JuSun

At a Look

Veracyte’s (NASDAQ:VCYT) Q3 2023 efficiency illuminates an organization at a pivotal juncture within the genomic diagnostics enviornment. The financials reveal a strong 19% YOY income progress, anchored by a big enhance in testing income. Medical implications are profound, particularly contemplating the 23% progress in take a look at quantity, a metric instantly tied to market demand and scientific adoption. Monetary stability is underscored by a powerful money place and a optimistic operational money stream, which helps strategic expansions just like the Illumina (ILMN) collaboration. This partnership, essential in increasing Veracyte’s market attain, exemplifies the corporate’s strategic agility. Nevertheless, challenges loom within the type of regulatory uncertainties and the necessity for continued adoption by healthcare professionals. Whereas Veracyte exhibits potential for sustained progress, pushed by innovation and strategic partnerships, traders ought to keep attuned to the complicated interaction of scientific adoption and market dynamics that can form the corporate’s trajectory.

Q3 Earnings

To start my evaluation, taking a look at Veracyte’s most up-to-date earnings report, the third quarter of 2023 exhibits a big YOY income progress. Complete income climbed to $90.1M, up 19% from $75.6M in 2022, pushed by a 27% enhance in testing income ($82.0M) and a 21% rise in product income ($4.0M), regardless of a 47% decline in biopharmaceutical and different income ($4.1M). Working bills escalated to $121.8M, primarily as a result of a $34.9M impairment cost. Consequently, the online loss widened to $29.6M from $8.7M in 2022. Share depend modestly elevated to 72.8M from 71.7M, indicating restricted dilution. Wanting forward, the corporate raised its 2023 income steering to $352M-$354M, anticipating a 19% YOY progress. This optimistic outlook, mixed with the present financials, presents an image of strong income progress balanced towards rising bills and a manageable enhance in share dilution.

Monetary Well being

Turning to Veracyte’s balance sheet, their present belongings embody money and money equivalents of $202.5M, with no short-term investments reported as of September 30, 2023. The full liquid belongings quantity to $202.5M. When evaluating present belongings ($271.2M) to present liabilities ($57.3M), the present ratio is roughly 4.7, indicating a powerful short-term monetary place. Veracyte’s whole liabilities stand at $70.9M, which, when juxtaposed with their whole belongings of $1.125B, displays sturdy solvency.

Over the past 9 months, Veracyte’s internet money supplied by working actions is $28.7M, signaling a optimistic working money stream.

Given the optimistic working money stream and substantial present ratio, the probability of Veracyte requiring further financing throughout the subsequent twelve months appears low. Nevertheless, you will need to be aware that these values and estimates are based mostly on previous knowledge and is probably not relevant to future efficiency, particularly contemplating the dynamic nature of the biotechnology sector.

Market Sentiment

In accordance with Looking for Alpha knowledge, Veracyte displays a posh monetary and operational panorama. Its market capitalization stands at $1.90 billion, suggesting average market confidence given its progress trajectory within the aggressive genomic diagnostics discipline. Income projections for 2023 are round $352 million, reflecting a year-over-year enhance of almost 19%. This upward pattern in income, together with strategic partnerships and expansions, just like the Illumina settlement, signifies sturdy progress prospects.

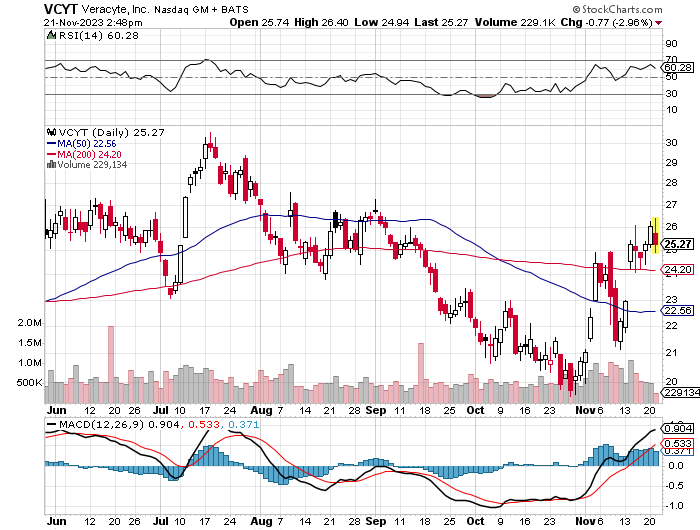

Inventory momentum evaluation reveals a blended image. In comparison with SPY, VCYT’s efficiency over numerous timeframes (3M: +5.04%, 6M: +6.77%, 1Y: +0.23%) has been uneven, suggesting potential volatility or market uncertainty particular to Veracyte’s sector or operations.

StockCharts.com

Brief curiosity in VCYT is noteworthy at 4.49%, with 3.26 million shares quick, which might be seen as a average stage of market skepticism or speculative curiosity towards the inventory. This stage of quick curiosity warrants consideration because it might result in elevated volatility or worth swings based mostly on company-specific information or sector tendencies.

