The worth of the stablecoin Pax Greenback (USDP), issued by the Paxos Belief Firm, rose to a excessive of $1.28, resulting in the liquidation of $529,000 in USDC for a market participant.

Like common stablecoins, USDP is designed to take care of a secure worth equal to that of a US greenback, offering merchants with a secure haven in opposition to the volatility that always comes with cryptocurrencies. Nonetheless, the current surprising worth improve highlighted by PeckShield has raised issues.

#PeckShieldAlert #Liquidation An deal with (0x09a5…a87f) was liquidated ~529K $USDC after $USDP (Pax Greenback) rose to $1.18 pic.twitter.com/UbWxx8kZU4

— PeckShieldAlert (@PeckShieldAlert) April 17, 2024

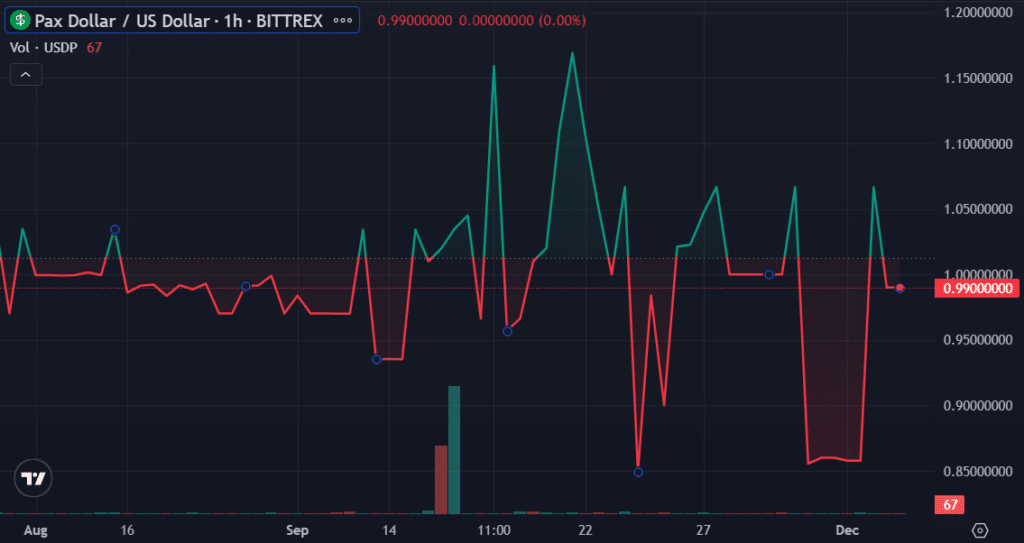

The stablecoin unusually spiked to $1.2848 at 16:10 UTC yesterday, earlier than lastly witnessing a subsequent drop to its normal worth of $1 4 hours later. Though the depeg went unnoticed by most, it had far-reaching results on a dealer’s credit score place, resulting in liquidations.

USDP Worth – April 17 | Supply: buying and selling view

You may also like: Uniswap’s buying and selling quantity reaches $3 billion regardless of SEC claims

The liquidation happened on the decentralized finance platform (defi) Aave, the place the dealer had used USDP as collateral to safe a mortgage in USDC. Significantly within the defi ecosystem, loans are backed by different belongings, with mechanisms in place to handle sudden shifts in market dynamics.

On-chain information confirms that the dealer misplaced the 529,000 USDC over sixteen odd trades from 16:16 to twenty:09 UTC, which coincided with the interval when USDP misplaced its peg. The transaction label signifies that the liquidation course of was robotically initiated by Aave’s built-in danger administration algorithms.

Because the USDP worth spiked, the platform probably predicted a attainable correction or return to the conventional pegged charge. Such a forecast might set off pre-emptive liquidation to restrict potential losses, particularly if the borrower’s Mortgage-to-Worth (LTV) ratio turns into unfavorable.

USDP, issued by Paxos, has suffered sure setbacks in current instances, marked by occasional depegs. A 2023 examine from SP International steered that USDP data the biggest deviations in opposition to the US greenback among the many prime stablecoins, after witnessing 7,581 delicate depeg occasions within the 24 months main as much as June 2023.

Learn extra: Tons of blockchain: X insurance policies to drive Telegram adoption