peepo

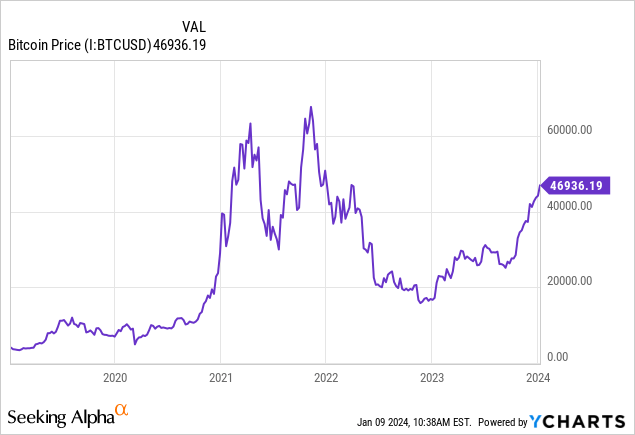

Bitcoin (BTC-USD) watchers received huge news at present. After years within the making, the ruling is in on a spot Bitcoin ETF. After a false begin yesterday when the SEC’s Twitter was hacked, the company voted to approve Grayscale Funding’s utility to transform its ~$27 billion closed-end Bitcoin fund (OTC:GBTC) into an ETF, together with a slew of different suppliers, together with BlackRock and Ark Make investments. This ruling means tens of millions of U.S. buyers will now be capable of purchase Bitcoin with the press of a button and with the price construction of an index fund. Public curiosity is very large, with the Bitcoin ETF being the highest trending matter on Twitter for many of the previous few days.

What’s subsequent? The ETFs ought to start buying and selling within the morning. Upon conversion, Grayscale’s Bitcoin Belief will redeem shares till it trades at web asset worth, ending the ultimate step in unlocking the billions of {dollars} in useless cash that was trapped contained in the fund. The ruling additionally brings competitors to the fund area–new funds are coming onto the marketplace for a fraction of the charges of Grayscale, giving buyers who purchased low the chance and promote excessive on Grayscale, and swap it out for a low-cost Bitcoin ETF. Nervous about deferring taxes? So long as you have held for at the least 12 months, finance theory strongly supports switching to a lower-cost fund. For holders in GBTC, the previous couple of years have been an up-and-down odyssey, however one which ended with a good decision. Bitcoin itself has been ramping up with investor enthusiasm constructing forward of the ETF approval and the 2024 halving occasion, however buyers could need to be cautious to not chase the worth increased.

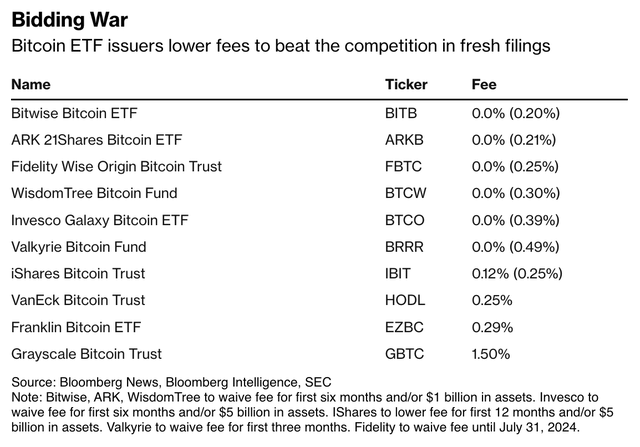

Bitcoin ETF Approvals (With Charge Buildings):

The SEC accredited the ETF functions without delay to permit some free market competitors on charges, this efficiently has prompted market participants to cut fees to draw belongings. A value conflict has developed amongst ETF issuers, with the newest price schedules beneath.

Bitcoin ETF Charge Buildings (Bloomberg)

What Do Spot Bitcoin ETFs Imply For Bitcoin Going Ahead?

