Uniswap is increasing its presence on L2 chains regardless of fears of a slowdown in September. The previous 12 months marked a transfer to L2 as a result of demand for extra favorable charges.

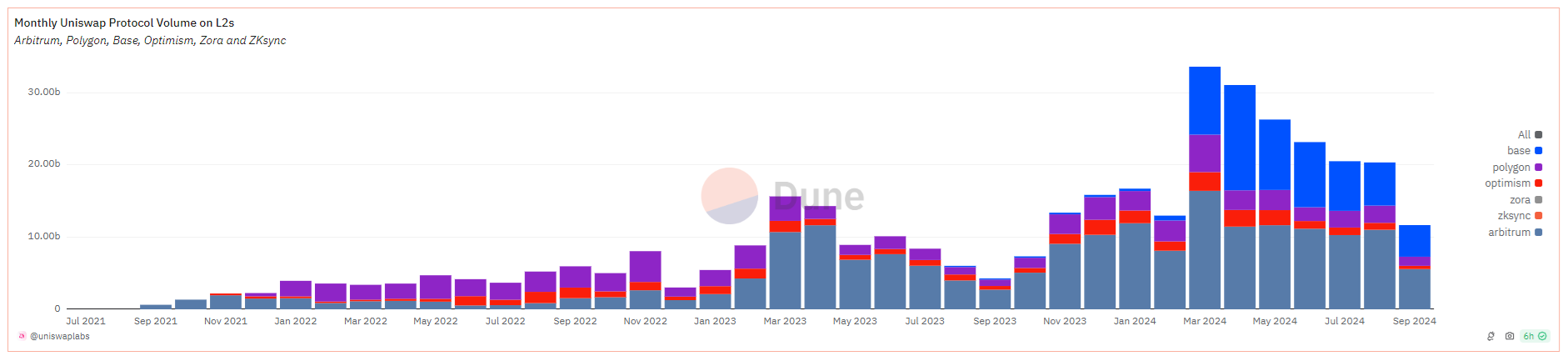

Uniswap V3 has elevated its presence on L2 chains over the previous 12 months. For September, the main DEX recorded a threefold improve in volumes in comparison with the identical month final 12 months. Uniswap had $11.68 billion in swaps, up from $4.29 billion in September 2023.

Throughout that point, Uniswap expanded its presence to a complete of 23 chains. The dominant ones are nonetheless Base and Arbitrum, as a result of low charges and lively advertising. Shortly after launch, Base started to maneuver liquidity swimming pools for Ethereum, primarily because of the creation of meme tokens.

Uniswap had a profitable 12 months with L2 chains. | Supply: Dune Analytics

On account of DEX’s vibrancy, Uniswap reached $43.28 million in month-to-month charges. Whereas Uniswap skilled a slowdown in September, the previous few months have been essentially the most profitable within the historical past of the DEX. The fast inflow of customers on Base made Uniswap the chief in meme token swaps.

The previous 12 months additionally noticed Uniswap develop on the Celo protocol. Celo remains to be an L1, however could change to an L2 to higher align with the tradition of Ethereum (ETH).

Uniswap’s progress on L2 reached greater than 20x since 2021. By 2024, Uniswap will break its personal document of $192 billion in annual transactions. On the similar time, Ethereum stays the layer that also carries $3.72 billion locked in worth as a result of outdated swimming pools and pairs. Ethereum remains to be the biggest supply of stablecoins, regardless of the inflow of USDT into Arbitrum and different L2 cash.

Arbitrum leads in volumes, however Base has essentially the most swimming pools

Uniswap’s success depends upon transporting each large-scale volumes and a number of small swimming pools. Arbitrum is the chief by way of volumes, with greater than $211 million in every day enterprise.

On Arbitrum carries Uniswap V3 251 cash in 485 pairs. The identical model on Base displays a way more lively token minting, with 338 cash and tokens totaling 694 {couples}. One of many largest issues for Base is the presence of pairs with low liquidity. A number of dozen addresses on Base have certainly stimulated visitors, however primarily by means of low-quality carpets.

A number of swimming pools have emerged in latest months, most of them now inactive. Whereas enlargement on Base is seen as optimistic for Uniswap, the presence of unverified tokens and just-launched swimming pools distorts the true buying and selling image.

Uniswap competes with Aerodrome in locked worth. Aerodrome goals for pairs with excessive liquidity, whereas Uniswap provides a wider number of tokens. From September 25, Uniswap will lock down $215 million in worth within the base model and is the second most lively app.

On Arbitrum, the Uniswap V3 swimming pools embody $291.99 million in all liquidity pairs. Uniswap is the biggest DEX on the L2 chain, surpassed solely by GMX perpetuals and Aave’s credit score swimming pools.

Uniswap remains to be the most effective Ethereum fuel burner

Regardless of the shift to L2, Uniswap nonetheless depends on Ethereum. The Uniswap routing service is essentially the most extensively used L1 good contract. Prices on Uniswap reached round $45,000 per hour, or $896K within the final 24 hours.

Ethereum itself carries 37.7% of all DEX volumes, for each massive and area of interest markets. WETH remains to be essentially the most influential asset for hyperlinks, together with USDT and USDC. The presence of bridged or native stablecoins on L2 has additional boosted decentralized volumes in 2024.

Uniswap now faces competitors from different DEX which have additionally grown prior to now 12 months. The main market nonetheless has a 45% market share of all the DEX market. Different hubs resembling Aerodrome are shortly catching up with a 20.6% share.

CurveDEX can also be build up its volumes, that are already lively $1.78 billion by way of liquidity. DEXs are already including options for focused liquidity, a device that permits minimal slippage inside a predetermined worth vary.

Whereas Uniswap prepares to launch V4 swimming pools, the UNI token remains to be in consolidation. UNI was buying and selling close to a one-month excessive of $6.84, however nonetheless removed from its year-to-date excessive of $15.20. UNI remains to be ready for a breakout, with a chance of $20 throughout a bull market. UNI additionally accomplished all token unlocks as of September 18, giving up one supply of potential worth stress.

Cryptopolitan reporting by Hristina Vasileva