additionally exhibited consecutive uptrends from the first of Might.

Its value surged from round $13 to over $14, closing at roughly $14.3 on the 4th of Might, marking a value enhance of over 1%.

Regardless of the optimistic motion, Chainlink’s general pattern remained much less optimistic than Pepe’s, with its value buying and selling under its quick and lengthy averages (yellow and blue traces).

As of this writing, it was buying and selling at round $14.2, reflecting a decline of lower than 1%.

Supply: TradingView

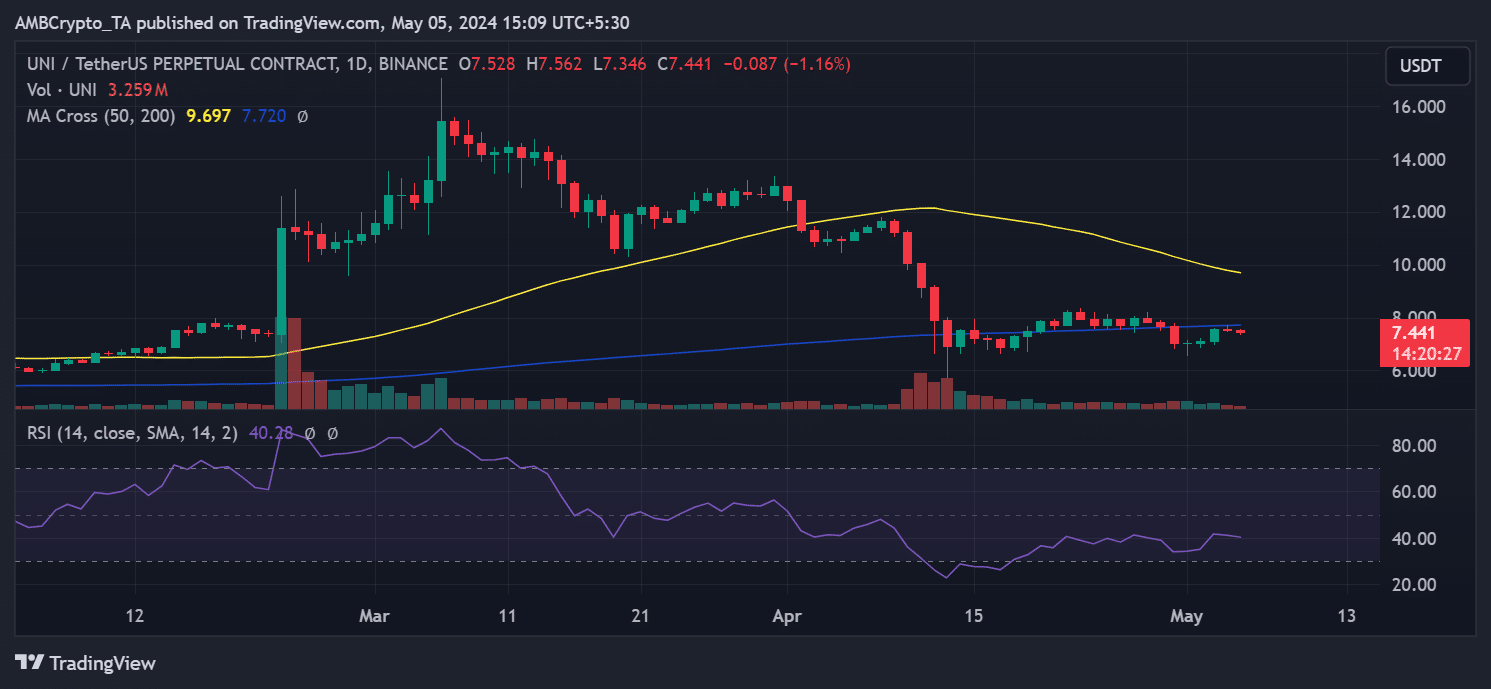

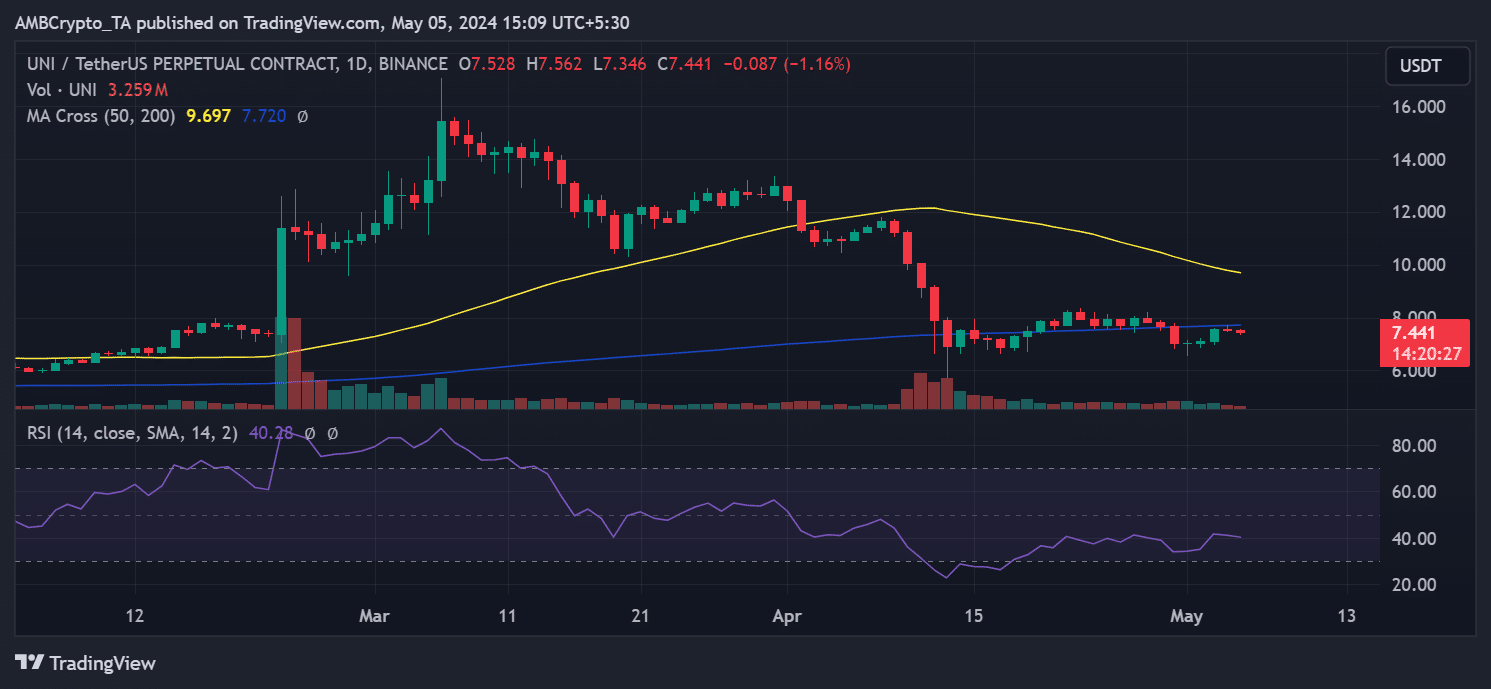

Among the many Ethereum commonplace tokens amassed by whales, Uniswap displayed the poorest value efficiency.

Whereas it noticed value will increase from the first of Might, solely on the 4th of Might did the rise exceed 1%, rising by 6.66% to commerce at round $7.5.

Nevertheless, regardless of the rise, its blue and yellow traces acted as resistance ranges. It was buying and selling at roughly $7.4, indicating a decline of over 1% in worth.

Moreover, its Relative Energy Index (RSI) hovered near 40, suggesting a bear pattern.

Supply: TradingView

Will Ethereum face the consequences?

The buildup of Pepe, Chainlink, and Uniswap is a optimistic sign for these Ethereum-based belongings. It suggests an anticipation of additional value appreciation, which is inherently bullish.

Is your portfolio inexperienced? Take a look at the LINK Revenue Calculator

Within the occasion of an eventual value surge for these tokens, the gross sales from these accumulating whales might set off additional accumulation by different merchants.

This resultant enhance in buying and selling quantity might considerably affect the general commerce quantity of the Ethereum community. Furthermore, an uptick in quantity would possible have an effect on the charges on the community.