MarsBars

This article was coproduced with Wolf Report.

Previous to the merger between BB&T and SunTrust, I used to be a buyer of BB&T.

When the 2 regional banks merged and fashioned Truist Monetary (NYSE:TFC) I made a decision to take by enterprise elsewhere.

I’ve been watching Truist because the late 2019 merger, hoping to see whether or not or not the synergies would supply a chance for me to change into a shareholder.

On this article, we’ll give you an replace, as the worth has change into enticing at present ranges.

The regional banking disaster and decline, in addition to total concern within the sector, have seen this firm underneath persistent strain for the higher a part of your entire 12 months of 2023.

Yahoo Finance

Each upside in addition to danger, however upside trumps danger

Most analysts appear comfy with a “maintain” ranking on Truist at the moment – although there are just a few like us who take into account Truist’s sell-off and danger to be overblown.

That is the stance we maintain.

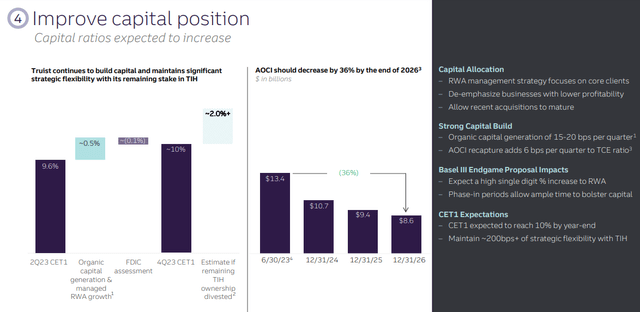

On the subject of the developments we noticed right here – potential HTM losses in bond portfolios which might put financial institution capitalization charges and CET-1 ratios in hassle – our stance was very early on that for a few of these banks, what was being stated and the way in which the share costs reacted was extraordinarily exaggerated. (Supply: Truist IR/2Q23)

Truist is without doubt one of the prime 10 industrial US banks with a really robust retail and industrial banking market share in seven of the ten fastest-growing markets within the nation. (Supply: Truist IR/2Q23).

It has a stable mixture of choices, with capabilities throughout the board.

Truist remains to be within the section of “simplification,” and it is seemingly that this shall be ongoing for a while.

Bear in mind, the merger for Truist went by in 2019/2020, so it has been 2-3 years, which for a financial institution this dimension nonetheless requires extra work. That is additionally the rationale, in our view, why Truist’s growth hasn’t been as optimistic as U.S. Bancorp (USB), one other financial institution however one which no less than is not buying and selling on the lows we’re seeing in Truist.

Nonetheless, related developments there, and the valuation has been down once more as nicely since August.

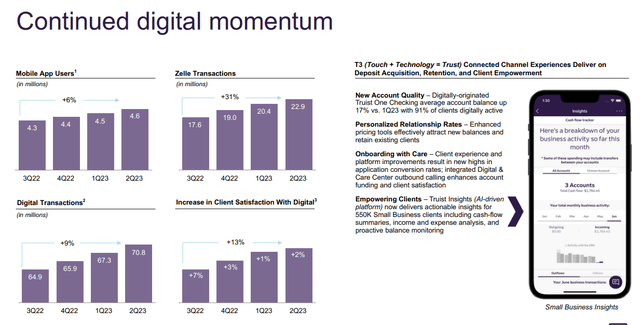

Like all banks we cowl, Truist appears to deal with simplification by issues like digitization, consolidation of the workforce, lowered geographic publicity, and a few restructuring of enterprise.

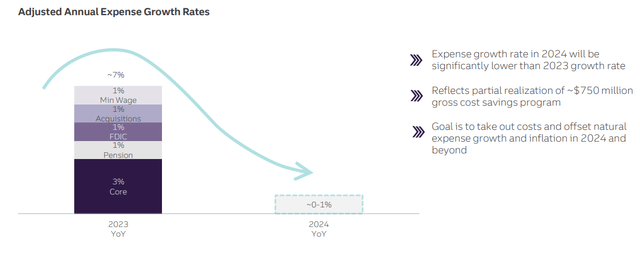

A $750M financial savings program is underway. The explanation that we’re pretty optimistic about that is that we have seen related financial savings packages and related steps taken by European banks, akin to Swedbank (OTCPK:SWDBF) and Nordea (OTCPK:NRBAY), and so they’ve largely turned out nicely.

