Morsa Photos/DigitalVision through Getty Photos

Q3 Earnings and Inventory Efficiency

Journey.com Group Restricted (NASDAQ:TCOM) reported its third-quarter earnings on November twentieth, 2023. Though the corporate surpassed the analyst estimates for each earnings per share and income for the third quarter, the inventory worth fell 10% after the earnings report was launched. One potential clarification for the inventory drop, regardless of the earnings beat, is that buyers had already priced vital future progress expectations into TCOM’s inventory worth over the previous yr. Provided that the inventory worth has elevated 33% over the past 12 months main as much as the earnings announcement, a number of the future potential tailwinds and progress prospects had been probably already mirrored within the firm’s valuation. In consequence, even a robust third-quarter earnings beat was not sufficient motivation for buyers to additional bid up the inventory worth.

In search of Alpha

Funding Thesis Spotlight

TCOM is going through some short-term dangers because of administration’s feedback about potential margin compression through the third quarter earnings name. Nevertheless, the corporate nonetheless maintains a management place within the on-line journey {industry} in China and has demonstrated the power to provide sturdy and steady revenue margins over time. We imagine TCOM has extra room to develop its worldwide enterprise shifting ahead by means of its sturdy partnerships with journey suppliers, which is able to enable it to successfully compete with different Chinese language on-line journey companies.

Moreover, TCOM’s valuation multiples proceed to commerce at a comparatively low stage in comparison with its historic vary. In consequence, we view the draw back danger for the inventory as restricted on the present valuation. Our focus stays on the long-term progress potential for TCOM’s enterprise, and we imagine the inventory has extra upside from present ranges. We charge the inventory as a Purchase.

Monetary Evaluate

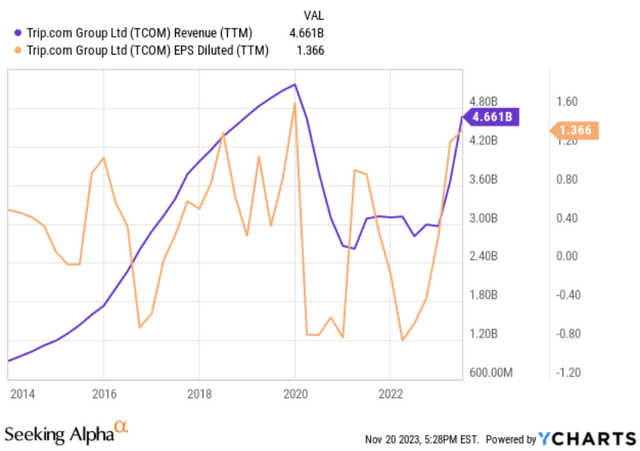

The corporate’s revenues elevated by 99% in Q3, and its adjusted EBITDA margin improved to 34% from 21% in Q2 or 33% final yr. China lagged behind within the lockdown schedule, so the nation’s strong progress charge is probably going a mirrored image of the lockdown’s comparatively subpar efficiency the earlier yr. Nonetheless, the enterprise’s earnings and revenues for the earlier 12 months had been each getting near surpassing their all-time excessive.

YCharts

Particularly, TCOM’s home journey enterprise inside China has already handed pre-COVID monetary ranges, whereas its worldwide journey bookings have recovered to round 80% of 2019 volumes. Given the numerous room for additional worldwide journey demand restoration, we imagine TCOM may develop each revenues and earnings to exceed historic peak ranges within the coming years as COVID impacts proceed to subside globally.

– Domestic resort bookings grew by 170% yr over yr and by over 60% in comparison with the pre-COVID stage for a similar interval in 2019.- Outbound resort and air reservations recovered to over 60% of the pre-COVID stage for a similar interval in 2019, surpassing the industry-wide restoration charge of 37% when it comes to worldwide air passenger quantity for a similar interval.

In the course of the earnings name, TCOM’s administration talked about that the present restoration in worldwide journey demand has been pushed by elevated journey inside Asia and the Center East areas.

APAC areas akin to Hong Kong, Macau, Thailand, Singapore, Korea, Japan remained prime outbound locations because of the increased restoration in flight capability and simple visa software……Specifically, lodges in additional than 15 in style locations, together with Dubai, Paris, Kuala Lumpur have supplied tailor-made providers akin to Chinese language language help and fee.

