Welcome to FT Asset Administration, our weekly publication on the movers and shakers behind a multitrillion-dollar world business. This text is an on-site model of the publication. Sign up here to get it despatched straight to your inbox each Monday.

Does the format, content material and tone give you the results you want? Let me know: harriet.agnew@ft.com

One scoop to start out: CVC is getting ready to announce its intention to drift in Amsterdam as quickly as this week in a mood-defying transfer by Europe’s largest personal fairness group.

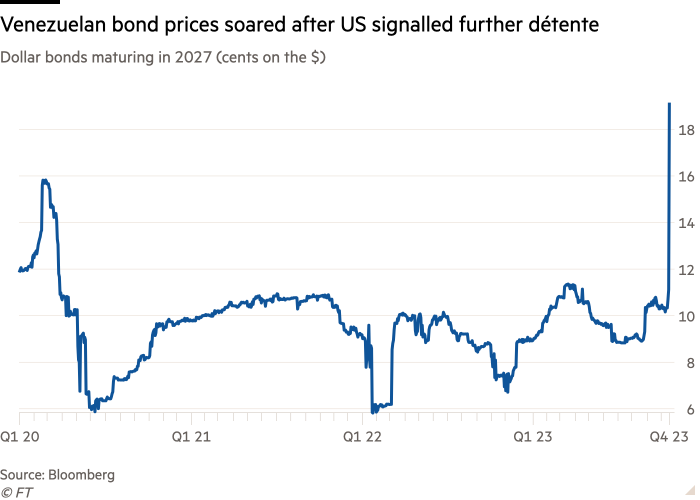

Venezuelan bond costs soar after US lifts buying and selling ban

Final week the US authorities eased sanctions that had barred American traders from buying and selling Venezuelan authorities bonds, a part of essentially the most intensive rollback of Trump-era restrictions on Caracas.

Venezuelan authorities bond costs soared on the information, handing fast giant positive factors to some hedge funds, write my colleagues Arjun Neil Alim, Mary McDougall, Costas Mourselas and Joe Daniels.

The value of Venezuela’s sovereign greenback bond maturing in 2027 jumped greater than 70 per cent to 19 cents on the greenback, in accordance with Bloomberg information.

The positive factors, which have been mirrored in different Venezuelan debt, got here after the US Treasury division late on Wednesday eliminated a ban on secondary buying and selling of sure sovereign bonds in addition to the debt of the state oil firm, Petróleos de Venezuela (PDVSA).

The nation’s bonds have for years traded at a small fraction of their face worth, following Venezuela’s default in 2017 and subsequent removing from extensively adopted indices, and the Trump-era buying and selling ban.

Some traders mentioned the comfort of sanctions may pave the way in which for an eventual restructuring of Caracas’s debt. It may additionally permit Wall Road heavyweights to dive into the market within the hope of huge income on bonds nonetheless buying and selling at extremely distressed ranges.

“We imagine this can be a begin of a multi-step course of . . . of reintroducing Venezuela into the monetary mainstream,” mentioned Nick Lawson, chief government of London-based brokerage Ocean Wall and a Venezuelan bondholder since 2021. “That may most likely embrace ramping up of Venezuelan oil and pure gasoline manufacturing and exports, re-inclusion of Venezuelan bonds in main rising market indices, debt settlement negotiations and eventual restructuring.”

Among the many hedge funds to learn from Thursday’s rally was Lee Robinson’s Altana Wealth, which launched a fund to purchase Venezuelan debt three years in the past.

The corporate has roughly $75mn invested in sovereign and PDVSA bonds with a mixed face worth of virtually $500mn as of the tip of September, Robinson instructed the Monetary Occasions. He mentioned:

“There was a serious push from each side [to improve relations] for over two years. The Center East and the Russian assault on Ukraine have maybe elevated the urgency from [the] US and allies.”

Learn the total story right here

The unusual loss of life of company Britain

Company Britain is dying. However it isn’t a pure loss of life, writes our chief economics commentator Martin Wolf. By forcing inherently unsure long-term pension guarantees to develop into — a minimum of notionally — sure, big harm has been inflicted on UK capital markets and executed to the nation’s company sector. It’s too late to undo the harm of alternatives foregone. It’s not too late to cease inflicting extra hurt sooner or later.

Martin argues {that a} revival of UK capital markets is crucial, to reverse a multiyear development by which pension and insurance coverage corporations have dumped UK equities, lowering the flexibility of corporations to boost capital and broaden.

This revival would require the recreation of huge swimming pools of native fairness capital, which might take pleasure in some great benefits of familiarity and contacts that include residence. Such funds shouldn’t be pressured to spend money on the UK. However they need to have the ability to see — and seize — native alternatives much better than outsiders.

A part of the reply is consolidation of surviving outlined profit funds. A examined resolution — the Pension Safety Fund — is already established and confirmed. It has a profitable consolidation document, with greater than 1,100 funds absorbed up to now. It could possibly kick-start the method. One other a part of the reply is a transfer in the direction of collective outlined contribution funds, rather than as we speak’s plethora of smaller funds, of which there are greater than 3,000, in accordance with Citi. Once more, consolidation is crucial.

