Metal Bank Limited (ASX: MBK) (‘Metallic Financial institution’, ‘MBK’ or the ‘Firm’) is happy to announce additional particulars relating to the Wadi al Junah Copper-Zinc-Gold-Silver Mission (‘Wadi al Junah’ or ‘the Mission’), which has been awarded to Consolidated Mining Firm (CMC) following a extremely aggressive Saudi authorities exploration licensing Spherical 6.

Highlights

- As introduced on 6 November, MBK’s Saudi Arabian JV firm, has been awarded the Wadi Al Junah Mission as a part of the Saudi Authorities’s Exploration Licensing Spherical 6

- Wadi Al Junah is potential for volcanogenic large sulphide (VMS) copper-zinc- gold-silver mineralisation and for shear zone gold-silver, with a number of untested precedence targets

- The Mission is 35km east of the Al Hajar Au-Ag-(Cu-Zn) deposit beforehand mined by Ma’aden and is proximal to the regional centre of Bisha, and near main entry routes, native cities and workforce

- Saudi exploration technique is supported by a properly capitalised in-country JV Firm in CMC and vital Saudi authorities incentives to de-risk and fast-track exploration

- Metallic Financial institution continues to evaluate new potential venture areas in Saudi Arabia potential for copper, gold and different vital minerals – a number of tenement functions in progress

CMC is a Saudi Arabian restricted legal responsibility firm owned by MBK (60%) and Central Mining Holding Firm (‘CMH’, 40%). CMH is a member of the Al Qahtani Holdings group, and was the JV accomplice of Citadel Sources which, underneath the management of Inés Scotland as Managing Director, was liable for the exploration and improvement of the Jabal Sayid copper venture in Saudi Arabia (previous to its acquisition by Equinox). CMC might be liable for managing and implementing the work program for the Wadi Al Junah venture utilising the technical experience of MBK, because the exploration JV accomplice, together with the KSA experience of the Al Qahtani Group. CMC has a present capitalisation of SAR5m (~AUD2.1m).

Wadi al Junah with an space of 427km2 was the biggest of the tasks supplied in Spherical 6 and is proximal to the main regional centre and airport of Bisha, with main entry routes passing by the license space and native cities and workforce shut by. The Mission is situated within the potential Wadi Shwas Gold Belt, a area under-explored for shear zone gold, VMS copper-zinc-gold-silver and intrusion-related gold and base metallic deposits. It’s supported by a number of mineral occurrences with encouraging geological observations, and gold, silver and copper grades in historic regional- scale reconnaissance mapping, which haven’t been adopted up by trendy work.

MBK’s technical workforce has ready a complete two-year work program, with an preliminary deal with following up the earlier restricted and floor based mostly exploration for mineral occurrences of copper, gold and silver. MBK is aiming to be drill-ready throughout the subsequent six months.

Commenting on this acquisition, Metallic Financial institution’s Chair, Inés Scotland stated:

“The profitable tender for the Wadi al Junah venture in Saudi Arabia by our JV firm CMC by way of a tightly contested and extremely aggressive exploration spherical speaks to our dedication, functionality and technical experience in attaining our technique of buying potential tenure inside Saudi Arabia, which we imagine stays underexplored and extremely potential.

Wadi al Junah represents our first venture again in Saudi Arabia, a area wherein MBK’s administration workforce has in depth expertise and a confirmed observe document of success, having beforehand developed the Jabal Sayid venture. We’re well-supported by each our JV accomplice and the numerous authorities incentives supplied by the Kingdom of Saudi Arabia in seek for the subsequent Jabal Sayid. The Arabian Defend has a lot underexplored potential, and we’re able to get our preliminary part of exploration underway as shortly as potential.”

