- USDT noticed a surge in exercise following regulatory scrutiny.

- Nevertheless, a typical buying and selling technique that might have benefited BTC did not materialize.

The U.S. authorities has reportedly launched one other investigation into Tether [USDT], a transfer some are calling the newest “Tether FUD” tactic.

The timing raises eyebrows, with some speculating that is an orchestrated try and inject concern and shake out the market earlier than a possible Bitcoin [BTC] breakout.

Provided that over 70% of cryptocurrency trades contain USDT pairs, analysts at AMBCrypto warning concerning the dangers tied to Tether’s centralization.

Any disruption to USDT might ship shockwaves by the whole market. Notably as BTC heads into the ultimate week of the “Uptober” frenzy.

USDT dominance hits new highs, however there’s a catch

Up to now week, USDT dominance has steadily elevated, with each day features exceeding 2%. Traditionally, an increase in USDT dominance usually coincides with BTC reaching market tops.

This was paying homage to its earlier shut close to $70K.

Nevertheless, the surge in USDT demand, pushed by rising panic, has positioned vital downward strain on BTC, which is presently buying and selling at $67K.

This example underscores the rising affect of USDT on Bitcoin’s value dynamics. Due to this fact, it’s essential to watch the consequences of the current scrutiny surrounding Tether carefully.

