PeopleImages

Thesis

The acquisition of Superior Disposal by Waste Administration, Inc.’s (NYSE:WM) in 2020 has consolidated the corporate’s management standing within the $80 billion solid-waste trade. The administration has emphasised on pricing and operational effectivity has enabled the corporate to develop within the current previous. The big scale of the corporate has meant that the WM can proceed to broaden EBITDA by mid-high single digit charge within the near-term. Whereas I’ve a optimistic view of Waste Administration’s prospects, I stay cautious for now for the reason that inventory is buying and selling at a premium, and any delays within the firm’s progress on its sustainability targets could result in a number of compression. Therefore, I assign a maintain score to the inventory.

Q3 Assessment and Outlook

Waste Administration reported better-than-expected outcomes for the third quarter of 2023, reaching an adjusted EBITDA of $1.54 billion, primarily because of decreased working prices. The SG&A bills as a share of income remained low at 9% for the quarter. Labor price inflation decreased to a 5-6% year-on-year enhance within the third quarter, and restore and upkeep bills noticed a 6-7% year-on-year inflation stage, partly as a result of WM obtained extra vans. The administration maintained its adjusted EBITDA outlook for 2023, with a variety of $5.7 billion to $5.8 billion. The corporate anticipates a 40-60 foundation level enlargement within the adjusted EBITDA margin to twenty-eight.5% on the midpoint of the vary.

I consider Waste Administration’s EBITDA could develop 5-6% in 2023, according to its long-term goal, as value will increase ought to offset inflation in driver wages and fleet prices. I consider acquisitions might add to whole income enlargement, however might be offset by declines in recycling and renewable-fuel credit. Adjusted EBITDA margin might broaden 50 bps after holding regular in 2022, pushed by automation and expertise investments that might scale back head rely and enhance worker effectivity.

WM has plans to launch its seventh RNG plant, the third in its development program, in January 2024. 4 further initiatives, together with two of the corporate’s largest ones, are anticipated to be accomplished in 2024. WM has deferred $150 million of its sustainability capital expenditure to 2024 and past, making the full year-to-date delay in sustainability capex $350 million. These delays are primarily attributed to the necessity to safe agreements to attach gasoline to the system and allowing delays. Nonetheless, WM maintains confidence in reaching its $740 million EBITDA objective for 2026.

I consider WM is about to extend the contribution of sustainable companies like renewable vitality and recycling by 2027. The corporate has set an formidable goal of lowering its Scope 1-2 greenhouse gasoline emissions by 42% by 2031. For my part, nearly all of this transformation is prone to stem from the era of renewable pure gasoline from dangerous landfill emissions, which can be utilized to energy their waste assortment autos, thereby lowering diesel emissions. The remaining progress in sustainability could come primarily from automating recycling services and enhancing their functionality to course of more difficult supplies like versatile plastics.

Plastics Stay an Space of Alternative

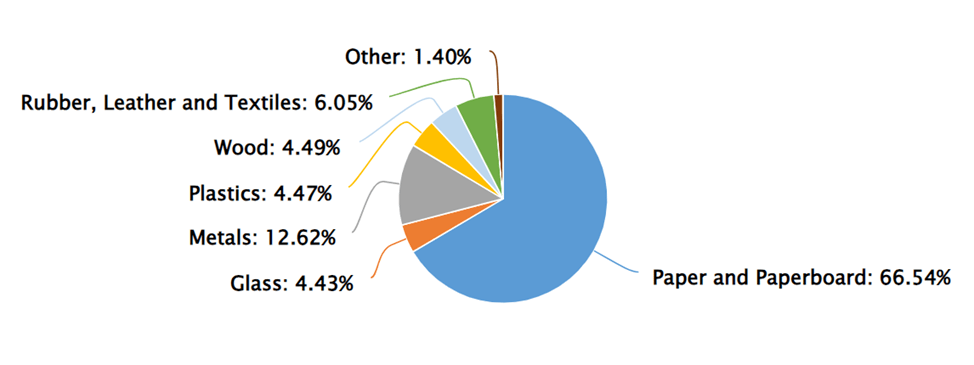

In response to the elevated demand for ecologically pleasant packaging, waste administration corporations akin to Republic Providers and Waste Administration are boosting their investments in plastic recycling. Whereas plastics presently account for a tiny fraction of the supplies processed by the solid-waste sector, that is anticipated to rise as extra measures to encourage the usage of sustainable packaging are adopted. Plastic recycling is being prioritized by client items companies as a part of their bigger efforts to forestall world plastic waste. Therefore, with the introduction of efforts, akin to prolonged producer duty laws, which holds corporations financially liable for the entire lifespan of their merchandise, plastic recycling could develop. Plastics account for lower than 5% of all recyclable stable trash, whereas paper accounts for over 67%. Waste Administration expects to generate incremental EBITDA by growing its processing capability, together with its skill to deal with new waste streams. The acquisition of a majority share in Avangard Revolutionary’s US enterprise in 2022 permits the corporate to course of difficult-to-recycle supplies akin to thin-film plastics.

