Sezeryadigar

The purchase thesis

VICI Properties (NYSE:VICI) is at the moment buying and selling at a price inventory a number of however is basically a development firm. A gentle money flowing base and glorious stability sheet present the inspiration from which to pursue accretive acquisitions. It has 3 key benefits:

- Superior natural income development fee

- Lowered working frictions leading to greater margins

- Flexibility of technique and capital availability to take advantage of mispricing

Allow us to start with a have a look at VICI’s value motion and valuation.

Performing however staying low cost

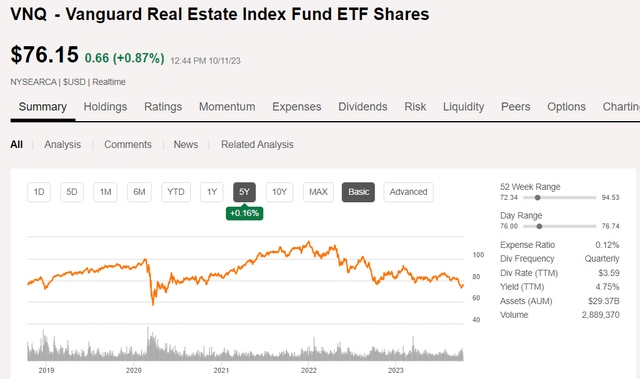

VICI has carried out nicely for buyers with a 5-year whole return of 84%

S&P World Market Intelligence

Notice that that is in opposition to a REIT index that has had 5 years of dormancy as measured by the flat Vanguard Actual Property ETF (VNQ).

SA

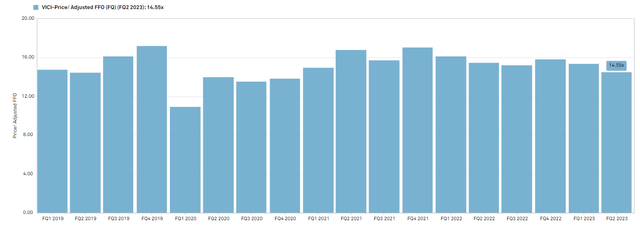

As a value-focused investor, I don’t normally like to purchase issues which are up a lot, however in VICI’s case, it has really gotten cheaper.

As the worth rose, the AFFO/share rose much more leading to a a number of that’s decrease at this time than it was 5 years in the past.

S&P World Market Intelligence

If we have a look at ahead AFFO which consensus spots at $2.23 for 2024, VICI is buying and selling at 13X AFFO. That may be a worth a number of and I feel VICI deserves a development a number of for the explanations detailed under.

Superior natural income development

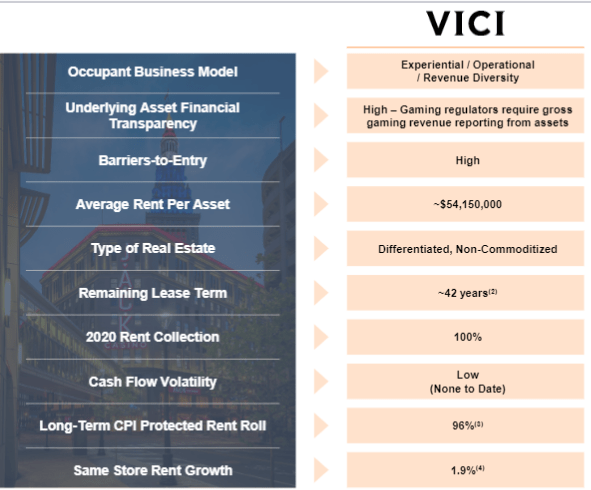

I’ll preserve this part transient as a result of whereas you will need to the thesis, this info can be broadly recognized. Mainly, VICI simply has good escalators with 96% of them having CPI inflation-based rollups.

VICI

Whereas many triple internet REITs have their escalators considerably offset by the bills of re-leasing as leases roll over, VICI has extraordinarily lengthy remaining lease phrases so the incremental income straight interprets to incremental AFFO.

Thus, the income development represents true natural development. This idea is closely featured in all of VICI’s displays and different investor communications so I feel the market is basically conscious of this benefit.

The facet of VICI’s enterprise that I feel shouldn’t be being appreciated by the market is the numerous value financial savings related to their minimal friction.

Low friction operations

Friction in economics or finance is sort of much like friction in physics. Simply as a shifting object loses kinetic vitality to friction because it slides alongside a floor, some portion of income will get eaten up by transactional and operational frictions.

Any time a number of entities are concerned it creates friction. Contemplate the idea of property upkeep in a 1 entity system the place the proprietor is the tenant versus a 2 entity system through which the owner and tenant are separate.

