- BTC is dealing with an enormous provide from Mt. Gox and German authorities, says Marathon CEO

- The manager considered Trump as pro-Bitcoin however advocated a bi-partisan method to crypto points.

Former U.S., president Donald Trump continues to achieve help from the crypto neighborhood. Inasmuch, Bitcoin [BTC] miner Marathon Digital CEO Fred Thiel has develop into the newest government to again Trump.

In a latest interview with Yahoo Finance, Thiel said,

“Former president Trump has positioned himself because the candidate that’s pro-Bitcoin. He believes that each one Bitcoin ought to be mined within the US and has been open to Bitcoin miners and folks within the house’

Quite the opposite, Thiel famous that Biden’s administration has been very ‘hostile’ to Bitcoin via varied businesses just like the SEC.

55 million BTC voters at stake

Nonetheless, Thiel added that Biden’s administration has been backing down from its hostility after realizing a big voting block was at stake. The manager stated,

‘I’m sensing thawing of the chilly from Biden’s administration as they notice there are 55 million voters on this nation who care about crypto.’

The manager additional urged either side to embrace points associated to Bitcoin and crypto.

A number of crypto figures have endorsed Trump. Final week, asset supervisor Ark Make investments’s CEO, Cathie Wooden, backed Trump as pro-business.

“I’m a voter relating to economics. And on that foundation, Trump’

When requested about present BTC value motion after slipping beneath $60K, Thiel talked about many components impacting the most important digital asset.

From macro expectations to promoting from German authorities, BTC miners, and Mt. Gox repayments, Thiel added,

“What we’re seeing proper now could be lots of provide available in the market and $1.2 billion outflows from the ETFs.’

The manager talked about $57K as a key help degree and $68K and $69K as key hurdles for BTC to clear. Through the Monday intraday buying and selling session, BTC dropped to $58.4K earlier than reclaiming $60K.

Regardless of the upcoming fears about Mt. Gox repayments, QCP Capital analysts suggested the replace may have much less influence based mostly on possibility market knowledge.

‘We see little exercise within the July choices market, suggesting the market isn’t anticipating volatility across the distribution itself’

