KanawatTH

US producers ended the 12 months on a bitter observe, in response to S&P International’s PMI survey. Output fell on the quickest charge for six months because the current order e book decline intensified. Manufacturing will subsequently seemingly have acted as a drag on the financial system within the fourth quarter.

The slowdown is spreading to the labor market. Payrolls had been lower for a 3rd month working as growing numbers of corporations grew involved in regards to the growth of extra working capability. The fourth quarter has consequently seen factories scale back employment at a tempo not seen since 2009 barring solely the early pandemic lockdown months.

With factories additionally chopping again sharply on their purchases in inputs once more in December, suppliers had been additionally much less busy on common, once more hinting on the growth of spare capability.

Whereas there was some uplift within the charge of each uncooked materials and manufacturing facility gate promoting value inflation, corporations’ prices notably continued to rise at a tempo beneath the survey’s long-run common to trace at traditionally subdued industrial value pressures.

Given present order e book tendencies, the general image from the survey is certainly one of provide exceeding demand for a lot of items, which factors to draw back dangers to manufacturing, employment and costs as we head into 2024. Potential provide chain disruptions have to be monitored, nevertheless, notably when it comes to transport, because the survey has clearly demonstrated up to now how provide chain tensions rapidly feed via to larger costs.

Under we plot our high 5 charts from the S&P International manufacturing PMI survey for the US, together with highlights from the survey’s sub-indices.

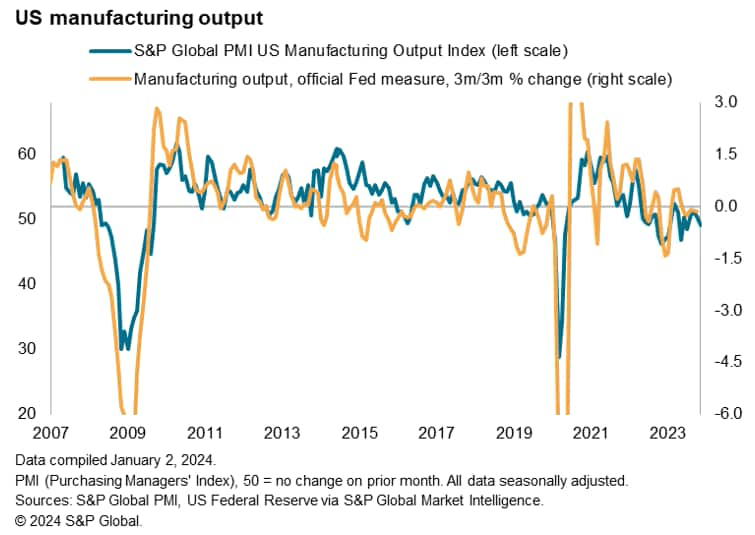

Chart 1: Manufacturing ends delicate 12 months with worsening pattern

The Output Index from S&P International’s US PMI survey, which measures month-to-month modifications in manufacturing volumes, fell to a six-month low in December.

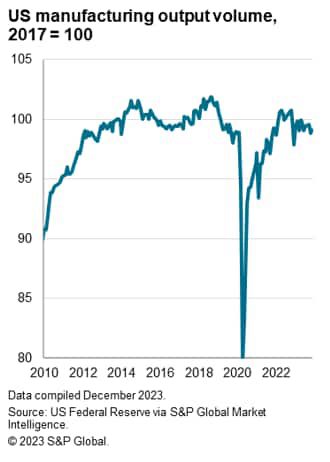

The December studying of 48.1 factors to a worsening manufacturing pattern on the finish of a disappointing general 12 months for US manufacturing. The index averaged 49.5 all through 2023, indicating a really modest general contraction of manufacturing. That compares with official knowledge, which as much as November (the most recent month for which statistics can be found) confirmed output working 0.5% beneath 2022 ranges on common.

As of November, manufacturing was 2.6% beneath its pre-pandemic peak, and was working 0.6% beneath the third quarter on common throughout the first two months of the fourth quarter, thereby including to the PMI’s sign of producing appearing as a drag on the financial system.