Moreover, they famous that demand and search volumes for outbound journey from China have already exceeded 2019 ranges. Nevertheless, precise outbound bookings have been restricted because of provide constraints like restricted flights and resort room capability.

In the event you take a look at our demand and provide aspect, the demand already exceeded 2019 stage….The primary one is the visa software course of takes a bit bit longer for sure areas, akin to Europe, United States, et cetera. Nevertheless, after the APAC assembly, I feel there will probably be enhancements on the visa software aspect. The second is the flight capability. As of Q2 — as of Q3, the flight capability solely recovered 50%

Provided that China has began to ease extra restrictions on abroad journey to the US after the APEC summit assembly concluded in November, it’s anticipated that TCOM’s worldwide journey enterprise, particularly to North America, will acquire extra momentum within the following quarters after this regulatory change.

Our enterprise has constantly carried out effectively, breaking earlier information in resort and air bookings. Moreover, outbound journey is quickly recovering, due to enhancements in worldwide airlift and vacationers’ strong need for worldwide expertise. So, we anticipate a repeatedly sturdy demand for outbound journey within the coming yr and are dedicated to enhancing our accomplice choices to fulfill this demand.

Dangers

Home Competitors Dangers

TCOM at the moment faces elevated competitors within the China on-line journey {industry} from sturdy friends akin to Meituan and Douyin.

Given Meituan and Douyin’s excessive frequency client platforms in different sectors like meals supply, their visitors acquisition prices are a lot decrease than TCOM’s. In consequence, these two companies have aggressively grown their presence within the on-line journey reserving house lately.

TCOM’s present technique to compete is to leverage its core capabilities in provide chain expertise and reserving system algorithms to deeply accomplice with journey suppliers. For instance, TCOM purchases resort room and flight ticket stock straight from suppliers upfront and gives end-to-end customer support to simplify the workflow for its companions. In consequence, regardless that Douyin drives vital client visitors, it lacks the devoted customer support groups to deal with complicated travel-related points. Consequently, airways and lodges nonetheless want to carefully collaborate with TCOM over various platforms.

And I feel OTA and content material platform have completely completely different core competence. Content material platform excel at producing artistic content material and sharing info, make them efficient at selling trending merchandise. Nevertheless, a lot of the content material platform, they lack very sturdy back-end system to meet the reserving capabilities, whereas OTA’s core competence within the — firstly, within the provider chain — normal provider chain and likewise, extra importantly, the capabilities to offer dependable providers.

We imagine there may be extra severe aggressive strain from Meituan in comparison with Douyin, as Meituan has demonstrated the aptitude to deal with journey bookings and buyer help at scale – straight competing with TCOM’s core strengths. Nevertheless, Meituan’s key benefit stays the sheer dimension of its home person base.

In distinction, TCOM has cultivated a robust market presence, particularly in worldwide journey, over the previous decade and has cast shut partnerships with abroad journey suppliers. In consequence, we predict TCOM ought to nonetheless retain vital aggressive benefits in serving outbound Chinese language vacationers and cross-border journey reserving wants in comparison with Meituan. Whereas Meituan’s desktop and app visitors is huge domestically, TCOM continues constructing out its international provide chains. Therefore, TCOM and Meituan might in the end carve out a duopoly in China’s on-line journey {industry} with extra delineation between home and worldwide focus.

Margin Dangers

In the course of the earnings name, TCOM’s administration famous that the corporate’s present high-profit margins are probably not sustainable. They defined that journey demand has rebounded a lot sooner than anticipated post-COVID, and TCOM might want to improve spending on gross sales and advertising and marketing to help this progress.

Particularly, administration expects long-term adjusted EBITDA margins of 20-30% to be extra sustainable in comparison with the 34% margin delivered this previous quarter.

So, within the longer interval, we predict we will certainly obtain — beforehand, we have now — give steering to our shareholders that to attain the margin stage towards like — to the 20% to 30% stage.

This decrease margin outlook is a danger issue that might trigger TCOM’s valuation multiples to contract. Buyers appear to have reacted negatively to the height margin commentary, resulting in the post-earnings inventory worth decline regardless of the corporate beating income and earnings expectations within the third quarter.

