Vitalik Buterin, the co-founder of Ethereum, reportedly has over $1 million trapped within the Optimism bridge.

This revelation comes from a broader examination by Arkham, a blockchain intelligence agency, which disclosed that quite a few crypto addresses have substantial quantities lodged in bridge contracts throughout completely different networks.

Cross-Chain Challenges: Ethereum Wallets Grapple With Locked Property

A pockets deal with that acquired 50 Ethereum (ETH) from Buterin’s identifiable Ethereum Title Service (ENS) deal with vitalik.eth, has seen $1.05 motionless for the previous seven months. If genuinely linked to Buterin, these funds symbolize merely a sliver of his huge $781 million cryptocurrency holdings.

Arkham’s investigation revealed that quite a few crypto addresses have substantial sums equally locked in bridge contracts. These embody addresses linked to main entities like crypto alternate Coinbase and several other DeFi whales.

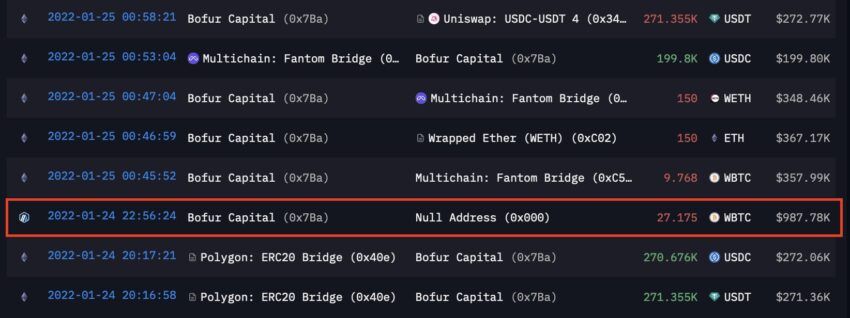

For instance, a pockets related to Bofur Capital has $1.8 million in wrapped Bitcoin (WBTC) caught within the Arbitrum bridge for 27 months.

“Bofur Capital’s 27 Bitcoin has been sitting within the Arbitrum bridge for over two years now, and is now price virtually $2 million,” Arkham mentioned.

Learn extra: How To Use Arbitrum Bridge To Bridge Ethereum Tokens

Bofur Capital’s Transaction of 27 Bitcoin. Supply: Arkham

Moreover, Thomasg.eth, the pseudonymous founder behind the decentralized air transportation answer Arrow, has $800,000 in ETH motionless in the identical bridge.

Furthermore, Coinbase tried to bridge $75,000 in USD Coin (USDC) to Ethereum six months in the past by way of the Optimism bridge. Regardless of the profitable switch, these funds haven’t been retrieved on Ethereum’s foundational layer. This example hints at both an ignored restoration course of or a deliberate pause in claiming the transferred belongings.

Cross-chain bridges like Optimism are essential in blockchain networks like Ethereum. Bridges facilitate the motion of belongings throughout distinct blockchains with no need a government, aiming to resolve interoperability points inherent in blockchain architectures.

The conditions involving Buterin and others illustrate the complexities and dangers of managing funds throughout decentralized platforms. There’s a probability that the homeowners of those wallets could have deliberately left their belongings inside these bridges. Nonetheless, the potential for these funds to be caught on account of technical points can’t be disregarded.

Learn extra: How To Use the Polygon Bridge: A Step-by-Step Information

Additionally, these bridges include important safety dangers. They’ve change into focal factors for cyber-attacks, with billions of {dollars} misplaced in recent times.

Notable safety breaches embody the $650 million Ronin bridge hack by North Korea’s Lazarus Group and the $100 million theft from the Concord Horizon Bridge, highlighting the vulnerability of those essential community junctures.