anyaberkut

I’ve been a scholar of the inventory marketplace for 45-years, and I proceed to be taught. The inventory market is, directly, each a easy system and probably the most advanced system now we have created.

It’s the most advanced system as a result of, not solely will we not perceive how all of the variables work together with one another, we do not even know what all of the variables truly are. We do know, nonetheless, that a lot of the variables are particular person sentient beings who can change their habits in line with the information-content within the system, which itself is all the time altering.

The inventory market is an easy system within the sense that there are solely two constants: fund-flows and the emotion of worry. These two drivers of the market all the time transfer the market in a predictable style, though there’s typically a lag and random noise that comes into play. Within the long-run, nonetheless, the market all the time strikes in line with the fund-flows and in line with the herd’s worry response.

On this piece I current the fund-flow a part of my most up-to-date weekly abstract.

Fund-Flows

In comparison with fiscal-2023, the fund-flows in fiscal-2024 are considerably increased:

- +$60B in net-transfers for the month of December, in comparison with +$47B final December.

- +$391B up to now this fiscal-year, in comparison with +$365B final 12 months at the moment.

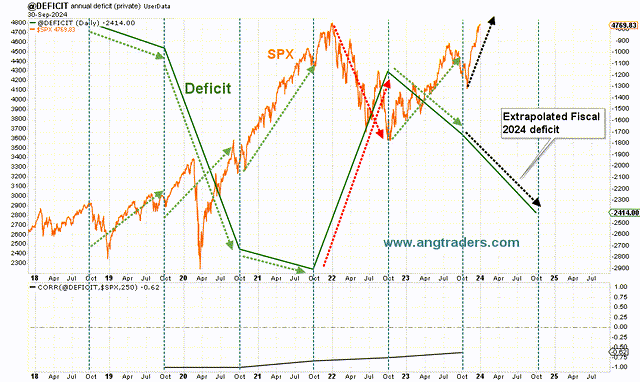

The chart under demonstrates how the SPX has a destructive correlation with the Federal spending-deficit; because the deficit will increase (will get extra destructive) the SPX will get extra constructive (inexperienced arrows). And when the deficit is lowered (will get much less destructive), the SPX pulls again (crimson arrows). The fiscal-2024 deficit is rising (extra destructive) relative to final 12 months (black arrows) and the SPX is reacting increased as anticipated.

Deficit-Spending (ANG Merchants, stockcharts.com)

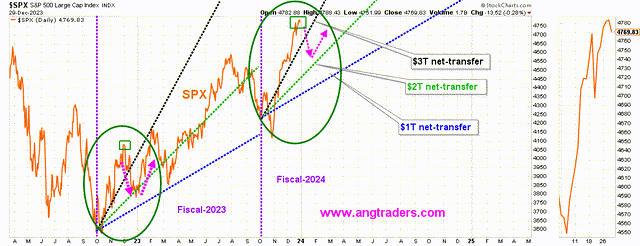

As was the case final 12 months, the SPX has over-extended itself relative to the net-transfer fee; The SPX is above the $3T/12 months net-transfer fee (black line under) and we anticipate that it’s going to transfer decrease, nearer to the $2T/12 months fee (inexperienced line) prefer it did final 12 months; the mid-January tax-take may present the excuse for a pullback. Nevertheless, the underlying market construction stays strongly bullish.

Web-Switch charges (ANG Merchants, stockcharts.com)

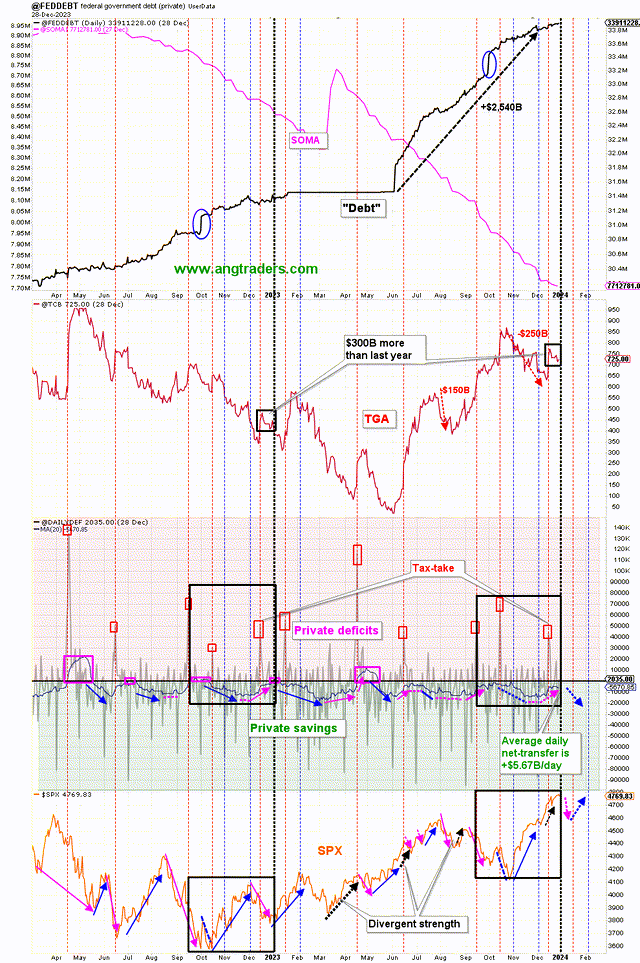

- The 20-day common of the each day net-transfers is +$5.67B/day which could be very wholesome in comparison with -$1.0B/day on the identical time final 12 months.

