- UNI confronted rejection on the $12.85 mark, just under the $13.1 liquidity pocket.

- A transfer under $10 was seemingly, however merchants ought to watch out for volatility.

Uniswap [UNI] registered an 81% transfer increased on the twenty third of February, measured from the day’s low to excessive.

This got here after a proposal to overtake the governance system was submitted by the Uniswap Basis’s Governance lead, Erin Koen.

AMBCrypto reported that the token was prone to rally towards $13.1, and the twenty fourth of February noticed UNI attain $12.85. This was a significant pocket of liquidity, and the bulls have been quickly rebuffed.

The place are the costs prone to go subsequent?

The honest worth hole may see historical past repeated

The cyan channel from $3.65 to $7.7 represented a variety formation on the weekly chart. In November, UNI broke out previous the mid-range degree at $5.3, forming a good worth hole (FVG, decrease white field).

This area was retested a number of occasions in current months as assist, however UNI didn’t shut a day by day session beneath 50% of the FVG’s width.

Equally, Uniswap’s current rally to $12.85 fashioned a big FVG, or imbalance. The 50% mark for this imbalance stood at $9.22. A retracement to this assist would current an excellent shopping for alternative.

Swing merchants have to be ready for volatility, although. Even a plunge as little as $7 can be thought of to be throughout the demand zone.

The RSI and the market construction have been firmly bullish. Nevertheless, the OBV retraced all of the positive aspects made. It’s not a sign of a reversal by itself, but it surely means that the bulls have run out of steam, no less than for the second.