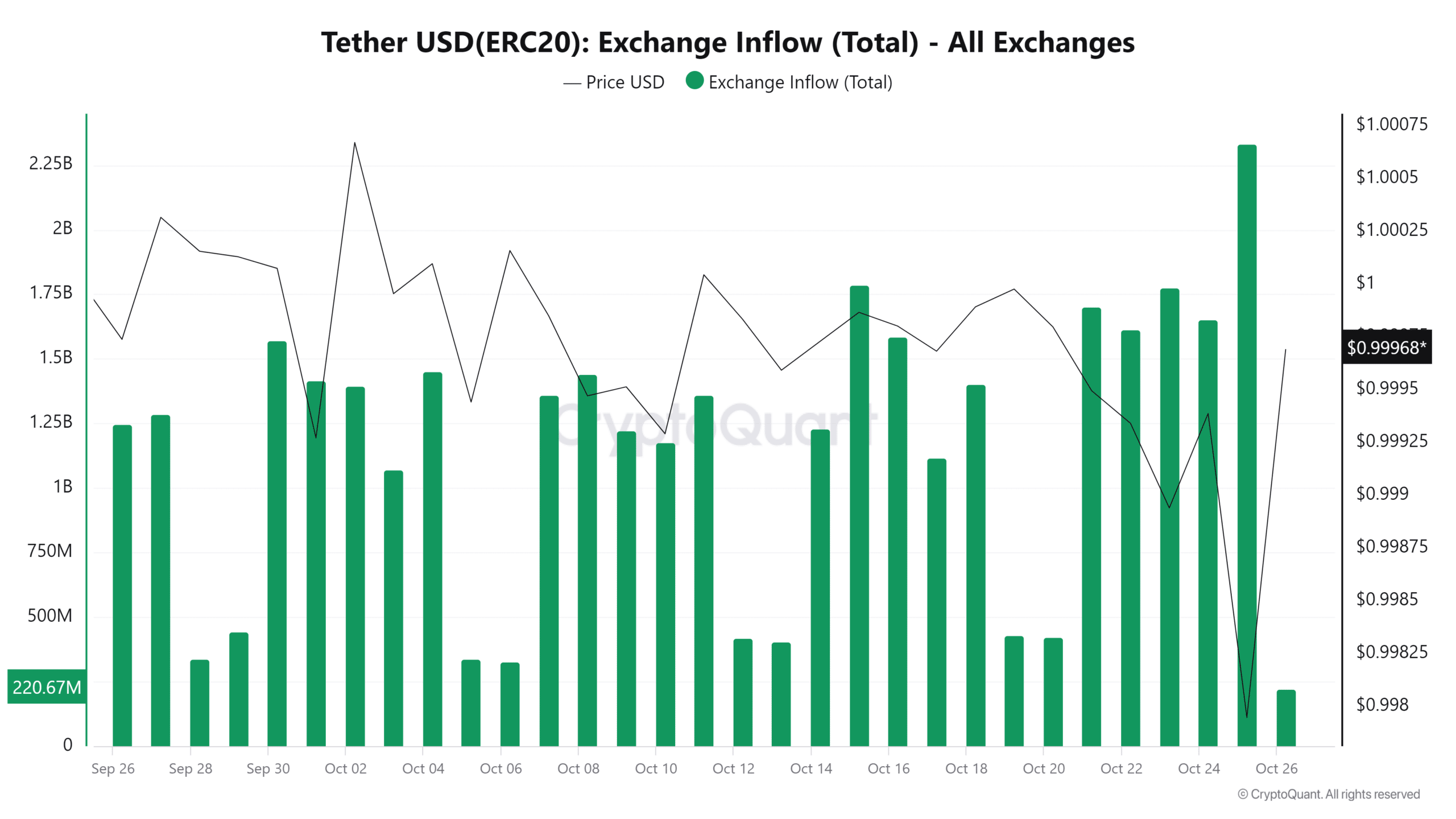

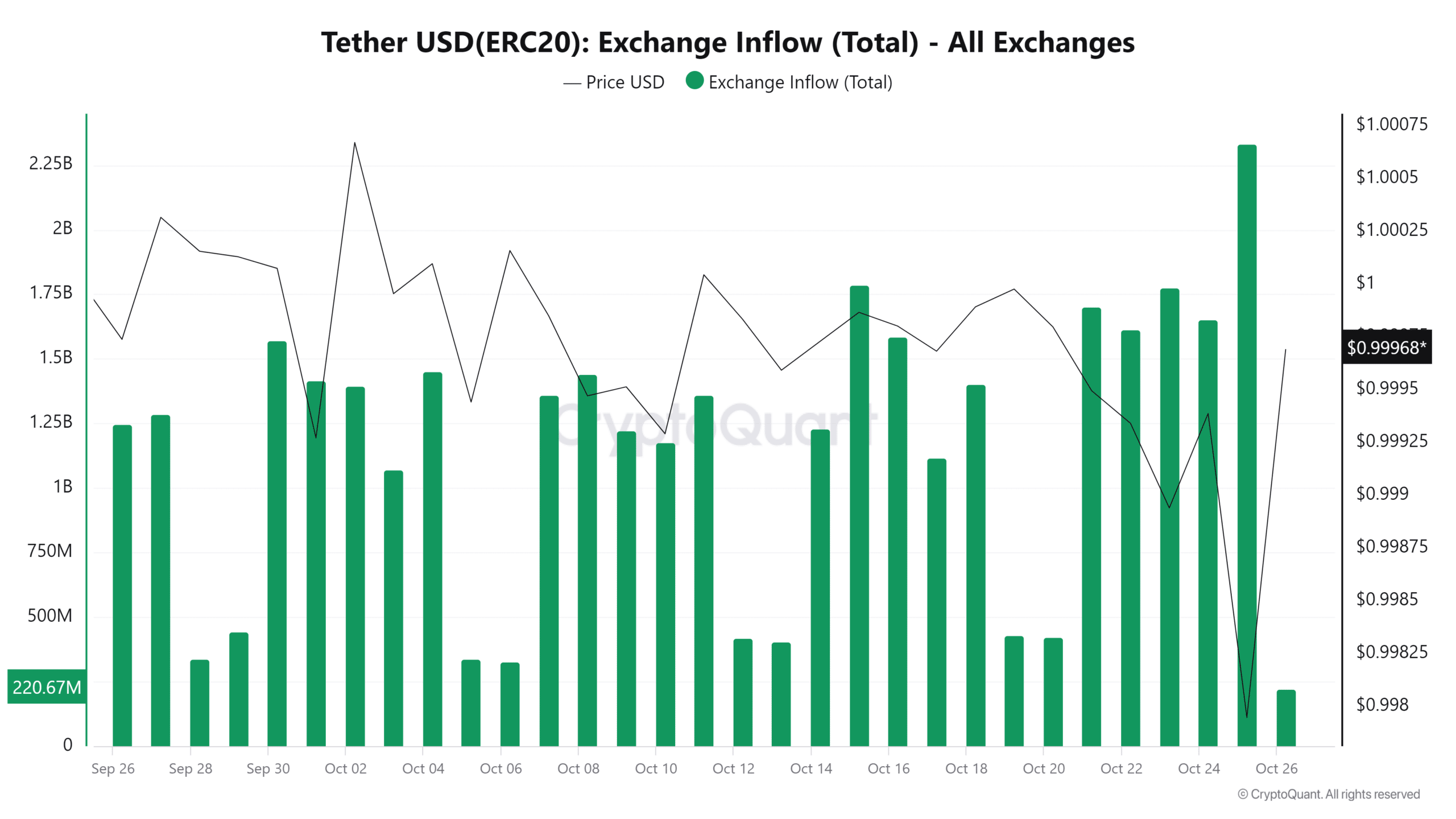

Supply: CryptoQuant

Curiously, throughout the late buying and selling hours when the information circulated, USDT inflows into exchanges surged dramatically, hitting a two-month excessive of over $2.3 billion.