We, due to this fact, see a great indication that TFC ultimately goes to appreciate related outcomes right here as nicely. (Supply: Truist IR/2Q23)

Expense development is the actual downside right here – as a result of as we see key charges enhance, clearly the financial institution’s internet curiosity revenue, or NII, goes to be growing.

What appears to fret most buyers about TFC, the expense development price already is estimated to be considerably decrease in 2024 than in 2023.

Truist IR

This financial institution’s capital ratios and CET-1 are considerably under different banks the place we often make investments.

For 4Q23, we now have an estimated CET1 of 10%, probably at 12% if the financial institution have been to divest its TIH possession. The banks we usually spend money on are at 15%-19%.

However right here, like with prices, capital ratios are anticipated to considerably enhance over time. Should you’re keen to carry and spend money on Truist till 2026, then it is best to see a exceptional payoff on this entrance.

Truist IR

So, Truist is on a enterprise push to simplify the enterprise, decrease bills, speed up its franchising mannequin, enhance the capitalization, and align the chief comp.

All of those are optimistic issues, and going by earnings and present developments, we now have conviction that that is the course the corporate goes. (Supply: Truist IR/2Q23)

The most recent earnings we now have for Truist are the 2Q23 earnings.

These have been optimistic, however sadly under consensus – which is a part of the rationale why the corporate is definitely down right here.

Truist IR

Improved digital momentum is all nicely and good, however we noticed expense development of 4.7% YoY and decrease internet revenue.

Some developments have been good – ROTCE of 19% nonetheless over $1.2B in internet revenue – however nobody likes seeing EPS go down.

The corporate’s YoY EPS was down 16%, on account of NPLs and better bills.

In comparison with some European banks, TFC has considerably greater NPLs.

That is additionally why Truist, in comparison with say a place in Handelsbanken (OTCPK:SVNLF) is just at 20% of the dimensions.

Handelsbanken has a comparable NPL of precisely 0.0%. (Supply: Handelsbanken 2Q23). Extreme high quality comes first, however Truist does have high quality and considerably greater potential for higher returns.

Loans are flat, and EOP loans are down barely, with some deposit decline.

Nonetheless, that does not actually bug us. Why?

As a result of the web curiosity margin spreads when deposits vs. liabilities are literally going within the course we anticipate on this macro. Depositors all the time are in search of good investments, and the consequences are literally lower than one would anticipate as a result of a lot of TFC’s deposits are noninterest-bearing.

That being stated, TFC goes to proceed to endure from the present atmosphere, the place greater yields are literally pretty straightforward to search out.

Simply take a look at what we’re writing about day by day. If somebody wished 5%-7% just a few years again with security, we might have been at a loss.

Immediately, it is virtually straightforward.

Nonetheless, you should take into account banks as long-term investments.

What’s taking place right here not simply with Truist however with any financial institution value its salt is that the banks at the moment are accumulating loans and investments, and so they’re doing so at considerably greater rates of interest. (Supply: Truist IR/2Q23)

It is a query of the potential HTM losses, and the financial institution is now, frequently, securing stable returns from what one might take into account funding/maturity transformations.

When rates of interest begin holding or begin declining, what we’ll see right here is that Truist, like different banks, shall be having fun with longer instances of upper rates of interest – and whenever you mix this with some great benefits of the financial institution’s geographical publicity, this leads me to have a look at this financial institution with a excessive conviction for the longer term.

