fotostorm

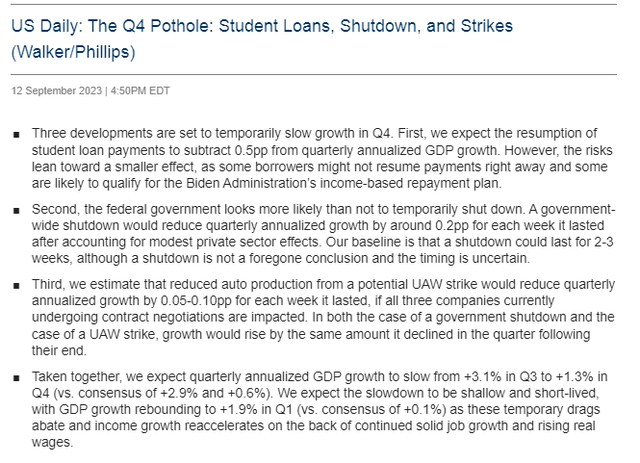

Is a This autumn pothole on the highway forward? That is what Goldman Sachs’ David Kostin asserts. Earlier this month, he and the remainder of the GS economics staff outlined a trio of dangers that would derail what has been a yr of surprisingly robust home actual GDP progress.

Together with a looming authorities shutdown and the continued UAW strikes, the resumption of scholar mortgage repayments might crimp budgets and harm discretionary spending.

May Uber Applied sciences (NYSE:UBER) be in danger? With Uber Eats having a excessive proportion of month-to-month energetic customers in the important thing 25- to 44-year-old cohort, some analysts consider draw back dangers are on the horizon.

I reiterate my purchase score on Uber, nonetheless. I see a sturdy longer-term earnings story taking part in out whereas value motion has carried out every part it ought to since I initiated protection on the inventory earlier this yr.

This autumn Dangers Forward

Goldman Sachs

In response to Financial institution of America International Analysis, UBER is a mobility platform that companies 72 nations, 750+ ridesharing markets, and 500+ Eats markets, and practically half of Core Platform Income is generated outdoors of the U.S. The corporate now has over 130 million month-to-month clients with revenues generated from Mobility, Supply, and Freight companies.

The San Francisco-based $91.1 billion market cap Passenger Floor Transportation firm throughout the Industrials sector has unfavorable trailing 12-month GAAP earnings and doesn’t pay a dividend. Forward of earnings subsequent month, the inventory encompasses a average implied volatility share of 35% whereas its quick curiosity is low at simply 2.4%.

Again in early Could, the corporate reported Q2 GAAP EPS of $0.18 which topped analysts’ estimates of a 1-cent per-share loss. Income was properly greater on a year-on-year foundation, +14%, at $9.2 billion, although that fell in need of what Wall Road projected. With Gross Bookings up 16% from year-ago ranges and an 18% rise on a constant-currency foundation, the general progress trajectory nonetheless seems sturdy.

Impressively, UBER reported report quarterly free money movement of $1.1 billion. The agency’s increasing EBITDA margin and excessive revenue flow-through come as the buyer sees some weak point, however Uber’s earnings come largely from its stable Mobility and Promoting segments – long-form video advertisements noticed a major increase from the identical quarter final yr.

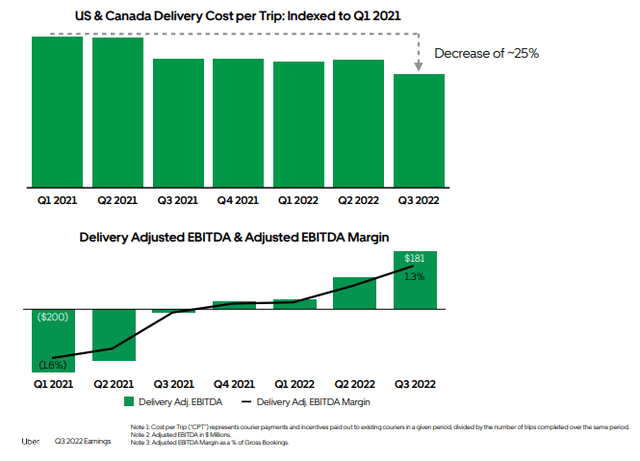

Supply Margins on the Rise

Uber IR

Key dangers embrace the potential for a number of compression resulting from macro elements (weaker client and company advert spending), slower progress in gross sales and customers from competitors, rising competitors from self-driving expertise corporations, and the opposed impacts of recent rules.

