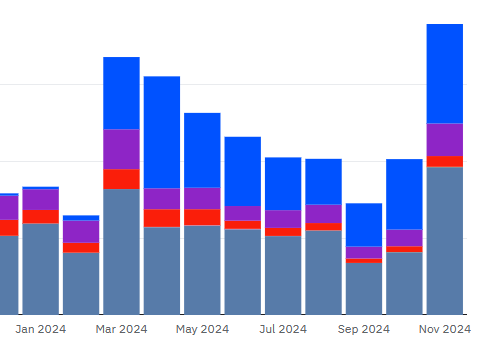

Uniswap exercise rebounded final month, with a brand new exercise document on L2 chains. The Uniswap variations on Base and Arbitrum led the best way, resulting in new all-time buying and selling quantity.

Month-to-month volumes for Uniswap variations on L2 chains reached a brand new all-time excessive. The growth was pushed by the variations on Arbitrum and Base, the 2 main L2 chains within the apps and exercise house. Uniswap exercise elevated on expectations of a dovish stance from Trump’s renewed Securities and Alternate Fee (SEC) crew.

Uniswap’s volumes on Arbitrum grew from $8.1 billion in September to $19.28 billion on the finish of October. Uniswap V3 on this L2 chain is behind Aave and GMX, two DeFi protocols with lending vaults and a a lot greater worth locked. Nevertheless, Arbitrum is turning into a serious platform for scalable, lower-cost DEX buying and selling, with over $365 million in liquidity within the decentralized buying and selling pairs.

On Base, buying and selling volumes elevated from $9.91 billion to $12.97 billion, whereas Uniswap remained the second most lively DEX on the tokenless chain. Uniswap’s progress has coincided with a normal restoration for L2 initiatives, by way of token market value and transaction exercise.

Uniswap expanded its exercise to an all-time excessive, boosted by its variations on Arbitrum and Base. | Supply: Dune Analytics

Uniswap V3 is the most typical DEX, with illustration in a complete of 23 L1 and L2 chains. Nevertheless, many of the exercise focuses on a handful of high chains. That is because of the fragmented liquidity, which is within the allotted liquidity pairs. There may be little spillover between Uniswap V3 variations, though there are vital liquidity inflows and outflows between high L2 and Ethereum.

Uniswap charges transcend Ethereum

The elevated exercise on Uniswap is mirrored in each month-to-month and short-term charges. As of November 27, Uniswap surpassed Ethereum and was among the many high 5 payment producers amongst chains and apps. The Uniswap Common Router burns greater than 10% of the overall gasoline on Ethereum, even surpassing the Tether (USDT) good contract. Uniswap’s primacy additionally reveals Ethereum’s fundamental use instances, with an emphasis on stablecoin transfers and DEX buying and selling.

Uniswap produced $5.44 million in charges for all chains, surpassing Ethereum. The DEX nonetheless trails Raydium, with $6.44 million in charges. Uniswap could have an opportunity to surpass Raydium if meme token exercise continues to say no.

Uniswap V3 earned $100.43 million in charges thus far in November, making it the strongest month within the second half of the yr. The current efficiency even surpasses October’s success, displaying that DEX additionally responds instantly to market rallies. Based mostly on Token Terminal information, Uniswap achieved this end in October $59.91 million in compensation.

The DEX nonetheless has $7.86 million in month-to-month losses from paying out incentives. Nonetheless, Uniswap is a internet profit to its ecosystem contributors and liquidity suppliers.

The elevated exercise on Uniswap is just not attributable to memes, as swaps on Ethereum are nonetheless comparatively costly. As an alternative, Wrapped ETH (WETH) is essentially the most lively asset, traded as a option to bridge liquidity to different belongings. Uniswap additionally depends on USDT stablecoins to money out WETH. Buying and selling WETH could be a option to lock in earnings, or to guess on the worth of ETH on the open market.

Uniswap ranks sixth in complete locked worth, and has $6.19 billion in liquidity in its buying and selling pairs. Up to now month, the locked worth has elevated by 30% as ETH and different belongings elevated in worth.

UNI token displays peak efficiency in November

UNI tokens broke above USD 13.20 and reached a one-month excessive. UNI has an opportunity to achieve the 2024 excessive at $15.39 once more, this time buying and selling on greater volumes in comparison with the Might peak. UNI has been accumulating for months and is now ready for a breakout as hypothesis strikes to altcoins.

UNI’s open curiosity rose to a six-month excessive of $212.9 million, with 65% dominance of lengthy positions. At this stage, UNI could stay dangerous within the quick time period, however maintains optimism for long-term growth to all-time highs. UNI is seen as a long-term bullish token, reflecting the indispensable DEX exercise for crypto adoption.

DEX tokens as a complete grew to become extra lively, surpassing $38 billion in worth. UNI was among the many greatest gainers, rising 53% in every week, surpassing the expansion of Raydium (RAY). Demand for DEX tokens additionally elevated different belongings equivalent to JUP and CAKE, attributable to elevated decentralized buying and selling.

Touchdown a Excessive-Paying Web3 Job in 90 Days: The Final Roadmap