VioletaStoimenova

It is all the time a terrific feeling to have the ability to purchase shares of a pretty firm instantly after these shares have plunged in worth. A great instance of this sort of alternative that lately crossed my radar includes Washington Belief Bancorp (NASDAQ:WASH). On October twenty fourth, shares of the corporate dropped almost 10% after administration announced monetary outcomes protecting the third quarter of the corporate’s 2023 fiscal yr. Since then, shares have declined a bit additional. Whereas it’s clear that there have been some points that traders ought to concentrate on, the corporate confirmed development the place it issues most and the inventory nonetheless appears to be like fairly engaging within the grand scheme of issues. That is clearly not a house run prospect. However for traders who would you like a small financial institution with upside, that is positively one to bear in mind.

Shopping for when there’s blood on the street

With a market capitalization of $380.9 million, Washington Belief Bancorp is a really small player within the banking business. However the firm has been round for a short time. It will possibly truly hint its roots again to the yr 1800. But it surely wasn’t till 1984 that the agency as we all know it immediately was organized. Opposite to the corporate’s identify, it’s not centered in both Washington, DC, or within the state of Washington. Slightly, it traces its identify again to Washington County, Rhode Island. As of the tip of final yr, the agency had 10 department workplaces positioned throughout southern Rhode Island, 14 department workplaces within the larger Windfall space of Rhode Island, and a single department workplace positioned in southeastern Connecticut.

Creator – SEC EDGAR Information

It is from these bodily branches that the financial institution supplies its providers to its clients. By accepting deposits from shoppers and industrial entities alike, it is ready to lend out vital quantities of capital. This consists of industrial loans similar to these devoted to industrial actual property and industrial and industrial actions. It consists of residential actual property loans, shopper loans, and extra. However the firm additionally supplies different banking associated providers as effectively. For example, as of the tip of final yr, it had an funding securities portfolio that was price $1 billion. As of the tip of the latest quarter, it is barely decrease than that at $969 million. Along with this, it engages in wealth administration providers. These providers embrace monetary planning providers, private belief and property providers, and extra. By the tip of final yr, it had amassed belongings underneath advisory of $6 billion.

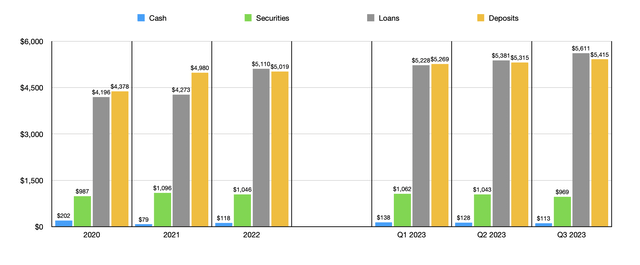

As I discussed already, shares of the financial institution dropped round 10% on October twenty fourth. To be completely sincere with you, I do not know why this decline occurred. Income exceeded expectations by $0.23 million, whereas earnings per share of $0.65 beat expectations by $0.07. Moreover, the financial institution demonstrated development the place it actually issues. However to do this, let’s shift a bit and speak about a few of its belongings through the years and the way they’ve modified. For starters, let’s contact on deposits. Technically a legal responsibility, deposits do enable the financial institution to lend out capital. Again in 2020, deposits have been $4.38 billion. By the tip of 2022, that they had grown to $5.02 billion. You’d assume, given the banking disaster that occurred earlier this yr, that deposits would have declined after that point. However that is not appropriate. In every of the previous three quarters, the worth of deposits has grown additional, hitting $5.42 billion as of the tip of the third quarter that was simply introduced. That third quarter studying is definitely $101.1 million above what the corporate achieved within the second quarter. One factor that I’ll say that can be constructive is the truth that solely 25% of the financial institution’s deposits are uninsured. This isn’t as little as I would love it to be, however I do set a threshold of 30% when taking a look at these banks to see which of them are greater threat and which of them are decrease threat. Sorry quantity 30% or decrease I contemplate to be impartial to constructive.

This development resulted within the worth of loans increasing from $4.20 billion in 2020 to $5.11 billion in 2022. As of the tip of the latest quarter, loans have been even greater at $5.61 billion. That’s $230 million above what the corporate reported within the second quarter. I do perceive that traders proper now are anxious about banks which have publicity to workplace properties. However the excellent news is that administration has by no means been devoted all that a lot to that form of actual property. As of the tip of the latest quarter, solely 5.2% of the corporate’s mortgage portfolio, by worth, is devoted to the workplace class. The truth is, its best publicity is to the multifamily dwelling class at $552.8 million, or 9.9% of general portfolio worth.