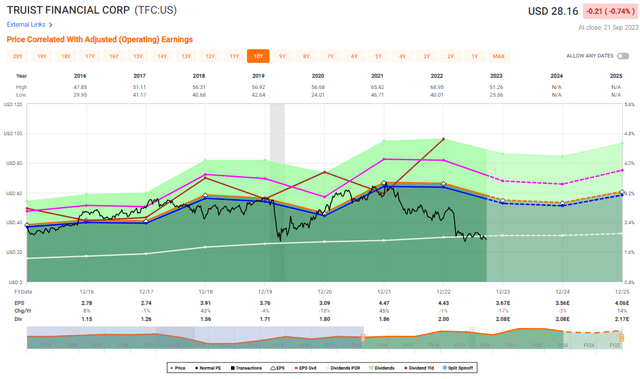

A lot as with different investments we cowl, the present decline in share value is not reflective of the same development in EPS drop.

Not as dangerous as we’re seeing.

The corporate is rising over time in revenues, its internet revenue is rising, and its profitability metrics and returns are good when thought-about within the context of this macro.

Effectivity ratios for banks are underneath strain, and with the expense steerage now in on the prime a part of the beforehand guided-for vary, we anticipate administration to be absolutely targeted on lowering the expense aspect of this equation.

Administration made feedback precisely to this reality within the newest earnings name – and given how a lot we like banks, and seeing effectivity ratios of even above 50%, we’ll say that Truist has loads of potential for enchancment.

Truist went by one of many greatest mergers of the latest decade in US banking. It is solely pure that such a growth is fraught with ups and downs, particularly going into an atmosphere akin to this.

So long as the core and fundamentals stay robust, and we see motion in the correct course, we actually haven’t any challenge with this.

And it is our stance that we’re really nonetheless seeing this going the correct approach.

We have been a part of merging organizations, and we all know such processes are extraordinarily time consuming and include unexpected roadblocks. It is due to this fact our stance that you just should not overreact to what’s at the moment popping out of Truist – as a result of it is going to enhance. (Supply: Truist IR/2Q23)

So we’re seeing a slight decline for this 12 months.

This looks as if a possible end result, with considerably greater income, however considerably greater bills. Nonetheless, the corporate additionally may be very clear that 3Q23 will deliver a decline in adjusted bills and see enhancements going into subsequent 12 months.

Truist has seen vital punishment, and very like with different banks, we imagine it is gone far too deep right here. Truist has vital upside, even with a double-digit EPS decline this 12 months, flat subsequent 12 months, and no earnings development till 2025-2026E when the financial institution will get its geese in a row.

Let us take a look at the financial institution’s valuation.

Truist Valuation – Lots to love about A-rated banking at a 7%+ Yield

Everytime you’re capable of get one thing like an A-rated or excessive BBB-rated establishment at a 7%-8% yield, you are probably in for one thing good.

The final time Belief was this low cost was throughout the COVID-19 crash.

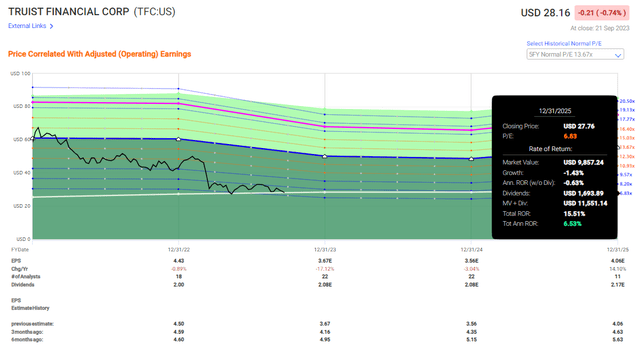

The financial institution is now buying and selling at a normalized P/E of round 7.2x, in comparison with a typical of 14.2x – so we’re basically speaking a 50% P/E low cost.

Clearly, some discounting is justified based mostly on the place the financial institution at the moment is. And we are able to perceive your frustration if you happen to invested previous to the regional banking crash – since you’re then down fairly deep.

All you should do to get an image of what might occur right here is one graph.

Truist Valuation (FAST Graphs)

Our funding M.O. is considered one of simplicity.

We discover undervalued companies that include qualitative fundamentals, dividends, a great enterprise mannequin, and different safeties.

