Dimitrios Kambouris

One of many issues that buyers actually respect about leisure conglomerate Warner Bros. Discovery, Inc. (NASDAQ:WBD) is the truth that shares of the enterprise are fairly low cost. That is true not solely on an absolute foundation, however additionally relative to comparable corporations. As a worth investor myself, I discover shopping for shares of low cost shares to be extremely rewarding when it’s executed proper. Nevertheless it additionally brings with it sure dangers like shopping for shares of firms that need to commerce at a reduction. Previously, I’ve been quite impartial on Warner Bros. Discovery.

When the administration crew at AT&T (T) ended up splitting WarnerMedia from its operations and merging them into Discovery to create the Warner Bros. Discovery entity that we all know at this time, I virtually instantly bought off my shares of the brand new enterprise. Based mostly on my very own evaluation on the time, Warner Bros. Discovery was not precisely a foul prospect. Nevertheless it was removed from being an ideal one. As I noticed it, the entire true worth was in AT&T. Since that point, I consider that my thesis on the matter has confirmed to be true.

Within the final article that I wrote about Warner Bros. Discovery, which was printed in October of 2022, I discussed that there was lots of uncertainty relating to the corporate’s streaming operations at the moment. General, the corporate was trying higher than it was previous to that time. However I nonetheless stated that the corporate was not ok to warrant an funding.

Since then, shares have fallen an additional 11.6% whereas the S&P 500 (SP500) has jumped 21.2%. And basically talking, not less than in some respects, the image continues to look higher. However once you add in a few of the negatives like its latest drop in subscriber numbers and the huge quantity of debt the corporate has available, I don’t but consider that it’s worthy of an optimistic evaluation. Due to that, I’m holding the corporate rated a “maintain” for now.

The image is bettering… and worsening

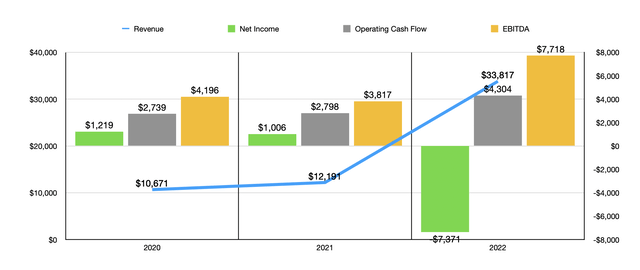

Writer – SEC EDGAR Knowledge

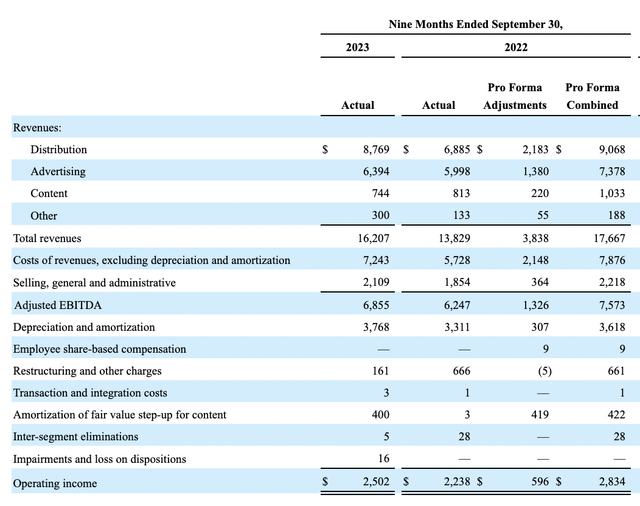

The latest basic knowledge that we have now relating to Warner Bros. Discovery covers the third quarter of the corporate’s 2023 fiscal yr. Should you have a look at the floor stage knowledge, the agency is, in lots of respects, performing fairly nicely. Within the chart above, as an illustration, you may see income, earnings, and money flows, protecting 2020 through 2022. And within the chart beneath, you may see knowledge protecting the first nine months of 2023 relative to the primary 9 months of the yr prior. The very first thing you’ll discover is that gross sales skyrocketed from 2021 to 2022. Nevertheless, it is necessary to dig a bit deeper with a view to perceive all that is occurring.