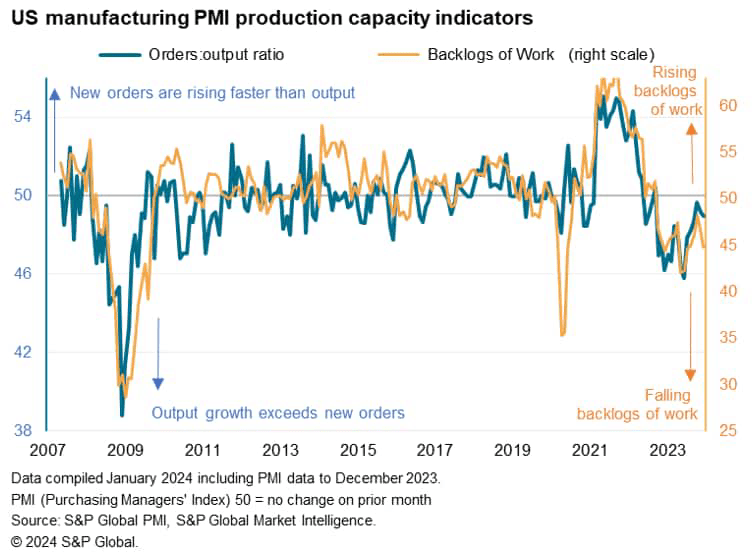

Chart 2: Spare manufacturing capability signaled

Backlogs of labor fell sharply in December, hinting on the growth of spare working capability. In distinction to the continuous rise in backlogs of labor seen between August 2020 and September 2022, when manufacturing was constrained by provide shortages, the previous 15 months have seen a sustained decline in backlogs of labor. This contraction displays a mix of fewer provide constraints alongside a downturn in new orders. New orders have now fallen for 16 of the previous 19 months. Present manufacturing ranges are subsequently being supported by orders positioned in prior months. As these again orders are depleted, firms come below stress to chop working capability.

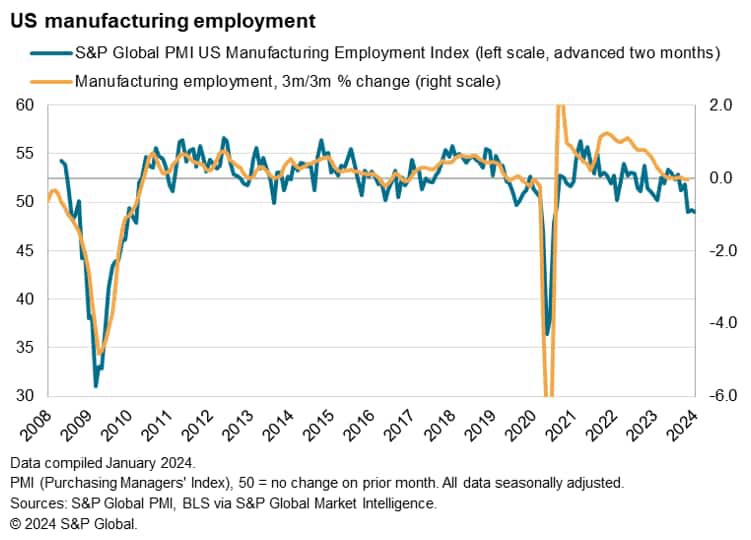

Chart 3: Employment falls in This autumn

Manufacturing facility jobs had been lower on stability for a 3rd successive month in December, in response to the PMI’s Employment Index. If the early pandemic lockdown months of 2020 are ignored, the current job shedding is probably the most extreme recorded by the survey because the international monetary disaster of 2009. Whereas some factories nonetheless report hard-to-fill vacancies, within the majority of circumstances the decline in employment in December mirrored stress to chop prices and capability within the wake of weak demand.

A divergence of the PMI employment in opposition to the official payroll numbers throughout the pandemic seems to have now labored out of the comparability, albeit with the current payroll numbers distorted by the auto staff strike (and subsequent return to work). The historic comparisons counsel that the PMI is roughly indicative of producing shedding round 20k staff per thirty days.

