JHVEPhoto

A big multinational client staples enterprise just like the one in all Unilever (UL) doesn’t carry any associations with excessive and speculative returns over the short-term.

As an alternative, an organization like UL is a car for wealth preservation and above market returns as soon as threat is taken into consideration. After all, there are intervals of time when perceived threat out there is low and a enterprise like that is put at a major drawback to the excessive development names.

That’s the reason, it’s important for long-term shareholders to build up extra inventory when it is beneficial to take action. For my part, one such interval was final October, after I coated Unilever as a excessive conviction concept for my subscribers.

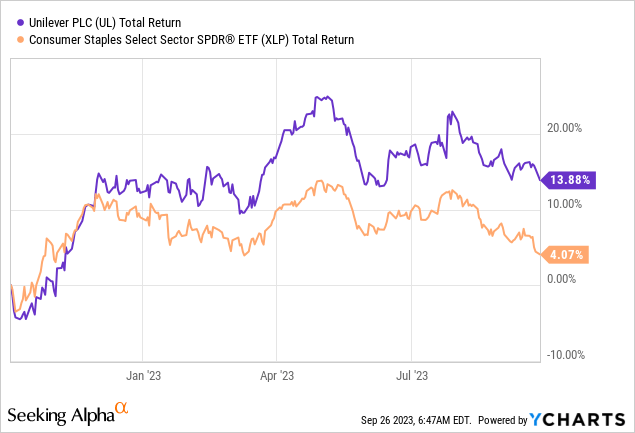

Regardless of all of the headwinds, UL delivered a complete return of practically 14% since then, thus considerably outperforming the Shopper Staples Choose Sector SPDR® Fund ETF (XLP) on an absolute foundation.

Unilever can be among the many largest positions in my private portfolio and the portfolio that tracks all of my excessive conviction concepts.

Searching for Alpha

Now that development shares are at vital threat of underperforming as a result of altering financial circumstances, worth names like Unilever are as soon as once more engaging. On prime of that, Unilever specifically has some vital traits that bears are ignoring or lacking out as a result of emotional biases.

The place Bears Are Getting It Flawed

Lagging income development and slower than anticipated turnaround in margins are among the many key speaking factors of Unilever’s bears. This highlights the poor understanding of the enterprise and is usually as a result of framework of evaluating development shares being utilized right here.

I’ll discuss margins within the subsequent part of this text, because it is among the key points of my funding thesis. However relating to development, Unilever’s topline determine has expanded by 17% since 2019 (pre-pandemic) which is nearly 5% on an annual foundation.

This may not sound as a lot, however it would not consider the numerous quantity of disposals that Unilever’s administration has made in recent times. Furthermore, after the extreme hit on Unilever’s enterprise throughout the pandemic and the latest inflationary pressures, the sturdy model portfolio has allowed for vital worth will increase which in the end led to a close to double-digit development fee for the primary half of 2023.

Unilever Q2 2023 Earnings Launch

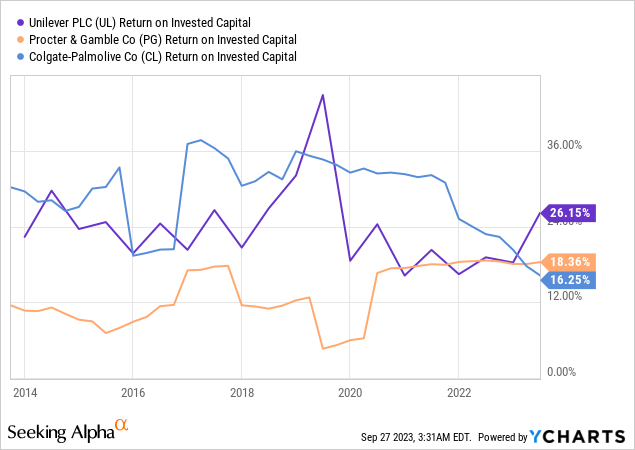

Extra importantly, traders ought to be following intently Unilever’s margins and return on capital, which has improved significantly over the previous 12 months.

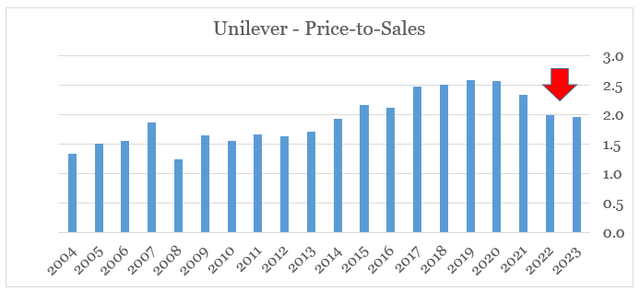

As Unilever’s enterprise is slowly bettering and the extra centered model portfolio permits for vital worth will increase with out lack of market share (extra on that later), the market has turn into more and more bearish on the inventory. For instance that, we might have a more in-depth have a look at the corporate’s Worth-to-Gross sales a number of, which has declined from 2.6 in 2020 to lower than 2.0 as of right now.

