Authored by Simon White, Bloomberg macro strategist,

Because the Federal Reserve proceeds with quantitative tightening, markets are more and more delicate to funding and liquidity situations. That makes it paramount to determine – forward of time – when funding stress is about to manifest.

September 2019 is just not a month the Fed needs to revisit. Funding situations quickly deteriorated, resulting in spikes increased in repo and different short-term interest-rates which are on the base of monetary markets. With out easily functioning funding markets all property are weak, as the price of financing positions turns into punitive, or evaporates altogether.

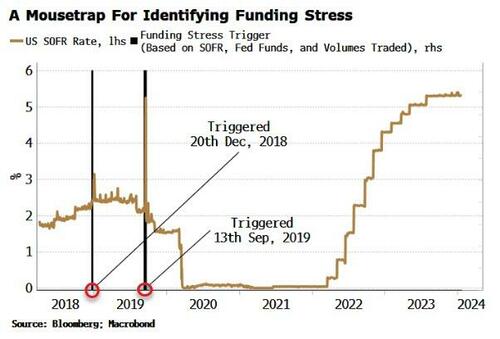

Can we determine when funding stress is imminent? It’s not straightforward, because it sometimes occurs abruptly. However we will construct a Funding Stress Set off that previously has given no less than a vital day or two discover that funding charges could also be about to shift notably increased. If and when the set off prompts within the present cycle can be signal QT has run its course (if the Fed hadn’t already ended it by then).

First, a quick reminder on 2019.

Then, as now, the Fed had been lowering the scale of its stability sheet, whereas on the identical time Treasury issuance was rising. Regardless that the Fed had stopped its balance-sheet run-off in August 2019, reserves continued to fall as different liabilities on its stability sheet, such because the Treasury account (TGA), rose.

The straws that broke the camel’s again had been a company tax-payment day and a big settlement of long-term USTs. The tax cost drained reserves because the Treasury deposited the proceeds on the TGA, whereas the settlement of USTs meant sellers’ demand for repo funding jumped.

Cue a sudden and non-linear deterioration in funding markets that led to the Fed having to step in and supply time period and in a single day repo loans.

Funding charges rapidly fell again down, however the danger to monetary markets from a repeat of this episode is actual and subsequently very a lot value attempting to arrange for.

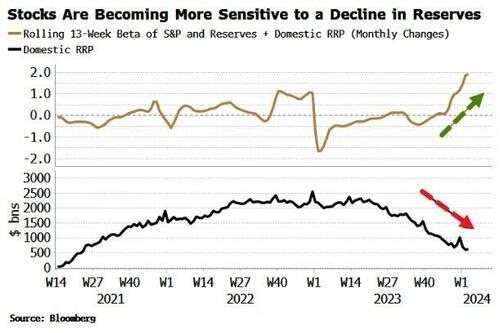

That’s much more the case as asset-prices’ sensitivity to the Fed’s stability sheet at present is increased than it was in 2019. The Treasury’s resolution to fund most of its borrowing utilizing payments on this cycle – subsequently making use of the trillions of reserves which were idling within the Fed’s reverse repo facility (RRP) – has meant shares and bonds have continued to rise regardless of the federal government working an enormous fiscal deficit.

The chart beneath exhibits shares’ sensitivity, i.e. their beta, to reserves plus the home RRP (the brown line). That sensitivity is rising because the RRP falls (white line in chart), indicating that shares have gotten extra weak to falling reserves. Equally for Treasuries.

That’s why holders of shares and bonds ought to care about how briskly the RRP is falling and the whole quantity of reserves within the system.

The large unknown is what number of reserves are wanted for the graceful functioning of funding markets. Fed member Christopher Waller has steered that the so-called lowest snug stage of reserves (LCLOR) is about 10-11% of GDP, i.e. ~$3 trillion, in contrast with the present stage of $3.6 trillion. The Fed’s Senior Monetary Officer Survey additionally asks banks what they suppose their LCLOR is and how a lot of a buffer they would like to carry above it.

The issue with utilizing this info as the idea for a funding-stress sign is that it’s lagging.

Reserves are launched on a weekly foundation, whereas the survey is barely biannual.

As an alternative we have to use each day knowledge. In constructing the Finance Stress Set off we use a number of key insights:

-

Funding stress tends to indicate up first on the tails of the each day repo charges traded between counterparties

-

Funding volumes of home banks in fed funds (i.e. reserves) sometimes rise as whole reserves fall, whereas international banks’ volumes have a tendency to say no when funding points develop

-

International banks are a lot larger debtors of fed funds than their home counterparts

-

General funding volumes (home + international banks) thus are likely to initially fall, earlier than rapidly rising once more, on the time of funding issues

-

Stress in funding markets is often preceded by an increase within the volatility of the unfold between totally different funding charges

The set off is proven within the chart beneath. It makes use of solely 4 standards primarily based on the above factors, taking into consideration Einstein’s maxim that fashions ought to be “so simple as potential, however no easier.”

It has solely activated twice: in 2018 and 2019. In 2018 it triggered on the twentieth December. This was a number of days earlier than the sharp rise in funding charges on the finish of that 12 months. The traditional, year-end flip when demand for money rises was exacerbated by Basel III regulation for GSIBs (World Systemically Essential Banks), who stockpiled reserves to make sure their loss-absorbency necessities didn’t rise.

The set off additionally activated within the 2019 funding episode, maybe appropriately on Friday the thirteenth of September, forward of the acute stress seen the next week that led to the Fed’s emergency repo provisioning.

No sign is ideal and all are essentially topic to retrofitting bias: there’s no assure the following funding flare-up will present itself in precisely the identical approach as prior episodes. The opportunity of a false damaging means sustaining vigilance to funding-market situations is important even within the absence of the sign being energetic.

Moreover, the Fed launched a standing repo facility in 2021 permitting banks to entry funding at a punitive charge, whereas it has additionally been attempting to de-stigmatize the usage of the low cost window.

Nonetheless, there is no such thing as a assure both of those would see notable use earlier than the funding-stress cat is out of the bag. The set off, however, makes use of each day value and quantity knowledge that ideally captures normal indicators of funding misery earlier than it considerably worsens.

Within the present surroundings of deeply intertwined fiscal and financial coverage, property are more and more delicate to funding markets, whereas the latter are extra liable to abrupt meltdowns.

Butterflies flapping their wings within the financial plumbing ought to subsequently be taken significantly by merchants and buyers throughout all asset courses.

Loading…