Revenue-taking exercise may pull UNI costs decrease

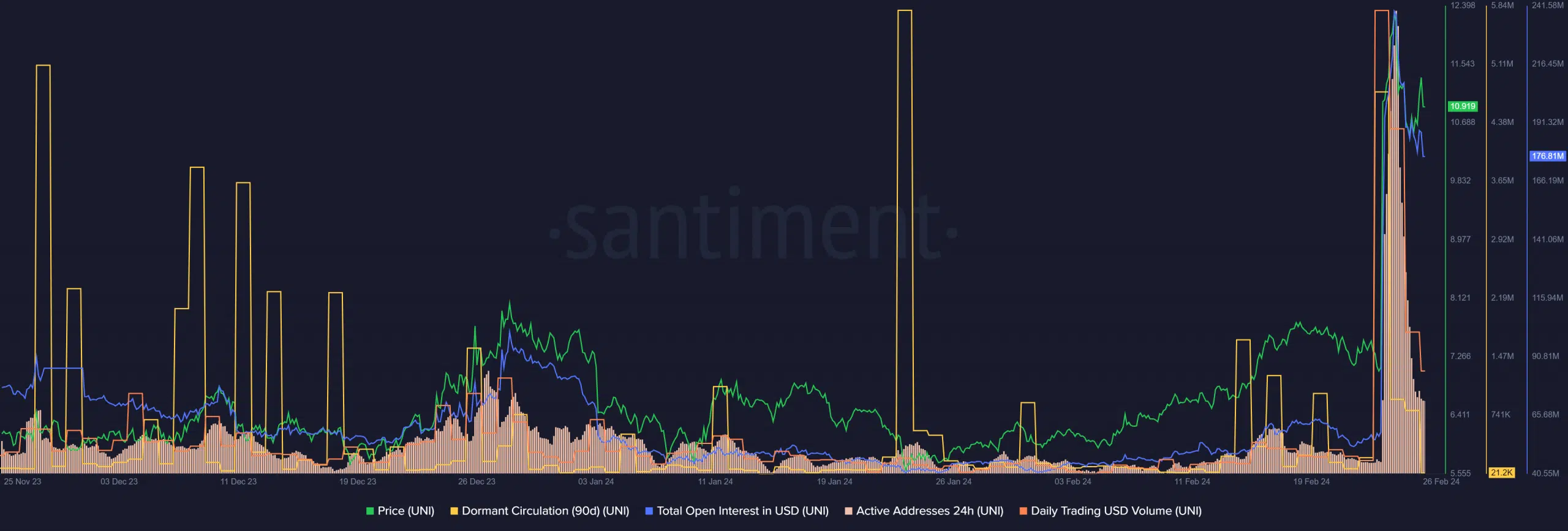

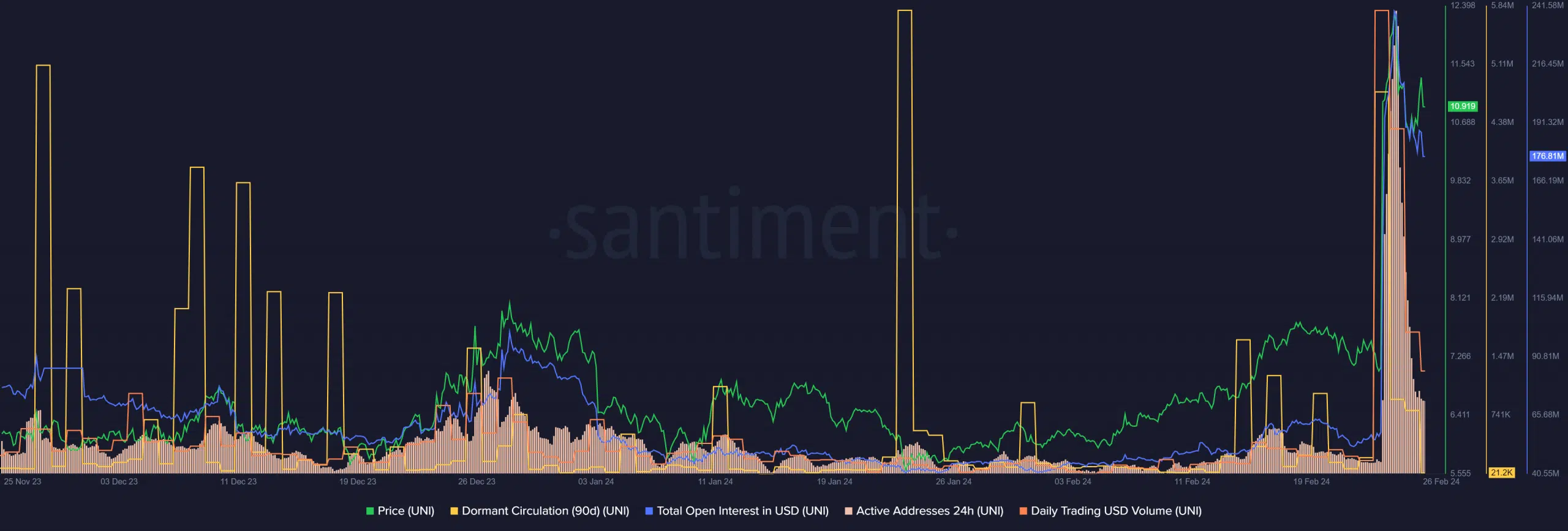

Supply: Santiment

The full Open Curiosity and the day by day buying and selling quantity noticed big spikes on the twenty third of February. This was an indication that real demand and FOMO was behind the rally.

Additionally, at press time, the OI had fallen from $239 million on the peak to $176 million. This may very well be a results of late longs being liquidated.

Speculators may thus wish to be cautious of volatility within the UNI market and may very well be higher off ready for a decrease timeframe vary formation.

Is your portfolio inexperienced? Verify the Uniswap Revenue Calculator

The energetic addresses additionally surged and have fallen dramatically, however remained far increased than the early February lows.

The dormant circulation surge steered that holders have been energetic in reserving income and promoting their UNI tokens.

Disclaimer: The knowledge introduced doesn’t represent monetary, funding, buying and selling, or different forms of recommendation and is solely the author’s opinion.