With the upcoming expiration of The Fed’s financial institution bailout facility (reminder they had been 12-month collateralized time period loans), and with The Fed’s reverse repo facility see a large $128BN in liquidity sucked out of it within the final two days, this week’s pleasure over at NYCB once more is certain to have seen some depositors query their choices (however we can’t learn about that for a few weeks as The Fed wants time to ‘handle’ the information).

RRP’s collision with the x-axis is correct on schedule…

Supply: Bloomberg

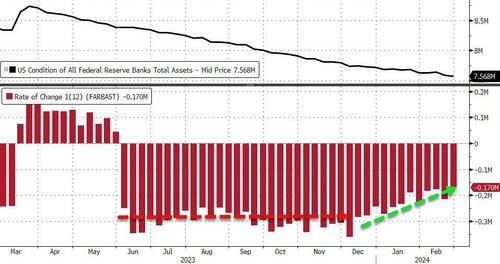

And whereas The Fed’s steadiness sheet continues to contract, we do observe that the tempo of contraction has slowed considerably this yr…

Supply: Bloomberg

And on the identical time, inflows to money-market funds continued to take whole belongings to recent report highs…

Supply: Bloomberg

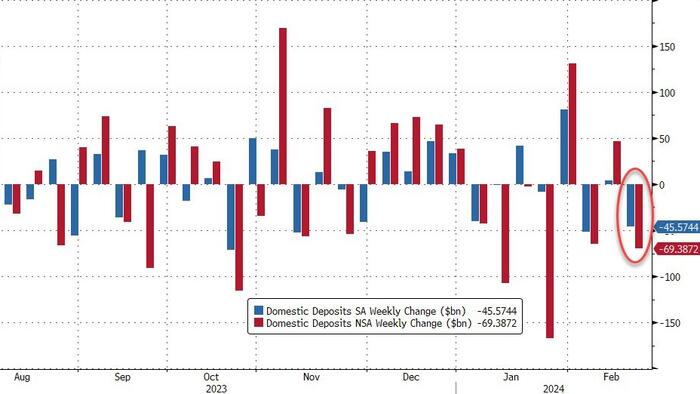

…as banks noticed deposits decline $48BN (SA) final week ($86BN within the final 3 weeks)…

Supply: Bloomberg

On a non-seasonally-adjusted foundation, whole deposits fell $74BN within the week ending 2/21 (down $206BN in 2024)…

Supply: Bloomberg

And, excluding international banks, home deposits dropped $46BN SA (Giant Banks -$36BN, Small Banks -$10BN), and tumbled $69BN NSA (Giant Banks -$62BN, Small Banks -$7BN)

Supply: Bloomberg

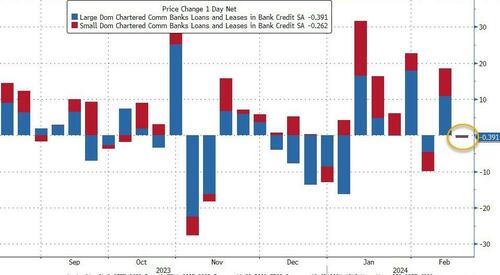

On the opposite aspect of the ledger, there principally no exercise in any respect in loans from small or massive banks. Fairly an odd print…

Supply: Bloomberg

US fairness market cap stays dramatically decoupled from financial institution reserves at The Fed. The final time it was this decoupled did not finish effectively…

Supply: Bloomberg

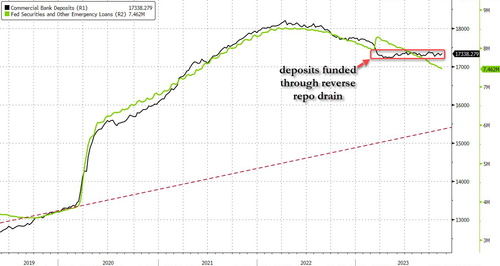

And at last, as for those who wanted a reminder after this week’s NYCB debacle – regardless of the rebound off the lows once more this week in regional financial institution shares, which should imply every thing is superior, proper? – the regional financial institution disaster continues to be very a lot alive as evidenced by the crimson line under (with out The Fed’s imminently expiring BTFP facility)…

Supply: Bloomberg

…what else are massive banks (inexperienced line) going to do with all that money burning a gap of their pockets (though we do observe an enormous money drop at massive banks – which incorporates NYCB, however this was the week earlier than).

As one veteran Fed watcher remarked “that is such a clusterfuck… deposits ought to be $500BN decrease

Supply: Bloomberg

The underside line is – this seems rather a lot like a ‘Small Financial institution’ disaster. The final time this occurred, the disaster sparked a sudden $300BN ‘run’ in small financial institution deposits (this time it is larger!).

Is The Fed ‘hoping’ for a managed bank-run this time – in order many small financial institution deposits are drained voluntarily, earlier than they’re drained suddenly in a panic (and the Reverse Repo facility is empty, unable to offer any cushion)?

Loading…