Brandon Bell

Introduction

I’d make the case that I am not an incredible shopper for many brokers, as I’ve a really low transaction depend. I barely commerce shares, and I virtually by no means promote a long-term (dividend) funding.

Nonetheless, final 12 months, I bought my Valero Vitality Company (NYSE:VLO) funding, which I purchased very cheaply through the pandemic.

On September 26, 2023, I wrote an article titled “Valero: Regardless of Large Power, I am Contemplating Promoting (Score Downgrade).”

Since then, shares are down 7.4%, together with dividends, underperforming the S&P 500, which is up 11.6% since then, by a mile.

That stated, I am trying to get again in, as I consider that Valero Vitality is among the greatest (albeit unstable) dividend development shares within the power house.

So, with out additional ado, let’s get proper to it!

Vitality Earnings Progress

I’ve mentioned Valero quite a bit up to now few years.

Nonetheless, as that is the primary article this 12 months, let’s take a step again to have a look at the larger image, particularly for the people who find themselves new to the VLO ticker.

Valero is a Fortune 500 firm headquartered in San Antonio, Texas, and operates as a multinational producer and marketer of petroleum-based and low-carbon liquid transportation fuels and petrochemical merchandise.

Or, to place it in another way, the corporate turns oil into value-added merchandise like gasoline, diesel, and kerosene. It turns corn into ethanol and different bioproducts into renewable diesel.

Whereas it’s working to spice up the manufacturing of renewables, as we are going to focus on on this article, its bread and butter is its refining enterprise, as we will see within the table beneath.

| $ Hundreds of thousands | 2021 | Weight | 2022 | Weight |

|---|---|---|---|---|

|

Refining |

106,947 | 93.8 % | 168,154 | 95.3 % |

|

Ethanol |

5,156 | 4.5 % | 4,746 | 2.7 % |

|

Renewable Diesel |

1,874 | 1.6 % | 3,483 | 2.0 % |

With company workplaces at One Valero Manner, the corporate has a various portfolio of operations spanning the USA, Canada, the UK, Eire, and Latin America.

| $ Hundreds of thousands | 2021 | Weight | 2022 | Weight |

|---|---|---|---|---|

|

United States |

82,940 | 72.8 % | 126,722 | 71.8 % |

|

Different Nations |

11,133 | 9.8 % | 20,096 | 11.4 % |

|

United Kingdom and Eire |

13,307 | 11.7 % | 17,822 | 10.1 % |

|

Canada |

6,597 | 5.8 % | 11,743 | 6.7 % |

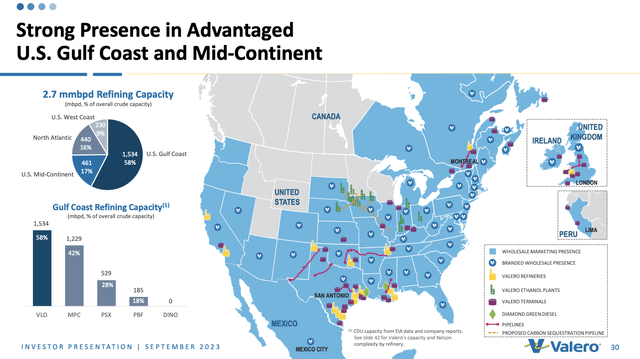

Going again to its segments, the corporate manages 15 petroleum refineries with a mixed throughput capability of roughly 2.7 million barrels per day.

Greater than half of this capability is positioned within the Gulf Coast, the place it’s the largest pure-play refiner.

Valero Vitality

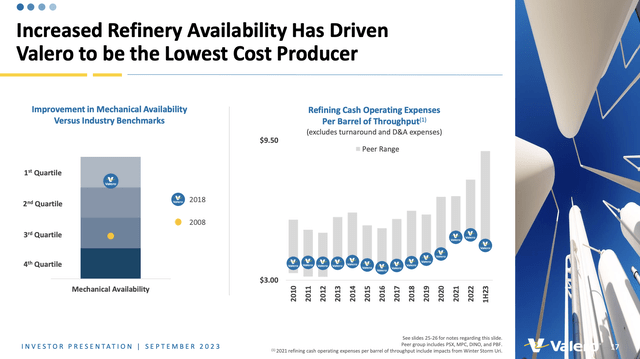

Due to strategic areas and prudent administration, the corporate is among the most effective producers in its trade.