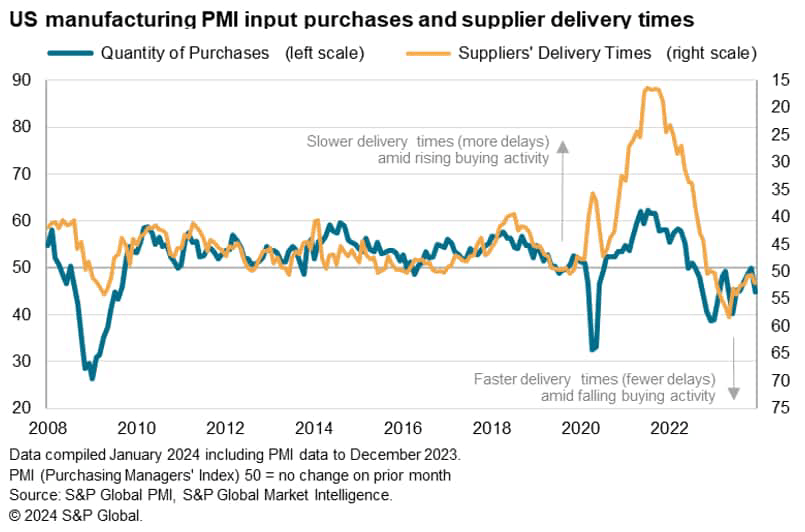

Chart 4: Factories slash enter shopping for

Producers additionally reduce on their purchases of inputs in December, reflecting a need to chop prices within the face of weaker manufacturing necessities. The amount of products bought by factories fell on the steepest charge since final June, dropping for a seventeenth successive month. This represents the longest and deepest spell of falling purchases because the international monetary disaster.

The pull-back in buying has taken stress off provide chains. Whereas longer supply occasions had been reported to an unprecedented diploma between 2020 and far of 2022, provider lead occasions shortened regularly over the course of 2023, as much as and together with December. Historically, this shortening of supply occasions is indicative of a shift from a sellers’- to a patrons’-market.

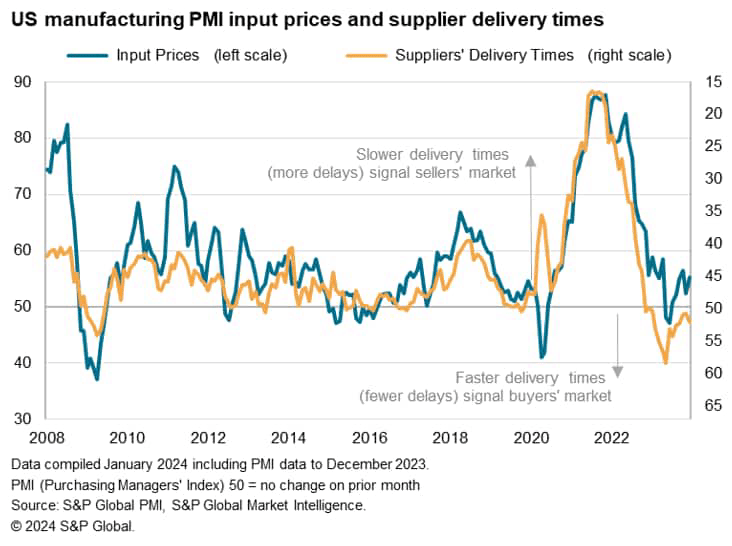

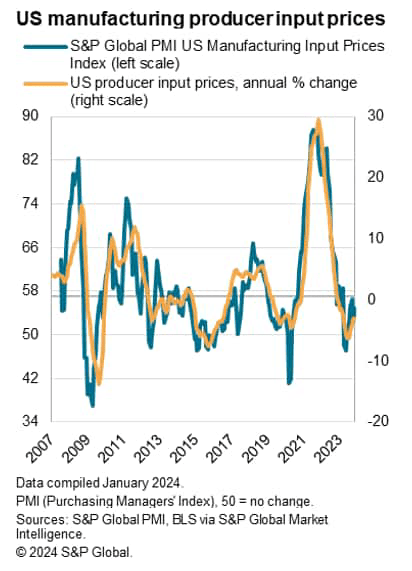

Chart 5: Lower cost pressures

The alleviated stress on provide chains over 2023, and the accompanying shift in the direction of a patrons’ market, has resulted in vastly decreased enter value inflation. Common costs paid for purchases by factories fell in Might and June and have since risen solely modestly by historic requirements of the survey.

The PMI enter value knowledge have acted as a dependable advance indicator of official producer costs, the survey in keeping with an additional fall in costs throughout December on a year-on-year foundation. Therefore manufacturing seems to have supplied an additional disinflationary power on inflation within the general financial system on the finish of 2023, albeit to a lesser diploma than in the summertime.

Nevertheless, on the time of writing there are rising considerations over provide chain stability within the Crimson Sea, and additional geopolitical dangers can simply trigger provide chain disruptions. Our fifth chart illustrated how longer provider supply occasions quickly translate into larger costs in right this moment’s world. International occasions subsequently have to be monitored carefully for provide chain and inflation dangers in 2024.

Editor’s Be aware: The abstract bullets for this text had been chosen by Searching for Alpha editors.