EPA

Continues to Prioritize Profitability Over Development

An emphasis on pricing and working self-discipline underneath Jim Fish has enabled the corporate to extend EBITDA by nearly 50% since he grew to become CEO in 2016. Following the acquisition of Superior Disposal Providers, Waste Administration has grown to turn into North America’s largest environmental-services agency, with gross sales estimated to achieve $20 billion in 2023. Waste Administration’s income has persistently risen at an natural charge of 3-5%, which is according to the solid-waste trade common. I anticipate a 5-7% enchancment in EBITDA for Waste Administration in 2023, which is in keeping with the corporate’s long-term aims. The vast majority of this enhance in EBITDA is predicted to come back from stable waste assortment and disposal, factoring in internet pricing changes, whereas the quantity is could stay secure, largely influenced by restricted GDP development.

Valuation

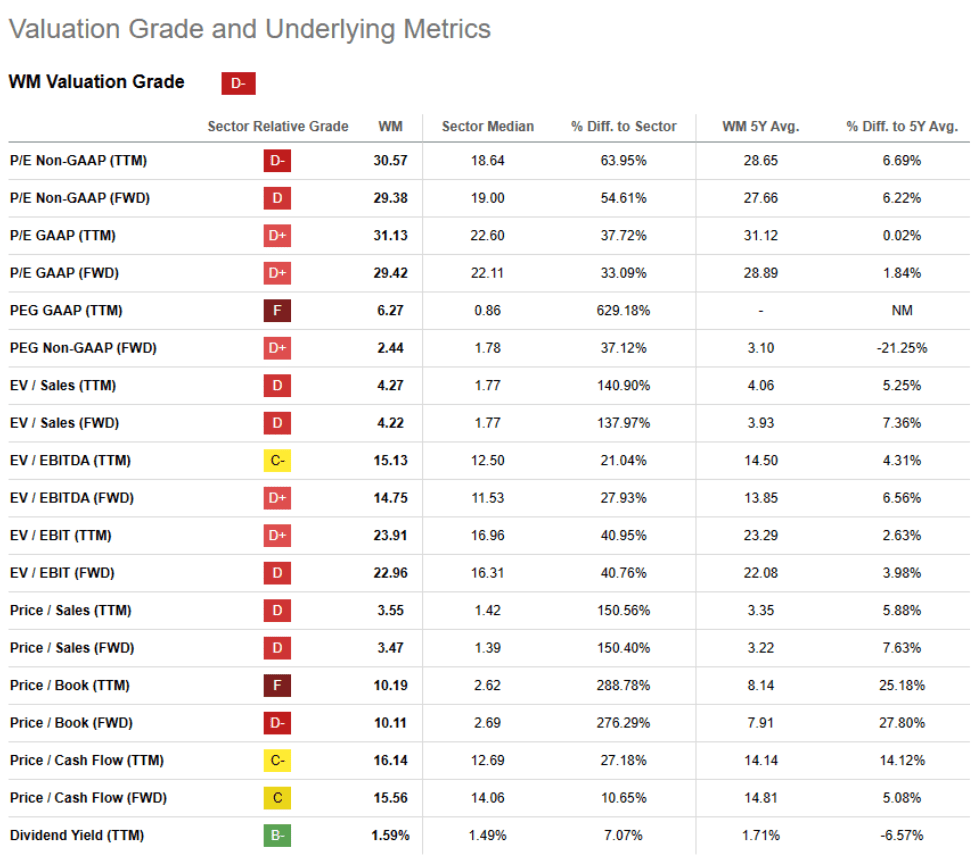

Waste Administration is at present buying and selling at roughly 30 occasions the subsequent twelve months, which is increased than its five-year common P/E of 26.6x as per Capital IQ. The present a number of can be increased than the sector median of 19x. The present elevated a number of appears to be largely pushed by expectations of long-term sustainability advantages past fiscal yr 2026 fairly than speedy income good points for my part. I consider at this elevated a number of, any potential delays within the firm’s sustainability initiatives can result in a compression within the inventory’s a number of. Therefore, I stay cautious and assign a maintain score to the inventory.

Searching for Alpha

Conclusion

WM is an trade chief within the Waste Administration area and can proceed to drive EBITDA development of mid-high single digits within the near-term. Nonetheless, the inventory’s valuation stays excessive with it buying and selling at round 30 occasions its subsequent twelve months’ earnings, which is above its five-year common P/E ratio of 26.6x. Though I maintain a positive outlook for Waste Administration’s future, I’m at present exercising warning as a result of inventory’s premium valuation and assign a maintain score to the inventory.