fotostorm

I’m nonetheless amazed by how a lot Uber (NYSE:UBER) has modified through the years. The corporate was previously referred to as a typical money guzzling title within the tech sector, however has reworked itself right into a money flowing enterprise. The pandemic introduced a standstill to its ridesharing enterprise, however it took that chance to develop its meals supply community. The upper rate of interest setting could also be now sarcastically serving to the corporate, because it makes it tougher for its foremost competitor in Lyft (LYFT) to compete on worth. UBER achieved its first GAAP revenue this quarter, however I clarify why it could be nonetheless too early to rejoice. I proceed to see the inventory as being undervalued at present ranges as shopping for alternatives start to dwindle within the tech sector.

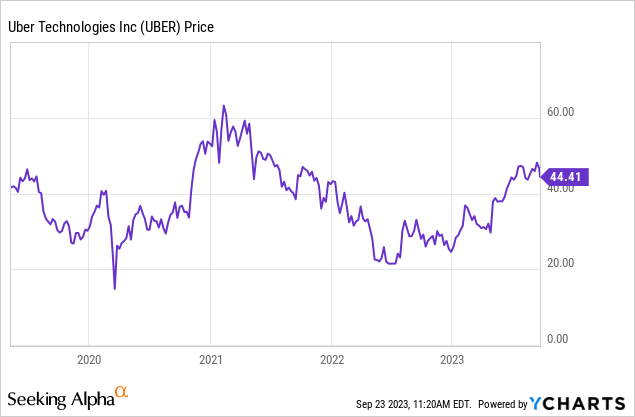

UBER Inventory Worth

UBER is lastly buying and selling increased than its IPO, however it’s a considerably completely different firm than then.

I final coated UBER in June, the place I rated the inventory a purchase because of its potential to thrive amidst the upper rate of interest setting. That thesis continues to play out as the corporate continues to develop margins and present stable progress regardless of the robust macro setting.