The 1 entity system

The property proprietor is economically inclined to carry out upkeep capex in such a means as to maximise the sum of residual worth of the property much less the prices incurred.

The two entity system

The property proprietor needs the above, however the tenant needs solely the capex that straight impacts its operations throughout the window through which the tenant will occupy the property.

There’s a misalignment of incentives which creates friction. In triple internet lease contracts, the tenants will usually be liable for some stage of upkeep however inevitably there shall be some quantity of deferred upkeep which ultimately falls on the owner when it comes time to re-tenant the property.

Band-aid fixes in the course of the lease time period lead to extra general capex than if the proper restore had been made within the first place.

Such frictions are simply the price of doing enterprise. Triple internet REITs have managed to be fairly profitable over lengthy intervals of time regardless of the frictions.

VICI is on the following stage. It has structured its enterprise in such a means as to attenuate friction. There’s an computerized alignment of incentives that comes from tenants understanding they’ll occupy the property for 50 or extra years.

Switching prices are insurmountable for casinos. In flats, somebody with out a lot stuff can transfer each couple years to catch no matter move-in reductions can be found, however in casinos, the playing license is tied to the property.

Mandalay Bay can not simply transfer to a brand new location. Its operations are one with the constructing. The tenant will seemingly be there so long as they continue to be in enterprise. This aligns the tenant’s capex incentives with these of the owner. Each naturally need the property to be lovely and useful and they also will capex accordingly.

VICI’s leasing contracts have a number of the greatest language I’ve seen amongst triple internet REITs because the tenants are obligated to place a sure proportion of revenues again into the constructing. This capex finances is on prime of the contracted lease.

By the extraordinarily lengthy lease phrases, excessive switching prices for the tenant, and the lease contracts, VICI has taken its operational frictions near 0.

Transactional frictions are additionally minimized at VICI. They don’t should be biking out and in of properties each decade, which incurs underwriting charges on the way in which in and the way in which out. They purchase the property as soon as and it might probably cashflow for the following 50 years beneath the preliminary contract and probably nicely past that.

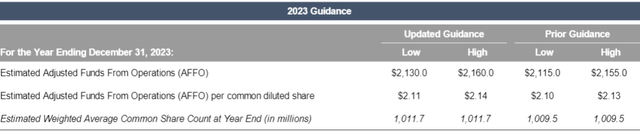

With leases this lengthy it’s in all probability sensible to not use straight-line GAAP accounting.

VICI emphasizes its AFFO which makes use of money rents, not the common lease over the lengthy lease time period. The common lease is considerably greater which is why VICI’s FFO is way greater than its AFFO, however VICI offers its steerage in AFFO in order to cleanly current at this time’s money circulation.

VICI

Present rents absolutely cowl VICI’s dividend.

VICI additionally avoids organizational frictions by minimizing using Joint Ventures or different buildings that create extra complexity with out offering incremental worth. JVs have grow to be extraordinarily standard amongst REITs which I feel goes to show to be a mistake over the long term. I used to be very enthused to listen to Ed Pitoniak (VICI’s CEO) talk about JVs on the convention name within the following method:

John G. DeCree

Honest sufficient. And possibly slightly simpler of a query. Going simply again to the Bellagio, potential alternative for instance. Do you — how do you contemplate proudly owning entire or a part of an asset? I feel there was some dialogue that possibly it might solely be a partial sale or a minority stake. Is that — would that be a consideration or how that issue into a choice for funding from VICI, whether or not it is the Bellagio or any asset that you just make sooner or later?

Edward Baltazar Pitoniak

Effectively, John, one of many strategic motivators for doing the deal we did again in late November, early December, was to consolidate what had been a three way partnership with MGM Grand/Mandalay Bay. So usually talking, whereas we don’t rule out joint ventures, usually talking, we’re clearly going to favor full possession of our property, each in gaming and non-gaming. Once more, we’re not completely dogmatic, however it’s our choice and I feel there’s significance and that means in the truth that our most up-to-date deal in Las Vegas was the consolidation of what had been a three way partnership, not the creation of a brand new three way partnership.

All of those friction-reducing enterprise practices sum to a decrease value construction. This implies an even bigger pie for each the tenant and the owner and from a valuation standpoint, it means extra of the lease flows by to AFFO. VICI’s G&A in 2Q23 was simply 2% of income, which is way decrease than most of its friends.

Capital availability to take advantage of mispricing

The above natural development features as an ideal base from which to develop externally. With this core set of steady property that require minimal capital funding whereas producing substantial money circulation, VICI is able of extra liquidity.

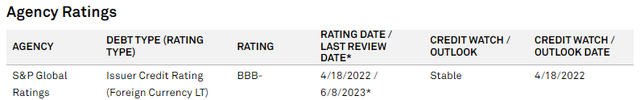

VICI additionally has entry to exterior capital given its measurement and credit standing.

