Justin Sullivan

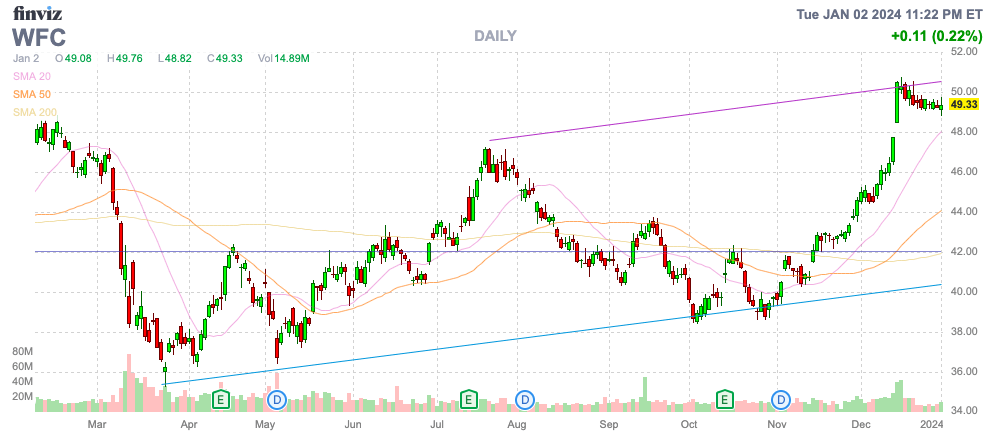

After a wild 2023 for banks, Wells Fargo (NYSE:WFC) truly enters 2024 with the inventory again on the highs near $50. The big financial institution hasn’t seen the earnings stream diminish throughout this era, but buyers panicked over fears of unrealized losses and a U.S. recession, neither that truly materialized. My funding thesis stays extremely Bullish because the inventory enters 2024 with extra stability within the enterprise and particularly with rates of interest normalized at larger ranges.

Supply: Finviz

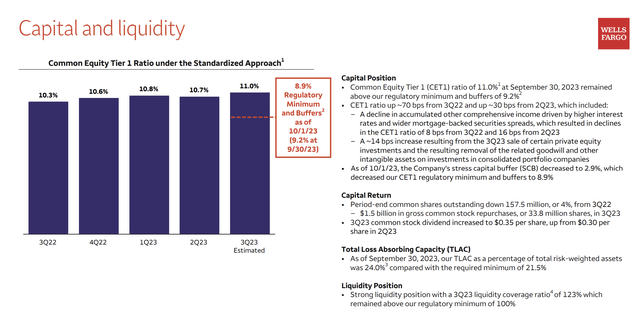

Capital Effervescent Over

Wells Fargo ended Q3’23 with a really sturdy capital ratio. The big financial institution boosted the CET1 ratio to 11.0%, up 70 foundation factors from the prior yr interval regardless of reducing the share rely by 157.5 million shares within the yr.

Supply: Wells Fargo Q3’23 presentation

Wells Fargo has capital far in extra of the present requirement for solely an 8.9% regulatory minimal. The issue dealing with the entire massive banks is the Basel III Endgame guidelines set to dramatically improve capital ratios over a phase-in interval.

On the Q3’23 earnings name, CEO Charlie Scharff made the next assertion on the anticipated hike to capital ratios:

Our sturdy capital ranges place us effectively for the anticipated will increase associated to the Basel III Endgame proposal launched within the third quarter. Primarily based on the place we ended the quarter, we estimate that our CET1 ratio can be 50 foundation factors above the totally phased-in required minimal if the proposed guidelines have been applied as written after factoring the expansion in RWAs and the ensuing decline in our stress capital buffer in addition to the influence of the brand new G-SIB buffer calculation adjustments.

If understood appropriately, Wells Fargo would see the CET1 capital ratio requirement surge to 10.5%, which quantities to an ~260 foundation factors enhance in capital necessities. The regulatory physique is presently in ongoing discussions with the massive banks with a heavy push again on the hefty required capital ratio enhance.

Within the final yr, Wells Fargo reduce the period-end widespread shares excellent down 157.5 million, or 4% from Q3’22. The big financial institution repurchased 33.8 million shares alone in Q3, or $1.5 billion value of widespread inventory.