Wadi al Junah Copper-Zinc-Gold-Silver Abstract

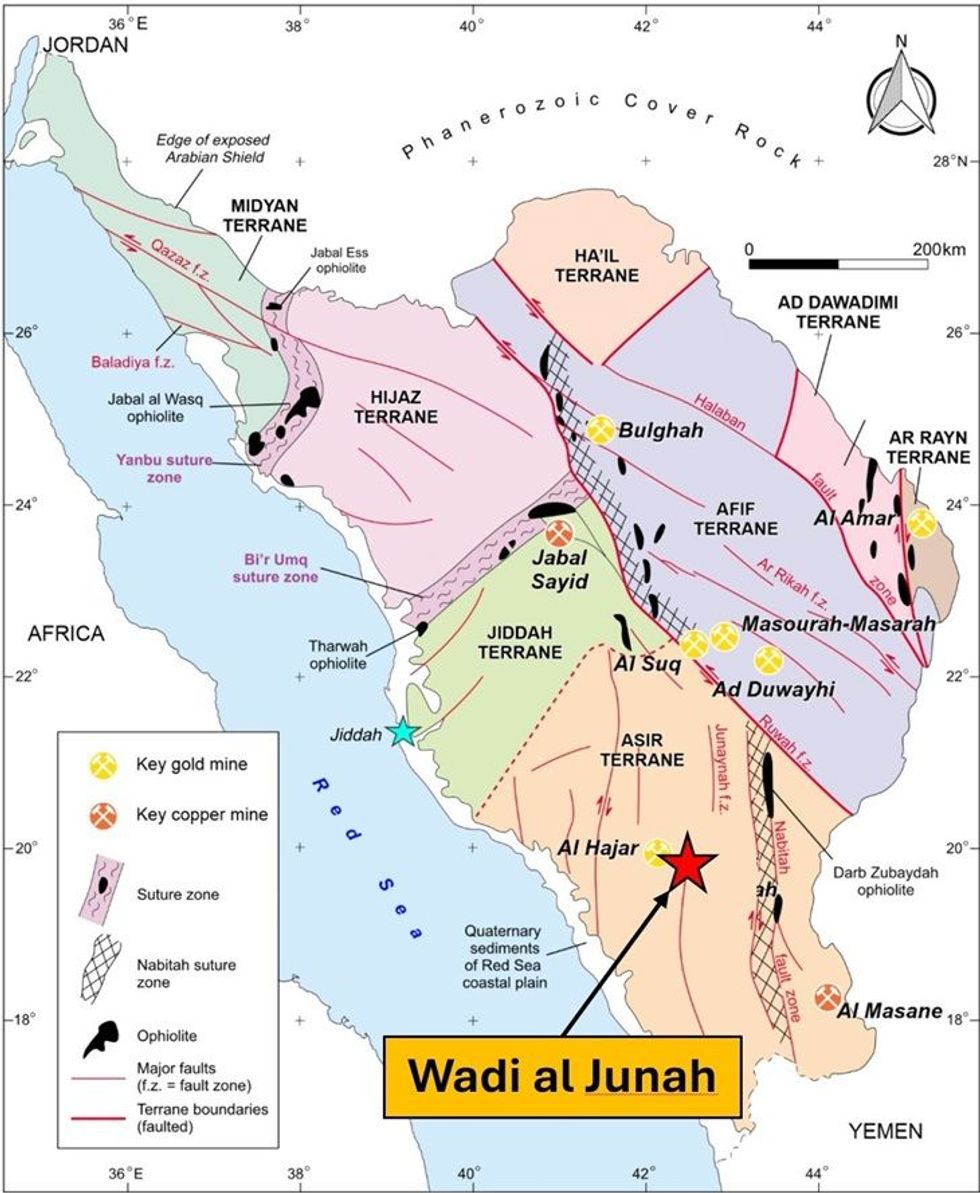

The Wadi al Junah venture space covers an space of 427sq km throughout the Asir province of the Arabian Defend, southwest Saudi Arabia (Figures 1 and a pair of). It’s roughly 375km south-east of Jeddah, 150km east-northeast of the port of Al Quinfidhad and round 35km east of the Al Hajar Au-Ag-(Cu- Zn) deposit beforehand mined by Ma’aden. It’s proximal to the main regional centre and airport of Bisha, with main entry routes passing by the license space and native cities and workforce shut by. Nearly all of the venture space is accessed by native tracks and wadi valleys in reasonable topography.

Determine 1: MBK MENA tasks displaying Wadi al Junah (Saudi Arabia) and Malaqa, Space 47 and Space 65 (Jordan).

Determine 2: Wadi al Junah location map throughout the Arabian Defend displaying main geological provinces and main Au and Cu mines (modified from KSA Ministry of Business and Minerals publication after Nehlig et al, 2002)

Determine 2: Wadi al Junah location map throughout the Arabian Defend displaying main geological provinces and main Au and Cu mines (modified from KSA Ministry of Business and Minerals publication after Nehlig et al, 2002)

Geology

Wadi al Junah is located throughout the central Asir terrane of the Archaean Arabian Defend (Determine 2) throughout the ~80km lengthy north-trending Wadi Shwas Gold Belt. The Shwas VMS belt on the western margin of the Wadi Shwas Gold Belt is host to the Al Hajar Au-Ag-Cu-Zn deposit, and quite a few different VMS base metallic and Au mineral occurrences of Proterozoic age are current within the area (Determine 3).

Three identified mineral occurrences happen within the tenement space – Haniyat (Ag-Cu-+/-Au+/-Zn), Wadi al Maytha (Ag-Cu) and Wadi Umm Rahka (Ag-Cu). Very restricted rock chip sampling as a part of regional scale mapping work within the 1960’s and 1970’s contains outcomes as much as 1.53% Cu, 0.44g/t Au and 160g/t Ag from these prospects, which have been by no means adopted up1.

Click here for the full ASX Release

This text contains content material from Metallic Financial institution Restricted, licensed for the aim of publishing on Investing Information Australia. This text doesn’t represent monetary product recommendation. It’s your duty to carry out correct due diligence earlier than appearing upon any data supplied right here. Please consult with our full disclaimer right here.