Blockchain intelligence agency Chainalysis lately reported a decline in stablecoin buying and selling quantity in the US.

“Although U.S. entities initially helped legitimize and seed the stablecoin market, extra crypto customers are pursuing stablecoin-related exercise with buying and selling platforms and issuers headquartered overseas,” the report said.

United States Dropping Stablecoin Market To Abroad

In response to Chainalysis, stablecoins have been liable for greater than 50% of all on-chain transaction quantity on centralized exchanges in latest occasions.

The report said:

“Chainalysis information reveals that greater than half of all on-chain transaction quantity to or from centralized providers between June 2023 and July 2022 passed off in stablecoins.”

Nonetheless, throughout this era, most stablecoin inflows to the 50 largest crypto providers have transitioned from providers licensed within the US to these abroad.

“As of June, a 54.6% share of stablecoin inflows to high 50 providers have been going to non-U.S. licensed exchanges.”

Learn extra: What Are Algorithmic Stablecoins?

US Authorities’s Rising Concern for Stablecoin Regulation

Nonetheless, the report highlights the truth that nearly all of stablecoins are tied to the US greenback. Moreover, it factors to the significance of the US authorities’s vigilant regulation efforts:

“Greater than 90% of stablecoin exercise takes place in stablecoins pegged to the U.S. greenback. U.S. regulators have a powerful curiosity in exercising some regulatory authority over stablecoins, given the central function of USD-denominated reserves to those belongings.”

In the meantime, Jason Somensatto, Head of North American Public Coverage at Chainalysis noticed that regulating stablecoins presents sure complexities, however these points are anticipated to be resolved within the close to future:

“These debates are resolvable and must be solved quickly within the curiosity of worldwide competitors and essential regulation.”

This comes following the U.S. Home Monetary Companies Committee publishing a draft of its stablecoin invoice on April 15. The Invoice suggests a number of adjustments, together with a pause on algorithmic stablecoins and giving the Federal Reserve management over stablecoins from nonbank corporations.

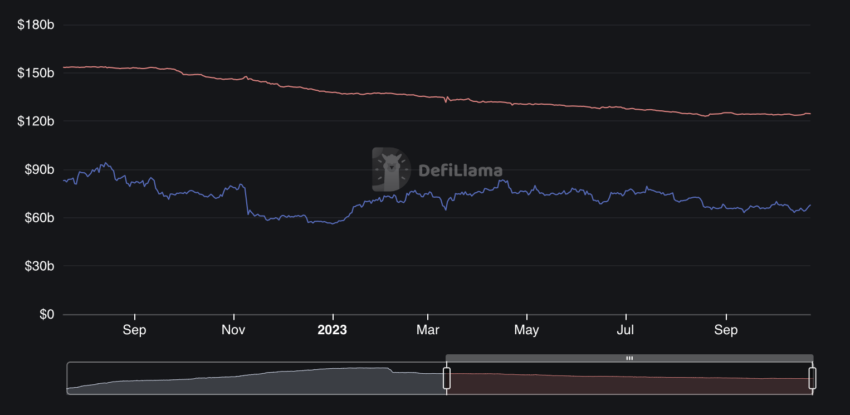

In response to DefiLlama, the whole market cap of stablecoins at present quantities to $124.56 billion. In the meantime, USDT boasts a dominant share of 67.6%.

On September 22, BeInCrypto reported that new information revealed the market capitalization of stablecoins fell to $124 billion in September. This was its lowest stage since August 2021.

Nonetheless, amongst 118 stablecoins, BUSD and FRAX recorded essentially the most substantial declines among the many high 10 by market capitalization.

BUSD’s market cap decreased by 19.2% to $2.5 billion. In the meantime, FRAX noticed a decline of 16.7%, bringing its market cap all the way down to $670 million.

Learn extra: What Is a Stablecoin? A Newbie’s Information

Disclaimer

In adherence to the Belief Venture tips, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to offer correct, well timed data. Nonetheless, readers are suggested to confirm information independently and seek the advice of with knowledgeable earlier than making any selections based mostly on this content material.