Wells Fargo was capable of enhance the capital ratios whereas repurchasing these massive quantities of shares. The financial institution moreover gives an almost 3% dividend yield for shareholders.

In any other case, underneath the worst-case situation of a large hike to required capital ratios because of the Basel III implementation, Wells Fargo will proceed decreasing shares counts whereas boosting capital. The bonus could possibly be a discount in Basel III necessities, offering the massive banks an instantaneous degree of extra capital resulting in extra share buybacks.

Revenue Image

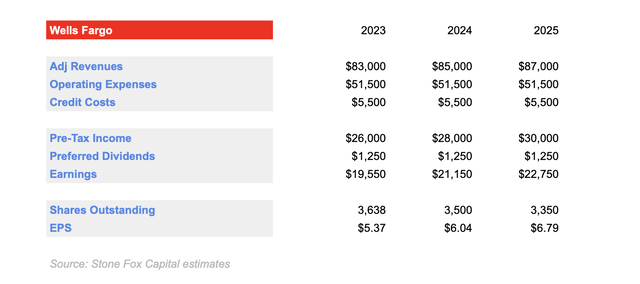

Wells Fargo has gotten thus far of a $5 EPS, however the market usually views the massive financial institution of hitting a revenue wall. The market wasn’t actually anticipating the financial institution to return to those revenue ranges, but the market seems wildly off track suggesting numbers will not enhance regardless of ongoing expectations for EPS boosts from share reductions.

The corporate has lengthy had the potential for a $6 to $8 EPS stream primarily based on effectivity enhancements. Wells Fargo had a purpose for chopping prices by as much as $10 billion earlier than the massive rate of interest hikes boosted NII and inflation made decreasing prices dramatically almost unattainable.

NII has held round $13 billion per quarter recently. An enormous drawback dealing with Wells Fargo is the asset cap nonetheless being in place in any case of those years.

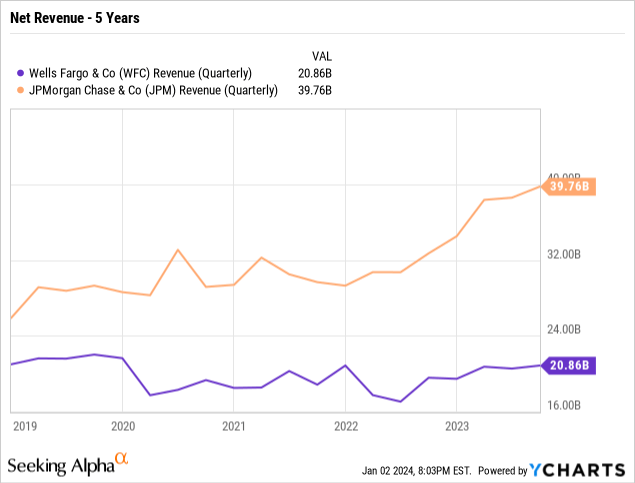

The Fed set the asset cap at $1.95 billion over 5 years in the past and administration has apparently instructed a practical target for removal is 2025. Throughout this era, Wells Fargo has seen quarterly revenues keep across the $20 billion vary whereas business chief JPMorgan Chase (JPM) has grown revenues to just about $40 billion, almost double Wells Fargo.

Clearly, the most important challenge is that Wells Fargo has been unable to spice up income whereas working bills are extra underneath management. The corporate has a goal for 2023 bills within the $51.5 billion vary, however revenues at the moment are solely working on the $80+ billion vary.

Even with barely larger credit score prices at $5.5 billion yearly, Wells Fargo has a simple path to a $6 to $7 EPS simply on barely larger income and decrease share counts. The projection is not that the massive financial institution cuts working bills anymore on account of inflation and such, however the firm retains prices flat whereas revenues rise to generate stable leverage.

Supply: Stone Fox Capital

The massive query stays when the asset cap is lastly lifted, permitting Wells Fargo to lastly develop the enterprise once more. The big financial institution can have stable progress potential because the cap is lifted.

Takeaway

The important thing investor takeaway is that Wells Fargo trades at solely ~10x normalized EPS targets whereas the corporate has simple EPS progress from restricted income progress and stable share buybacks. Even with the brand new Basel III laws, the massive financial institution ought to have the capital for share buybacks and finally Wells Fargo will get the asset cap lifted permitting for the enterprise to lastly develop once more.