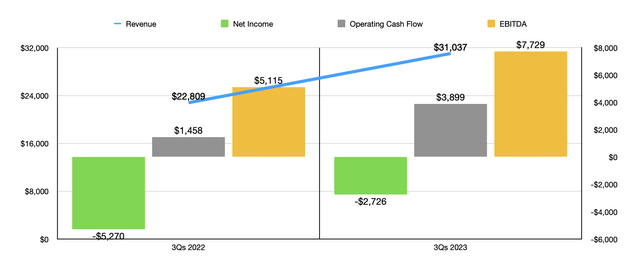

Writer – SEC EDGAR Knowledge

The excellent news for shareholders is that, to make issues simpler, the administration crew on the firm offers knowledge that exhibits what the basic image would appear like for the enterprise had the merger between WarnerMedia and Discovery taken place initially of the agency’s fiscal yr. That is obligatory as a result of the merger didn’t, in truth, happen in that method.

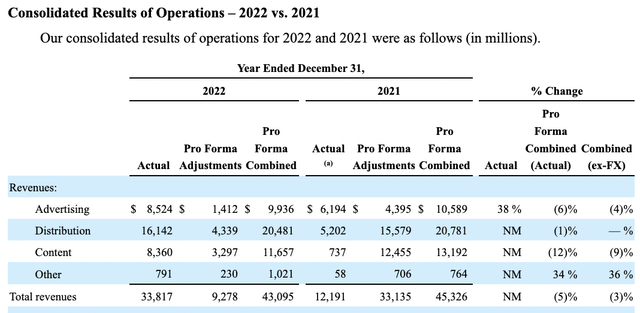

For the time previous to 2023, I will not cowl the entire knowledge since our main focus needs to be on more moderen outcomes. However within the picture beneath, you may see the income image for the corporate because it was in comparison with what it might have been had the transaction been accomplished initially of any given fiscal yr. As an alternative of seeing income soar from $12.19 billion in 2021 to $33.82 billion in 2022, professional forma outcomes would have proven a decline from $45.33 billion to $43.10 billion.

Warner Bros. Discovery

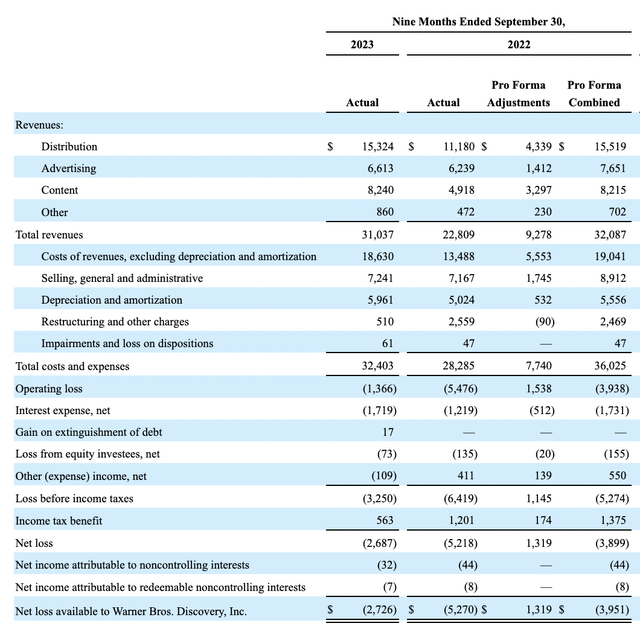

Within the subsequent picture beneath, you may see complete knowledge protecting the primary 9 months of 2023 relative to the primary 9 months of 2022. As an alternative of seeing income climb from $22.81 billion to $31.04 billion, a rise that might be spectacular it doesn’t matter what, we’d truly see income drop barely from $32.09 billion to $31.04 billion. On the underside line, as an alternative of seeing the agency’s internet loss enhance from $5.27 billion to $2.73 billion, the development was much less substantive from a lack of $3.95 billion to $2.73 billion. Admittedly, that is nonetheless an enchancment, simply not of the magnitude that the official GAAP outcomes reveal.