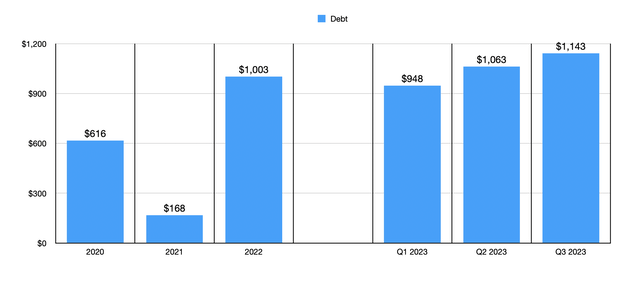

There are different metrics that we must be listening to as effectively. The worth of securities, for example, has bounced round in a reasonably slender vary in recent times with a low level of the $969 million simply reported and a excessive level of $1.10 billion on the finish of 2021. However there isn’t a clear pattern as to the path it’s transferring. The worth of money, in the meantime, has behaved very equally. Between 2020 and 2022, it fell from $202.2 million to $118.4 million. However immediately, it is a bit decrease at $113 million. Debt on the financial institution has elevated, however it’s not at a stage that I might be terribly involved with. At present, it is at roughly $1.14 billion. That is up from the $1 billion reported for the tip of 2022.

Creator – SEC EDGAR Information

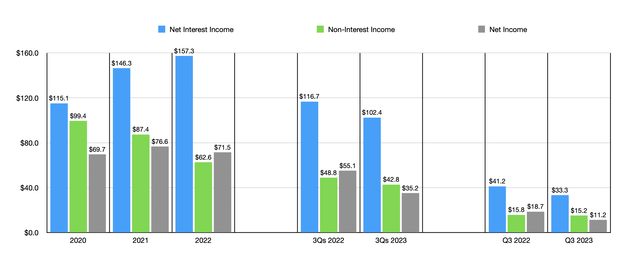

The general development that the financial institution noticed between 2020 and 2022 allowed its income and earnings to climb. Internet curiosity earnings elevated from $115.1 million to $157.3 million. It did see a decline in non-interest earnings from $99.4 million to $62.6 million. However that was due to a plunge in mortgage banking income from $47.4 million to $8.7 million. An increase in rates of interest, mixed with decrease spreads on mortgages, could be blamed for this drop. The previous of those points resulted in fewer mortgages being accepted. That did not cease internet earnings from growing modestly from $69.7 million to $71.5 million. However that is the place a number of the difficulty is available in. Internet curiosity earnings, non-interest earnings, and internet earnings, all drop yr over yr. Although belongings are greater, the corporate is coping with greater rates of interest that it has to pay out, not solely on its debt but in addition on its deposits. This triggered its internet curiosity margin to shrink from 2.71% within the first three quarters of final yr to the primary three quarters of this yr. For so long as rates of interest stay elevated, this can show problematic and it’s possible why the market responded so negatively despite the fact that administration exceeded expectations.

Creator – SEC EDGAR Information

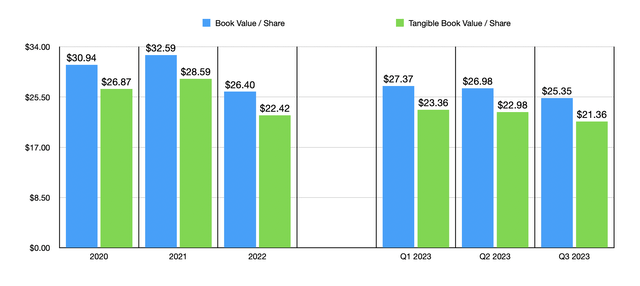

This does make pricing the corporate a little bit of a problem. If we use monetary outcomes protecting final yr, we see that the financial institution is buying and selling at a worth to earnings a number of of 5.3. A great resolution is to annualize the outcomes skilled to date for the yr. That may give us internet earnings for 2023 of $45.7 million. However even in that case, the value to earnings a number of of the financial institution is sort of low at 8.3. It is also buying and selling at a worth to ebook worth of solely 0.88 and at a worth to tangible ebook worth of 1.05. These are completely affordable ranges that I might contemplate to be pretty engaging.

Creator – SEC EDGAR Information

Takeaway

So far as banks go, Washington Belief Bancorp appears to be like to be an fascinating prospect that does have upside potential to it. My greatest drawback with it’s that backside line outcomes have worsened this yr due to rate of interest points. And that’s one thing traders must take care of for a while. However even accounting for that, shares do not look unreasonably priced and just about every thing else relating to the financial institution appears to be like bullish. I’m particularly enthusiastic in regards to the continued development in its deposits throughout what’s a tough time. And in the long term, this can remember to pay dividends.