We spend money on them, and we preserve our funding, except one thing basic adjustments, for so long as the enterprise will not be excessively overvalued.

If it turns into overvalued to the place we take into account it pretty valued, we trim/promote, and repeat the method with one other firm.

And it is due to corporations akin to this one.

What is the seemingly RoR for Truist?

This is how we see it.

Truist is a financial institution that ought to, over the long run, even with the dangers talked about, commerce no less than at a stage of 10x P/E.

Forecasting this financial institution at a 10x P/E ahead ratio implies that we, even with declines and an EPS development price till 2025E of solely 2% per 12 months inclusive of the reversal, are seeing an upside of 23.4% per 12 months.

That is what we take into account the conservative thesis for this financial institution.

If we’re speculating on the upside, and a reversal to 12-14x P/E if this financial institution will get its “geese in a row,” then that upside simply turns to 35% yearly at a 12.5x P/E, or over 40% yearly till 2025E, on the idea of a 14.5x P/E.

None of those estimates are outlandish or unrealistic if we see a turnaround right here.

As a result of really dropping cash over the long run looks as if such an unrealistic prospect right here, that is what I base my thesis upon.

Now even if you happen to forecast Truist at 6.8x P/E, are you dropping cash inclusive of dividends right here?

TFC Upside (FAST Graphs)

So you possibly can argue forwards and backwards as to what you possibly can anticipate from Truist right here, however so as to anticipate an eventual lack of capital right here, you would need to both anticipate an entire deterioration of Truist’s enterprise mannequin (and then you definitely should not spend money on the primary place), or your timeframe must be very brief (and once more, then you definitely should not make investments on this market in any respect, as I see it).

In another scenario, we see the inevitable end result for a Truist funding as considered one of a optimistic nature.

Different analysts?

We’re speaking 24 S&P world analysts following Truist.

Out of these 24, 10 are at “BUY” or equal – most are at the moment at “Maintain” However these analysts go from a low vary value goal of $29 to considered one of $50/share, with a mean of $37/share.

We go to $40/share for this firm.

This marks a present upside of over 25%, and that’s the reason we’re at a “Robust Purchase” for Truist Monetary.

This can be a nice alternative, along with Lincoln Nationwide (LNC), within the finance sector, and one we take into account one of many strongest and most secure on the NA market at the moment.

When you’ve got any questions, let me know – in any other case right here is my thesis for Truist.

Thesis

- Truist Monetary is a class-leading regional financial institution with above-average fundamentals and an incredible yield. Whereas the financial institution remains to be digesting what we might take into account one of many extra related M&As of the previous decade in US banking, we maintain a powerful conviction that the financial institution ultimately will come out on prime.

- Truist Monetary stays undervalued regardless of some headwinds in 2Q23 on account of unfavorable bills and NPL growth. None of these issues are out of character however have been maybe barely worse than anticipated. The pathway to restoration has merely grown barely longer, and the market is reacting to it.

- We take into account Truist a “Purchase” with a conservative PT of $40/share. This represents a 2025E 9.9x P/E and comes with an upside of over 23% per 12 months from the present valuation. I am lengthy the financial institution at a mean price foundation of under $30/share.

Closing Ideas

Simply as I used to be going to publish this text, I opened up Barron’s to learn an article by Jacob Sonenshine titled “A Troubled Financial institution Merger Is Lastly Fixing Itself.”

“The payout totals slightly below $2.8 billion a 12 months, which is well lined by subsequent 12 months’s internet revenue of $4.8 billon. Even an earnings disappointment ought to nonetheless go away loads of money to return to shareholders.”

I like Barron’s and I am completely happy to see a optimistic spin on this 7.4% financial institution. I concur with the Barron’s author:

“Given Truist’s earnings potential, you are getting a great dividend whereas we wait.”

Be aware: Brad Thomas is a Wall Road author, which suggests he isn’t all the time proper together with his predictions or suggestions. Since that additionally applies to his grammar, please excuse any typos chances are you’ll discover. Additionally, this text is free: Written and distributed solely to help in analysis whereas offering a discussion board for second-level pondering.