S&P World Market Intelligence

It may and sure will make investments many billions in acquisitions over the approaching years.

The rate of interest alternative

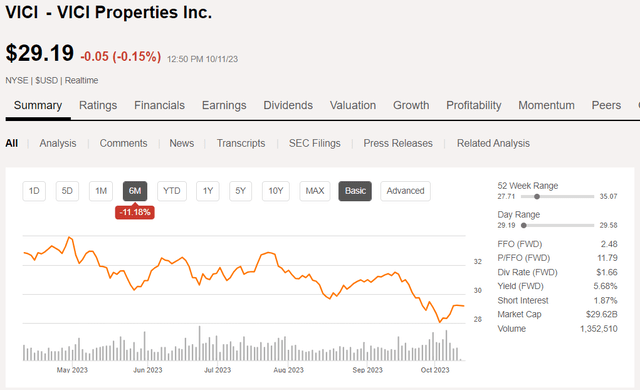

As rates of interest rose violently over the previous 6 months, triple internet REITs obtained clobbered. VICI fell together with its class.

SA

I final wrote about VICI on March sixth, through which I downgraded it to a maintain on valuation. The selloff since that point has as soon as once more made it opportunistically low cost which is why I’m returning to a strongly bullish stance.

Moreover, VICI has gained a brand new development angle which we’ll element under.

Rising rates of interest are regarded as the loss of life knell of triple internet REITs however for VICI they’re really a possibility. I’ll clarify extra deeply under why it is a chance, however for starters, you may see under that VICI grew AFFO per share by the whole rising fee surroundings and is predicted to proceed rising AFFO/share.

S&P World Market Intelligence

There are 2 massive shifting elements when rates of interest rise.

- Curiosity expense will increase

- Cap charges rise

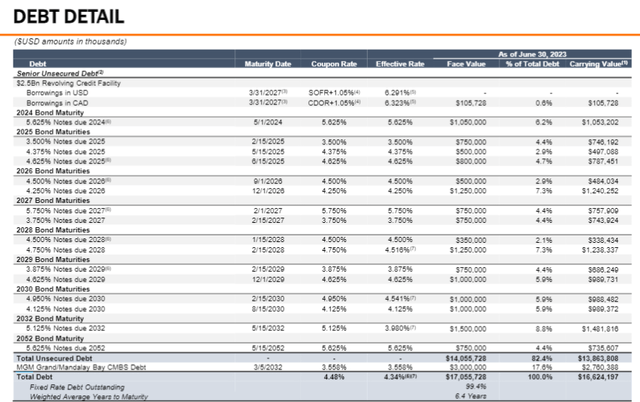

VICI’s curiosity expense doesn’t appear like it is going to rise all that a lot. They’re 99% fastened fee debt with a weighted common remaining time period of 6.4 years.

Supplemental

Essentially the most notable near-term maturity is the 5.625% notes due 2024. It’s simply over $1B however that is amongst VICI’s most costly debt so I don’t suppose it might be all that rather more costly at this time. Given VICI’s measurement and credit standing, I believe they may refinance at 6.5% or much less. That will be round $10 million in incremental curiosity expense or a few penny a share.

So the expense aspect seems fairly manageable and I feel will probably be greater than offset by the elevated acquisition alternative.

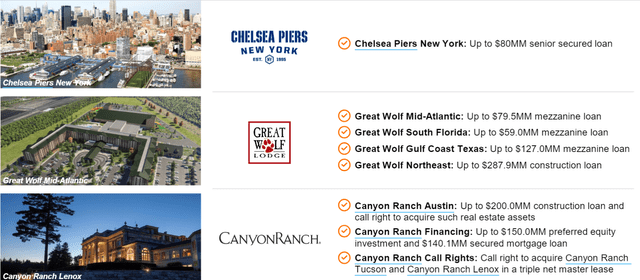

There’s a massive alternative in being well-capitalized in a world the place others are usually not. VICI has began hinting at plans to amass or in any other case accretively benefit from misery in experiential actual property as present loans come due. Ed Pitoniak mentioned the potential alternative on the earnings name:

“greater than $37 billion of resort and lodge CMBS financing will come due from 2024 by 2028. And I ought to level out that is solely a fraction of the general mortgage financing on U.S. inns and resorts throughout this era”

The implication is that by their Canyon Ranch technique, they will scoop issues up (probably at distressed costs) and convert to this enterprise mannequin.

A key distinction right here is that experiential properties like inns and resorts are usually not struggling operationally. Demand is powerful and continues to look sturdy going ahead. The issues many operators are operating into are on the financing aspect. Thus, it isn’t a plan of buying distressed properties, however relatively extremely worthwhile properties which are distressed on account of financing.

