pilipphoto

In July, I wrote a bullish article on Vita Coco (NASDAQ:COCO), however flipped to a “Maintain” ranking after the corporate misplaced a serious personal labor buyer. With the corporate lately reporting earnings, let’s catch-up on the identify.

Q3 Outcomes

For Q3, COCO noticed income rise 11% to $138.1 million, up from $124.0 million a yr in the past. That simply missed analyst expectations for gross sales of $139.6 million.

Internet earnings soared to $15.2 million, or 26 cents per share, in comparison with $7.3 million, or 13 cents per share, a yr in the past. That topped the consensus by 1 cent.

Adjusted EBITDA greater than doubled from $11.8 million a yr in the past to $26.9 million.

Gross margins improved 1,440 foundation factors to 40.7%, up from 26.3% a yr in the past. On a sequential foundation, gross margins rose 410 foundation factors.

segments, Americas Vita Coco Coconut Water noticed income soar practically 9% to $89.7 million. Volumes rose practically 7%. Americas Non-public Label income, in the meantime, climbed 14% to $28.3 million, with volumes up 36%.

On the worldwide facet, Vita Coco Coconut Water gross sales jumped 7% to $11.4 million, regardless of volumes down -5%. Non-public label gross sales soared practically 160% to $6.0 million. Volumes climbed 47%.

The corporate ended the quarter with $94.9 million in money and de minimus debt.

The corporate famous that in response to Circana that it had a 5% market share within the coconut water class. It famous the class grew 19% within the U.S., whereas its U.S. retail greenback gross sales have been up 23%, displaying that it’s nonetheless taking market share.

This was a really strong quarter from COCO, with strong gross sales and quantity progress throughout classes and markets. The marketplace for coconut water continues to be sturdy, and COCO continues to take share inside that market. Worldwide personal gross sales have been significantly sturdy, boosted by new distribution with strategic retailers in Western Europe.

In the meantime, gross margin restoration continues to be a spotlight, as the corporate advantages from freight prices coming down. Ocean freight charges are actually again to extra regular pre-Covid ranges and gross margins for 2024 must be just like 2023 ranges.

Outlook

Wanting forward, the corporate guided for full-year income to develop 13-15%. That is up from an earlier outlook of 10-12% gross sales progress and authentic steerage of September 11% progress. Vita Coco Coconut Water gross sales are projected to rise within the mid-teens. It additionally now expects to keep up many of the personal label enterprise from the client it thought it misplaced, and to see expanded personal label distribution from new and present prospects.

It’s searching for gross margins to be between 35-37%, which is unchanged from its prior outlook. It initially forecast full-year gross margins of 32-34%.

Adjusted EBITDA is projected to return in at between $64-67 million. That is up from earlier steerage of $56-60 million, and authentic steerage of $52-58 million.

Discussing the sudden change in outlook of its personal label enterprise on its Q3 earnings name, Co-founder and Government Chairman Michael Kirban stated:

“I would like to supply an replace on our personal label enterprise. As we indicated throughout our second quarter earnings name, we had anticipated to stop to provide a serious buyer on personal label coconut water and personal label coconut oil, with the transition doubtlessly occurring as early because the fourth quarter of 2023. We additionally indicated that this buyer is vital for our branded merchandise, and we expressed our dedication to help a easy transition. Since our final replace, this buyer has requested that we proceed our partnership, and we now anticipate to proceed supplying a good portion of their personal label coconut water wants, a choice that we consider is reflective of their valuing our provide chain for its excellent reliability and high quality. This can be a vital change to our prior expectations for the personal label enterprise with this key buyer, and we’re excited to proceed this partnership and discover methods to additional increase it over time. As additional proof that our personal label provide chain is likely one of the greatest on the earth, all of our personal label income progress within the third quarter versus the identical interval final yr got here from accounts exterior of this main buyer, together with the advantages of latest retailer relationships across the globe.”

The return of its huge personal label buyer, which is presumably Costco (COST), is a large win for the agency. The shopper initially balked at value will increase, however apparently couldn’t discover a provider with the size of COCO to exchange them with going ahead.

It’s not usually that an organization wins a battle with the likes of a retail large like COST, however COCO held agency and was prepared to stroll away from the enterprise, which in the long run allowed it to maintain many of the enterprise on its phrases. This was an sudden and spectacular win.

Valuation

COCO trades round 22.6x the 2023 consensus EBITDA of $67.2 million and 20x the 2024 consensus of $76.0 million.

It trades at a ahead PE of practically 40x the 2023 consensus of 80 cents. Primarily based on 2024 analyst estimates of 91 cents, it trades at 23.5x.

COCO is projected to progress its income between 14% this yr, after which see it enhance practically 4% in 2024 earlier than accelerating to 11.5% in 2025.

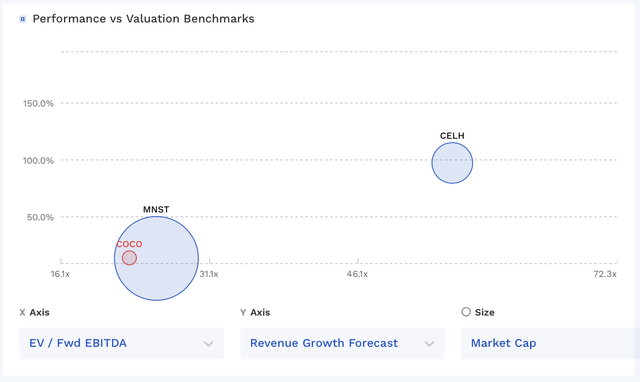

It is tough to discover a good comparability for COCO. Monster Beverage (MNST) has a barely increased income progress fee and trades at a barely increased a number of, whereas Celsius (CELH) is presently a lot quicker and trades at a giant a number of.

COCO Valuation Vs Friends (FinBox)

Conclusion

The rationale I lowered by ranking on COCO earlier was because of the lack of its main personal label buyer. Nevertheless, with that not being the case and the inventory buying and selling across the identical value, I’m going to improve the inventory again to “Purchase.”

The truth that the corporate was in a position to have a serious retailer come crawling again to it to provide the majority of its personal label coconut water providing on COCO’s phrases may be very bullish for my part. This simply reveals that COCO is the by far a very powerful participant on this house and that the obstacles to entry at scale even for personal label are fairly excessive. Shifting ahead, COCO ought to proceed to develop with the general coconut water market, in addition to with newer product improvements and elevated distribution. Expectations for 2024 additionally don’t look that tough given how the general market has been rising, and I would anticipate an analogous beat and lift cadence subsequent yr for the corporate, just like this yr.

The most important dangers for the inventory could be any total slowdown out there, maybe as a consequence of a weaker client, in addition to if ocean freight charges went up once more.