UBER Inventory Key Metrics

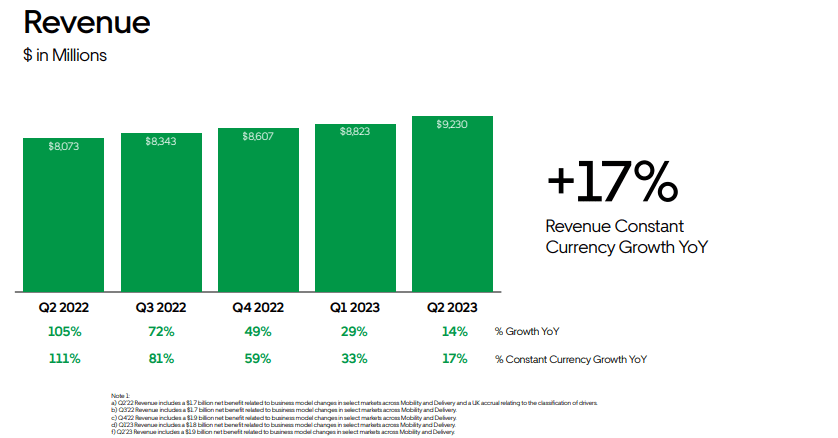

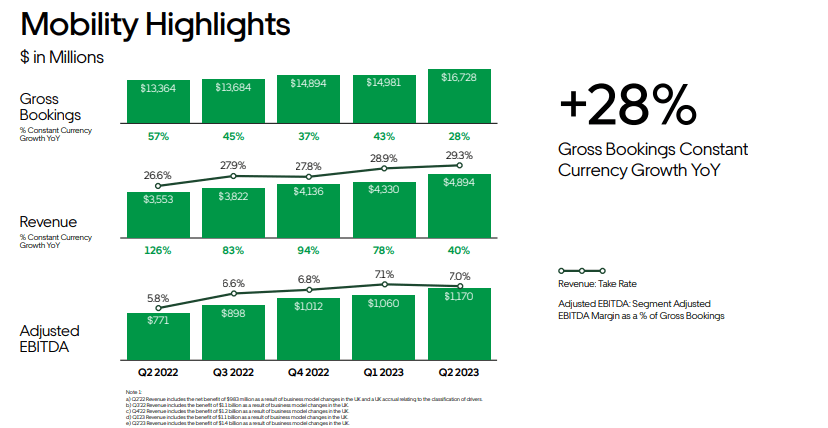

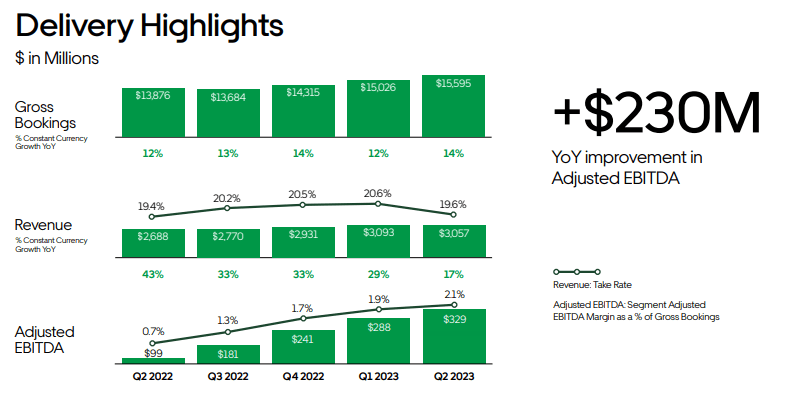

In its most up-to-date quarter, UBER delivered gross bookings of $33.6 billion, up 16% YOY and on the higher finish of steering. Income grew 17% YOY to $9.2 billion.

2023 Q2 Presentation

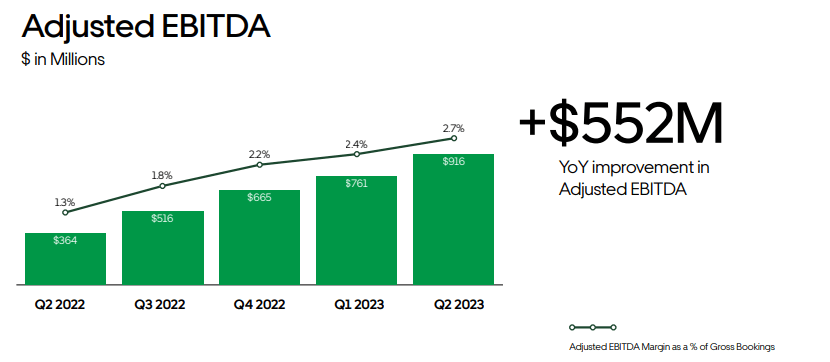

UBER beat administration steering of adjusted EBITDA of $800 million to $850 million, with adjusted EBITDA coming in at $916 million. It nonetheless feels bizarre to say that UBER is turning into a money move story.

2023 Q2 Presentation

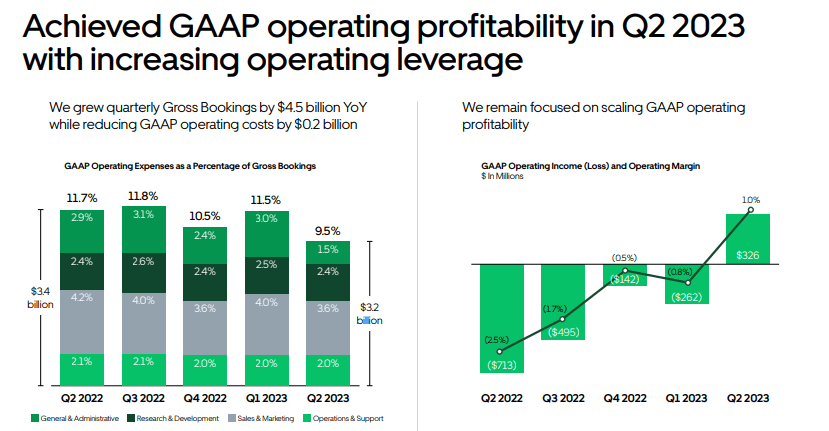

UBER reported a shock GAAP revenue on each an working margin and internet margin foundation. This was completed by excessive working leverage.