Institutional ownership dynamics are telling, with new positions amounting to 1,078,272 shares and sold-out positions at 1,164,199 shares. Key establishments like ARK Funding, Wellington, Vanguard, and BlackRock point out a mixture of slight reductions and modest will increase of their holdings, reflecting a cautious but stance from main institutional gamers.

Insider trades over the previous three and twelve months present a internet exercise of +41,128 and -148,637 respectively, indicating a current uptick in insider confidence, though the yearly pattern suggests a extra cautious or profit-taking method. This insider exercise, whereas not conclusively indicative, gives perception into inside views on the corporate’s future.

Veracyte’s Balancing Act: Innovation and Market Dynamics

Veracyte has been making notable strides within the aggressive genomic diagnostics panorama, as evidenced by their sturdy Q3 efficiency. The corporate reported a 19% enhance in whole income to $90.1 million and a 23% progress in take a look at quantity. These figures mirror not solely a powerful market demand for his or her merchandise but in addition the effectiveness of their strategic initiatives, similar to increasing their diagnostic portfolio and specializing in R&D. The shows at medical conferences, together with the ASTRO annual assembly, and the publication of research findings in JCO Precision Oncology, underscore their dedication to advancing the sphere via each tutorial and scientific channels.

Financially, Veracyte’s era of $14.2 million from operations and a money reserve of $202.5 million as of Q3 point out a strong basis to assist ongoing operations and strategic expansions, such because the multi-year in vitro diagnostic settlement with Illumina. This collaboration is especially strategic, mixing competitors and cooperation to reinforce the worldwide availability of Veracyte’s exams, thereby bolstering their worldwide market presence.

The aggressive panorama consists of gamers like Cofactor Genomics, Numares, Qualisure, and Illumina. Veracyte’s relationship with Illumina, evolving from aggressive to collaborative, displays a nuanced method to sustaining a aggressive edge whereas leveraging {industry} partnerships for mutual profit.

Nevertheless, Veracyte faces important industry-specific challenges. The regulatory and reimbursement environment is a continuing variable; any shifts might impression the corporate’s market entry and profitability. Moreover, the success of Veracyte’s exams hinges on their acceptance and adoption by physicians, requiring ongoing efforts in schooling and relationship-building.

The character of genomic testing itself presents inherent dangers. The accuracy of exams just like the Decipher Prostate Genomic Classifier relies upon closely on pattern high quality. Misrepresentations in samples might result in inaccurate remedy choices, a threat extending throughout Veracyte’s product vary. This highlights a important facet of genomic diagnostics: the stability between technological development and the complexity of organic methods. Furthermore, the “routine use” of exams like Decipher, amongst others, for “threat stratification or scientific decision-making” just isn’t advisable by the American Urological Affiliation as of their 2022 guideline. Thus, whereas Veracyte’s improvements provide substantial developments in most cancers prognosis and remedy, additionally they convey to mild the intricate challenges concerning the utilization and interpretation of genomic knowledge throughout the nuanced contexts of particular person cancers.

In essence, Veracyte’s Q3 efficiency and strategic undertakings exemplify a strong method to navigating a posh, aggressive market. Their monetary well being, emphasis on innovation, and strategic partnerships place them nicely for continued progress. But, the corporate should stay vigilant in addressing the regulatory, operational, and scientific challenges inherent within the genomic diagnostics discipline. Balancing innovation with the practicalities of scientific software and market dynamics will probably be key to their sustained success and management on this evolving {industry}.

My Evaluation & Suggestion

In conclusion, Veracyte’s current monetary efficiency, highlighted by a 19% YOY income enhance and sturdy operational money stream, demonstrates important progress potential within the genomic diagnostics sector. The corporate’s strategic collaboration with Illumina and the enlargement of its diagnostic portfolio are commendable steps in direction of consolidating its market place. Nevertheless, traders ought to stay cautious given the aggressive panorama and the inherent volatility of the biotechnology sector.

Over the approaching weeks and months, traders ought to monitor a number of key points. Firstly, the evolving regulatory surroundings and reimbursement insurance policies might considerably impression Veracyte’s market entry and profitability. Secondly, the adoption price of Veracyte’s exams by healthcare professionals is essential, as it can dictate income sustainability. Thirdly, regulate the corporate’s R&D progress and any strategic partnerships or acquisitions that would improve their aggressive edge.

To mitigate dangers, traders would possibly think about a diversified funding method, balancing holdings in Veracyte with different healthcare and expertise shares to unfold sector-specific dangers. Moreover, staying up to date on {industry} tendencies and regulatory adjustments will probably be important for well timed decision-making.

Given the present panorama, I assign Veracyte a confidence rating of 45/100, reflecting a ‘Maintain’ funding suggestion, though leaning barely bearish. This rating is predicated on the corporate’s sturdy monetary well being and progress prospects, tempered by the challenges and uncertainties of the genomic diagnostics market. Buyers ought to look ahead to shifts in market dynamics, regulatory adjustments, and inside firm developments to reassess this place as needed.