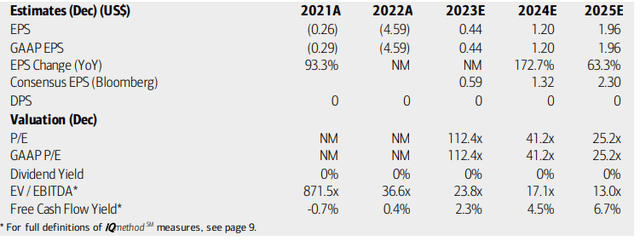

On valuation, analysts at BofA see earnings persevering with the development effectively into optimistic territory. Out-year EPS is seen north of $1 whereas the 2025 consensus estimate, on the newest test, is $1.79 per In search of Alpha. This fast-growing firm just isn’t anticipated to pay dividends any time quickly, however the agency is free money movement optimistic. With earnings a number of anticipated to dip into the mid-20s with bottom-line progress, the PEG ratio is engaging trying forward.

Uber: Earnings, Valuation, Free Money Circulate Forecasts

BofA International Analysis

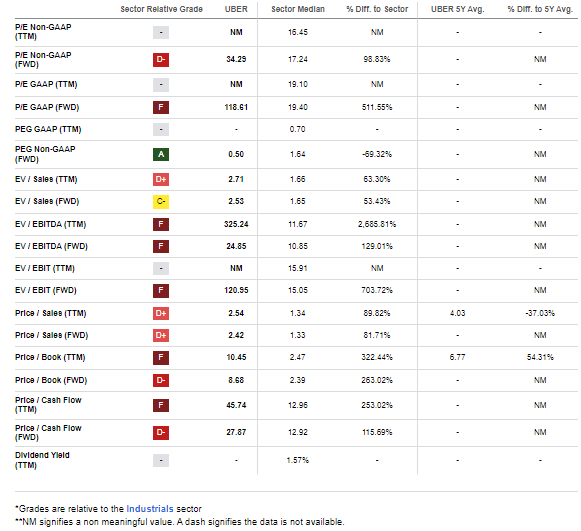

UBER’s ahead PEG ratio is presently simply 0.5, incomes it an A score there (although the general valuation score is only a D). Following the stable Q2, I proceed to say {that a} 25x P/E on $2 of future EPS is a really cheap valuation. On a ahead gross sales foundation, the inventory is only a 2.4 a number of – effectively beneath that of rival Instacart Maplebear (CART) that simply went public. The trailing 12-month price-to-sales ratio is at a 37% low cost to its 5-year common, too.

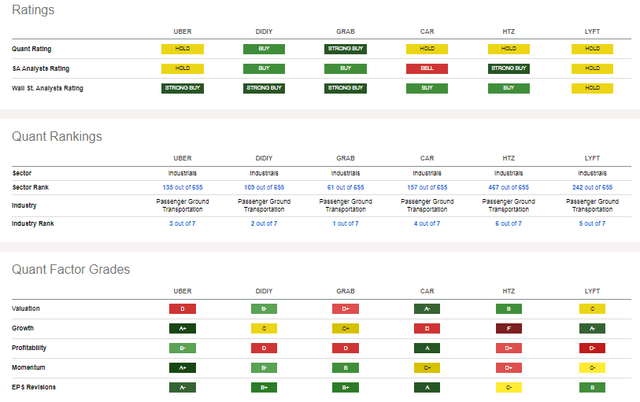

UBER: Poor Valuation Grades, However Banking on Development

In search of Alpha

In comparison with its friends, Uber has every part you need except for worth earnings multiples. However I don’t anticipate this quick grower to be “worth” within the coming years. I do contend that it’s a GARP play, although, and its robust profitability and upside EPS revisions again up that narrative. Amongst its rivals, Uber additionally has the very best momentum proper now, although I’ll spotlight some near-term dangers to cost motion.

