Antoine2K

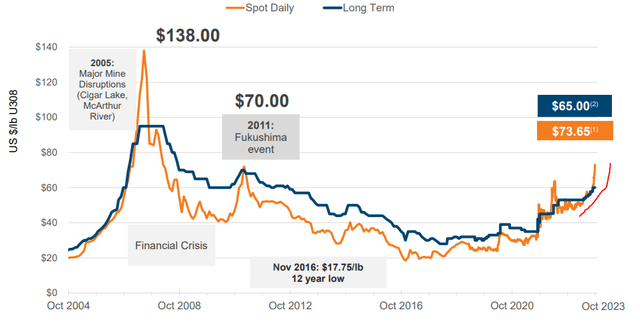

In our final protection of Uranium Royalty Corp. (NASDAQ:UROY), (TSX:URC:CA), we gave it a impartial score. Our score included the enhancements in valuation and instructed traders that an upswing would solely materialize if we received a full-blown uranium bull market coming to the forefront. That was in March of this 12 months and naturally, as everybody who has not been dwelling below a rock, is aware of, the uranium bull market is again. You possibly can see that on the right-hand facet of this chart as each spot and long-term costs have gone vertical lately.

UROY Presentation

UROY has responded in variety. Whereas it has lagged behind the bigger shares within the sector like Cameco Company (CCJ) and even the International X Uranium ETF (URA), it has managed to place collectively an honest rally.

We have a look at the place the firm stands and the way it’s progressing in attaining its targets. We additionally weigh in on the warrants for extra potential upside.

The Firm

UROY is a royalty firm that hopes to capitalize on the rising supply-demand imbalance for uranium. It goals to construct a diversified portfolio of royalty property throughout the globe whereas holding bodily uranium with money available. The latter serves as a modality to stay uncovered to the potential bull market because it seeks out royalty alternatives.

UROY Presentation

It has had some success in constructing its royalty portfolio as proven in its presentation. A few of these property are certainly world-class.

UROY Presentation

However should you observe rigorously above and beneath, you’ll discover that whereas these are massive mines, UROY’s share of the manufacturing or potential manufacturing is extraordinarily small.

UROY Presentation

It could be onerous for a novice investor to place weightage on what all of this implies for the precise success of the corporate. However they’ll glean some information of this by inspecting the monetary statements.

Q1-2024

UROY has an April fiscal year-end, so July 31, 2023, represents the primary quarter of the 2024 monetary 12 months. The revenue assertion instantly pertains to what we have been speaking about within the earlier part. There are at present no revenues and the assertion begins with expense gadgets.

UROY Financials

Whereas some royalty property are in manufacturing, they haven’t but proven up on the revenue assertion. The rationale for that’s these royalty agreements are typically filled with complicated phrases and situations and the “sharing” begins after sure targets are met. One other place which provides you an thought of simply how small all of the royalty numbers will probably be (even once they do finally present up) is the stability sheet. Complete royalty-related property are simply $46.25 million.

UROY Financials

That represents everything of the invested quantity (adjusted for any forex fluctuations). So for sure, that funding quantity will at finest produce a small fraction in precise royalties yearly. You additionally need to account for the truth that most of those will not be in manufacturing until fairly a couple of years from now.

Valuation

Established royalty firms have a typical framework for valuation and relying on whether or not that royalty proper is perpetual (like that for a Pizza chain), or depleting (like mineral property in a mine), one can provide you with a a number of of revenues that works. After all, the important thing to success within the case of mining royalty property is to purchase at a low valuation (low worth to gross sales) at some extent the place the underlying is about to understand. You possibly can see our framework for that in our earlier work on Royal Gold Inc. (RGLD). Within the case of UROY there’s a number of guesswork concerned. The primary cause is that there’s nothing remotely attention-grabbing on the revenue assertion. You can not even use a worth to income quantity.

