Max Zolotukhin/iStock through Getty Photographs

By Kevin Flanagan

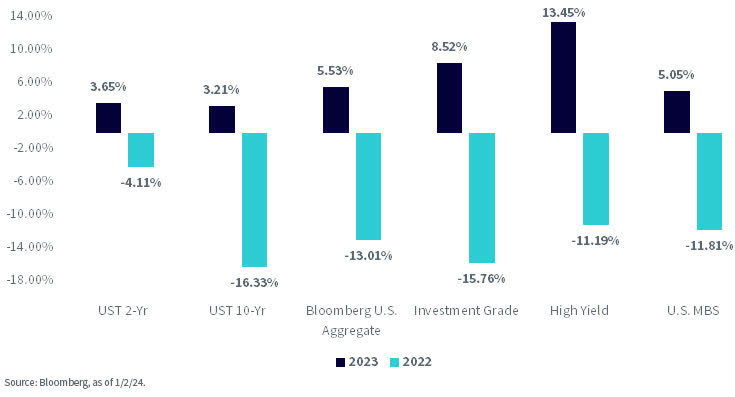

In what may be described as a giant understatement, calendar yr 2023 proved to be an unimaginable roller-coaster for U.S. fastened revenue. From rates of interest to unfold actions, volatility continued to be underscored in a reasonably noteworthy style. Nonetheless, with all of this forwards and backwards, an attention-grabbing consequence occurred… the main fastened revenue asset lessons all wound up registering constructive returns.

So, let’s first check out 2023 after which flip our consideration to what traders may contemplate within the bond market throughout the brand new yr.

Fastened Earnings Whole Returns

2023

The bar chart neatly shows how final yr’s performances stood in stark distinction to 2022, arguably one of many worst years for fastened revenue on document. As you may see, constructive returns have been loved by all the main asset lessons from charge delicate, Treasuries (UST) and mortgage-backed securities (MBS), to credit-sensitive, funding grade (IG) and high-yield corporates (HY), together with the benchmark Bloomberg U.S. Mixture Bond Index, the Agg.

Going again to the purpose I used to be making within the intro, it wasn’t all roses for U.S. fastened revenue final yr, simply the other, actually. As lately as late October, it was positive wanting like 2023 was going to be one other yr of unfavorable efficiency for bonds, which might have made it three in a row for the broader fastened revenue area, the Agg.

However as soon as the calendar turned to November, every thing modified. Sentiment within the cash and bond markets shifted dramatically and yield ranges plummeted throughout the board, whereas MBS and company bond spreads narrowed significantly. Listed here are some notable stats for: Yr-Finish 2022, Oct/Nov Highs, and Yr-Finish 2023:

- UST 2-Yr yield: 4.43%; 5.22%; 4.25%

- UST 10-Yr yield: 3.87%; 4.99%; 3.88%

- US MBS unfold: +51 bps; +82 bps; +47 bps

- US IG Corp: +130 bps; +130 bps; +99 bps

- US HY Unfold: +469 bps; +438 bps; +323 bps

Did you occur to note that the UST 2-Yr and 10-Yr yields and MBS spreads ended up being little modified from year-end 2022? In the meantime, IG and HY company spreads narrowed significantly simply over the past two months.

2024

What does the brand new yr have in retailer for the fastened revenue traders? Our major theme for 2024 is to concentrate on the brand new charge regime, and now there seems to be a brand new twist. I’ve mentioned typically how bond yields have risen to ranges a era of traders have not seen earlier than. Nonetheless, 2024 additionally appears to be like prefer it might be the yr for the Fed to start slicing charges, not climbing them.

Listed here are some key themes for 2024:

- Whereas it seems charge cuts are coming, a notable deterioration in financial knowledge and continued disinflation could also be required to validate UST market expectations for important coverage easing in 2024

- Quick period fastened revenue is our desire to “play the speed minimize commerce”

- We proceed so as to add period in a deliberate method, shifting nearer to impartial stances relative to benchmarks

- Nonetheless, given the inverted nature of the yield curve and our expectation for ongoing rate of interest volatility, we stay allotted to Treasury floating charge notes

- We stay constructive on quality-screened credit score and have selectively rotated into MBS

Conclusion

As we have seen over the past couple of years, market sentiment can shift reasonably shortly, and arguably at occasions, unexpectedly. So, keep tuned!

Kevin Flanagan, Head of Fastened Earnings Technique

As a part of WisdomTree’s Funding Technique group, Kevin serves as Head of Fastened Earnings Technique. On this function, he contributes to the asset allocation staff, writes fastened income-related content material and travels with the gross sales staff, conducting client-facing conferences and offering experience on WisdomTree’s present and future bond ETFs. As well as, Kevin works intently with the fastened revenue staff. Previous to becoming a member of WisdomTree, Kevin spent 30 years at Morgan Stanley, the place he was Managing Director and Chief Fastened Earnings Strategist for Wealth Administration. He was liable for tactical and strategic suggestions and created asset allocation fashions for fastened revenue securities. He was a contributor to the Morgan Stanley Wealth Administration International Funding Committee, major writer of Morgan Stanley Wealth Administration’s month-to-month and weekly fastened revenue publications, and collaborated with the agency’s Analysis and Consulting Group Divisions to construct ETF and fund supervisor asset allocation fashions. Kevin has an MBA from Tempo College’s Lubin Graduate College of Enterprise, and a B.S in Finance from Fairfield College.

Editor’s Be aware: The abstract bullets for this text have been chosen by Searching for Alpha editors.