2023 Q2 Presentation

I notice that because of some curiosity expense from debt on the steadiness sheet and after adjusting for unrealized features on funding securities, the GAAP internet margin was very slim. Nonetheless, I’m uncertain that many buyers would have anticipated UBER to ship such a shocking turnaround for the reason that pandemic.

2023 Q2 Presentation

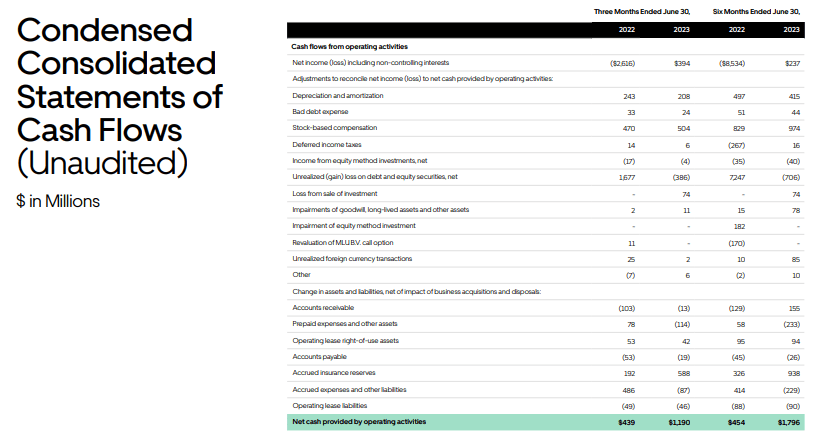

It’s value noting that UBER delivered $1 billion in free money move within the quarter. As anticipated, the mobility phase delivered the strongest progress, as UBER continued to learn from an ongoing restoration from the pandemic.

2023 Q2 Presentation

The supply enterprise delivered stable progress as properly regardless of robust comparables. UBER has pushed sturdy sequential progress in supply adjusted EBITDA over the previous a number of quarters.

2023 Q2 Presentation

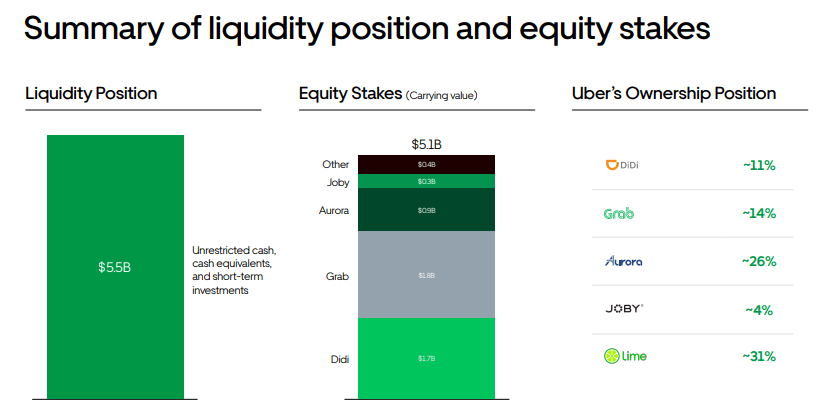

UBER ended the quarter with $5.5 billion of money and $5.1 billion in fairness investments, versus $9.3 billion of long run debt. I sometimes want to see internet money steadiness sheets from tech shares provided that that is the norm throughout the sector, however with the corporate starting to meaningfully move money, this steadiness sheet place seems to be acceptable.