Competitor Evaluation

In search of Alpha

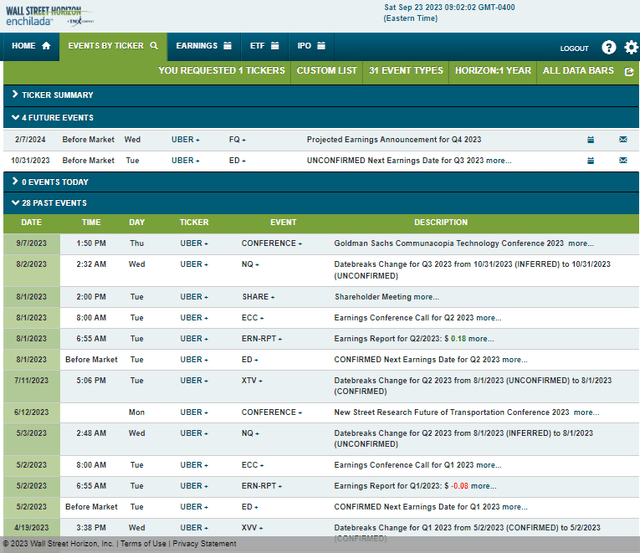

Wanting forward, company occasion knowledge offered by Wall Road Horizon present an unconfirmed Q3 2023 earnings date of Tuesday, October 31 BMO. No different volatility catalysts are seen on the calendar.

Company Occasion Danger Calendar

Wall Road Horizon

The Technical Take

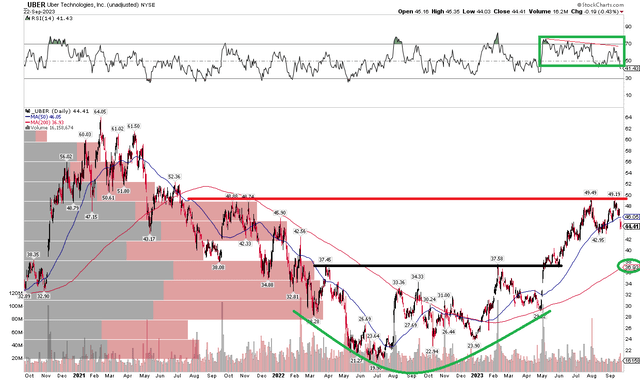

As talked about earlier, UBER has carried out every part it has presupposed to do since Q2, in my opinion. Discover within the chart beneath that shares practically touched $50 and have since pulled again after printing a near-term double prime. Additionally check out the RSI momentum gauge on the prime of the graph – whereas it stays in a bullish vary, there was some modest bearish divergence as value rose in the summertime. I famous that in my preliminary evaluation earlier this yr.

I see near-term assist round $42, so that will be a superb place so as to add to the place. Longer-term assist is seen on the rounded-bottom breakout level within the $37 to $38 zone. General, with a rising long-term 200-day shifting common and better highs & greater lows going all the best way again to June of 2022, the bulls seem in management. I proceed to see $50 as resistance, however a breakout above that stage would portent a doable rise to $58 based mostly on this rising $8 vary that’s now a number of months outdated.

Huge image, the trip just isn’t at all times easy, however I see Uber’s technical view as optimistic.

UBER: $50 Stays Resistance, $42 Close to-Time period Help

Stockcharts.com

The Backside Line

It’s regular as she rides with Uber. Shares rallied to resistance and have pulled again, providing traders an opportunity to hop in on this high-growth firm.