Jan-Schneckenhaus

Funding Thesis

I needed to check out VeriSign (NASDAQ:VRSN), which is in control of the 2 top-level domains on the web: .com and .web, to see how its financials have appeared over the past whereas and to see if this may be a great time to take a position. Sadly, even with excessive margins enterprise, the corporate’s lack of top-line progress, coupled with subpar financials, it’s not a great time to start out a place at this stage, subsequently I assign the corporate a maintain ranking till I see enhancements throughout the board.

Briefly on the Firm

VeriSign offers area title registry companies, particularly the web sites that finish with .com and .web, that are the 2 hottest top-level domains globally. The corporate additionally manages .cc, .gov, and .edu.

The corporate additionally helps fight web crime by preventing towards area title abuse and spam. Moreover, the corporate additionally points digital certificates, that assist confirm the web site’s id and make sure that the connection to it’s safe, defending you from hackers and faux web sites.

So, as you possibly can think about the corporate did pretty effectively through the early ’00s up till the dotcom bubble burst, because the irrational exuberance dissipated, which affected the corporate’s financials fairly dramatically because it needed to make quite a lot of write-downs on acquisitions. These totaled into tens of billions of {dollars}, which the corporate remains to be recovering from in the present day.

Nonetheless, the corporate remained a key participant within the business that simply continued to thrive over the following couple of many years and it’s not going to go away any time quickly, as increasingly more of the world is related to the web.

Financials

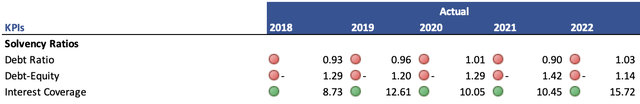

As of Q3 ’23, the corporate had round $943m in money and short-term investments, towards round $1.8B in long-term debt. That’s numerous debt, nevertheless, I do not suppose it is a problem for the corporate, given the truth that it has quite a lot of liquidity. Nevertheless, the quantity of debt is a bit regarding once we have a look at the solvency metrics that I deem necessary to evaluate the corporate’s danger with leverage. The debt-to-assets ratio has been a bit on the higher finish, and over what I feel is suitable. A ratio lower than 0.6 is the higher restrict of acceptance and within the final 5 years, the corporate’s ratio has been round 1 to 1, which is not nice. The destructive debt-to-equity ratio can be not excellent, as a result of, over the past decade or extra, the corporate’s shareholder fairness has been destructive, which I’ll cowl later. Lastly, the saving grace of solvency is the corporate’s skill to fulfill its debt obligations, and doubtless essentially the most weight I placed on this metric than the opposite two, which is the curiosity protection ratio. The corporate’s been very worthwhile and is making first rate earnings from operations, whereas its curiosity bills remained the identical. As of the newest quarter, VRSN can cowl its curiosity expense on debt 13 occasions with its working earnings. For reference, many analysts agree {that a} protection ratio of two is ample. So, it is a bit bit overleveraged, which is a bit dangerous, however it could simply deal with the curiosity bills, subsequently, I’ll nonetheless apply a margin of security within the later part of the article. I might prefer to see the corporate paying down debt, because the quantity stood nonetheless over the past 7 years.

Solvency Ratios (Creator)

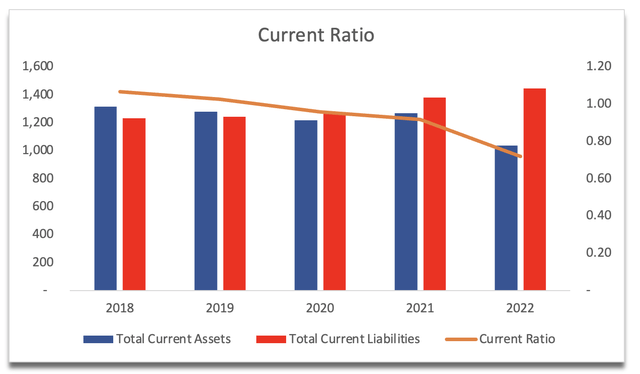

The corporate’s present ratio just isn’t the best both, nevertheless, a lot of the firm’s present liabilities are made up of deferred revenues, which is unrealized earnings as a result of the corporate hasn’t offered the total 12 months service, so I am not too apprehensive about both.

Present Ratio (Creator)

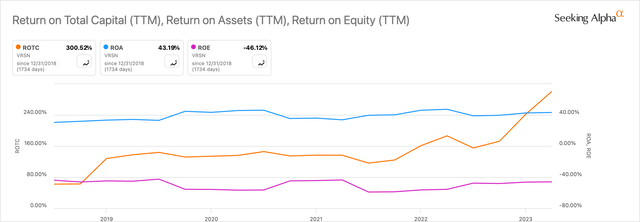

Now let’s take a look at some effectivity and profitability metrics. ROA has been excellent over time, which implies that the administration is using the corporate’s property very effectively. ROE then again has been struggling for a very long time, because of the firm’s destructive shareholder fairness, which was brought on by the huge destructive retained earnings over time. The advantage of that’s these retained earnings have been coming down over time as a result of the corporate has been worthwhile, which makes the destructive shareholder fairness not as dangerous as it might look on the books. If the corporate can proceed lowering the destructive retained earnings, I might see ROE changing into constructive within the subsequent couple of years. What can be very spectacular is the corporate’s return on complete capital or ROTC, which is artificially inflated because of the firm’s destructive shareholder fairness. I’d anticipate ROTC to come back down significantly over the following couple of years as soon as shareholder fairness turns constructive. So, it seems like the corporate could be very environment friendly at using capital and its property.