Valero Vitality

The corporate additionally has a three way partnership with Diamond Inexperienced Diesel Holdings, which owns two renewable diesel crops.

On high of that, it’s certainly one of America’s largest ethanol producers, able to producing 1.2 billion gallons per 12 months and quite a few typical by-products like dry distiller grains and corn oil.

One factor the corporate may be very pleased with (and rightfully so) is its shareholder distributions.

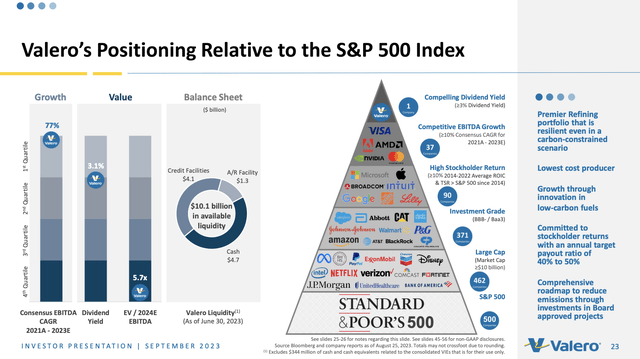

As we will see within the pyramid beneath, the corporate believes it’s the greatest choose amongst large-cap companies with investment-grade steadiness sheets and elevated EBITDA development.

Valero Vitality

Though I’ve to say that the corporate was cherry-picking quite a bit within the pyramid above (it additionally has intervals of unfavorable EBITDA development, and why filter out small corporations?), I’ve to provide Valero numerous credit score for being an incredible supply of rising earnings for shareholders.

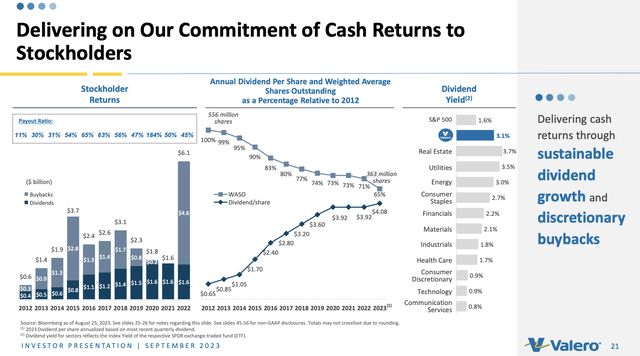

As we will see beneath, the corporate has maintained a wholesome payout ratio in yearly since 2012, aside from the pandemic.

Since 2012, it has grown its annual dividend from $0.65 to $4.08.

Dividends play a vital position in Valero’s dedication to returning money to shareholders.

Therefore, the dividend coverage is designed to supply shareholders with a dependable stream of earnings, making Valero an interesting selection for income-oriented buyers.

Valero Vitality

The present dividend of $1.02 per share per quarter ($4.08 per 12 months) interprets to a yield of three.2%.

On January 31, 2023, the dividend was hiked by 4.1%, which was the primary dividend hike because the pandemic.

On a full-year foundation in 2023, the corporate is anticipated to generate $8.7 billion in free money movement. This interprets to roughly 20% of its $44.3 billion market cap.

This exhibits that the dividend is extraordinarily protected.

It’s also protected by a steadiness sheet with a sub-0.5x leverage ratio and an investment-grade BBB credit standing.

Valero ended 3Q23 with $9.2 billion of whole debt, $2.3 billion of finance lease obligations, and $5.8 billion of money and money equivalents. The debt-to-capitalization ratio, web of money, was 17%.

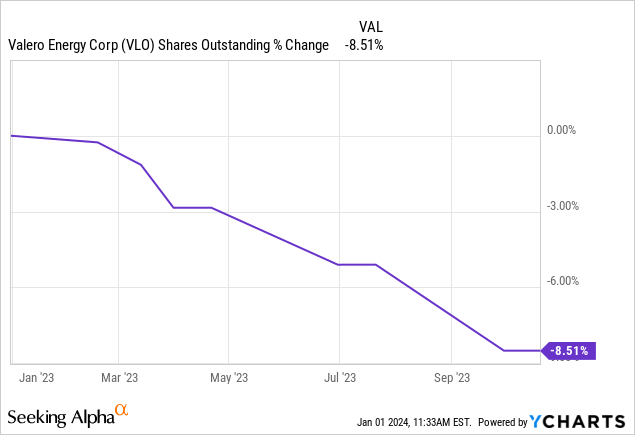

On high of that, Valero employs share buybacks as a strategic device for capital allocation.