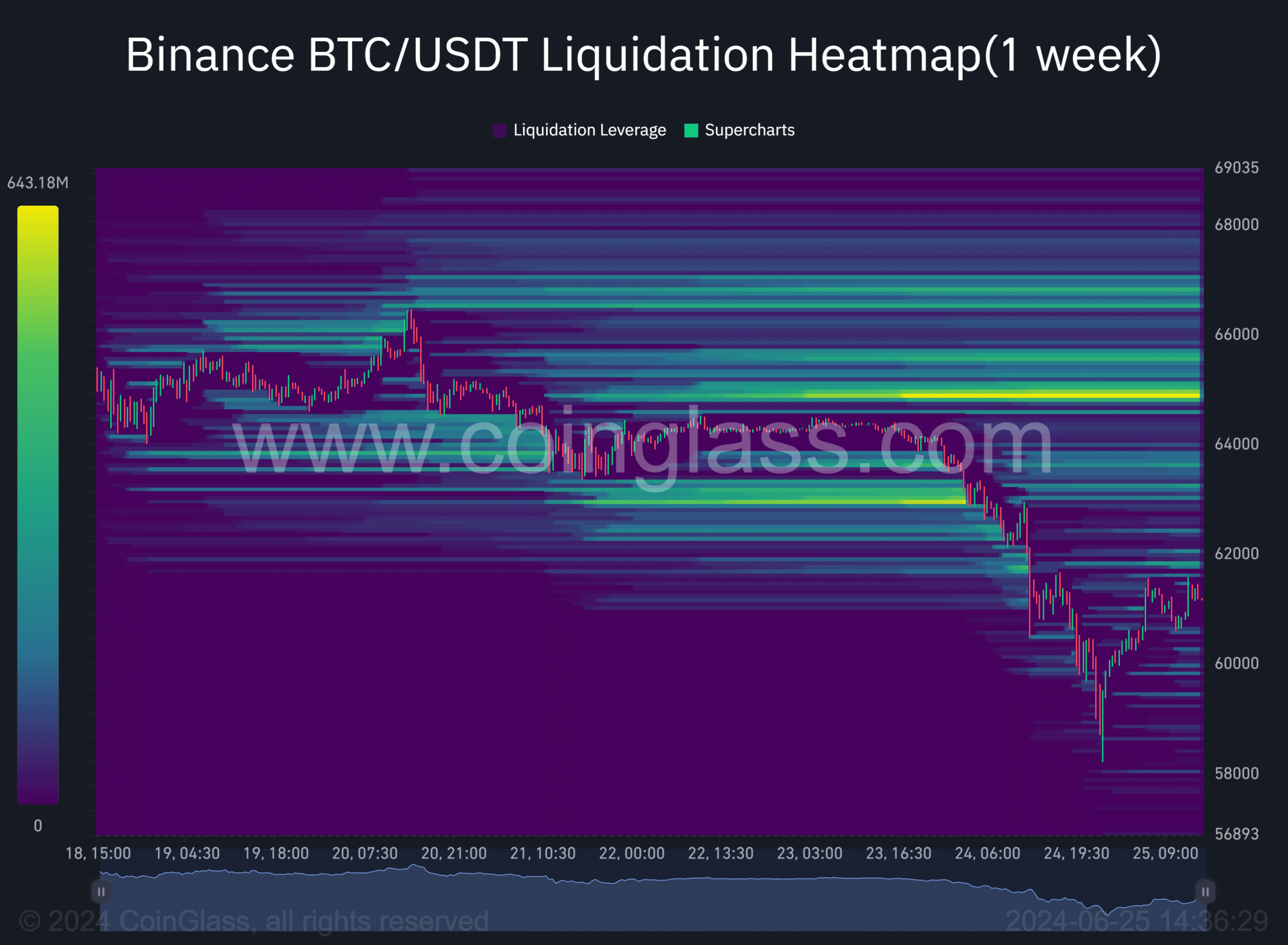

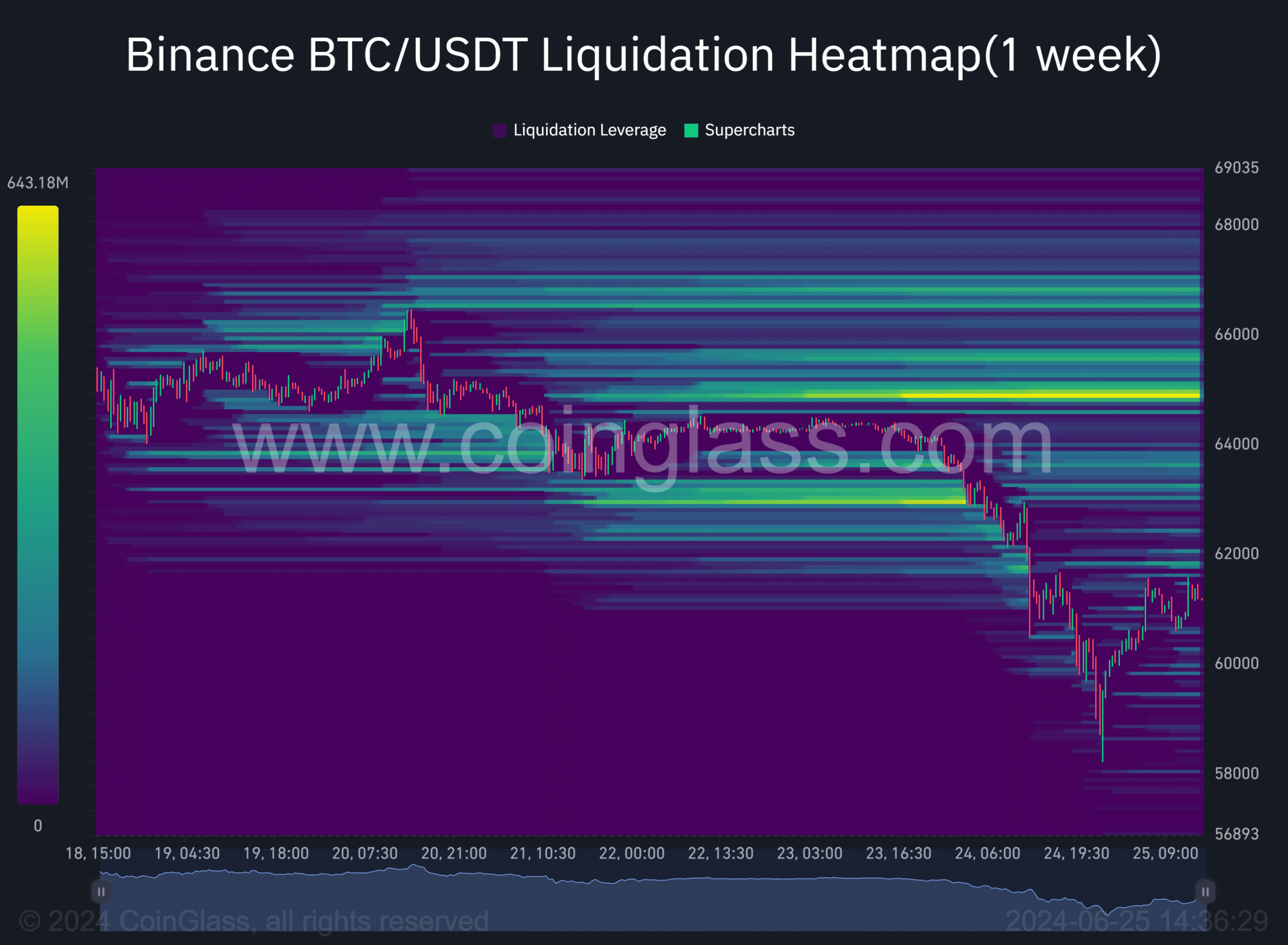

Moreover, most market liquidity was on the upside on the weekly charts, particularly at $64K, underscoring a transfer towards the cluster (orange) may very well be attainable.

Supply: Coinglass