In a July speech, Chancellor Jeremy Hunt mentioned the state-owned British Enterprise Financial institution would assess how the federal government may play a “better function” in serving to pension funds to spend money on home belongings to encourage financial progress.

Now my colleagues Laura Noonan and Josephine Cumbo reveal that the UK authorities is about to unveil plans subsequent month for a brand new funding car overseen by the state that’s supposed to turbocharge pensions funds’ investments in high-growth personal corporations.

After months of discussions with pension funds, the BBB is now creating plans for an funding car the place pension funds can co-invest in high-growth corporations underneath the steering of the financial institution.

Chart of the week

Europe’s riskiest company debtors are paying the very best premium in seven years to faucet the area’s €412bn junk bond market, highlighting rising fears {that a} lengthy interval of excessive rates of interest and an financial slowdown may set off additional defaults, writes Harriet Clarfelt in New York.

The so-called “unfold” — or hole — between the yields on euro-denominated company debt rated triple C or decrease and authorities paper has widened to greater than 18 proportion factors on common, in accordance with an ICE BofA index.

That marks the largest unfold since June 2016 and surpasses ranges seen in 2020 when the Covid-19 disaster triggered fears of messy defaults and bankruptcies. Firstly of final yr, the unfold was as little as 6.7 proportion factors.

Authorities bond yields have soared on each side of the Atlantic in current weeks, dragged skywards by considerations that each the Federal Reserve and the European Central Financial institution will preserve rates of interest ‘greater for longer’ to get inflation underneath management. However company bond yields have climbed at an excellent quicker tempo.

Increasing spreads point out that bondholders are demanding bigger premiums to compensate them for the danger of a default.

Analysts and traders mentioned the widening of dangerous European spreads underscored persistent considerations over the well being of the area’s economic system. In addition they pointed to structural points inside Europe’s high-yield bond market — together with its lack of depth and liquidity — which have fuelled sharper strikes than these in the identical asset class within the US.

“I feel the financial backdrop in Europe is certainly worse than within the US,” mentioned Christian Hantel, a company bond portfolio supervisor at Swiss agency Vontobel. The widening of spreads “needs to be seen within the context of slower financial progress, the aggressive rate of interest hikes and the continuing elevated inflation numbers”.

5 unmissable tales this week

Cathie Wooden’s Ark Funding Administration has a brand new pitch to traders who could be involved by the asset supervisor’s big losses — consider the tax write-offs. As a result of Ark’s actively managed ETFs have misplaced a lot cash previously 18 months or so, the agency is telling traders that they’re unlikely to incur taxes on capital positive factors distributions for a minimum of the subsequent two years.

St James’s Place has introduced the biggest overhaul of its charges in its 31-year historical past, because the UK’s greatest wealth supervisor bows to strain from regulators to make sure it complies with new guidelines defending shoppers. The announcement by the FTSE 100 group confirmed an earlier Monetary Occasions report revealing the group confronted strain from regulators to embark on a extra radical overhaul of its charges than the modest adjustments it made in July.

Fund supervisor M&G is to shut its £565mn property fund following sustained outflows by UK retail traders trying to get out of the ailing actual property market. The closure illustrates the renewed strains affecting the UK’s property fund sector, which suffered a spate of suspensions following the Brexit vote in 2016 and once more through the early phases of the coronavirus pandemic in 2020.

US personal fairness investor J Christopher Flowers has warned {that a} dramatic enhance in personal credit score investments by life insurers is creating systemic threat for traders. Flowers, who tried a rescue of insurer AIG through the 2008 monetary disaster, mentioned traders have been underestimating the dangers ensuing from a flood of cash into personal credit score loans and a push by insurers into these belongings seeking greater funding yields.

Funding platforms are going through scrutiny from the UK’s Monetary Conduct Authority over the quantity of curiosity they pay on clients’ money deposits as they reap rewards from hovering charges. DIY buying and selling platforms together with Hargreaves Lansdown and AJ Bell have reported bumper income in current weeks regardless of shoppers making fewer trades and holding smaller asset portfolios, with the windfall largely pushed by curiosity paid by banks the place they deposit clients’ cash.

And eventually

To mark 50 years because the loss of life of Pablo Picasso, the Centre Pompidou in collaboration with the Musée Nationwide Picasso — Paris have put collectively the largest retrospective of drawn and engraved work ever organised. Picasso. Drawing à l’infini presents almost a thousand works — notebooks, drawings and engravings. The drawings illustrate Picasso’s fixed means of reinvention and renewal. Because the artist himself as soon as mentioned: “It took me 4 years to color like Raphael, however a lifetime to color like a baby.” Till January 2024.

Thanks for studying. You probably have buddies or colleagues who may take pleasure in this article, please ahead it to them. Sign up here

We’d love to listen to your suggestions and feedback about this article. E mail me at harriet.agnew@ft.com