Warner Bros. Discovery

This doesn’t change the truth that shares of Warner Bros. Discovery are basically low cost. Based on administration, steering for the 2023 fiscal yr ought to end in EBITDA of between $10.5 billion and $11 billion. This compares to the $7.72 billion generated in 2022. It is a huge enchancment and it’s because of value reducing initiatives which have allowed the corporate to seize synergies in extra of $5 billion. Although this has come at a value that’s estimated to be towards the upper finish of the $1 billion to $1.5 billion vary that administration beforehand forecasted. Given the magnitude of the financial savings, it is a small value to pay that buyers needs to be very proud of.

No estimates have been offered in relation to working money circulate. However assuming it’s anticipated to extend on the identical charge that EBITDA at its midpoint ought to, buyers ought to anticipate a studying of just below $6 billion.

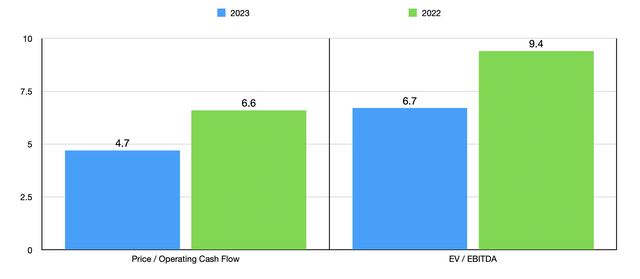

Writer – SEC EDGAR Knowledge

Within the chart above, you may see what this does to the pricing of the inventory for 2023 relative to 2022. The value to working money circulate a number of ought to drop from 6.6 to 4.7. In the meantime, the EV to EBITDA a number of of the corporate is predicted to fall from 9.4 to six.7. Typically, when multiples are within the single digit vary like this, it needs to be construed as a bullish signal.

However shares aren’t simply low cost on an absolute foundation. Within the desk beneath, I in contrast the enterprise to 2 comparable corporations. It’s fairly a bit cheaper than both one. As a be aware, I used to be tempted to match it to The Walt Disney Firm (DIS) as nicely, given its huge streaming and theatrical manufacturing divisions. However given what number of different operations exist underneath the Disney umbrella, I felt it would not be comparable sufficient.

| Firm | Worth / Working Money Circulate |

EV / EBITDA |

| Warner Bros. Discovery | 4.7 | 6.7 |

| Netflix (NFLX) | 35.1 | 10.3 |

| Paramount World (PARA) | 64.5 | 37.4 |

Based mostly on the info seen to date, Warner Bros. Discovery appears to be like to be an attention-grabbing turnaround prospect. Nevertheless, there are components of the corporate that I stay uncomfortable with. Initially, I do not like the huge quantity of debt that the enterprise has on its books. Web debt as of the tip of the newest quarter was $42.42 billion. Granted, the latest surge in EBITDA ought to deliver the online leverage ratio of the enterprise right down to about 3.95. That is a pleasant enchancment over the 5.50 studying that we get utilizing EBITDA from 2022. That’s more likely to proceed dropping from this level on as long as profitability stays elevated.

This alone wouldn’t be sufficient to trigger me to take a bearish stance on the enterprise, particularly the large enchancment that we have now seen from 2022 to 2023. However it’s a piece of the pie that buyers must take into accounts.

Warner Bros. Discovery

One other factor that bothers me is that a big portion of the corporate’s income and earnings comes from its Networks division. As of the tip of the 2022 fiscal yr, this included 30 U.S. normal leisure, way of life, and information networks, in addition to worldwide networks and regional sports activities networks, that the corporate made accessible to varied home and worldwide tv networks. Whereas income managed to develop from $13.83 billion within the first 9 months of 2022 to $16.21 billion on the identical time for 2023, precise professional forma income for the primary 9 months of 2022 was increased at $17.67 billion. As an alternative of seeing earnings rise from $2.24 billion to $2.50 billion, earnings would have truly fallen from $2.83 billion on a professional forma foundation.

