XRP has taken buyers on an thrilling curler coaster journey this 12 months, taking them on a visit by means of the highs and lows of the market.

There have been a whole lot of ups and downs, from a small rise in March to an enormous surge in July and one other one in the course of October. Regardless that this thrilling journey has ended, XRP is now buying and selling at a mere $0.59, an enormous drop of 30% from its all-time excessive of $0.95.

Regardless of this, the present trajectory of XRP showcases a chronic consolidative sample spanning a number of months, hinting at a possible windfall for affected person buyers. As an example, a bullish head-and-shoulders setup is getting ready to completion, including a optimistic dimension to the outlook.

XRP: Purchase The Dip?

Within the occasion that the XRP worth maintains its upward momentum and efficiently breaches resistance, the stage is ready for a speedy and substantial rally to the upside, presenting a tantalizing alternative for these positioned to capitalize on the potential features.

After wanting on the present state of affairs, it appears like XRP is unquestionably within the “buy the dip” sector. For those who suppose that XRP will proceed to rise in worth, shopping for a number of the digital asset proper now would possibly appear to be an important probability to make some huge cash. Individuals who consider that XRP will go up in worth over the long run see investing in it now as deal.

XRP market cap at the moment at $32.2 billion. Chart: TradingView.com

Even within the face of the current correction inside the cryptocurrency market and the marginal dip in XRP’s worth, certain analysts maintain an optimistic stance, suggesting that Ripple’s coin is poised for a surge to unprecedented heights.

#XRP The Prepare

Subsequent Stops: $1.3-$3-$5.8-$27:

Macro View:

Reviving echoes from the 2017 surge, aiming for $27 looks like a believable goal. The markers at $3 and $5.8 stand as crucial milestones, but pushing to $6-$7 would possibly include some turbulence. These bold targets… https://t.co/Aojv3sYmtG pic.twitter.com/c0RSHhlFnA— EGRAG CRYPTO (@egragcrypto) November 27, 2023

Notably, Twitter consumer EGRAG CRYPTO stands for example, outlining the potential upcoming targets for the token, signaling a prevailing perception within the latent upward potential regardless of current market fluctuations.

EGRAG stated that XRP might go as much as $6 or $7 if it went above the “essential milestones” of $3 and $5.80. Primarily based on the way it did through the 2017 bull run, the skilled went on to say that he thought the token would explode to $27.

Within the present wave of market optimism, XRP is actively taking part, pushed by rising anticipation surrounding ETFs and witnessing probably the most substantial surge in inflows since late 2021.

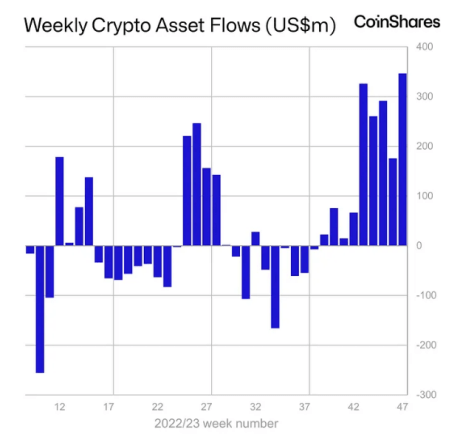

Primarily based on the latest report from CoinShares, digital asset funding merchandise noticed a formidable $346 million inflow within the earlier week alone. Considerably, this marks the best weekly influx throughout a nine-week streak, sparked by heightened expectations of a spot-based ETF launch in the USA.

Notably, this surge is notably probably the most strong because the bull market noticed in late 2021.

This bull run can be a particular one for $XRP

Final cycle we noticed HEAVY suppression & inactivity as a result of entire lawsuit subject

However issues have modified since then

The truth is, change is likely to be an understatement

As Ripple has flipped this round into probably the most BULLISH end result attainable… pic.twitter.com/PzDsPVAyyO

— Kyren (@noBScrypto) November 24, 2023

Optimistic Forecast For XRP

In the meantime, one other Twitter consumer who thinks Ripple’s coin goes to have an enormous surge quickly is Kyren. They declare there are a variety of explanation why XRP might expertise a “distinctive” bull run sooner or later.

The re-listing of XRP on key cryptocurrency exchanges, Ripple’s engagement with a number of central banks worldwide, and the corporate’s profitable streak in its authorized battle in opposition to the US Securities and Change Fee (SEC) are a couple of of those.

The broader crypto market is at the moment wanting good as a result of buyers are wanting ahead to the Federal Open Market Committee (FOMC) minutes which can be popping out quickly. The market can also be going up due to rumors concerning the approval of a Bitcoin Spot ETF and different optimistic occasions.

(This website’s content material shouldn’t be construed as funding recommendation. Investing includes danger. Whenever you make investments, your capital is topic to danger).

Featured picture from Krzysztof Kubicki/Pexels