VICI can remove the financing misery and get an ideal deal within the course of. They’ve moved relatively considerably into the experiential area.

VICI

Simply as VICI obtained into casinos at very excessive cap charges earlier than they have been a scorching actual property sector, they could quickly have the chance to finance or personal a wide range of experiential actual property at IRRs nicely above going market charges.

VICI has a historical past of opportunism, and it now has the monetary energy to capitalize on no matter alternatives it sees. I’m positive a few of these shall be misses together with the hits, however the important thing right here is that they’re persistently getting in at greater returns than are in any other case accessible.

Win/win of loans

A REIT lending to an actual property operator is sort of totally different than a financial institution doing it as a result of the REIT needs the true property. When a financial institution receives actual property by foreclosures they normally find yourself promoting it at fireplace sale costs such because the foreclosed properties within the monetary disaster. Thus, foreclosures is a destructive for the financial institution usually.

It’s a totally different state of affairs for a REIT. These loans are collateralized by actual property that VICI needs to personal. If the borrower defaults, VICI functionally purchases the property on the discounted fee of the loan-to-value ratio. VICI has explicitly said that they solely present loans hooked up to actual property they need to personal. I don’t anticipate these counterparties defaulting, however the probably favorable features of foreclosures considerably cut back the danger of the loans.

World pursuits

A good portion of U.S. casinos at the moment are owned by massive monetary establishments or REITs, however the possession is probably extra fragmented in different international locations. VICI has moved into Canada with some accretive on line casino acquisitions and is actively pursuing different international locations as nicely.

Canadian casinos strike me as nicely positioned because the nation appears to have an excellent greater propensity for gaming than the U.S. with better demand per capita.

General, VICI has a relatively massive pipeline of potential offers with returns on invested capital (ROIC) that considerably exceed their weighted common value of capital (WACC).

Progress at a price a number of

VICI is buying and selling at 13X ahead AFFO which is cheaper than the common REIT and less expensive than the S&P. I discover this a number of to be considerably too low as VICI has attributes that may usually be related to firms that commerce at premium multiples.

- Sturdy development outlook from each natural and exterior

- Trophy caliber properties

- Funding grade stability sheet

- Massive market cap

- Observe report of dividend development and shareholder returns

I feel it ought to commerce at 16X ahead AFFO or about $35.50. That represents simply over 20% upside from at this time’s value. This isn’t the biggest upside accessible at this time within the beaten-up REIT sector, however it’s fairly a big upside relative to the danger stage of such a longtime firm. That stated, there are all the time dangers to funding.

Dangers to thesis

Whereas VICI is diversifying considerably, the overwhelming majority of its revenues nonetheless come from casinos which implies that something that threatens the business additionally threatens VICI.

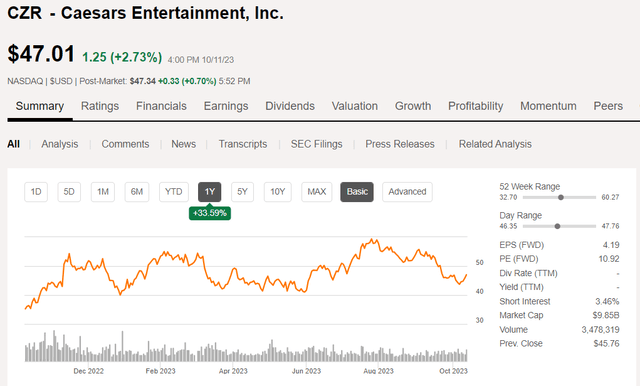

Presently the dangers to casinos seem relatively low. VICI’s tenants are at the moment in nice form with ample EBITDAR protection of lease. Its largest tenant, Caesars (CZR) is buying and selling up properly with sturdy earnings.

SA

Nevertheless, the at the moment sturdy state doesn’t imply the long run is with out danger.

Playing is a vice. Some would argue that it’s dangerous to the human situation. On the present second, society doesn’t appear to have any kind of urge for food to ban or restrict gaming, however issues can change. My crystal ball shouldn’t be adequate to estimate the prospect of such an prevalence, however in my eyes that’s the largest danger to be careful for – a societal or cultural disapprobation of playing at massive.

The Backside Line

VICI presently represents the most effective type of worth inventory; one which is buying and selling at a price a number of however doesn’t belong there. Market volatility creates alternative and it seems VICI has fallen by the cracks. We’re scooping this up for its mixture of worth, yield, and development.

Editor’s Notice: This text was submitted as a part of Searching for Alpha’s Finest Worth Thought funding competitors, which runs by October 25. With money prizes, this competitors — open to all contributors — is one you do not need to miss. If you’re curious about changing into a contributor and participating within the competitors, click on right here to seek out out extra and submit your article at this time!