A key query mark for the U.S. and international financial system is round when the Federal Reserve will lower rates of interest in 2024 and by how a lot.

After a speedy set of fee hikes all through 2022, the U.S. Federal Reserve now faces the problem of timing its easing of financial coverage to make sure a comfortable touchdown for the financial system.

Visual Capitalist’s Niccolo Conte created this visualization (from their 2024 Global Forecast Series) utilizing information from the Federal Reserve to chart previous rate of interest lower cycles and visualizes forecasts by high banks and establishments on once they count on the primary fee lower of 2024 and the variety of cuts they count on by finish of 12 months.

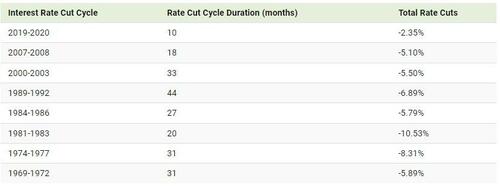

Wanting Again at Previous Curiosity Price Cuts Cycles

Whereas rate of interest cycles are an financial balancing act which have to be rigorously managed, fee hikes and cuts of the previous have sometimes been steep and swift.

Wanting again at previous rate of interest cuts for historic context, we are able to see how rapidly these easing cycles performed out, particularly these within the Seventies and Nineteen Eighties.

Price cuts sometimes start as soon as the Federal Reserve has affirmation that the financial system has slowed down and inflationary pressures have subsided. Almost each rate of interest chopping cycle has seen the financial system enter a recession proper earlier than or after fee cuts have began.

“There may be all the time a delay between when central banks elevate rates of interest and when the financial system feels the consequences.”

– Simon Rabinovitch, The Economist

Whereas the recessions happen across the time charges are lower, they’re often a delayed impact from the tighter monetary situations attributable to fee hikes, with cuts bringing looser and extra accommodative monetary situations for the financial system down the road.

Institutional Forecasts for Curiosity Price Cuts in 2024

After a few of the most rapid rate hikes in historical past kicked off this newest rate of interest cycle in 2022, market members and banks are leaning in direction of equally speedy set of fee cuts in 2024.

Most establishments, together with J.P. Morgan, Deutsche Financial institution, and Morgan Stanley, expect the Fed’s first fee lower to happen on the mid-point of the 12 months in June. There’s a group of outliers which incorporates UBS, Financial institution of America, and Goldman Sachs, which can be anticipating the primary fee lower as early as March.

Relating to the entire quantity of rate of interest cuts we’ll see in 2024, the vast majority of establishments are forecasting round 100 to 125 foundation factors (bps) in fee cuts, which might carry the Federal Funds Price to round 4-4.25%.

Price Cuts or Not, is a Recession Inevitable?

Whereas practically each rate of interest cycle of the previous has skilled a recession across the time of fee cuts, Federal Reserve Chair Jerome Powell is optimistic that this time could also be completely different.

“I’ve all the time felt, for the reason that starting, that there was a chance, due to the bizarre state of affairs, that the financial system might cool off in a method that enabled inflation to come back down with out the form of giant job losses which have typically been related to excessive inflation and tightening cycles.

Thus far, that’s what we’re seeing.”

With FOMC members themselves projecting extra conservative fee cuts in 2024 with a forecasted median year-end fee of 4.6%, time will inform whether or not extra conservative or agressive fee cuts this 12 months will handle to maintain the financial system out of a recession.

* * *

This visible is from Visible Capitalist’s 2024 Global Forecast Series Report:

Get full entry to the sequence, which compiles insights from 700+ skilled predictions for what is going to occur in 2024, by changing into a VC+ member right now.

Loading…