Unlock the Editor’s Digest without spending a dime

Bitcoin change traded funds have pulled in just below $900mn within the first three days of buying and selling, as traders cautiously welcome the brand new inventory market autos that observe the cryptocurrency.

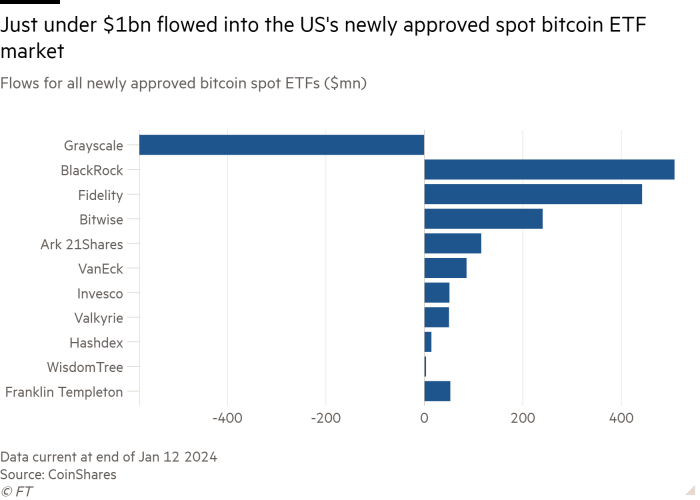

The brand new funds, which embody these from BlackRock, Franklin Templeton and Invesco, have had internet inflows of $871mn, in line with knowledge from CoinShares, a digital asset supervisor.

BlackRock, the world’s largest asset supervisor, led the way in which with $723mn of inflows, adopted by Constancy with $545mn. The inflows have been offset by $1.18bn of outflows at Grayscale, which transformed its current $28bn bitcoin fund into an ETF alongside the brand new launches.

Analysts imagine the majority of the outflows is prone to be traders shifting to one of many new funds, which all cost decrease charges than Grayscale. Excluding the outflows at Grayscale, the ten new ETFs have drawn in simply over $2bn.

Crypto fanatics celebrated the approval of the funds by the US Securities and Alternate Fee final week after greater than a decade of rejections. Supporters hope it should entice new traders to the token and enhance its worth in the long run.

Rising hypothesis that the SEC would approve so-called spot bitcoin ETFs had pushed the worth of bitcoin up greater than 70 per cent since October. Nonetheless, bitcoin has fallen roughly 6 per cent since their approval.

“Under no circumstances was this launch a mass success,” stated Ilan Solot, co-head of digital property at Marex Options. “Bitcoin’s newest worth motion exhibits that this has up to now been an underwhelming launch for merchandise that have been so extremely anticipated.”

The funds’ collective efficiency additionally fell in need of the $1bn that ProShares pulled in on its first two days after launching a bitcoin futures ETF in October 2021.

Grayscale, which has run a bitcoin belief since 2013, helped open the door to regulatory approval for bitcoin ETFs after profitable a court docket victory in opposition to the SEC final 12 months. However analysts stated its conversion final week supplied traders a chance to exit their holdings.

Beforehand, traders had been in a position to promote their holdings solely within the over-the-counter market, and so they typically traded at a big low cost to the worth of bitcoin.

“There’s plenty of shuffling round of deck chairs . . . as a result of Grayscale was buying and selling as a closed-end fund for thus lengthy, however as quickly because it turned an ETF it turned liquid, so it’s not shocking to see promoting stress coming from Grayscale,” stated James Butterfill, head of analysis at CoinShares.

Analysts additionally identified that Grayscale charged a 1.5 per cent payment, which is greater than a share level increased than new market entrants.

“Following a pointy run-up in valuations, it’s pure to see some profit-taking from the funding group,” stated Zach Pandl, Grayscale’s managing director for analysis.

Some brokers have declined to supply buying and selling within the new bitcoin ETFs. Vanguard, the world’s second-largest asset supervisor, stated the brand new merchandise “didn’t align with its provide of a well-balanced, long-term funding portfolio”.

Analysts stated flows into bitcoin ETFs would take time to materialise as advisers turned snug sufficient with the merchandise to advocate them as additions to shopper portfolios.

“This isn’t about day one. That is new for lots of shoppers,” stated an govt at one of many issuers who declined to be recognized. “It’s going to take a while to have a full training and perceive its function in a portfolio and in the end select to make an allocation to a product. What I’m most enthusiastic about is the long-term prospects. We’re giving entry to a completely new market.”

Further reporting from Steve Johnson in London