2023 Q2 Presentation

Trying forward, administration has guided for gross bookings of $34.0 billion to $35.0 billion, representing 20.3% YOY progress, and adjusted EBITDA of $975 million to $1.025 billion, representing practically 100% YOY progress and stable sequential progress.

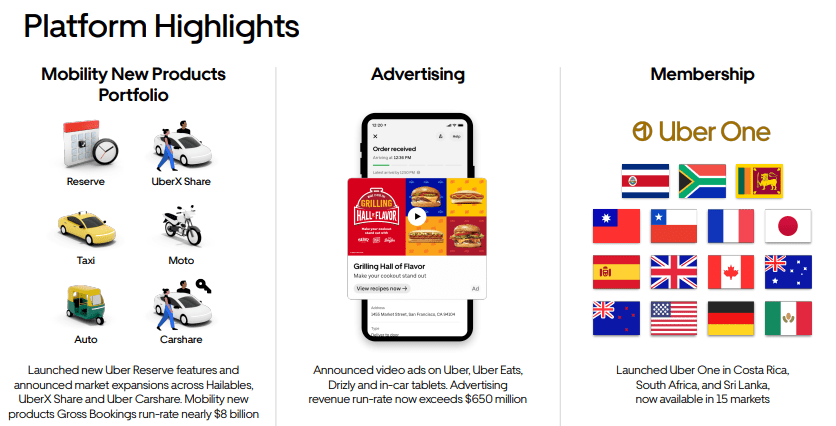

On the convention name, administration appeared to provide bold long run steering, outlining how they’ll simply maintain a double-digit progress price for the bottom enterprise. Administration began by stating expectations to develop the viewers by a “high-single digits or low-double digits” price primarily based on new merchandise and worldwide enlargement, in addition to displaying stable frequency progress as properly.

Whereas administration declined to name UBER a generative AI play like many tech friends, they did notice that they’ve been utilizing “machine studying and deep studying fashions” for a decade to unravel issues like “pricing, matching, and routing.” Administration famous that UberOne membership penetration has giant room to develop, with it standing within the “excessive 20%-s” general and “mid-30percents” in supply. Administration famous that memberships accounted for greater than 50% of gross bookings in Taiwan.

Administration reiterated expectations for the advert enterprise to achieve $1 billion in 2024, with it already exceeding $650 million. With UBER now producing constructive free money move, when would possibly the corporate start repurchasing inventory or returning money to shareholders? Administration hinted that after this may be attainable as soon as they achieved the milestone of an funding grade ranking – I would not be shocked to see that happen within the close to future as the corporate finally reaches a impartial leverage place. Administration famous that competitor Lyft has lastly grow to be extra aggressive in pricing, however didn’t seem involved about worth competitors danger. In addition to administration’s perception that there’s greater than sufficient room for a duopoly, the excessive rate of interest setting has made it prohibitively costly for LYFT (or different opponents) to compete on worth, and this reality is particularly essential for LYFT inventory which is buying and selling at very low valuations.

Is UBER Inventory A Purchase, Promote, or Maintain?

UBER has come a great distance from its ridesharing begin, because it has had success integrating promoting and a membership providing into the platform.

2023 Q2 Presentation

Whereas UBER is now not a direct self-driving play because of having to desert its in-house self-driving ambitions to preserve money through the pandemic, it has partnered with Waymo to nonetheless provide self-driving companies, and it additionally has a visual catalyst in bringing on increasingly standard taxis on-line. UBER is the main gig transportation funding, and it’s worthwhile as well.

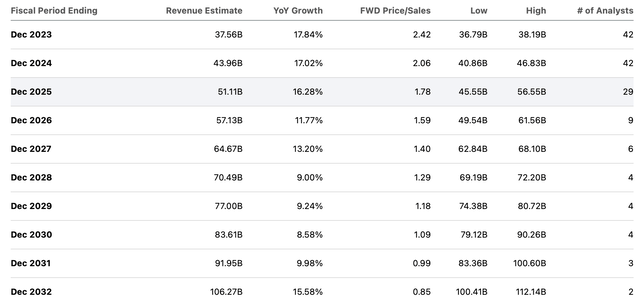

At current costs, UBER discovered itself buying and selling at round 2.4x gross sales.