The corporate repurchases its personal shares from the open market, lowering the whole variety of excellent shares.

This, in flip, can improve shareholder worth by boosting earnings per share and doubtlessly signaling to the market that the corporate believes its inventory is undervalued.

Because the overview above exhibits, the corporate has purchased again roughly 35% of its shares between 2012 and 2023.

Over the previous 12 months alone, VLO purchased again 8.5% of its shares.

Within the third quarter earnings name, the corporate was requested about its money deployment.

The corporate answered that it’s more likely to deploy extra cash when alternatives current themselves. Given its steadiness sheet and up to date free money movement advantages, it’s nonetheless in an incredible spot to purchase again numerous inventory.

Doug Leggate [Question]

Okay. My follow-up is a fast one possibly for Jason. However one other $1.8 billion of buybacks. You have now purchased again, I believe, about 15% of your shares within the final 1.5 years. You continue to obtained loads of money on the steadiness sheet, and we all know this sector is notoriously seasonal. I am simply curious how we must always take into consideration your deployment or technique of — into seasonal intervals whenever you get — maybe get extra opportunistic?

Jason Fraser [Answer]

[…] After which that brings us to buyback and you recognize our put up to buybacks is to have the annual goal of 40% to 50% of adjusted web money from operations, and we view the buyback as a flywheel supplementing our dividend to hit no matter our goal is for the 12 months. Within the third quarter, we had a 68% payout year-to-date by means of the third quarter, we’re at 58%. So I’d say, underneath these situations, even given the softer seasonality within the fourth quarter, you need to undoubtedly count on us to pay out over 50% for the 12 months.

With that stated, let’s take a more in-depth take a look at its numbers.

The Attractiveness Of VLO

Regardless of all the excellent news up to now, I bought VLO final 12 months, which was primarily primarily based on the macroeconomic atmosphere.

That is what I wrote in my prior article:

Nonetheless, given the present danger/reward and different funding alternatives, I am contemplating promoting a little bit of Valero Vitality Company to doubtlessly purchase it again at decrease costs if I get the prospect.

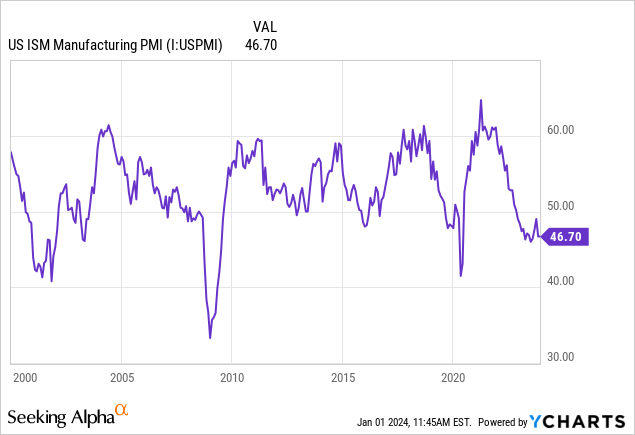

As we will see within the chart beneath, the ISM Manufacturing Index has been in a longer-term decline, which is indicative of slower financial demand.

This decline has additionally pressured Valero.

For instance, the refining section achieved $3.4 billion in working earnings for 3Q23, with refining throughput volumes averaging 3 million barrels per day at 95% capability utilization.

Refining money working bills have been $4.91 per barrel, larger than the steerage of $4.70 per barrel, primarily on account of elevated power costs.

Complete web earnings attributable to Valero stockholders for the third quarter of 2023 was $2.6 billion or $7.49 per share, barely decrease than the $2.8 billion or $7.19 per share for a similar interval in 2022.

Adjusted web earnings for 3Q23 was $2.8 billion or $7.14 per share.

Regardless of these cyclical setbacks, Valero stays targeted on operational excellence, prioritizing strategic tasks, and honoring shareholder returns.

For instance, the DGD Sustainable Aviation Gasoline mission at Port Arthur is on schedule, anticipated to be full in 2025, and is estimated to price $315 million.

With this mission, Diamond Inexperienced Diesel is anticipated to turn out to be one of many largest sustainable aviation gas producers on the planet.

Valero Vitality

Valero additionally continues to judge alternatives in carbon seize and storage for lowering the carbon depth of standard ethanol.