- The Treasury Common Account steadiness is $300B increased than it was final 12 months (black containers on the TGA chart under); this represents potential elevated future spending which corresponds to a better inventory market.

- The mid-January tax-take may present the excuse for a short-term pullback within the SPX.

Abstract Fund-Flows (ANG Merchants, stockcharts.com)

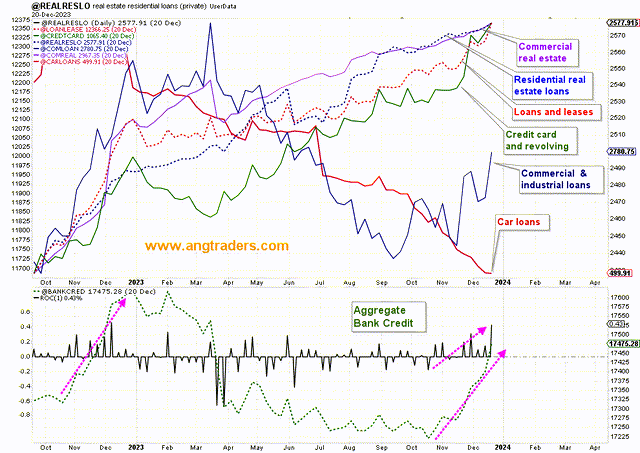

Financial institution credit score, the opposite supply of liquidity, was lowering throughout 2023 till October (begin of fiscal-2024) and has been rising ever since. It stays to be seen if it should proceed to extend for the reason that first quarter of the calendar-year tends to weaken financial institution credit score temporarily– 2023 was uncommon as a result of the credit score pullback lasted all 12 months, so maybe 2024 will see financial institution credit score not weaken within the first quarter.

Combination Financial institution-Credit score (ANG Merchants, stockcharts.com)

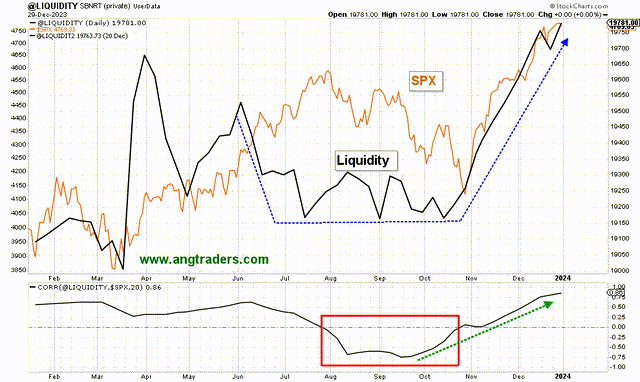

Our liquidity mannequin has been rising steadily since October (aside from a small dip the week earlier than final).

Liquidity (ANG Merchants, stockcharts.com)

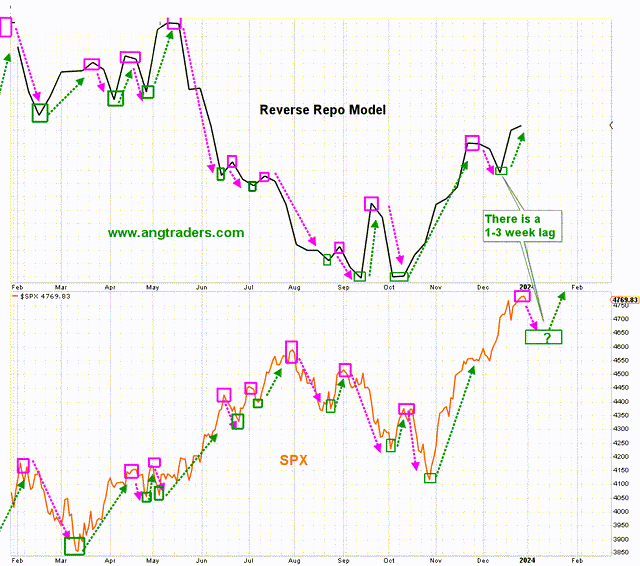

The reverse repo mannequin made a low (inexperienced field) a few weeks in the past and we anticipate the SPX to make a low within the subsequent two weeks.

Reverse Repo Mannequin (ANG Merchants, stockcharts.com)

Traders ought to have a possibility to “buy-the-dip’ over the subsequent two weeks.

“It’s in all probability the one report of its sort on the planet when you concentrate on it.“

“ I’m SO VERY grateful for the invention of this web site, and the knowledge and information I’ve gained ... “

” I’ve not seen one of these evaluation wherever else. Please sustain the superior work! – James “

“ Pleased ANG subscriber right here. I imagine them to be the very best broad market analysts on in search of alpha. “

” Greatest right here in in search of alpha…@ANG Merchants . Better of the very best! “

Make the most of our14-day free trial and keep on the precise aspect of the market and Away From the Herd.