Valuation

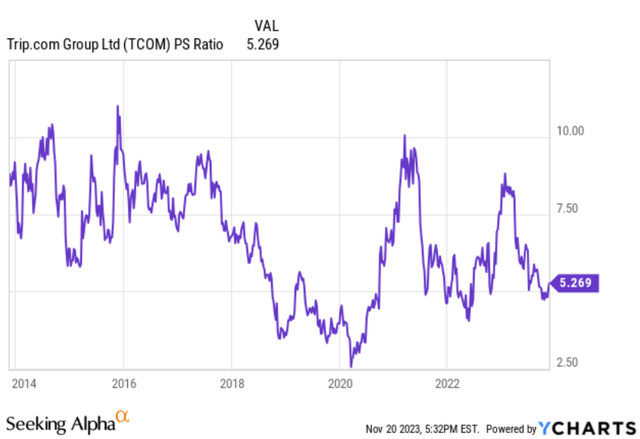

TCOM at the moment trades at a P/S ratio of 5.2x, which is close to the underside of its historic valuation vary.

YCharts

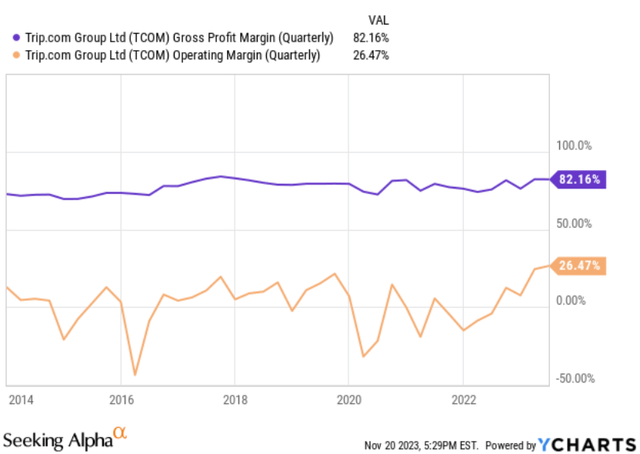

The administration’s outlook for elevated spending on advertising and marketing and customer support to help a lowered 20-30% adjusted EBITDA margin poses some draw back danger components for profitability. Nevertheless, TCOM has been capable of constantly keep sturdy gross margins traditionally even by means of aggressive challenges. This implies the corporate continues sustaining a aggressive place in China’s on-line journey {industry}, regardless of the rising competitors from Meituan and Douyin.

We imagine as TCOM expands its worldwide journey enterprise and company journey choices, it might probably additional strengthen partnerships with abroad and home suppliers that may assist safe its market management in the long term. If TCOM proves it might probably keep sector management, the short-term margin compression danger appears an appropriate trade-off to us.

Given the present low valuation a number of towards the backdrop of TCOM’s progress restoration momentum in worldwide markets, we see engaging risk-reward at present ranges for long-term buyers.

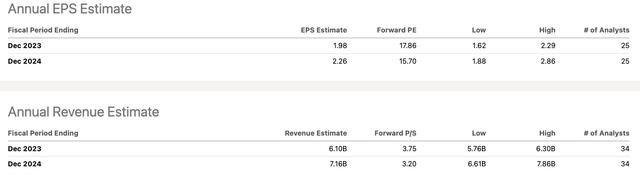

YCharts

Promote-side analysts at the moment estimate TCOM buying and selling at a ahead price-to-sales ratio of three.75x for 2023 and three.2x for 2024. Each of those ahead valuation estimates stay beneath the corporate’s long-term historic median price-to-sales ratio. The reductions to TCOM’s regular valuation vary make the inventory attractively priced for long-term buyers.

In search of Alpha

Conclusion

TCOM has maintained its management place in China’s on-line journey {industry} by means of its sturdy reserving system capabilities and customer support choices. Regardless of rising competitors from firms like Meituan, TCOM has continued to provide wholesome revenue margins over time. Its present valuation multiples are on the backside of historic ranges, limiting additional draw back danger, in our view.

Though margin compression considerations contributed to the post-earnings inventory worth sell-off, we imagine this presents a shopping for alternative for long-term buyers. TCOM is nearing an inflection level the place each income and earnings surpass pre-COVID peaks amid a broader journey demand restoration. As soon as provide bottlenecks ease and restrictions additional chill out, TCOM’s progress trajectory stays very constructive.

Given the corporate’s aggressive strengths in expertise and partnerships, management place sustenance, and low historic valuation, we charge the inventory as a Purchase for long-term buyers keen to look by means of near-term margin shifts. We might be consumers on extra inventory worth weak spot pushed by short-term margin fears.