This weak spot has come even at a time when administration has been in a position to get increased contractual affiliate charges right here at residence. Promoting income has dropped by 13% yr over yr due to viewers declines in each home normal leisure and information networks, in addition to general weak spot that administration claims exists within the U.S. market. Some worldwide markets have additionally confirmed to be a ache in relation to promoting, although to not the extent that the U.S. has.

Even worse was the content material facet of issues, with income plunging 26% due to the timing of third-party content material licensing offers right here at residence and a discount in worldwide sports activities sub licensing income. On the whole, that is an space that appears to be in hassle, largely because of a shift away from conventional networks and towards on-line content material.

Warner Bros. Discovery

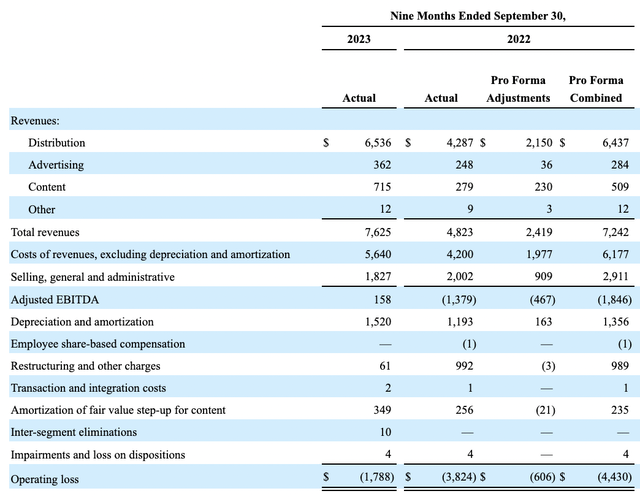

In the meantime, direct to client content material that features streaming operations has managed to develop, even on a professional forma foundation. Gross sales on a professional forma foundation have grown from $7.24 billion to $7.63 billion. On high of this, the underside line for the enterprise can also be bettering properly. In actual fact, administration is forecasting EBITDA of $1 billion or extra related to these operations in 2025. For the primary 9 months of 2023, the enhancements on the income facet have been largely pushed by development related to the corporate’s U.S. ad-lite subscriber providing, increased engagement, and better pricing.

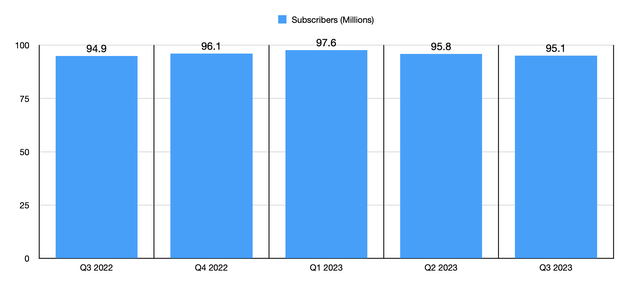

Right here at residence, the launch of the Final tier of subscription additionally performed a job that helped the enterprise. What bothers me, nonetheless, is the truth that, after peaking at 97.6 million subscribers within the first quarter of 2023, we have now seen solely declines in subscriber depend since. By the tip of the third quarter, that quantity had fallen to 95.1 million. A drop in subscriber numbers at a time when different opponents are rising is disconcerting.

Writer – SEC EDGAR Knowledge

Takeaway

In my view, Warner Bros. Discovery is an attention-grabbing prospect that very nicely may go on to generate important upside for shareholders. Nevertheless it’s not a prospect that’s and not using a good quantity of danger. While you have a look at the present areas of weak spot for Warner Bros. Discovery, Inc. and what that may imply for the lengthy haul, I’m not but comfy turning bullish on the enterprise.

If shares proceed to drop and/or if we see significant enhancements in a few of these weak areas, my mindset may change. However relative to the upside that is on the desk, I consider that the chance is simply too excessive for somebody like me. Due to that, I’ve determined to maintain Warner Bros. Discovery, Inc. shares rated a “maintain” for now.