Profitability and Effectivity (In search of Alpha)

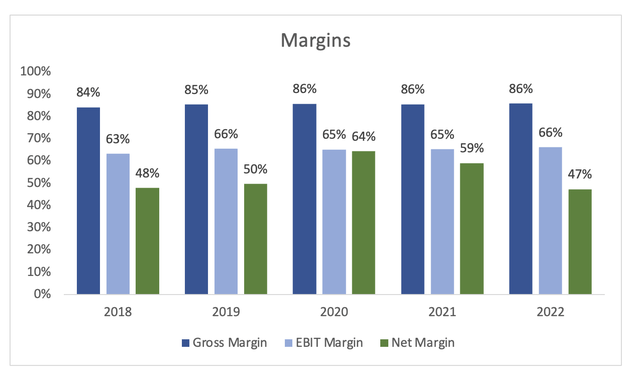

Proceed on effectivity and profitability, the corporate’s margins are very spectacular, though have been trending down in FY22 and barely recovered as far as of Q3 ’23 to round 49% when it comes to web margins. I do not suppose there’s a lot in the way in which of bettering such extraordinary margins. It could be good to see the numbers attained in FY20, however that was throughout COVID-19, so I do not suppose it is going to be very real looking.

Margins (Creator)

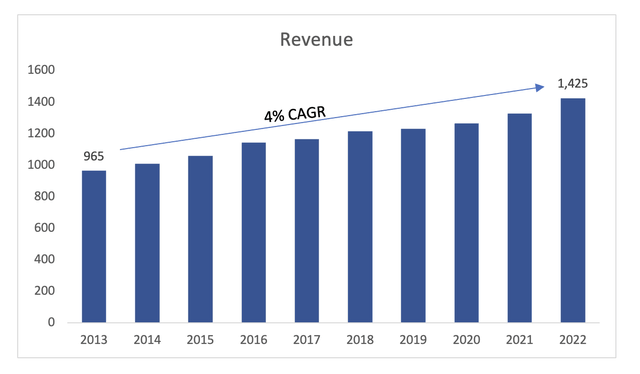

I often search for margin growth to drive the corporate’s worth, nevertheless, I feel what would wish to occur for the corporate to drive its worth and share value up, is it could get some catalysts to raise its top-line progress, which has been abysmal, round 4% CAGR over the past decade.

Income Progress (Creator)

Total, the corporate has been chugging alongside simply advantageous in my view. The corporate’s backside line has not grown as a lot as I’d have appreciated, and the corporate just isn’t prioritizing paying down the excellent debt and isn’t rising notably quick, which begs the query of what’s the firm doing to excel. I like that the corporate is bettering its retained destructive earnings, however it’s going to take some time earlier than we see a distinction. Nothing thrilling in regards to the firm’s financials, which implies I should assign a little bit of a margin of security to my calculations.

Valuation

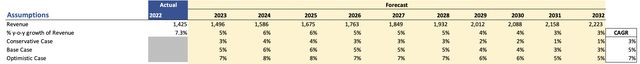

It is onerous to be too optimistic in the case of income progress, nevertheless, I shall be a bit extra forgiving this time round. I often prefer to go together with decrease progress than the corporate’s historic CAGR, however for VRSN, I made a decision to offer a bit little bit of a kick of round 1% further for the bottom case. To cowl all of my bases, I additionally included a conservative and an optimistic case. Under are these assumptions and their respective CAGRs.

Income Assumptions (Creator)

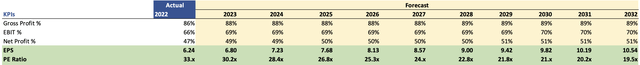

By way of margins and EPS, I went with a barely extra conservative outlook than what the analysts are estimating, simply to offer myself a extra margin of security. Under are these assumptions.

Margins and EPS (Creator)

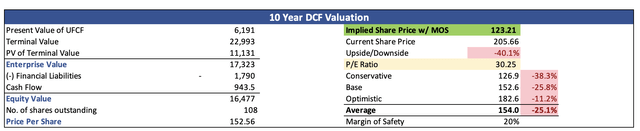

Moreover, I made a decision to go together with the corporate’s WACC of round 7.5% as my low cost fee for the DCF, coupled with a 2.5% terminal progress fee. I often go together with one thing greater for my low cost fee to get much more MoS, nevertheless, the corporate appears to be very secure, so I made a decision to not. Nevertheless, on prime of those assumptions, I added a 20% further margin of security, because of the firm’s lack of enhancements financially and the dearth of progress catalysts. This manner I will even get some extra room for error. With that stated, the corporate’s intrinsic worth, and what I’d be keen to pay for it’s round $123 a share, which implies the corporate is buying and selling at a heavy premium to its truthful worth.

Intrinsic Worth (Creator)

Closing Feedback

I feel such a excessive P/E ratio that the corporate calls for proper now could be too excessive for an organization that has no income catalysts to raise its progress. I typically do say that I’d be keen to pay a premium to personal corporations which have excessive ROIC or ROTC, nevertheless, I do not suppose the corporate is price that rather more than what my PT suggests. Perhaps at $150 a share, I’d begin to take into account the corporate to be nearer to funding, however proper now, it’s nowhere close to a great time to commit some capital in the direction of it. Due to this fact, I’m assigning the corporate a maintain ranking, till it could enhance its earnings or enhance its top-line progress considerably to assist such a excessive P/E.