So the tough gauge right here is an adjusted worth to NAV. We are able to get to this in a few steps. Beginning with the value to tangible ebook worth, we will see that UROY is buying and selling at about 2.1X the final identified tangible ebook worth.

This tangible ebook worth makes use of the Uranium worth as of July 31, 2023. Understand that there’s a number of Uranium stock on the stability sheet.

As at July 31, 2023, the Firm holds 1,548,068 kilos (April 30, 2023: 1,548,068 kilos) of U3O8. The carrying worth of $85,705 (April 30, 2023: $85,561) consists of an accrual for the Firm’s entitlement of the manufacturing from the McArthur River mine of 1,038 kilos U3O8 for calendar 12 months 2022 and the estimated manufacturing from the McArthur River mine from January 1, 2023, to July 31, 2023. On August 31, 2023, the Firm acquired 1,038 kilos of U3O8 associated to the manufacturing in calendar 12 months 2022

Supply: UROY Financials

So it’s essential to regulate that upwards based mostly on the value adjustments for Uranium since then. That might push up the worth of Uranium inventories by about 40% and the worth of complete fairness by about 20%. URPY additionally did one other secondary offering and since this was accomplished above the tangible ebook, it was accretive to that tangible ebook worth. Adjusted for the money burn, we estimate that UROY is near about 1.75X tangible ebook worth. That quantity will not be notably excessive. It definitely will not be anyplace within the ballpark of the place it was in March 2022, the place we steered you may as properly promote (see, A Good Level To Exit). So regardless of the good rally, UROY has truly change into a bit cheaper than it was because the starting of the 12 months. That is in fact attributable to the massive rally in uranium costs and traders should determine if this new worth for uranium is sustainable.

The Warrants

Uranium Royalty Corp. WT EXP 120624 (OTC:URCWF), (URC.WT:CA) is an attention-grabbing play for individuals who suppose that the Uranium bull market is simply starting. UROY has no choices listed on the Canadian/TSX facet. There are alternatives current on the US facet and these run until July 2024. URCWF is the formally issued warrant from UROY, and it expires on December 6, 2024.

The Firm’s frequent shares and customary share buy warrants, every of which is exercisable into one frequent share at an train worth of $2.00 per share till December 6, 2024 (the “Listed Warrants”), are listed on the TSX below the symbols “URC” and “URC.WT”, respectively. The Firm’s frequent shares are traded on the NASDAQ Capital Market below the image “UROY”.

Supply: UROY Financials

This warrant is deep within the cash as the value on the TSX facet is at present CAD3.81.

So this warrant principally provides you a 2X leverage on UROY, which itself is leveraged to the value of Uranium. With warrants, typically we favor an out of the cash strike with a really lengthy expiry for hypothesis. The one-year out expiry is definitely fairly harmful, and we see danger of very excessive share losses if we’ve got a generalized bear market in 2024.

Verdict

UROY remains to be in its early phases of building a royalty portfolio. The valuation will not be demanding, because of an appreciating asset on the stability sheet, uranium stock. We do not personal this and do not have plans to both. For a direct publicity to Uranium, we’ve got really useful the Sprott Bodily Uranium Belief (OTCPK:SRUUF) (U.UN:CA).

The warrants add leverage on high of an already speculative funding and can amplify the beta. That isn’t our model. A extra prudent technique could be a coated name technique on the US facet, one thing just like what we did with Denison Mines Corp. (DNN) with a 50% return (See, Valuation Is Compelling For This Uranium Play). We’ll revisit this in 2-3 quarters to see if we truly can see the primary hints of income on the revenue assertion to rethink our choice.

Please observe that this isn’t monetary recommendation. It could seem to be it, sound prefer it, however surprisingly, it isn’t. Traders are anticipated to do their very own due diligence and seek the advice of with knowledgeable who is aware of their targets and constraints.

Editor’s Observe: This text discusses a number of securities that don’t commerce on a significant U.S. trade. Please pay attention to the dangers related to these shares.