Over the previous 35 days, the full worth captured in decentralized finance protocols (defi) has elevated by $11.89 billion, recovering from a low of simply over $83 billion on April 13. Though the $100 billion mark has not but been reached, the worth captured in defi is approaching that milestone after hovering just under it.

Defi Protocols See $11.89 Billion Increase

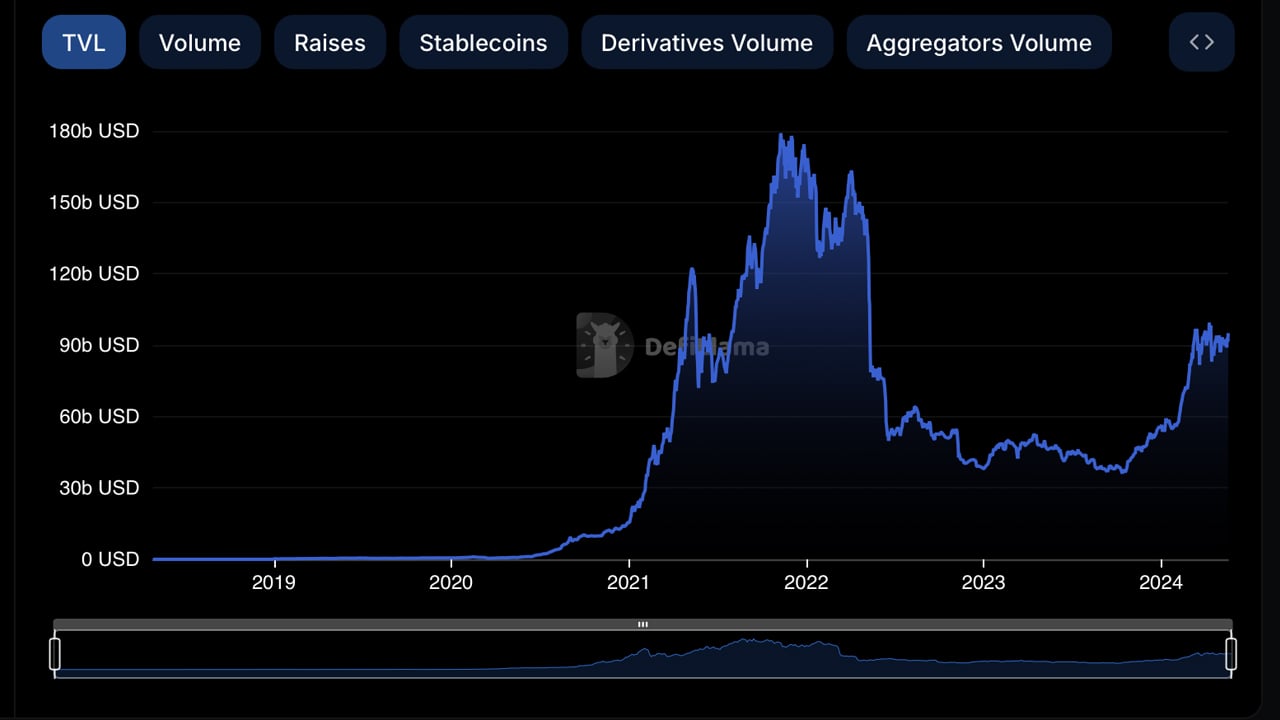

In response to statistics from defillama.com, the full worth (TVL) in defi as of Could 18, 2024 is $94.93 billion. This is a rise of $11.89 billion from the low of $83.04 billion recorded 35 days earlier. Of TVL’s prime 5 protocols, Eigenlayer had the most important improve in 30 days, with TVL rising 19.67%.

Whole worth recorded in defi as of Could 18, 2024, based on defillama.com statistics.

Lido Finance, the most important defi protocol by TVL dimension, noticed a modest improve of 1.49% over 30 days. Bitcoin.com Information has reported on liquid staking spinoff functions witnessing vital withdrawals in current weeks.

Nonetheless, Lido dominates the TVL of $94.93 billion with a worth of $29.21 billion as of Could 18, 2024. Eigenlayer’s TVL at present stands at $15.39 billion and between each Lido and Eigenlayer, the duo’s TVL in defi represents 46 .98% of your complete TVL. The remainder of the highest 5 members noticed a 30-day improve as Aave’s TVL rose 9.21%, Makerdao’s locked worth rose 7.95% and lending protocol Justlend rose 4.96%.

Different notable gainers included Etherfi with 28.91% and Zircuit Staking with 74.61%. Jito noticed a rise of 31.84% and Marinade Finance grew by 16.37%. Perfectswap noticed a grueling 100% discount in 30 days, as did eight different defi protocols. As Defi continues its regular restoration, with its whole worth transferring ever nearer to the necessary $100 billion milestone, this may occasionally mirror renewed confidence on this dynamic sector of the cryptocurrency ecosystem.

What do you consider the current motion within the defi world and the TVL heading in direction of $100 billion? Share your ideas and opinions on this matter within the feedback under.