Regardless of this spike, USDT dominance remained robust, posting a each day acquire of practically 3%. This implies that many merchants perceived the information as exaggerated or deceptive, opting to keep up their internet imports.

Nevertheless, there’s a robust chance that within the coming days, USDT deposits into exchanges might surpass internet outflows.

If the present BTC value seems to be a market backside, it might appeal to vital liquidity, doubtlessly driving its value increased.

On the flip facet, stakeholders would possibly shift their property into different high-cap altcoins or memecoins, seizing the chance to alternate USDT for extra inexpensive alternate options.

The final week of October could carry elevated exercise within the crypto market, with a number of cash poised for a possible parabolic rally.

Odds of capital shifting into BTC

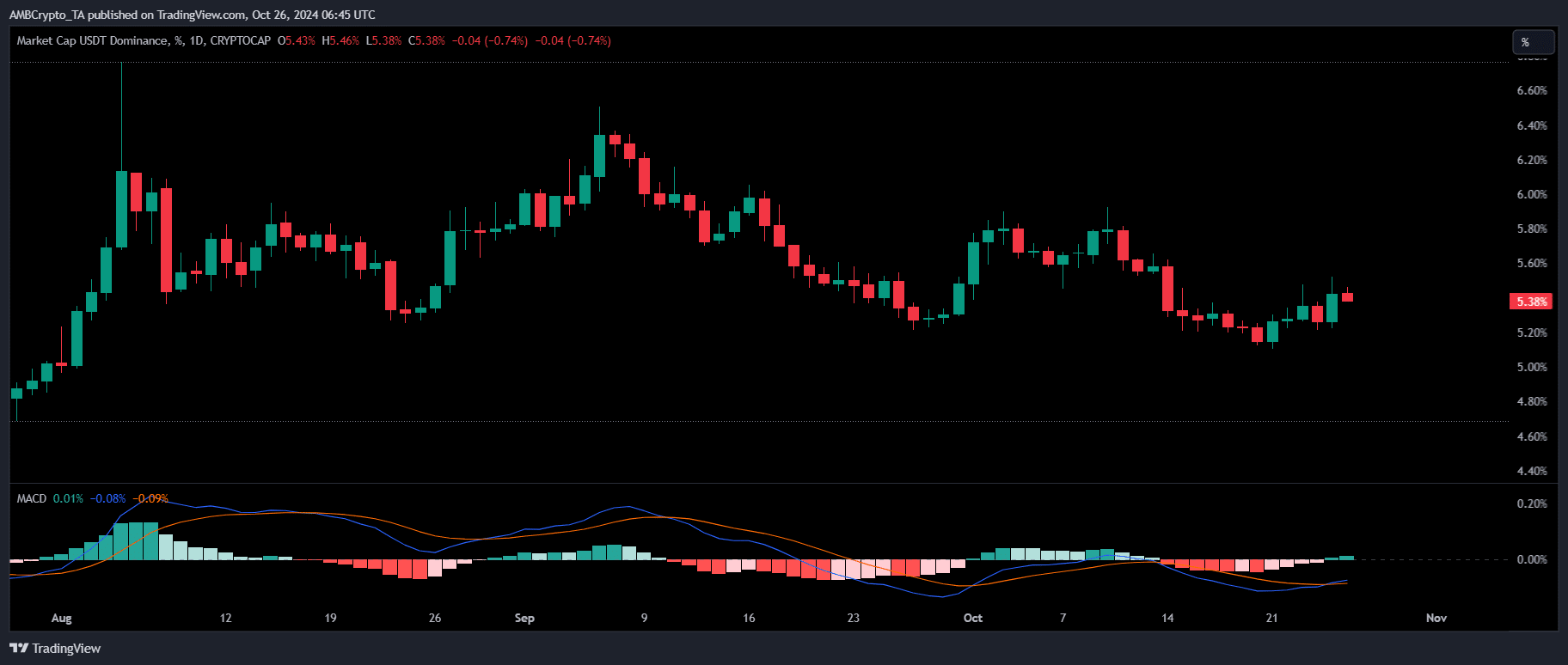

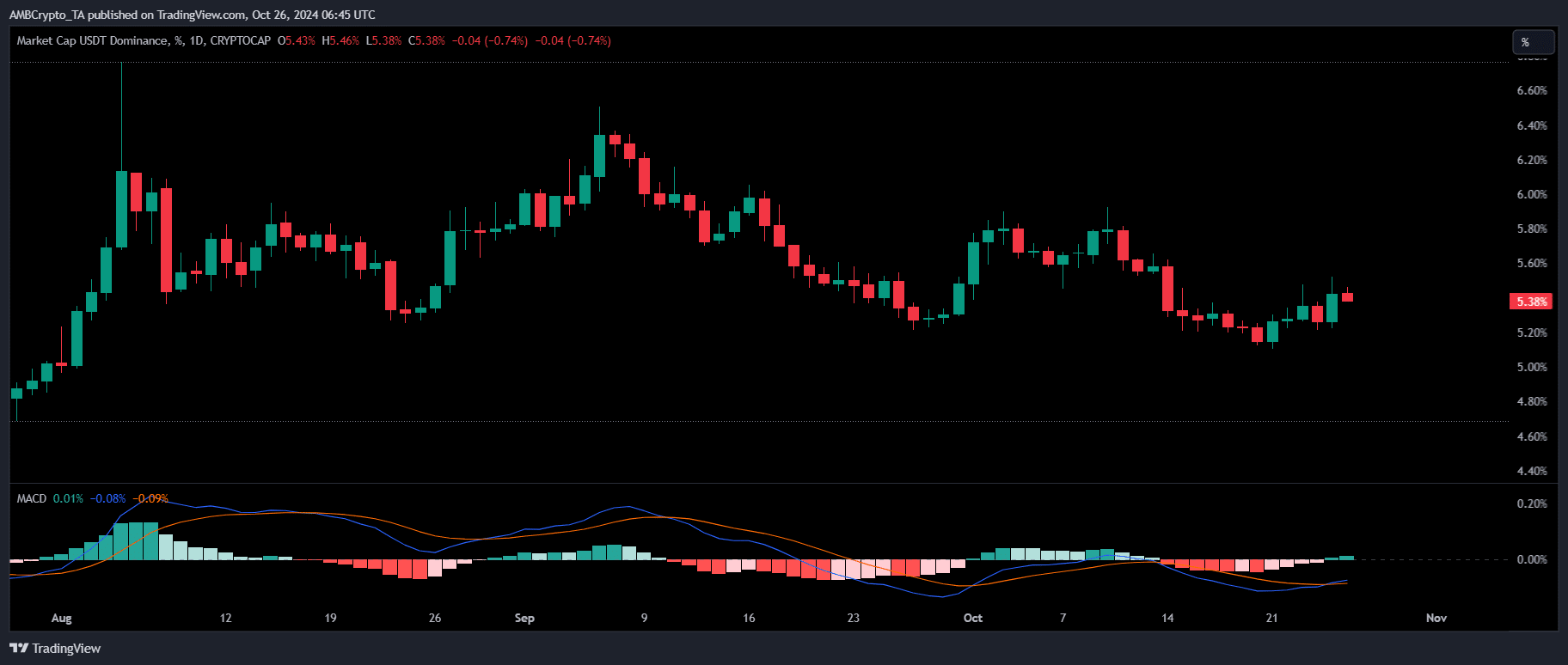

Presently, USDT stands at a crossroads. The investigation information triggered investor panic and large promoting strain. But, the each day chart confirmed a bullish MACD crossover for USDT dominance.

Supply: TradingView

The elevated volatility available in the market – sparked by Bitcoin’s dip to close $67K – has fueled speculation a few potential pullback to $64K, the place the subsequent backside might type.

Furthermore, regardless of 12 hours passing for the reason that information broke, which usually prompts traders to dump USDT for BTC, merchants have but to brush the lows.

This situation reinforces the potential for a retracement, making the present value a much less interesting entry level.

Is your portfolio inexperienced? Try the BTC Revenue Calculator

The approaching week is essential for BTC, as its destiny hinges in the marketplace’s response to USDT. Presently, the chance of traders strategizing for a parabolic rally seems restricted.

This might dampen the possibilities of the crypto market closing October on a bullish notice.