In a vacuum, having spot Bitcoin ETFs creates a transparent increase in demand for Bitcoin. The most typical query I’ve acquired through the years about Bitcoin from buyers is how they’ll purchase it. The dearth of a spot ETF had the impact of suppressing demand from buyers, who purchased much less Bitcoin than they’d in any other case or did not purchase in any respect as a result of they weren’t comfy with the choices.

Earlier choices included shopping for on platforms like Coinbase (with excessive transaction charges), shopping for on platforms like BlockFi or Celsius (happily, I pulled my deposits out earlier than they collapsed), or the Bitcoin Futures ETF (BITO), which has underperformed Bitcoin by roughly 3.5% annually since inception, doubtless attributable to structural points with buying and selling futures for giant measurement. I believed GBTC was one of the simplest ways to purchase Bitcoin on the time as a result of large low cost to web asset worth, and plainly this was confirmed right. Nonetheless, as I discussed earlier than, GBTC already has numerous belongings and their administration charges aren’t aggressive to purchase the fund with out a steep low cost to NAV. Subsequently, I believe your greatest guess is probably going going to be to plug your cash into the iShares Bitcoin Fund (IBIT) at a 0.12% initial expense ratio. Cathie Wooden’s Ark Bitcoin Fund (ARKB) can even be a contender– they’re providing a full waiver on charges for six months.

Now, about Bitcoin itself. Everybody and their brother appears to have purchased Bitcoin earlier than the ETF approval, and numerous this sizzling cash goes to look to money out. This was apparent from the massive value swings when the SEC’s Twitter account received hacked yesterday. and If the provision from speculators cashing in exceeds the demand from new buyers pumping cash into the ETFs, then the worth is more likely to fall. However, the provision of Bitcoin is relatively restricted, so small modifications in demand could cause large ramps in value. In a earlier piece, I lined how the worth of gold is surprisingly correlated to how a lot of it’s being mined at any given time. If this holds true for BTC (and it has traditionally), 2024 may very well be a surprisingly good 12 months.

On stability, when you personal GBTC, you are going to need to money in anyway to maneuver to a lower-fee ETF, so it is doubtlessly a great time to take earnings. I consider that Bitcoin is more likely to commerce to $100,000+ over time as a result of having an alternative choice to central financial institution currencies is tremendous beneficial. Nonetheless, the trail to get there’s more likely to have loads of twists and turns, so taking some earnings after the GTBC conversion is probably going prudent, as is dollar-cost averaging into Bitcoin for brand spanking new buyers.

Unsure how a lot to allocate to Bitcoin? First, allocate no matter you are comfy with, not an arbitrary quantity like 10%. Second, fashionable portfolio concept suggests {that a} good start line is to match the burden of the asset relative to its market worth within the investible international monetary markets. An method taken by quant and former threat supervisor Aaron Brown is to allocate a continuing 2% to Bitcoin, shopping for extra when it drops and promoting when it rises. He wrote in 2021 that this technique made him 40% of his whole wealth over time with solely 2% in danger at any given time. Different buyers are extra bullish, with Tom Lee calling for Bitcoin to hit $500,000. I do not foresee 10x returns for Bitcoin within the subsequent few years, however I do see good worth, albeit with extra required value sensitivity than the largest bulls available in the market.

Backside Line

At present’s ruling is a watershed second for Bitcoin. The emergence of spot Bitcoin ETFs creates the infrastructure for tens of millions of buyers to undertake Bitcoin as an asset class. Should you purchased GBTC for the low cost, then congrats on the win. Now you can contemplate swapping it for a lower-fee ETF. Should you do not personal any Bitcoin, there isn’t any should be panic shopping for now, however contemplate allocating cash over time to the iShares Spot Bitcoin fund for the long-run potential for Bitcoin to function a retailer of wealth outdoors of central financial institution management.

Editor’s Observe: This text discusses a number of securities that don’t commerce on a significant U.S. trade. Please concentrate on the dangers related to these shares.