CoffeeAndMilk/E+ by way of Getty Pictures

Overview

My suggestion for Common Music Group (OTCPK:UMGNF) is a purchase ranking, as I imagine the enterprise is well-positioned to learn from the rising adoption of music subscription companies. Notably, I believe the time for a worth hike is close to the nook, which might be a key progress driver for UMGNF transferring ahead.

Enterprise

UMGNF is a diversified conglomerate overseeing a large spectrum of enterprises encompassing recorded music, music publishing, merchandising, and audiovisual content material throughout over 60 world areas. Their core actions contain the invention and nurturing of proficient recording artists and songwriters. Moreover, UMGNF is deeply concerned within the manufacturing, distribution, and promotion of music. Over the previous 5 years since 2017, the enterprise has continued to develop at a really wholesome clip of 13%, from EUR5.6 billion in income in FY17 to EUR10.3 billion in income in FY22. Not solely was income an incredible performer, however enterprise profitability has additionally continued to enhance at a gentle clip, from EUR977 million in FY18 to EUR2 billion in FY22. The enterprise reviews in 3 segments: recorded music, music publishing, and merchandise, which symbolize 77%, 17%, and 6% of FY22 income, respectively. An analogous ratio is for EBITDA as properly, at 81%, 17.5%, and 1.5%, respectively.

UMG

Latest outcomes & updates

UMGNF’s 2Q23 outcomes have been a powerful success. Group revenues have been 6% larger than anticipated. Subscription streaming grew at a quicker clip than anticipated, growing to 13.0% from 10.3% in 1Q23, and ad-supported progress elevated to five.3% from -2.2%. Robust working leverage and EUR24 million in money compensation financial savings contributed to an adjusted EBITDA of EUR590 million, which was 9% larger than projections. UMGNF’s 2Q23 outcomes present the corporate can adapt and thrive in a digitally remodeled (subscription-based) market, for my part.

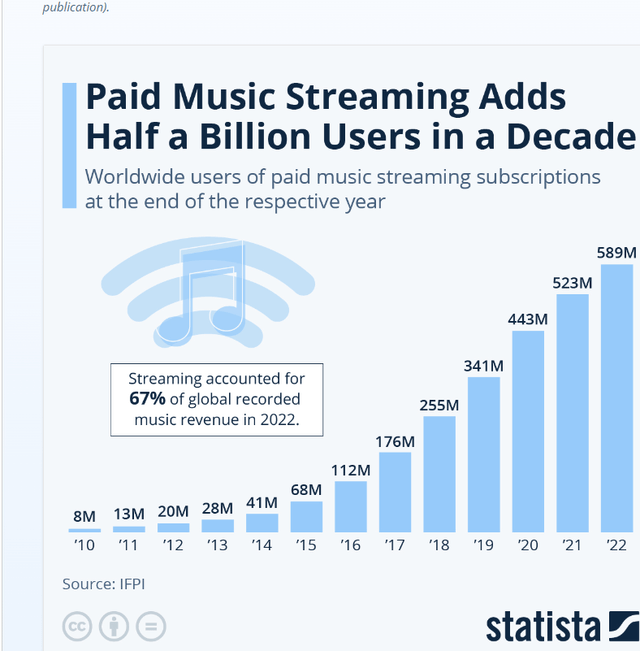

For my part, UMGNF will profit from streaming’s continued fast growth past 2023. The IFPI, as referenced within the 1Q23 earnings name, predicts that the market will increase by no less than 25% within the coming years because the variety of subscribers will increase from 600 million to greater than 1 billion. Whereas it took the world greater than a decade to succeed in 600 million subscribers, I imagine the incremental subscriber provides from right here might be at an accelerated tempo given the web infrastructure (cellular web bandwidth was not adequate to help music streaming again then) and demographic tailwind (youthful generations demand comfort greater than older individuals).

Statista

With increasingly more individuals utilizing music streaming companies like Spotify, YouTube Music, Deezer, and many others., I anticipate these corporations to boost their costs, which might be excellent news for main file labels like UMG which have revenue-share licensing agreements with these companies. To present some context on why these subscription platforms are essential, First, income traits within the trade have shifted positively because the introduction of digital music streaming platforms, following years of structural decline as a result of proliferation of digital piracy within the early 2000s. Royalties from streaming have begun offsetting losses from the sale of bodily downloads, which has been optimistic for the trade. The subscription mannequin is central to streaming’s success, in essence. There are simply so many extra advantages to streaming, which is the explanation why I’m optimistic concerning the trade. For example, the platforms both cost a month-to-month charge in trade for entry to the whole music library or they provide the service without cost in trade for the listener’s consideration to ads. Since subscriptions have turn into a lifestyle for many individuals and costs have been relatively stable for a very long time, I believe it is honest to boost them now. This might be just like the Netflix mannequin, during which they have been low-cost for many of the 2020s till everybody obtained “hooked” to the companies, then they began elevating costs, gushing in tons of money. I believe the platforms will observe an identical sport plan, which might be music to UMGNF’s ears.

Valuation and danger

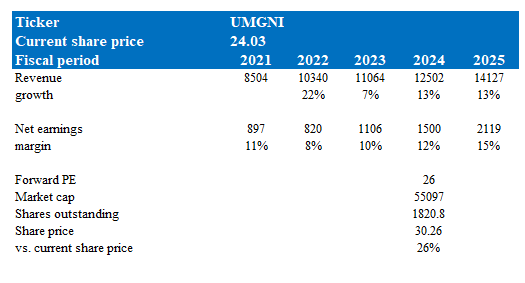

Writer’s valuation mannequin

In response to my mannequin, UMGNF is valued at $30 in FY24, representing a 26% enhance. This goal worth is predicated on my progress forecast of low teenagers in FY24 and FY25, which is the enterprise’s historic progress charge, supported by subscriber progress and in addition worth will increase. As income grows and UMGNF continues to expertise working leverage, margins shouldn’t have any points increasing again to historic ranges within the mid-to-high teenagers proportion vary. UMGNF 26x ahead PE, which I imagine to maintain at this degree as I anticipate progress and margins to proceed increasing. At 26x PE, UMGNF is buying and selling in step with Warner Music Group (WMG), which is buying and selling at 25x ahead PE. Each of those corporations are anticipated to develop equally and have related margins.

The chance with UMGNF is that its adoption of streaming subscription companies may be quite a bit slower as UMGNF will now have to penetrate growing markets. In these markets, it could be powerful for UMGNF to start out with excessive costs (to help pricing progress). As such, progress may be slower than anticipated over the medium time period.

Abstract

I like to recommend a purchase ranking for UMGNF as a consequence of its favorable positioning to capitalize on the rising adoption of music subscription companies. Latest outcomes, such because the sturdy 2Q23 efficiency, exhibit UMGNF’s capability to adapt and thrive within the evolving digital market. The continuing growth of the music streaming trade is predicted to learn UMGNF, particularly as subscriber numbers proceed to rise. Moreover, the potential for worth will increase in streaming companies is a optimistic indicator for main file labels like UMGNF, which have revenue-sharing agreements with these platforms. This aligns with the trade development of streaming platforms evolving their pricing fashions over time, akin to the success seen within the streaming video trade.

Editor’s Notice: This text discusses a number of securities that don’t commerce on a significant U.S. trade. Please pay attention to the dangers related to these shares.