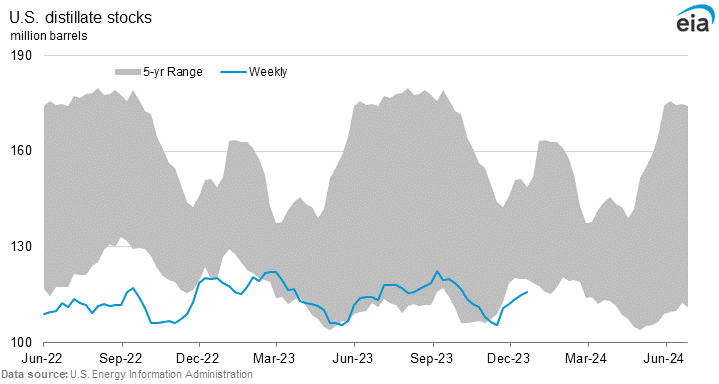

Moreover, regardless of cyclical headwinds, it advantages from very low distillate inventories in the USA.

On December 20, the Wall Avenue Journal reported the next:

Distillate shares, largely diesel gas, elevated by 1.5 million barrels, to 115 million barrels, and have been 10% beneath the five-year common. Expectations have been for a 700,000-barrel construct.

U.S. Vitality Info Administration

I count on low inventories to show into vital drivers of pricing advantages as soon as financial demand improves.

So, what in regards to the valuation?

Valuation

The valuation is fascinating for quite a few causes.

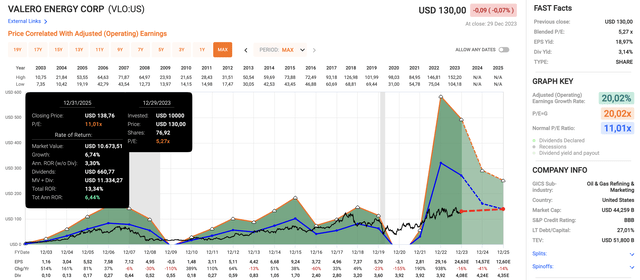

- As we will see within the chart beneath, analysts count on a long-term normalization in earnings. They count on that the post-pandemic advantages from constrained trade provide and elevated margins will average, leading to no less than three years of double-digit EPS declines.

- At the moment, VLO trades at a blended P/E ratio of simply 5.3x, which may be very low cost.

- The long-term normalized valuation a number of is 11.0x.

- Nonetheless, due to the anticipated EPS contraction, the inventory has a good worth goal of roughly $139, which suggests 6.4% annual returns by means of 2025. That’s not very juicy.

FAST Graphs

When incorporating macroeconomic uncertainty and the latest inventory worth surge, I’ll stay on the sidelines.

Nonetheless, as I’m an enormous fan of the corporate’s deal with dividend development, buybacks, and long-term development investments, I’m trying to purchase the inventory on a possible 1% to twenty% inventory worth decline.

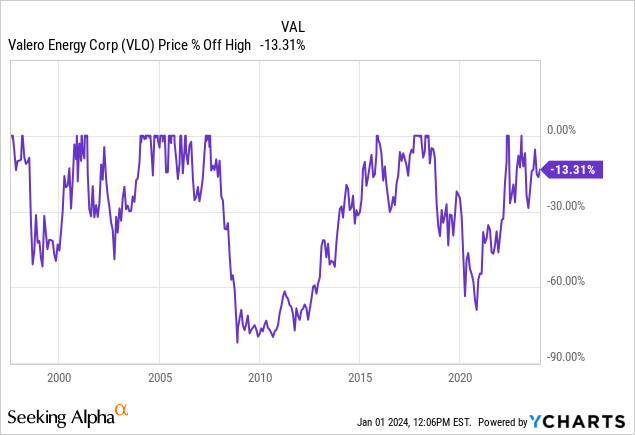

As we will see within the chart beneath, inventory worth declines of greater than 10% are fairly widespread.

Therefore, I am carefully watching VLO in 2024 to deploy money if I get the chance.

Takeaway

Valero Vitality stands out with its sturdy refining enterprise, shareholder-focused insurance policies, and numerous product portfolio.

The corporate’s dedication to constant dividends and substantial share buybacks units it aside available in the market.

Regardless of a latest sell-off, Valero’s fundamentals stay robust, backed by a safe monetary place.

My cautious shopping for technique sees a good worth goal of $139 and goals for potential entry factors throughout inventory worth declines of 1% to twenty% in 2024.

In any case, Valero’s distinctive qualities make it not solely a cyclical play however a strategic funding alternative with long-term potential.