ready by the writer, utilizing information from annual experiences

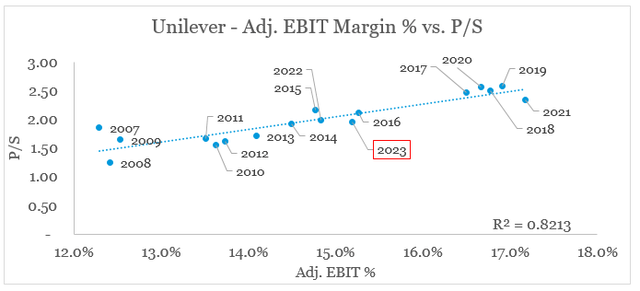

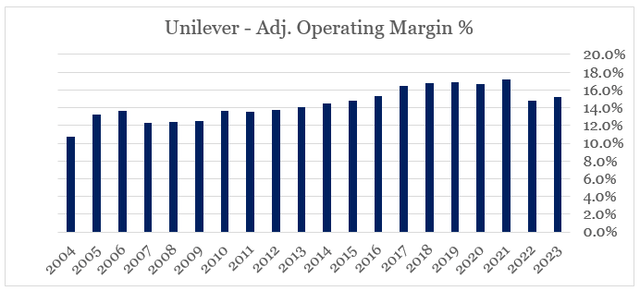

Though I see no justifications for this past the short-term, the truth is that Unilever’s present working margin cannot help a better a number of at the same time as topline development stays elevated. The rationale why I’m saying that is due to the greater than a decade-long sturdy relationship between UL’s Worth-to-Gross sales a number of and its Adjusted Working Margin.

ready by the writer, utilizing information from annual experiences and Searching for Alpha

What this implies is that the 14% return we noticed originally of this text was virtually totally as a result of Unilever’s elevated gross sales development, which was greater than sufficient to offset the latest decline in profitability. As we glance ahead, nonetheless, margins are set to enhance whereas development will decelerate however is unlikely to be beneath the speed of inflation.

A Backside In Profitability

As I discussed above, Unilever skilled a serious drop in working margin in 2022, and though there was some enchancment over the primary half of 2023, they continue to be at of their lowest ranges in 2016.

ready by the writer, utilizing information from annual experiences

We additionally noticed that the market is presently pricing in a situation through which this stage of profitability will stay fixed. For my part, that is the place the market is getting it fallacious and the place the chance lies.

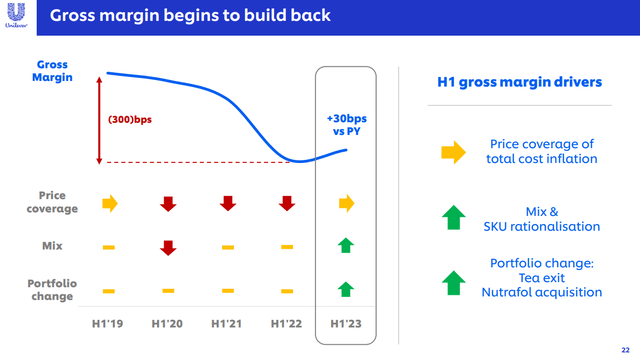

To start with, one of many main causes for the decline has been the drop in Unilever’s gross margin. This, in flip, has been induced by the point mismatch between the latest worth enhance in uncooked supplies and the complete implementation of Unilever’s worth will increase.

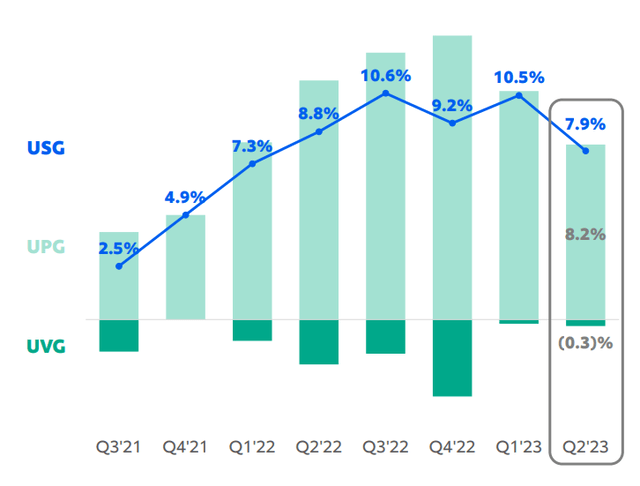

As worth will increase proceed to movement via the topline determine, Unilever’s gross profitability will expertise a tailwind within the coming quarters, however extra importantly is that even the double-digit worth development (UPG on the graph beneath) didn’t end in a cloth quantity loss (see UVG beneath).

Unilever Investor Presentation

Thus, the worth protection of complete inflation would probably have a cloth optimistic impression on Unilever’s gross margin going ahead, along with the present tailwinds ensuing from the portfolio optimization and restructuring.

Unilever Investor Presentation

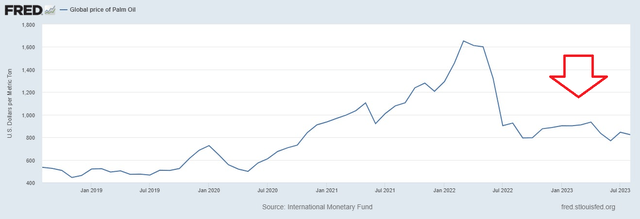

As standard, commodity costs stay because the wild card within the equation, however we’re already seeing a notable cool-off in a few of Unilever’s most important uncooked supplies used. For instance, the corporate is among the largest patrons of palm oil within the client items business and the worldwide worth of the oil is already down considerably.

FRED

One other vital enter for Unilever is soybean oil, which stays elevated in worth, however has come down barely from its latest prime and now trades well-below the 2022 highs.

FRED

Conclusion

Over the previous 12 months, Unilever has outperformed the broader client staples sector as topline development determine got here in greater than anticipated. Within the meantime, bears stay centered on issues within the rear-view mirror, comparable to decrease profitability and the fading impression of upper product pricing. The error they’re making is that margins are actually set to enhance and will drive an upward a number of repricing. Final however not least, the extra optimized and really sturdy model portfolio will enable for reasonable topline development.

Editor’s Notice: This text discusses a number of securities that don’t commerce on a serious U.S. change. Please pay attention to the dangers related to these shares.