Looking for Alpha

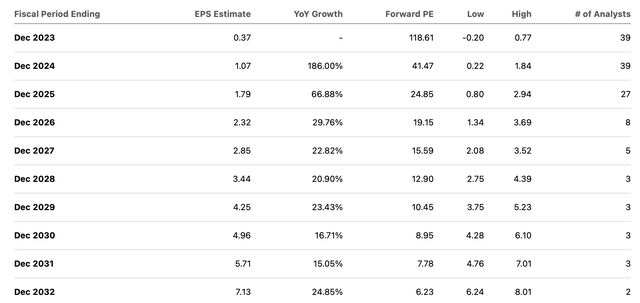

Consensus estimates have the inventory wanting low cost at round 6x earnings in 2032.

Looking for Alpha

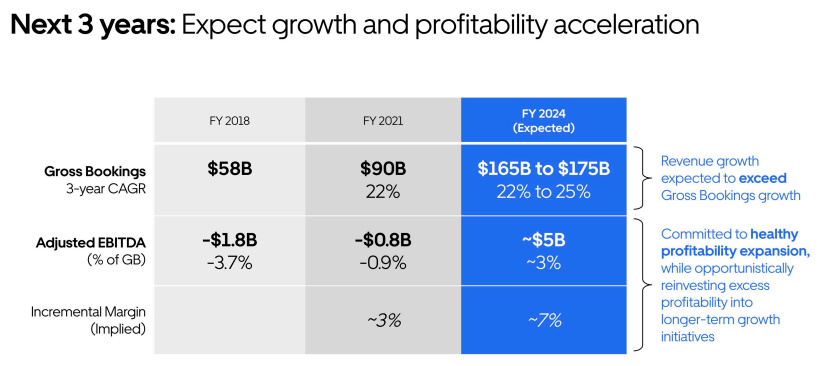

At its 2022 Investor Day, UBER had guided for round 3% adjusted EBITDA margin primarily based on gross bookings by 2024.

2022 Investor Day

That means round 15% adjusted EBITDA margin primarily based on income. If we assume that UBER can obtain 15% internet margins over the long run, maintain 13% income progress and commerce at a 1.5x worth to earnings progress ratio (‘PEG ratio’), then I might see the inventory buying and selling at 2.9x gross sales, implying stable upside from each a number of enlargement and ongoing progress.

What are the important thing dangers? UBER faces nice aggressive and regulatory danger. It’s attainable that the competitors intensifies – maybe a competitor with deep pockets enters the fray, or maybe DoorDash (DASH) acquires Lyft (LYFT) to create a near-lookalike of sturdy rivals. It may not be such a loopy risk, provided that LYFT trades over 75% decrease than its IPO worth. I ought to notice that anecdotally UBER doesn’t look like essentially the most consumer-centric title within the sector as DASH deserves that title – the above proposed marriage would possibly pose important aggressive headwinds for the corporate.

UBER additionally faces nice regulatory danger. Politicians could proceed to work in the direction of forcing gig firms like UBER to deal with their contractors as a substitute as staff. Which will both result in decrease revenue margins, increased client costs, or each, as these firms can be pressured to offer employee advantages. It’s not totally clear how rather more “fats” UBER has left to cull – any such regulatory motion would possibly decrease long run internet margin assumptions. UBER isn’t “dust low cost” particularly contemplating that this was a enterprise mannequin that few revered solely a number of years in the past – the inventory has an extended strategy to fall if sentiment breaks down, simply have a look at the valuation of LYFT for an instance.

I reiterate my purchase ranking for the inventory because it seems to be benefiting from the upper rate of interest setting because of each increased curiosity earnings in addition to decrease aggressive threats.